On September 29th, the European Central Bank (ECB), the International Energy Agency (IEA) and the European Investment Bank (EIB) are holding a high-level conference on ensuring an orderly energy transition in Paris. The event comes at a time when Europe is facing energy price shocks and attempting a transition to renewables, without a coherent and cohesive strategy.

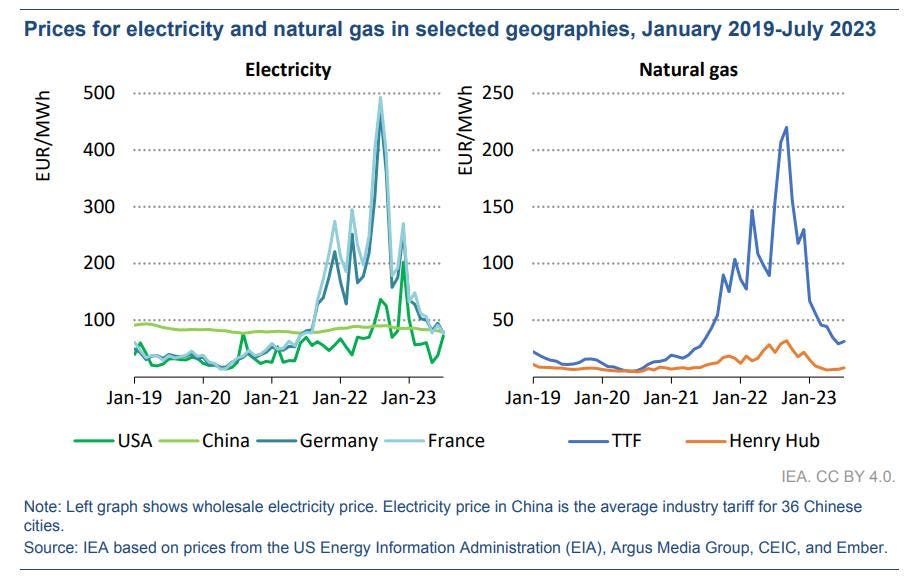

The price shocks resulting from Russia’s invasion of Ukraine and subsequent sanctions evidenced that Europe was ill-prepared. After the an initial, painful blow with costly oil and gas, energy prices are once more on the rise. WTI and Brent crude benchmarks are hovering around $90 a barrel, while many analysts forecast $100 or more. Diesel in the US has gone above $140 and in Europe it is up 60% since summer.

Higher energy prices could be making European industry uncompetitive. Across the region, including the EU and the UK, input costs have increased well above other advanced economies, such as Japan, the US and Canada. In October 2022, the Economist Intelligence Unit argued that “high energy prices will have long-term implications, in the form of higher debt burden, business failures and changes to the green transition.” Furthermore, it found that Russian gas imports have not fully been replaced by Norwegian and LNG shipments.

Beyond that, there are concerns that there is no industrial policy in Europe that is comparable with that of the US, China, Korea, and Japan. This not only reflects on energy, but across sectors. Still, this area is where the lack of direction is most acute. First, as Europe attempts to carry out the green transition, and secondly, with war in Ukraine, it has become a vital strategic issue.

There is an important foreign policy aspect to Europe’s strategy as well. It will need to secure an affordable supply of critical minerals for a clean energy supply chain on one hand, and of fuels on the other. In most ways, politics has so far worked against this objective.

The EU and Mercosur, an alliance of South American countries including Brazil and Argentina, has stalled since it was put forward in 2019. Mainly, this is due to concerns by French farmers to face competition from the southern agricultural powerhouses. However, this has meant that Europe is missing out on advantageous deals with some of the largest commodity producers, with regards to mining and fossil fuels.

In Francophone Africa, political animosity against former colonial masters is also creating hurdles. Since 2020, western Africa has seen a wave of military takeovers with a strong anti-French and anti-European rhetoric. Some corporations are saying that it will be business as usual, but it is hard to believe that Brussels will be able to cut advantageous deals with such regimes.

This autumn, there are two points to look for: first, if Europe will be able to present a coherent strategy for energy, clearing the uncertainty of businesses and ordinary people. Second, as winter nears, we will find out if the region is prepared for another energy price shock. Will it be desperately scrambling, driving up input costs once again? Or is there a plan that will put Europeans at ease?

Read the full article here