Startups face significant challenges, with a high failure rate due to reasons like lack of funding, operational issues, or product-market fit. Recognizing common mistakes, seeking expert guidance becomes crucial. Startup accelerators and incubators, born in Silicon Valley in the mid-2000s, offer valuable support with mentorship, funding access, and networks for entrepreneurs. In the era of web3 technologies, many of these programs are now focusing on harnessing distributed ledger tech to accelerate mainstream adoption. This article explores their role in this transformation and their synergy with the evolving technological landscape.

What makes web3 Venture Funding so special

Before we delve further into this topic, it is important to highlight the distinctive nuances that shape the landscape of venture capital and innovation in the realm of web3. Emerging in the wake of the Great Financial Crisis, the foundations of web3 were laid by Bitcoin

BTC

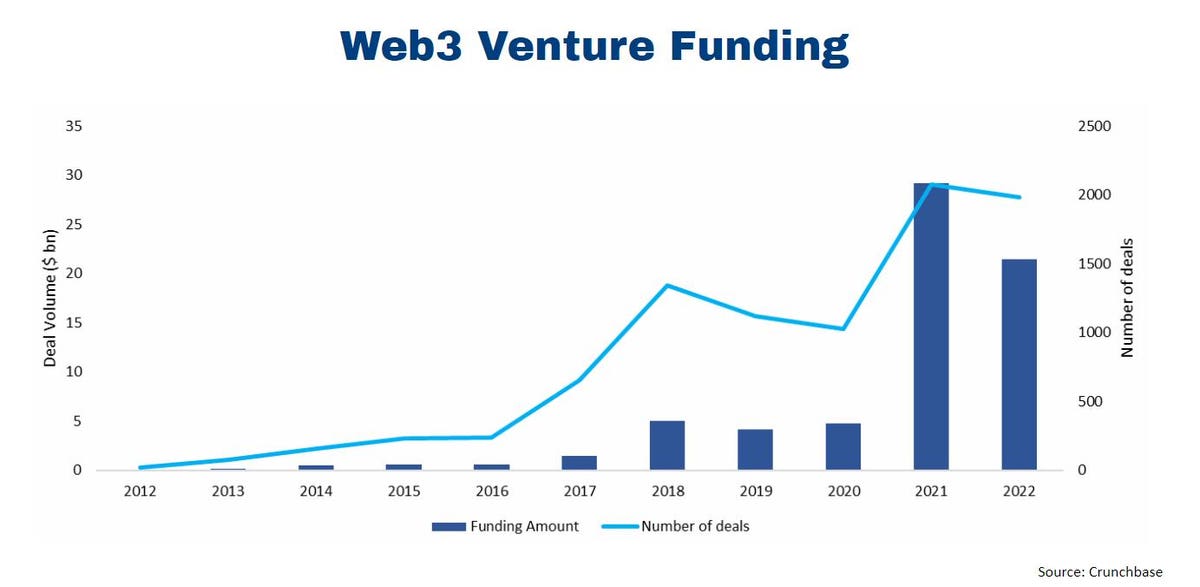

Web3 operates within a markedly cyclical pattern, punctuated by vivid cycles of boom and subsequent contraction, recurring approximately every four years. These cycles are largely bound by Bitcoin’s halving schedule. Instances of fraud, rug pulls, regulatory pressures, or shifts in the macroeconomic environment have been catalysts for the bust cycle.

Given this backdrop, it is unsurprising that the web3 venture capital domain is also subject to substantial volatility. On an annual basis, data sourced from Crunchbase illustrates a significant decrease of nearly 80% in capital inflow during the first half of the year, plummeting from $16 billion to a modest $3.6 billion1. That is, the capital flow tends to follow the trajectory of the hype.

A successful venture takes more than funding

However, those keeping up with web3 know that funding represents just one facet among several prerequisites for successful web3 endeavors. Beyond financial backing, the recipe for success demands the right team composition, unwavering resilience, tireless networking, continuous product refinement, and arguably, a touch of serendipity. This complex orchestration of factors is precisely where the role of accelerators and incubators emerges.

Incubators and accelerators recognize that mere financial infusion into “the next big thing” does not consistently translate into achievement. Their value proposition encompasses far more, extending guidance and support across these aforementioned dimensions. Against this backdrop, let’s delve into a comparative analysis of incubators and accelerators.

A comparison: Startup incubators vs. accelerators

Startup Incubator:

- Description: A startup incubator program focuses on helping startups in their founding stages of development. It provides guidance, training, networking opportunities, and sometimes funding.

- Focus: Incubators aim to help startups develop or mature a minimum viable product (MVP) and achieve product-market fit.

- Content: Incubator programs offer workshops and training by experienced startup experts on topics like idea validation, MVP creation, and business models. They also cultivate the right entrepreneurial mindset.

- Startup Stage: Incubators are most suitable for startups with a basic idea or problem to solve, along with some initial research as a foundation.

- Product: Startups don’t necessarily need a developed product at the incubation stage. Oftentimes, individuals can even apply without an idea.

- Equity: Startups typically retain the majority of their equity, the usual equity ask is 4-15%.

- How to Participate: Entrepreneurs can apply to incubator programs with their skills, ideas, or startups. Programs can or cannot charge a participation fee.

- Team: Usually, individuals and teams can apply to incubator programs. Throughout the program, they will be matched with the right people to supplement their strengths.

- End Goal: The primary goal of incubators is to help startups reach product-market fit and build a stable foundation.

Startup Accelerator:

- Description: A startup accelerator program is focused on helping startups scale after they have achieved product-market fit. It provides guidance, training, networking opportunities, and sometimes funding, with a strong emphasis on growth.

- Focus: Accelerators target the growth phase of a startup’s development, aiming to help them achieve rapid expansion.

- Content: Accelerator programs offer expert guidance, education, and resources that are tailored to scaling a startup. They also prepare startups for investor pitches to raise seed capital.

- Startup Stage: Accelerators are suitable for startups that have already acquired first customers and know their ideal customer profiles alike, indicating product-market fit.

- Product: Startups at the accelerator stage should have an MVP or developed product.

- Equity: Similar to incubators, startups retain the majority of their equity, the usual equity ask is 5-15%. In general, the younger the startup and the less validated its product, the higher the equity ask will be.

- How to Participate: Startups can apply to accelerator programs with their existing business. Equally, programs can or cannot charge a participation fee.

- Team: Commonly, startups applying to an accelerator will already have a core team, and will then receive support to make additions to it.

- End Goal: Accelerators focus on helping startups scale massively and prepare for further investment.

Startup incubators focus on nurturing early-stage startups and helping them achieve product-market fit. Startup accelerators concentrate on scaling startups that have already achieved product-market fit2. Both types of programs offer similar resources like guidance, training, networking, and potential funding. The content is tailored to their respective goals. The choice between an incubator and an accelerator depends on the startup stage and its growth objectives. Also, when it comes to web3, there are different kinds of accelerators and incubators. It could be that a VC focusing on tech also devotes parts of its attention to web3, whereas over time, many web3 “pure plays” (i.e., programs that solely focus on web3) emerged too.

How incubators and accelerators help startups grow

- Mentorship: Entrepreneurs are paired with experienced mentors who provide personalized guidance, sharing insights garnered from their own web3 ventures, helping startups navigate challenges and make informed decisions.

- Industry Expertise and Workshops: Participants gain access to specialized web3 industry knowledge and insights. They offer a deeper understanding of trends, technologies, and market dynamics, enabling them to make strategic choices that align with the unique demands of the web3 landscape. Industry experts deliver immersive workshops and masterclasses, covering diverse topics such as decentralized applications, smart contracts, tokenomics, product-market fit, customer identification, growth hacks, and team building, equipping participants with practical skills and knowledge.

- Tech Tools and Infrastructure: Web3 incubators and accelerators provide startups with access to cutting-edge technologies, software platforms, and development tools. These are specifically tailored to the complexities of decentralized technologies, expediting the technical development process.

- Partnership and Networking Opportunities, and Greater Confidence for VCs at Later Stages of the Funding Journey: By fostering connections with fellow entrepreneurs, industry professionals, and potential investors, participants can form strategic partnerships that enhance their startup’s ecosystem. The credibility gained through association with reputable incubators or accelerators can also bolster the startup’s appeal to venture capitalists as it progresses through the funding stages. According to a survey carried out by Harvard Business Review involving 900 venture capitalists, it was discovered that close to 70% of investment deals originate from connections within their professional networks3.

- A Spirit of Competition Among Cohort Members Pushing Everyone to Work Their Hardest: The atmosphere of healthy competition within the program’s cohort encourages startups to push their boundaries, driving innovation and motivating participants to excel beyond their comfort zones.

- Capital/Funding: Early-stage startups receive initial funding or capital injections, providing the financial foundation needed to propel their web3 projects forward and initiate growth.

- Market Research and Intelligence: Access to curated market research and intelligence empowers startups to refine their product strategies, target specific user segments, and anticipate emerging trends within the evolving web3 landscape.

- Incubator/Accelerator Brand Can Give Potential Clients Confidence (i.e., Credibility for the Startup): The reputable brand of the incubator or accelerator lends startups credibility. This instills confidence in potential clients, users, and stakeholders, enhancing their willingness to engage and invest in the startup’s offerings.

Evolution of web3 accelerator and incubator programs

At the very left-hand side are the well-established first-movers in the accelerator and incubator niche, who over time have also made blockchain-related investments. It was really only from 2018 onwards that more and more programs emerged, coinciding with the first big crypto boom and bust cycle in 2017/8. 2021, due to the excess of capital available, and the hype around Bitcoin, DeFi, NFTs & Co., consequently saw the biggest influx of accelerators and incubators in the web3 industry.

An overview of some of web3’s most prominent incubator and accelerator programs

“Specialized incubators and accelerators in the web3 space are needed because they recognized that web3 entrepreneurs need a very tailored mentorship program. No one has the exact same entrepreneurial journey, and assisting founders in identifying and consequently leveraging their strengths while helping with most tasks related to the startup is invaluable for many of them. Given web3’s novelty, identifying smart and passionate people and then steering them in the right direction while finding the optimal web3 business strategy is a good recipe for accelerating the industry’s growth.”

To conclude

In the dynamic realm of web3 startups, incubators and accelerators play a vital role in shaping success. As startups navigate the challenges of this landscape, these entities provide tailored mentorship and resources, steering them away from common pitfalls and towards bold, innovative moves.

Originating in Silicon Valley during the mid-2000s, accelerators and incubators have evolved into essential pillars of the venture capital world. Now, as web3 technologies dominate headlines and are set to reshape industries, these entities are adapting their focus to embrace the potential of distributed ledger technologies. This article underscores their role in accelerating web3’s mainstream adoption, bridging the gap between startups and the ever-evolving tech landscape.

The volatile nature of web3 VC, characterized by cycles of hype and contraction, emphasizes the need for stable support. Incubators and accelerators rise to this challenge, offering more than just funding. They provide tailored mentorship, industry insights, networking, and technological tools, empowering startups to thrive amidst uncertainty.

In this intricate ecosystem, startups, incubators, and accelerators collaborate to drive innovation and connect visionaries. As the web3 landscape advances, these entities remain at the forefront, fostering growth and shaping entrepreneurship. Specialized support is crucial for web3 startups, and through this collaboration, the industry propels forward, fueled by innovation and guided mentorship.

References

[1] https://hbr.org/2021/03/how-venture-capitalists-make-decisions

[2] https://news.crunchbase.com/web3/crypto-blockchain-startup-vc-funding-falling-data/

[3] https://blockchain-founders.io/educational-resources-for-entrepreneurs/startup-incubator-vs-accelerator-vs-company-builder-vs-venture-studio-what-is-the-right-one-for-me

Read the full article here