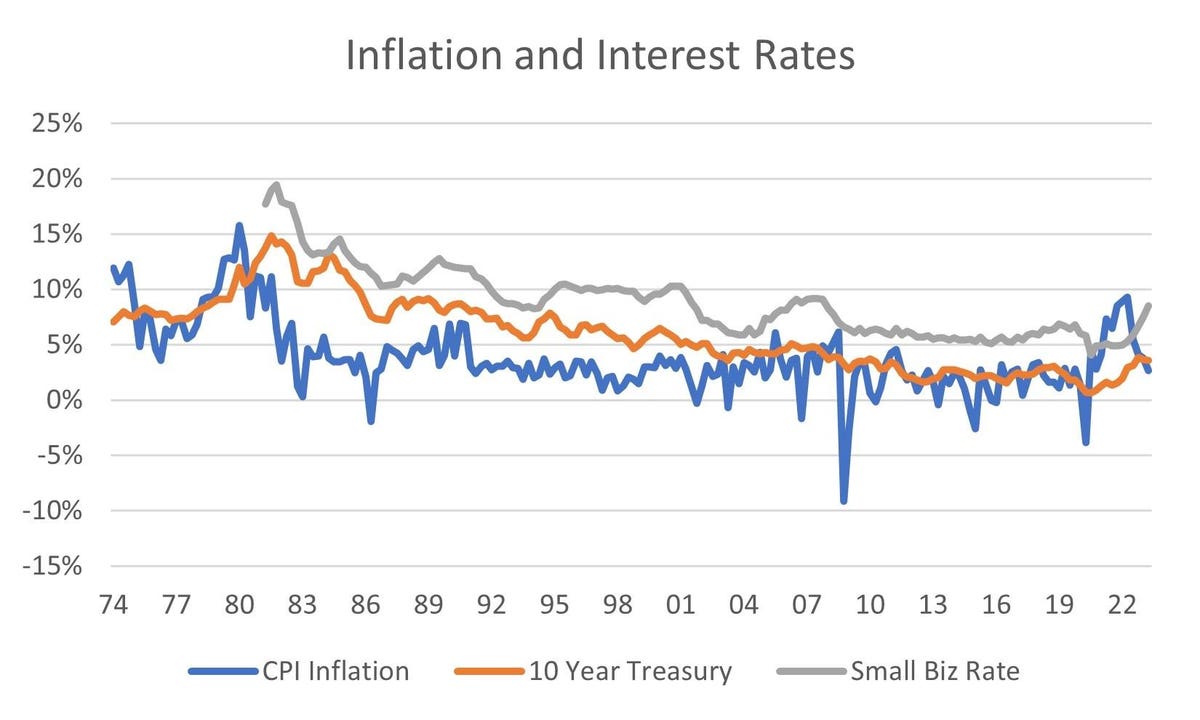

High inflation is more than a tax on everyday spending, it also impacts longer run costs through higher interest rates. Chart 1 shows the relationship between inflation (blue line), interest rates (orange line), and the rate paid by small business owners on their loans (gray line). The recent decline from near 10% inflation rates should work its way through to lower interest rates for consumer and businesses, assuming no “setbacks” like those experienced in the late 1970s and early 1980s. But just how much depends on what lenders “expect” inflation to be in the future when loans are repaid.

Here’s how the transmission of inflation to interest rates works. Suppose a friend wanted to borrow $100 from you. You’d have to take the money out of your bank account and give up any interest it would have earned. So, what interest will you charge? At least you would charge what the bank was paying you. But the loan is being paid back in the future, and with inflation rampant, that $100 won’t buy the same amount of stuff it did when you made the loan. You need to add something to the rate to cover inflation. And how well do you know your “friend”? There is a chance that the loan won’t be repaid, interest or principal. You need to add an insurance premium to the rate you charge. This is the process that goes on in credit markets. A simple formula outlines the rate determination:

Interest Rate = Risk Free Return + Risk Premium + Expected Inflation

The risk-free return for any loan maturity can be determined from the yield on Treasury bonds and notes. For example, the 10-year Treasury bond yield will tell you what you could earn with your money with certainty if you loaned it to the government. The Risk Premium is the most difficult to calculate. Are you lending to Walmart or one individual? Check their financial statements if available and their credit score. If you made a lot of $100 loans you could look at the average loss experience. This is basically what banks do when making loans to many small businesses vs. a large well-established company. Then there is the inflation premium. Loan dollars repaid in an inflationary future lose purchasing power. If the dollars repaid will purchase 10% less stuff, your 5% interest is wiped out. Lenders must “predict” future inflation to set their lending rates. The longer the maturity, the harder it is to forecast future inflation. Consider the inflation risk in a 20- or 30-year mortgage. Lenders are continually processing new information about the economy and borrowers to set their loan rates, but it’s costly and imprecise (risky).

Bond markets do provide some clues. The Treasury issues “indexed bonds” which increase in maturity value by the CPI inflation rate each year. With no risk from default or from inflation, the yield on those bonds compared to the yield on regular Treasury bonds reveals the “market’s” view of the inflation premium for any given maturity. In 1981, the 10-year Treasury bond yielded 14.8%, and buying those guaranteed that yield for 10 years! The yield on the Indexed 10-year Treasury bond was 11.4%. The CPI inflation rate was 13.5% (1980:2), roughly the same as the inflation premium. With no default risk, the difference measures what investors were demanding for inflation protection after 1980 and Fed actions. Small business owners reported paying an average rate of 19.4 (1981:4), indicating an average risk premium of over 7%. Banks could always lend their money to the government, a safer alternative but a much lower interest rate (risk vs return tradeoff).

The importance of dealing with inflation is obvious from the formula for interest rate determination. If no one expects future inflation, the inflation premium is 0 and interest rates will be lower. The prime rate of interest in the 1980s reached 21%, mostly because inflation was running at double digit rates, virtually guaranteeing an inflation loss on money repaid even in the very short run. Lower inflation means a lower tax at the cash register but also lower interest rates on credit cards, auto loans, and mortgages into the future.

Read the full article here