Really kicking off in 2016, the ongoing momentum in new U.S. LNG (liquefied natural gas) export project development has put the U.S. at the heart of the global market.

And especially now, as Europe remains dead set on getting away from Putin’s energy, we are positioned as the continent’s largest gas supplier.

The U.S. has great potential for its LNG exports to swing between Europe and Asia based on price signals and changes in consumption.

With seven export terminals today, we stand with Qatar and Australia as the “big three” of global LNG exporters.

Up from 20-25% in 2023, the U.S. share in the global LNG supply mix should hit 30-35% over the next five years.

Numbers wise, the general thinking is that U.S. LNG exports will about double to ~28 Bcf per day over the next five years.

For reference, today’s global LNG market is about ~55 Bcf per day.

This is all very important since we should expect the world’s LNG demand to double by 2040.

Over the past 18 months (since Putin invaded Ukraine), we’ve really seen how U.S. LNG is essential for our allies.

Pre-war, Russia was supplying nearly 45% of Europe’s gas, and it’s unimaginable how bad things could have gotten in Europe without U.S. LNG.

U.S. LNG exporters boosted shipments to Europe by 125% to nearly 8 Bcf per day in 2022, with continent accounting for 65% of our total LNG exports.

U.S. LNG explains “How Putin lost the energy war.”

This flexibility and especially since we have the cleanest-produced gas in the world, this is why “U.S. LNG Exports to Take Center Stage At G7 Meeting.”

Further, U.S. LNG also helps solve worsening global energy poverty, while also reducing greenhouse gas emissions to fight climate change.

This is exactly why President Biden’s Secretary of Energy, Jennifer Granholm, immediately publicly supported U.S. LNG when she came onto the job in February 2021.

Not to mention that in April President Biden approved the $39 billion Alaska LNG, a whopping 3.5 Bcf per day export project along the North Slope.

And remember, this is easily the most climate conscious administration in U.S. history, with the reality setting in that clean, reliable, and versatile natural gas is the go-to fuel for the energy transition.

I knew I was right.

Seemingly very rare in our energy-climate discussion today, U.S. LNG exports have strong bipartisan support.

Emitting 50% less CO2 than coal, I’d argue that the most important thing “green groups” should be doing to fight climate change is to get the giant coal-based Asian economies off coal and onto much lower emission natural gas.

Gas is the backup for naturally intermittent wind and solar as well, for those frequent times when the sun isn’t shining and the wind isn’t blowing, the load-following required to avoid rolling blackouts.

This is why Germany, to me unquestionably the world’s “greenest government” investing trillions of dollars in the energy transition, is now fast-tracking huge amounts of LNG import infrastructure.

Further, as a gigantic economic boon, U.S. LNG exports easily support tens of thousands of high-paying jobs and tens of billions of dollars in tax revenues.

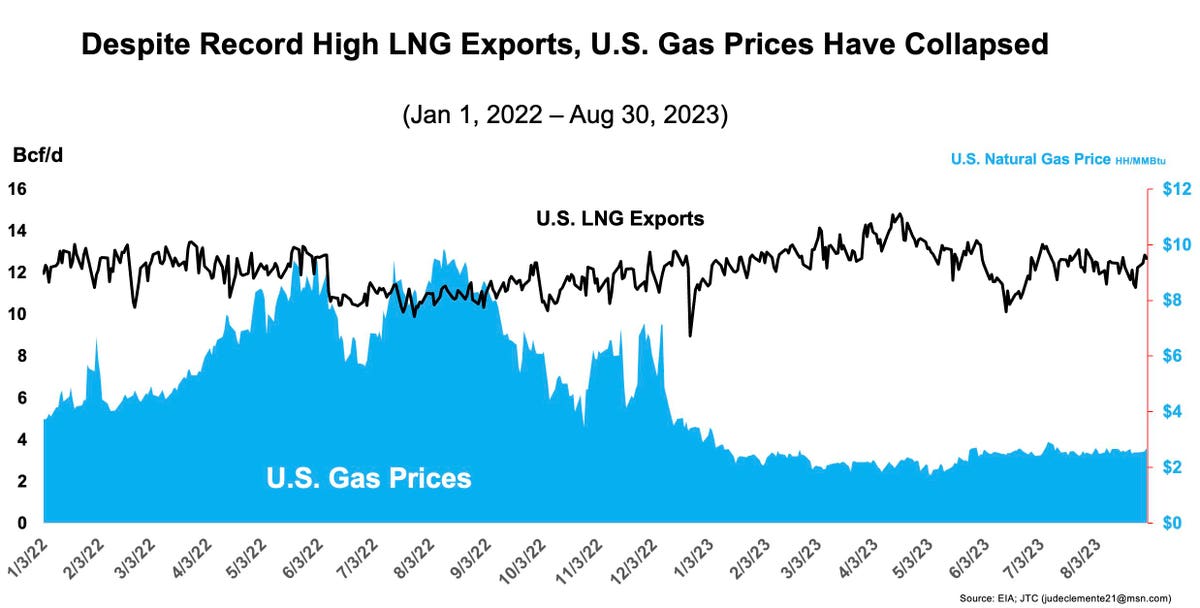

And let’s be clear: record U.S. LNG exports haven’t increased the price of domestic natural gas (Figure).

While our prices were surely way up last year (naturally following the gas price soar in Europe and Asia that went into the $60 to $80 range), our gas prices have since collapsed, all while our LNG exports have remained at record highs.

LNG is only ~17% of the global gas market, so trading activity and positions in the market (often from powerful hedge funds), and the false link that much higher prices in Europe and Asia should mean higher prices here, were our problem last year.

Fundamentally speaking, there was no justification for U.S. gas prices to hit $10 last August.

Unlike oil, there is no “global” gas market; today, there is a “globalizing” gas market.

For example, at the end of April 2023, we were setting records of 14-15 Bcf per day of LNG exports, yet U.S gas prices were just $2.20 or so, as compared to around $7.00 for that same time period in 2022.

Those citing domestic gas problems in Australia as to what negatives LNG exports could bring the U.S. must dig deeper.

Yes, massive exporter Australia has faced local supply shortages and high domestic prices but the country has been exporting 75-85% of its domestic production.

Today at just ~13%, the U.S. will never come close to that.

And there is a natural incentive for the U.S. gas industry to keep domestic prices low to ensure that we can best compete with low-cost, well-positioned, and government-backed heavyweight Qatar (who wants to account for 40% of new LNG supply by 2029), as well as emerging Russia, Canada, Mozambique, and others.

But beyond all this, U.S. LNG exports incentivize and beget new domestic gas production.

This is crucial since our climate goal of electrification will inevitably mean more gas.

Some people are having trouble accepting this, but “more natural gas” is a fundamental pillar of our energy-climate discussion.

That’s because the competition is nowhere near displacing natural gas.

Natural gas is by far the main source of U.S. electricity (40%), about double both second and third place coal and nuclear.

We all know that coal power here in the U.S. is in structural decline, with the already decimated fleet perhaps halving by 2026.

Small Modular Reactors are eventually coming but will take decades for material impact, and even that could prove a stretch: our seemingly perpetually “right around the corner” dream of a nuclear build-out is confronting eye-popping cost overruns, not to mention that we have nowhere near enough nuclear experts.

And intermittent wind and solar are provably more supplemental than alternative.

Even for the most green governments, the anti-gas, unrealistic business is thankfully losing: see the German LNG import expansion and “California regulators approve more gas storage capacity” for proof.

Wind and solar are available 30% of the time on good days and simply cannot replace coal, gas, and nuclear that are available 85% or 90% of the time.

Again, just a few of the problems for renewables is physics, higher costs, and capital intensiveness, not “a lack of investment:” “The first U.S. offshore wind auction in the Gulf of Mexico was a dud.”

Shhh…the secret is out: “Electric cars run on natural gas.”

So, my point is that U.S. gas demand in the future could be much higher than some are suggesting, thus new production will remain absolutely essential, and LNG exports help us expand our production.

Brookings was correct from the outset of our LNG journey: “a host of reports by third party analysts have found that the pricing implications of [LNG] exports are indeed modest.”

The U.S. Department of Energy does model a slight rise in pricing from LNG long-term, but, not just uncertain, it’s nowhere near enough to even consider dangerous protectionist policies like blocking or constraining LNG exports (which is Putin’s dream).

Up from an all-time record of 102 Bcf per day right now, the U.S. Department of Energy’s National Energy Modeling System in May forecast that a Fast Builds Plus High LNG Price would boom U.S. gas production to 135 Bcf per day in 2050.

The reference case scenario is 115 Bcf per day in 2050.

As for domestic prices, in the High LNG Price case, the Henry Hub spot price reaches about $4.30 per MMBtu by 2050, versus the Reference case price of $3.80 (Figure).

Higher LNG exports in the Fast Builds Plus High LNG Price case results in a projected Henry Hub price of $4.80 in 2050.

For reference, Henry Hub averaged $6.45 in 2022.

But, we’ve been at record U.S. LNG exports, with record production, and prices have still been at an extremely low level of ~$2.60.

Indeed, even with such low gas prices now (which would usually work to take production offline), we’re already seeing the extremely high value of LNG because it is keeping record production online.

More LNG export terminals next year and beyond will keep our gas production business humming.

If we didn’t have the expanding LNG export valve, there is no doubt that domestic production would’ve been forced to drop because of such low prices.

And without this record production thanks to LNG, who knows how much higher prices would have gone since we just had the hottest July on record with record gas used for electricity (48 Bcf per day) and our prices barely moved, stuck in the incredibly low $2.40 to $2.80 range.

But, we should know that these gas prices are not sustainable: and remember, during the 2020 price collapse during Covid-19 (to below $1.50 in June 2020), we had over 100 of our E&P companies go bankrupt.

We need a fair gas price for both consumer and producer, and U.S. Department of Energy forecasts have continually predicted that’s exactly what we’ll have.

Even in this collapsed market around the world, U.S. prices are well below those seen competitors in Europe ($10 to $13) and Asia ($11 to $14).

So, even with just about any rise in domestic pricing, we would still keep our competitive advantage, and, importantly, boost a U.S. gas industry that has been burdened by unfairly low prices this year.

Don’t forget that the gas industry was explaining how it was surviving when natural gas prices were $4.00 back in December.

For all these reasons, like we fortunately saw with President Biden’s approval of the Mountain Valley Pipeline, we need more policies to support natural gas: more pipelines and more related infrastructure.

As Europe has been painfully finding out, staying practical in the climate fight might be our best advantage of all.

Read the full article here