The American arm of Fraport—the owner of Frankfurt Airport the busiest gateway in Germany—will be taking over the retail business at Washington D.C.’s two main airports from January: Washington Dulles International and Ronald Reagan Washington National. And smaller retailers may be in with a good chance of being part of the offer.

Fraport USA announced the win for center management concessions on Thursday last week, following a tender process. The contract, which covers both airports, will run for just over 10 years starting from January and ending in March 2034.

The deal marks a major coup for Germany’s Fraport which, until now, had a major focus on the northeast of the U.S. with responsibility for the center management of individual terminals at the New York gateways of Newark Liberty International (Terminal B) in New Jersey and JFK International (JetBlue’s Terminal 5) in Long Island, New York.

Fraport USA also has retail concessions at the smaller airports of Baltimore/Washington, Cleveland Hopkins, and Nashville whose traffic in 2022 totaled approximately 42 million passengers.

Handed customers on a plate

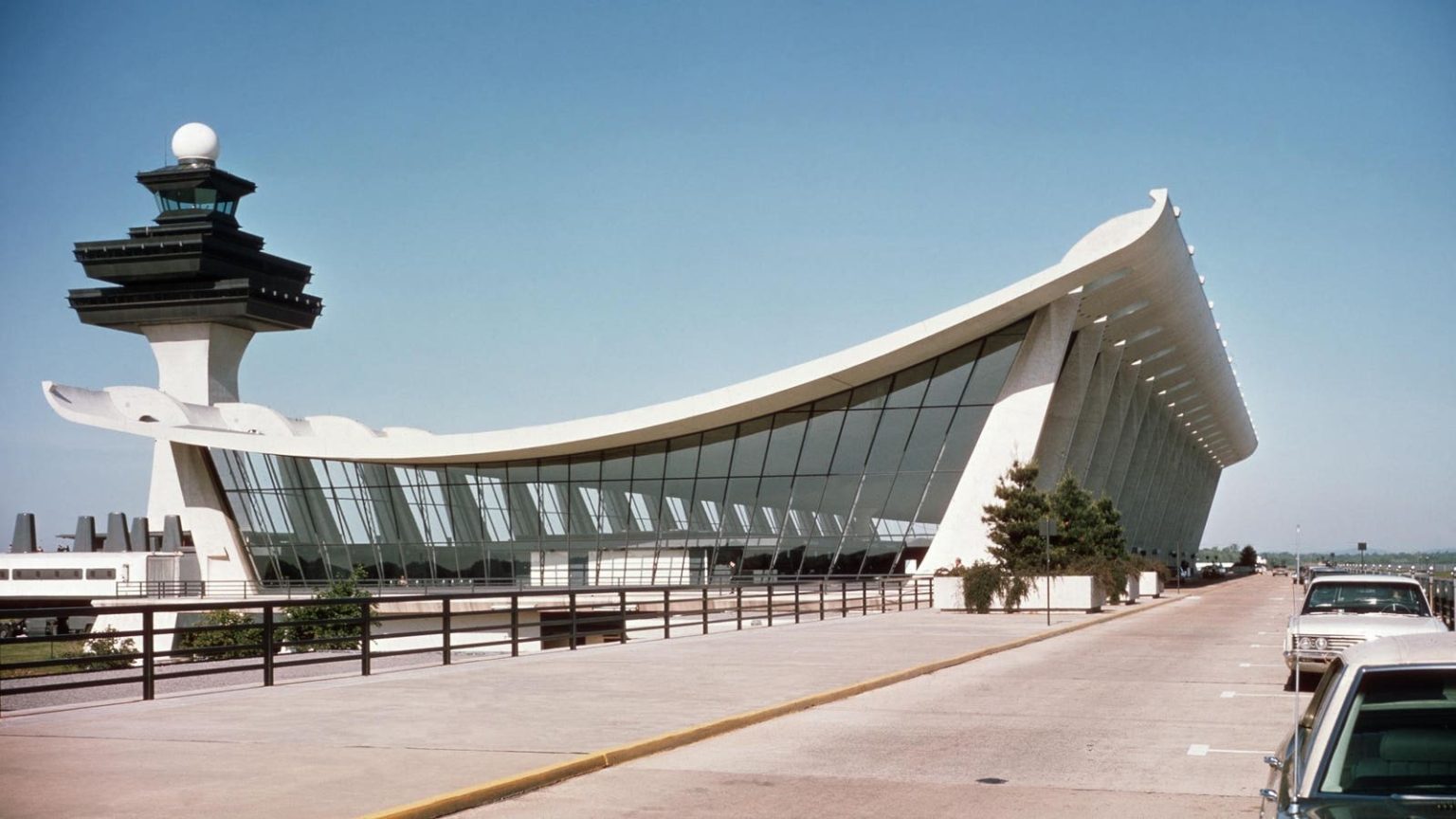

The addition of Dulles International, located in the state of Virginia, and Ronald Reagan National—both operated by the Metropolitan Washington Airports Authority (MWAA)—give Fraport USA significantly more scale. In 2022, the two airports serving the capital processed 21.4 million and 24 million passengers respectively, handing Fraport USA 45.3 million extra consumers, an annual number that may well rise again in 2024 when its concessions start.

Fraport USA considered itself to be among the market leaders in airport retail and F&B (food and beverage) in American airports before picking up the Washington concessions. The subsidiary claims its locations have among the highest passenger spending anywhere in the country. That will be put to the test in D.C. where the company is now tasked with revamping the roughly 118,000 square feet of retail and F&B concession space at the two airports.

So far only predictable talk of “enhancing the airport experience” has been uttered, with plans to deliver more localized retailing and dining at the airport. However, Fraport USA’s CEO, Sabine Trenk—who only took on the top job in June after serving as chief operating and commercial officer for Fraport Brasil—has said that she will give smaller firms a role in the retail transformation.

Support for the small guy

In a statement, she commented: “As part of our approach, we will support smaller companies from the region so that passengers can savor Washington D.C.’s typical sense of place before departure or when arriving.” She has promised an “innovative and world-class” retail program at the two airports so the pressure is on to deliver something special.

The group has a good record in terms of retail concepts. A USA Today readers’ choice poll ranking the 10 best airports for shopping in America put Baltimore Washington in tenth place and Nashville at the top for showcasing the city’s rich music culture, and Tennessee’s whiskey production and history.

Over the past few years, Washington’s MWAA has made efforts to maximize non-airline revenue by diversifying its concessions program with an enhanced terminal concessions strategy for dining, retail, and newsstands. It has also pursued other non-airline revenues such as digital and land development resulting in a consistent year-over-year growth in non-airline revenue.

While the pandemic impacted that growth, passenger activity is up again, and the authority’s 2023 budget for non-airline revenue was increased by 20.4% above 2022 and will likely rise again next year when Fraport USA takes over.

The concessionaire also needs to build back profitability. While revenue topped €100 million last year, a 52% increase, EBITDA fell by 13% to just under €50 million, while EBIT fell by 77% to €4.8 million.

Read the full article here