In a story that should surprise no one, the Wall Street Journal and others are reporting that the long-anticipated deal between U.S. energy giant ExxonMobil

XOM

PXD

Rumors about a possible deal between the two companies have circulated off and on since at least 2017, and heated up again this past April. But, as with so many times before, the rumors soon cooled down when no deal was consummated. Perhaps this time will be different, but only time will tell.

As of close of business Thursday, Pioneer boasted a market cap of more than $50 billion, meaning it would become Exxon’s biggest acquisition since its $81 billion merger with Mobil Oil Company in 1998. If completed, this deal would easily surpass ExxonMobil’s $41 billion buyout of Fort Worth-based independent XTO Energy in 2009.

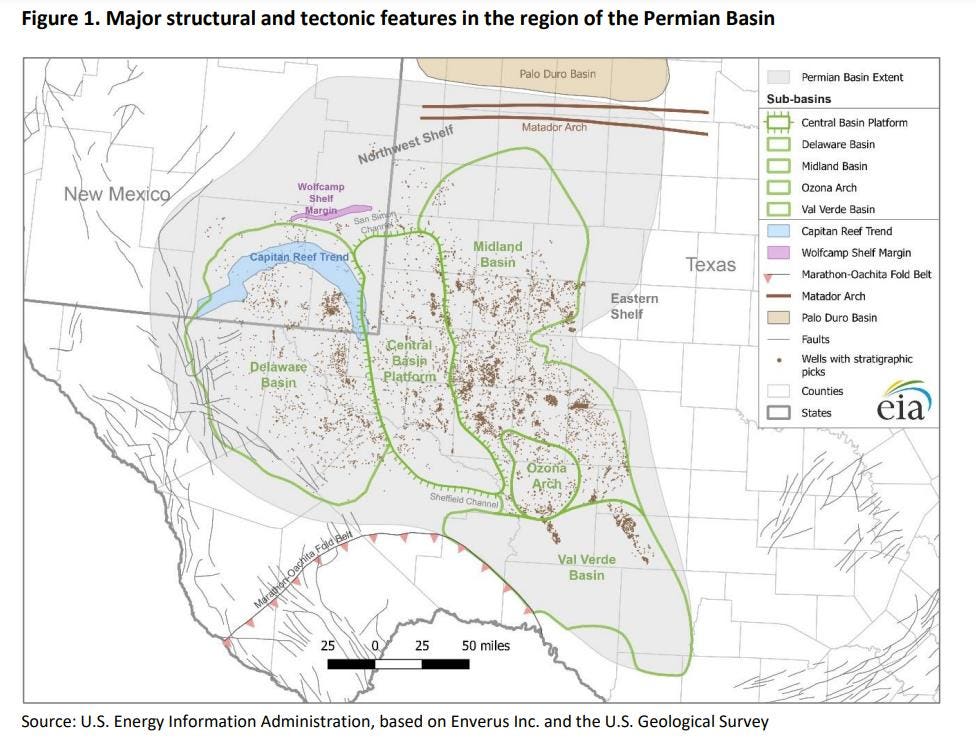

A merger between the two companies would also cement the combined company as far and away the dominant producer in the Permian Basin, the world’s most active oil and gas play. Pioneer has long ranked as the biggest holder of leases and drilling opportunities in the Midland sub-basin of the greater Permian Basin region, while ExxonMobil owns substantial leasehold in both the Midland and Delaware basins.

An ExxonMobil/Pioneer deal would signify the continuation of the ‘bigger is better’ philosophy that has dominated the shale oil and gas sector in recent years. That has been the dominant theme as upstream companies have sought to grow through acquisitions as the main means of maintaining their inventories of future drilling projects. Growth via M&A also provides opportunities to optimize head counts and take advantage of other economies of scale and operational efficiencies.

The large amount of contiguous acreage owned by the two companies would allow ExxonMobil to optimize water usage, recycling and transport operations, minimize the number of truck trips related to each specific task, and maximize efficiencies related to both drilling and hydraulic fracturing scheduling, among an array of additional efficiencies.

For its own part, Pioneer has also been active in the growth via acquisitions space, executing buyouts of both Parsley Energy and DoublePoint Energy for a combined $11 billion during 2021. The company has grown to become the largest pure-play Permian Basin company under the leadership of longtime CEO Scott Sheffield.

A deal with Pioneer would come just three months after ExxonMobil’s last big acquisition, the $4.9 billion buyout of midstream company Denbury in July. That deal was another natural fit for the energy giant, mainly additive to its Low Carbon Ventures (LCV) business unit, given Denbury’s suite of CO2 pipelines and other CO2-related assets. Exxon’s LCV unit has a heavy focus on mounting major carbon capture and storage projects along the Texas and Louisiana Gulf Coast, where much of the Denbury assets are located.

But a deal with Pioneer would be all about oil and gas, all about the upstream, and all about the prolific Permian Basin. It would also be entirely consistent with the beefed-up, Permian-heavy capital budget Exxon and its CEO, Darren Woods, rolled out early this year.

This is a deal that has always seemed like a natural fit but has never managed to come to fruition. Perhaps this time will be the charm.

Read the full article here