We’ve seen these predictions before, and they have always been wrong. But officials at the International Energy Agency (IEA) have decided to take another shot at predicting the date when the long-projected “peak oil” will finally arrive as part of its annual World Energy Outlook that will be published in October.

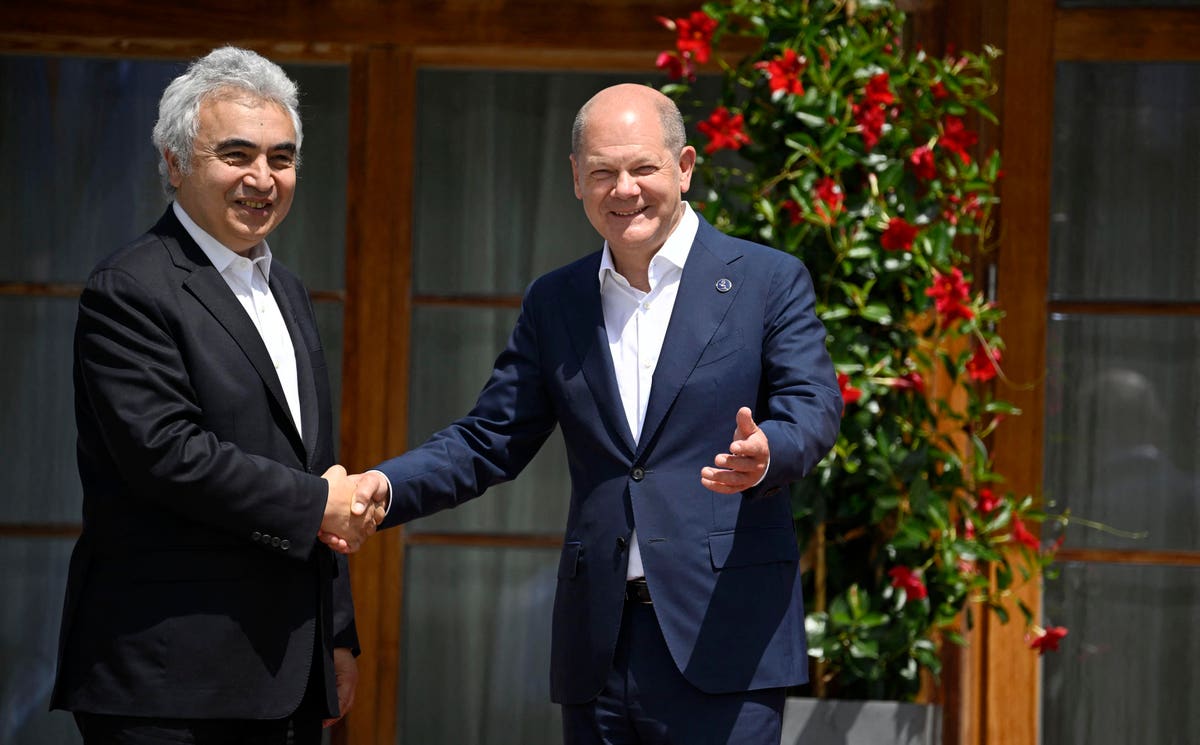

In an op/ed for the Financial Times headlined “Peak fossil fuel demand will happen in this decade,” IEA chief Fatih Birol predicts exactly what the title implies, which is that demand for not just oil, but also for natural gas and coal, will fall into permanent decline before the current decade is out. This is far from the first time such a prediction has been made, either by the IEA or some other promoter of the energy transition, and we can be certain it will not be the last. The question, as it has been for well over a century now, is whether this latest prediction is, unlike all the hundreds of similar projections that have preceded it, the one that will finally come true.

Mr. Birol seems fairly confident this time around, even going to the extent of saying this latest predicted “peak” will happen with or without any further green energy subsidies or other pro-transition policy decisions taking place. In this view, the cake has already been baked.

“Based only on today’s policy settings by governments worldwide — even without any new climate policies — demand for each of the three fossil fuels is set to hit a peak in the coming years,” Birol states. “This is the first time that a peak in demand is visible for each fuel this decade — earlier than many people anticipated.”

Noting that “some pundits suggested global oil demand might have peaked after it plunged during the pandemic,” Birol claims the IEA was wary of such projections at the time. But now, three years later, the agency believes the rapid increase in electric vehicle adoption, especially in China, has set demand for crude on a course to peak before 2030.

As noted above, IEA extends its peaking projection not only to oil, but to natural gas and coal as well. Global demand for all three fossil fuels rose to new record highs in 2022, with coal’s growth attributable mainly to China’s voracious appetite for using it to generate reliable electricity to fuel its economic growth.

But Birol says that tide has begun to turn, even in China itself. “Even in China, the world’s largest coal consumer, the impressive growth of renewables and nuclear power, alongside a slower economy, point to a decrease in coal use soon,” he says. With other developing nations also trying to shift away from coal and replace it with some combination of natural gas and renewables, this aspect of the IEA report seems most reasonable.

IEA’s projected peak for natural gas demand by 2030 is the one that probably bears the most watching, given that most other respected projections released this year show demand for that cleanest of fossil fuels rising well past then before finally reaching a peak. In its own Global Energy Outlook published in August, for example, ExxonMobil

XOM

The basis for IEA’s projected pre-2030 peak in gas demand, says Birol, “is the result of renewables increasingly outmatching gas for producing electricity, the rise of heat pumps and Europe’s accelerated shift away from gas following Russia’s invasion of Ukraine.”

Certainly, ExxonMobil has a vested interest in seeing demand for oil and natural gas continuing on a stronger path than IEA projects, but it is fair to note that IEA has historically seemed to have a bias towards projections about a rapid transition that have required later revisions. This has been a regular feature of the agency’s projections for oil demand in recent years.

The Bottom Line

Finally, it should also be pointed out that every respected study that attempts to project future demand for energy of all types concedes that demand for these fossil fuels will peak sometime in the coming few decades. ExxonMobil’s own outlook for peak oil demand is basically in line with the IEA projection, for example.

The question about IEA’s latest projections is whether those peaks will all come about so quickly without further government interventions designed to pick winners and losers. With so many variables at play, and with the potential for major world events – such as Russia’s war on Ukraine – to intervene and knock the expected progression off-kilter, all of these exercises amount little more than educated guesses. Where the IEA’s projections are concerned, we will just have to wait until 2030 to see.

Read the full article here