The Apple Safe-Haven Argument

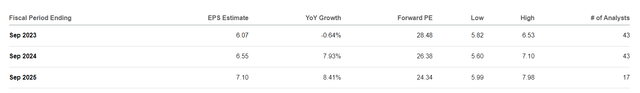

Why are investors paying close to 30x earnings on Apple (NASDAQ:AAPL) stock, paying a 50-60% premium to the S&P 500 (SP500) ? I have long reflected on this question. Because how I see it, Apple’s business momentum doesn’t justify a premium to the general equities market based on growth, like for example Microsoft (MSFT), Nvidia (NVDA) or Google (GOOGL) do. In fact, according to analyst consensus estimates, Apple’s earnings are expected to remain flat in 2023, and grow at a 7-8% CAGR through 2025. The hereby implied geometric CAGR is only slightly above the growth rate estimated for the S&P 500 constituents.

Seeking Alpha

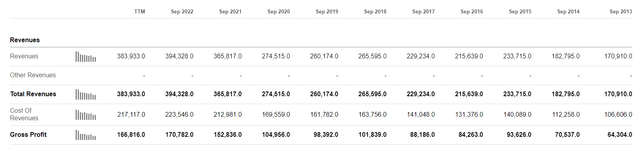

Looking beyond growth, however, there is another reason to pay more for certain stocks: quality and consistency of earnings. The more predictable and better-moated a company’s earnings stream, the more are investors willing to pay. In that context, Apple truly shines. During the past 10 years, Apple has consistently achieved revenue growth and steady value accumulation. From 2013 to 2023 TTM, revenues expanded at a 8% CAGR, growing from $170 billion in 2013 to $384 billion for the trailing twelve months.

Seeking Alpha

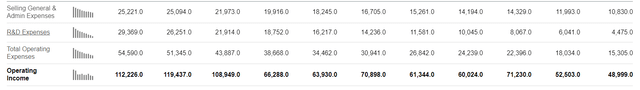

Over the same period, operating income jumped from $49 billion to $112 billion, also a 8%-ish CAGR.

Seeking Alpha

Reflecting on these numbers, perhaps most interesting is that there was only one year, 2019 over 2018, where Apple did not score a year on year revenue and operating income. And this “blip” in the data was not caused by commercial pressure on Apple’s product, but on macro trends in context of currency fluctuations. Tim Cook commented in the Q2 earnings call:

We had a blockbuster quarter for iPad, with revenue up 22% from a year ago; this is our highest iPad revenue growth rate in six years. And it was another sensational quarter for wearables with growth near 50%. This business is now about the size of a Fortune 200 company, an amazing statistic when you consider it’s only been four years since we delivered the very first Apple Watch …

… We like the direction we’re headed with iPhone and our goal now is to pick up the pace. Importantly, our active installed base of devices continues to grow in each of our geographic segments and set a new all-time record for all major product categories. That growing installed base is a reflection of the satisfaction and loyalty of our customers and it’s driving our Services business to new heights.

We had our best quarter ever for the App Store, Apple Music, cloud services and our App Store search ad business and we set new March quarter revenue records for AppleCare and Apple Pay.

We see this result as a positive outcome in light of ongoing headwinds from weaker foreign currencies relative to the US dollar. In constant currency, our year-over-year revenue performance would have been 200 basis points better than our reported results indicate. We had great results in a number of areas across our business. It was our best quarter ever for Services with revenue reaching $11.5 billion.

So, with Apple shares an investor gets quality. This though was also expressed beautifully by Warren Buffett during the 2023 Berkshire investor meeting, with Buffett saying that Apple would be the best business the conglomerate owns.

Watch The Treasury Yield

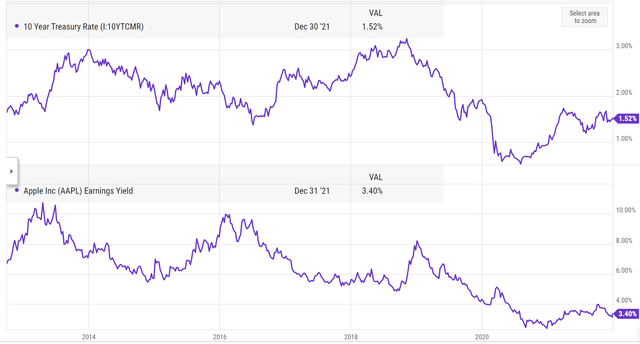

All, that said, however, I would like to point out that Apple’s leadership in quality doesn’t free the company from valuation benchmarks. In fact, if an investor accepts that Apple stock offers “ultimate quality”, then an investor is inadvertently assuming that Apple is equal in character to a “safe-haven asset”. An when we talk about a “safe-haven asset”, then we have a benchmark, namely the U.S. Treasury.

In a time when U.S. treasuries were yielding below 2%, the inverse earnings yield on Apple, with about 3% was considered quite attractive. But with short-dated Treasuries jumping close to 6%, and 10 year Treasuries topping 5%, the relative attractiveness has shifted, now disfavoring Apple.

Investors will be quick to point out that the comparisons is not perfect, because Apple also offers features of a growth asset. But as I have established in the introduction, Apple is a not a great investment vehicle to capture growth. Most notably, the number of annual iPhone shipments, Apple’s core product accounting for about half of group sales, appears to be topping out on close-to-full market penetration. And iPhone replacement cycles may be extending on notoriously small, unconvincing product upgrades.

That said, the upside opportunity in expansion is, in my opinion, quite perfectly offset by the downside risk. While Apple has turned out to be quite riskless in the past, the future may bring a few headwinds. In a previous article I have already argued that Apple may see as much as $18 billion worth of highly margin accretive sales at risk in context of the ongoing U.S. vs Google trial — if the DOJ restricts the freedom of Google’s (GOOG) search/ application agreements with OEMs. In addition, investors should not forget the possibility of Apple itself encountering antitrust challenges from the DOJ, particularly concerning its role and business model within the Apple Store. Lastly, on a related note on risks, I also point out Apple’s has strong exposure to China, both on the demand (almost 20% of sales) as well as the supply side.

So, net/net I think it is fair to say that Apple’s growth outlook is neutral at best. And if this statement is accepted as true, Apple’s 30x P/E looks overvalued compared to a 5% yield on Treasuries. To close the valuation discrepancy, Apple should trade down towards a competitive earnings yield, which I calculate at 20x.

My argument that Apple’s earnings yield should trade in line with the Treasury yield is further supported by historical data. In the past 10 years, Apple’s earnings yield has traded at a similar wave pattern as the Treasury yield. And on a relative basis, throughout the past decade the Treasury yield was actually 200-300 basis points lower than Apple’s earnings yield. But now, in October 2023, Apple’s earnings yield is almost 200 basis points lower. This observation further boosts my argument that Apple’s earnings yield should converge upwards, to trade more in line with the Treasury yield.

YCharts

A Note On Upcoming Earnings

In context of the thesis, Apple’s upcoming earnings for the September quarter are relatively irrelevant — but I expect the reporting to support the thesis: low topline growth, but stable earnings. In that context, analysts project Apple to generate sales in the range of $87.8 billion to $92.13 billion. At midpoint, this would suggest a year over year contraction of about 1% (yes, negative growth). On earnings, analysts expect EPS in the range of $1.34 to $.47, implying year over year growth of 8.08%.

Investor Takeaway

Apple’s lofty valuation at nearly 30 times earnings, well above the S&P 500, is perplexing with growth trajectory lagging behind tech giants like Microsoft, Nvidia, and Google. However, Apple’s appeal lies in its consistent earnings and quality, which does warrant a valuation premium. While Apple’s track record of consistency is impressive, it shouldn’t render the stock exempt from valuation benchmarks. Comparing it to a “safe-haven asset” invokes a connection to the U.S. Treasury, whose yields have risen. With Apple’s growth prospects appearing neutral at best and potential risks like antitrust issues and exposure to the Chinese market, its P/E ratio of 30x seems overvalued. A more competitive earnings yield, estimated at 20x, would align it with Treasury yields. This is supported by historical data. To conclude, with the 10 year Treasury trading at 5%, I see Apple’s valuation as unsustainably high; and a rerating is likely imminent. I advise to sell while the price is rich.

Read the full article here