As the 50th anniversary of the first major oil crisis approaches next month, it is important to understand that much of the damage done was with the encouragement and approval if not instigation of the world’s most prominent energy experts. What happened in 1973 and later in 1979 was two short-term, politically driven disruptions of oil supply that caused prices to spike, just as basic microeconomics would predict. Unfortunately, this was followed by a misguided expert consensus that had severe negative consequences for the global economy, including for oil exporters and the industry.

First, the term ‘experts’ needs to be qualified by the fact that, after oil dominated the news, people of all stripes flocked to the subject. Consultants saw oil work as a source of easy money, academics realized oil research was more likely to get published, and pundits of all stripes recognized that commentary on oil got attention that, say, remarks on health care policy or banking regulation would not. (If that sounds familiar, search the phrase ‘climate change.’)

Initially, there was a healthy debate about whether the crisis was a transient event of represented a phase change in markets. But the 1979 Iranian Revolution discredited those, like M. A. Adelman and Peter Odell, who argued that resources were plentiful and cheap and only constrained by political factors. The new alarmists who disagreed with that view included the Central Intelligence Agency and Energy Secretary James Schlesinger who said in 1979 that world oil production would probably never go higher. (It has since increased by 40 million barrels a day.)

Markets were said to be myopic for not pricing oil and gas high enough to encourage needed investments in expensive energy sources, leading governments to provide guidance and subsidies (such as for exploration in the Canadian Arctic) or loans (as in the Synthetic Fuel Corporation) to accelerate their development. Industrial policy in action, and not in a good way.

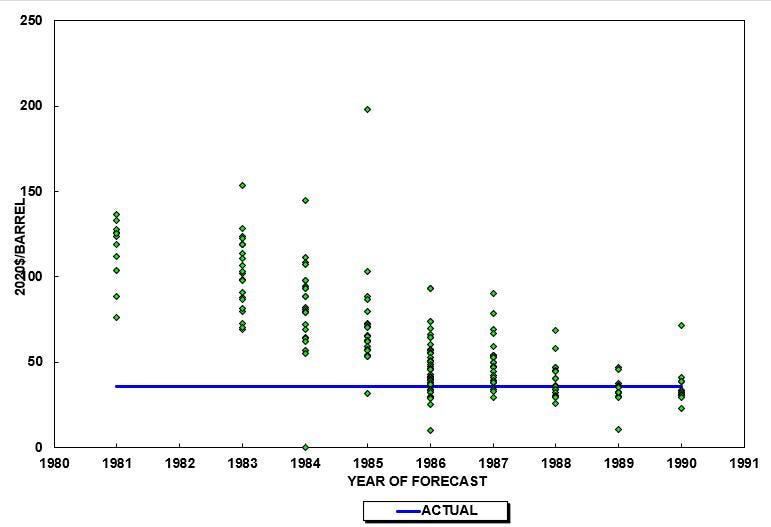

Amazingly, this mistaken consensus was overwhelming. The World Bank, the IMF, the International Energy Agency and the Department of Energy, along with crowds of academics and nearly everyone in the oil industry, were all convinced that energy had entered a period of transition from cheap conventional fuels to expensive, often unconventional fuels (sounds familiar?), that would require ever higher prices. Surveys by the Department of Energy, the Society of Petroleum Evaluation Engineers and the Viennese International Energy Workshop (figure below) all confirmed this.

That an expert community could be in agreement and yet so wrong reflects the nature of debate on complex issues, where those who disagree are derided and shunned, which is hardly a new phenomenon. In fact, seventeenth century Japanese scholar Kaibara Ekken observed, “One should not blindly regard all one has heard as true and reject what others say merely because they disagree, nor be stubborn and refuse to admit mistakes.”

Certainly, debate about the Oil Crises resembled this, as the few dissenters from the consensus were derided and shunned. A study from the Harvard Business School in 1983 warned that “U.S. consumers, encouraged by some unknowing writers and economists, began to believe that OPEC members were no longer able to hold up oil prices…” [emphasis added] Two years later, the price collapsed, as if a crowd of experts had not insisted otherwise.

There were three pernicious effects from these errors. First, oil exporters were told that the short-term equilibrium price during the Iranian Revolution was actually the long-term equilibrium price, and that prices would inexorably continue rising. And so they defended a price that was so high that demand for OPEC oil dropped by half from 1980 to 1985 (as the figure below shows). Throughout the market collapse, the experts predicted an imminent turnaround that never arrived.

Again, actual market behavior fits in well with basic microeconomic theory which would predict prices would revert to the mean after a supply disruption caused a spike. Yet the overarching consensus after 1980 was that they would continue rising. My then-boss M.I.T.’s Nazli Choucri, presenting our model’s forecast in 1980 of near-term declining prices to Energy Modeling Forum 6, was told ‘oil is different.’ The average price forecast for 1990 of the ten computer models presented at EMF6 was $125, about three times the actual.

Second, many oil producing nations decided to conserve their resources instead of developing them. Some countries, like the Shah’s Iran, had pursued aggressive expansion of oil production after the 1973 Oil Crisis, but after his fall, the new government argued that he had wasted the nation’s resources and they kept oil production at less than half pre-Revolutionary levels. The policy of doing the opposite of the reviled predecessor, along with the regime’s xenophobia, was more responsible for the change than any objective analysis, but many other countries justified their resource nationalism with invalid economics, once again supported by the expert consensus.

After all, didn’t the U.S. Secretary of Energy James Schlesinger himself tell them in 1978 that oil in the ground was worth more than money in the bank? Academics assured them that in 1931 Harold Hotelling proved that long-run energy and mineral prices had to rise exponentially (they never have, and he didn’t argue that). Others explained that oil and gas were ‘premium’ fuels and should be saved for ‘premium’ uses like petrochemicals, instead of mundane functions such as power generation.

Not surprisingly, by convincing countries to retard if not eschew investment in oil and gas, the expert consensus reduced oil supply and kept prices higher for longer, which seemed to confirm the consensus about physical scarcity, even though political decisions were responsible, not the physics or economics of the resource. This was in effect a self-fulfilling prophecy, and not the good kind, resembling a circular firing squad.

Finally, oil exporting governments, told of the fabulous wealth that would be showered on them in coming years (see figure below) launched massive spending programs with a number of detrimental impacts. Social spending greatly improved the well-being of the citizenry but even so a significant amount of money was wasted. Terry Lynn Karl’s The Paradox of Plenty described how the Venezuelan president threw money at numerous ill-considered economic projects, attempting to leap-frog the country’s industrial sector to First World status, bolstered by expectations of soaring oil revenue. Later, countless projects from Alaska to the U.A.E. built in the boom years were abandoned or grossly underutilized afterwards because much lower than expected oil revenue didn’t cover operating costs.

There is an additional feedback loop (aka circular firing squad) besides resource pessimism reducing supplies and reinforcing resource pessimism. Expert consensus about a popular topic like oil in the 1970s is self-reinforcing, as it attracts many who are not truly experts to the field; these newbies are naturally reluctant to deviate from the consensus, fearing ostracism. (Even today, bullish forecasters are more popular than bearish ones.) And while some might seek to hear opinions that deviate from the consensus, that is often the exception rather than the rule, as Ekken noted centuries ago.

Energy, like climate change, is an extraordinarily complex system which allows for the non-expert community (and many in the expert community) to be led astray. Understanding the substance behind a consensus requires a significant degree of work which few undertake; many find just reading a report’s executive summary a high bar to overcome. But this complexity also means that there is always evidence to support nearly any view, just as some point to unusual snowfall in warm climates to decry the existence of global warming. Cherry-picking is also easier, since few bother to check whether any given datum or anecdote reflects or deviates from reality.

Finally, self-reflection seems to rarely leave the therapist’s office. Communist regimes were famous for ‘self-criticism’ events, where those who disagreed with the Party line were made to acknowledge and apologize for their deviant thinking. The opposite is often true in the West, where analysis of failure is criticized as blame-seeking. Few like to dwell on past mistakes and most are reluctant to criticize their friends, colleagues, and/or organizations. The result is a borad failure to learn from mistakes, as M.I.T.’s Steve VanEvera pointed out two decades ago. (Citation below.)

The lesson is hardly new. Bram Stoker’s Van Helsing said, “We learn from failure, not from success.” That we don’t explains Karl Marx’s comment that history repeats, but the first time as tragedy, the second time farce.

Stephen Van Evera, “Why States Believe Foolish Ideas: Non-Self-Evaluation by States and Societies,” in Andrew K. Hanami, ed., Perspectives on Structural Realism (New York: Palgrave Macmillan, 2003), pp. 163-198.

Terry Lynn Karl, The Paradox of Plenty: Oil Booms and Petro-States, University of California Press, 1997.

Read the full article here