CEO Dan Widmaier talks exclusively with Forbes about going public and the ups and downs of running a synthetic biology firm.

Bolt Threads, a maker of biomaterials including a key ingredient for skincare inspired by spider silk, plans to go public in a SPAC deal that values the one-time unicorn at $250 million.

“We wanted to zig when others zag,” cofounder and CEO Dan Widmaier told Forbes. “If the expectation is that things always go up, that’s ludicrous. Things go up, things go down. The real question is, are you building a product that matters to people over time.”

With the deal, Bolt Threads will merge with blank-check company Golden Arrow Merger Corp., whose CEO is investor Timothy Babich. Babich, a Goldman Sachs alum, founded London-based Fortelus Capital Management in 2009 with a focus on European special situations and subsequently set up his own investment firm, called Nexxus Holdings.

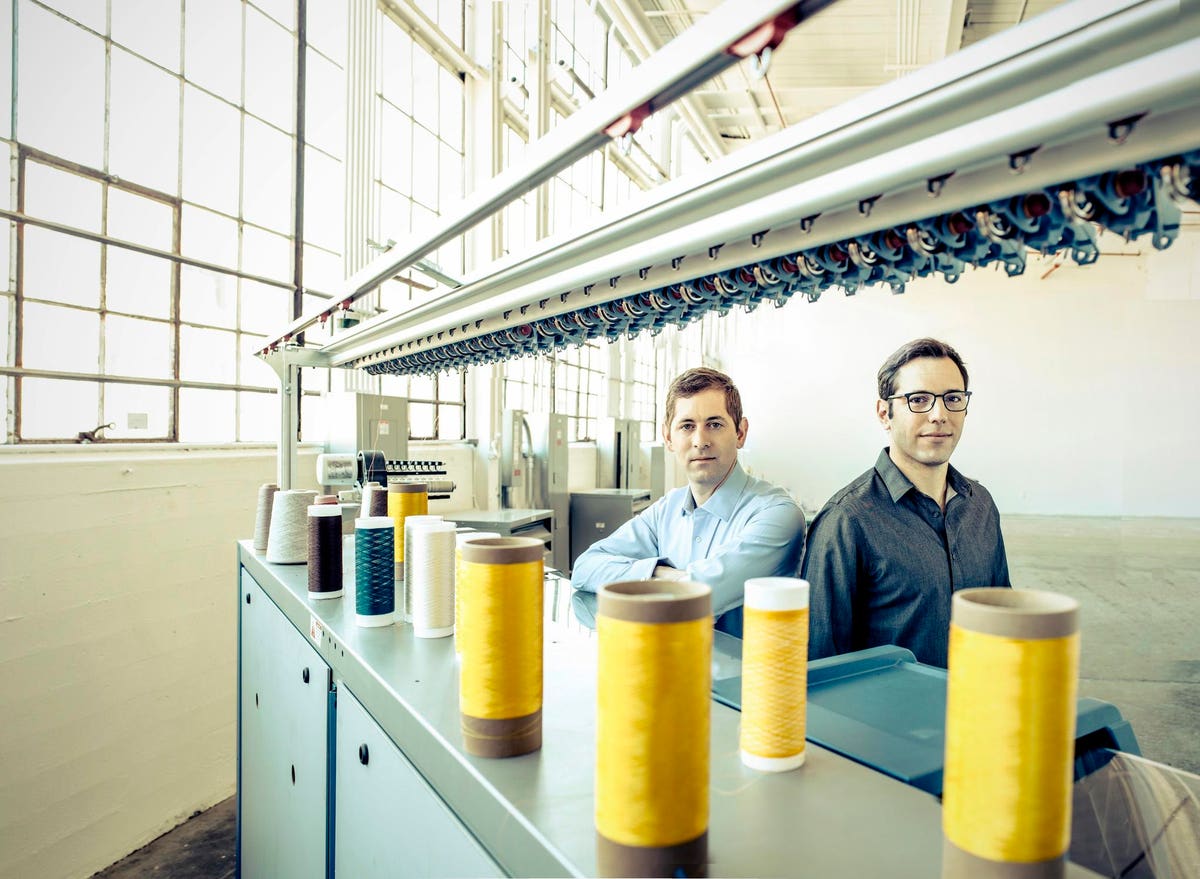

Widmaier, 42, will remain CEO of the new company, to be renamed Bolt Projects Holdings. Cofounder David Breslauer, who has a Ph.D. in bioengineering from UC Berkeley and UCSF, will stay chief technology officer. The deal, which gives Bolt Threads a pro-forma enterprise value of $346 million, is expected to close in the first quarter of 2024.

Widmaier said that Bolt Threads, which has raised $334 million as a private company from investors that include Founders Fund and Baillie Gifford, had begun looking for SPAC partners earlier this year to provide the capital it needed to grow. While SPACs have been out of favor and many synthetic biology companies have come on hard times, Widmaier has kept the faith in the powers of the technology to solve some of the world’s most difficult environmental problems.

“We have a big, bold, long-term vision with biomaterials,” he said. “It’s a big vision that’s going to require a lot of trips back to the well to make new products over time on this platform.”

Widmaier, Breslauer and Ethan Mirsky (who has since left the company) founded Bolt Threads in 2009 to crack the code on growing artificial spider silk, something that scientists around the world have been trying to do for decades. Spider silk is known for being extremely soft and strong, and it could make long-lasting, lightweight and sustainable clothes in an industry filled with textiles that harm the environment.

Widmaier studied spider silk during his Ph.D. program in chemistry and chemical biology at UCSF and once kept an office full of giant golden orb weaver spiders spinning webs in hula hoops. But making bio-based spider silk at scale proved difficult, and the Berkeley, California-based company refocused its operations on other biomaterials.

Today, Bolt’s main product is a key, biobased ingredient for skincare and cleansers that it calls b-silk and that was inspired by spider silk. For a time it produced its own line of skincare products under the brand Eighteen B, but it has since switched to a model of selling its ingredients to other brands. Its b-silk is now in brands like Vegamour that are sold at Sephora stores throughout the U.S. It holds a total of 34 patents for b-silk (of a total 49 throughout the company) and has another 131 pending. B-silk is designed to replace silicone elastomers, which are chemicals that don’t degrade over time and comprise a market that Bolt pegs at $4 billion.

Bolt also introduced a biomaterial known as Mylo that’s a “leather” made from mycelieum, the roots of a mushroom. Last year, the first Mylo products from yoga-clothes company Lululemon and fashion designer Stella McCartney hit the market. That product is currently on hold, however, as Bolt focuses on its b-silk.

“In my mind this is a pretty beautiful story,” Widmaier said. “You take something that has a massive problem with persistence and replace it with [something] biobased and biodegradable.”

Widmaier declined to disclose Bolt’s revenue until after it completes its regulatory filings with the Securities and Exchange Commission.

Deep tech is hard and synthetic biology is head-bangingly difficult as Bolt Threads and others in the space have learned. Ginkgo Bioworks, which has a vision of creating better tools for biology, has seen its stock crater since going public in a SPAC deal that briefly made all five founders billionaires in September 2021; the company’s market cap is now $3.7 billion. Amyris, the original biofuels company that moved into personal care, filed for Chapter 11 bankruptcy in August. And one-time highflier Zymergen imploded four months after its $3 billion IPO, and was subsequently acquired by Ginkgo.

With the deal, Bolt Threads will receive $46 million that it plans to use to gain distribution for b-silk and bring down the costs of its production. Eventually, Widmaier said, he hopes to add additional biomaterials in consumer products, including personal care, fashion, footwear and maybe home goods.

Widmaier has been saying for years that the effort is tough and still in its early stages. “It’s proven to be true,” he said. “But with real examples of real products, maybe we can say that it was worth going through.”

Read the full article here