Every person approaches investing a little differently. I, for starters, place a tremendous amount of weight on companies that generate consistent financial growth. Even though I understand that volatility does exist, I generally like to see revenue, profits, and cash flows increase over the long run. When companies don’t do this, it is a big warning sign to me and it suggests that a rather large margin of safety needs to be baked into the stock in question if you are to invest. Rarely is the margin of safety large enough in my case. But every so often, there will come a company that means that. A great example of this can be seen by looking at ACCO Brands (NYSE:ACCO), a diversified firm that produces a number of consumer, technology, and business branded products such as Five Star notebooks, various video game and computer accessories, stapling and laminating tools, storage products, calendars, and much more.

Recently, sales and profits from the company have come under pressure. At the same time, cash flows have shown some slight improvement. This inconsistency in financial performance is a big negative to me. But when you consider just how cheap the stock is, it is difficult to be bearish on it. Of course, part of being an investor is knowing that the picture can change rather quickly. So those who do consider buying into a company like this would be wise to pay careful attention when new data does come out. And for ACCO Brands, that next time is November 2nd, after the market closes.

Mixed performance is far from ideal

Back in the middle of June of this year, I ended up revisiting my prior thesis regarding ACCO Brands. In that article, I recognized that the company had underperformed recently, with shares dropping even while the broader market moved higher. This lackluster share price performance was driven by declining sales, profits, and cash flows. But despite those troubles, the stock looked incredibly cheap, leading me to keeping it rated a ‘buy’. Since then, the stock has continued to underperform, but only by a bit. While the S&P 500 has dropped 3.4%, shares have returned downside of 4.2%.

Author – SEC EDGAR Data

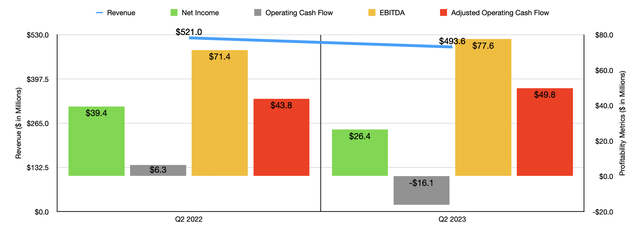

In some respects, this downside was warranted. Consider how the company performed during the second quarter of 2023. Revenue for that time came in at $493.6 million. That’s 5.3% lower than the $521 million reported one year earlier. This sales decline came even as management succeeded in increasing prices rather significantly. Had volume been flat, sales would have been up 8.1% year over year because of price increases. However, lower demand caused by macroeconomic conditions and, in particular, weak computer accessory sales, sent total sales volume down 13.2% year over year. On a percentage basis, the biggest weakness for the company came from its ACCO Brands EMEA segment, with revenue plunging 8.8% because of the aforementioned issues. But the largest dollar impact involved ACCO Brands North America, with revenue plunging $14 million, or 4.6%.

The drop in revenue brought with it a rather unfortunate decline in profits. Net income fell from $39.4 million to $26.4 million. This was in spite of the fact that the company’s gross profit grew from $150 million to $164.2 million. The biggest problems stemmed from an increase in the firm’s selling, general, and administrative costs from 17.6% of sales to 19.9% and from a rise in interest expense from $10.8 million to $15.5 million. Higher incentive compensation costs and lower sales ratchet it up the expenses of the former, while the latter increased because of the variable rate debt that the company has on its books. The average interest rate under the $510.2 million in variable debt that the company had outstanding at the end of the most recent quarter grew from 3.02% last year to 6.63% this year.

Author – SEC EDGAR Data

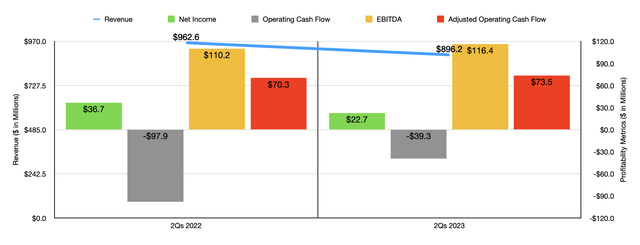

Although net profits declined, the other profitability metrics for the company were largely positive. The one exception to this was operating cash flow. It went from $6.3 million to negative $16.1 million. But if we adjust for changes in working capital, we get a rise from $43.8 million to $49.8 million. And finally, there is EBITDA. It managed to grow from $71.4 million last year to $77.6 million this year. As you can see in the chart above, the results experienced during the second quarter of the year were mostly consistent with the first half of the year as a whole. The one outlier in this case is operating cash flow. But I do believe that it’s the least important of the metrics, while the most important is the adjusted figure for it.

Author – SEC EDGAR Data

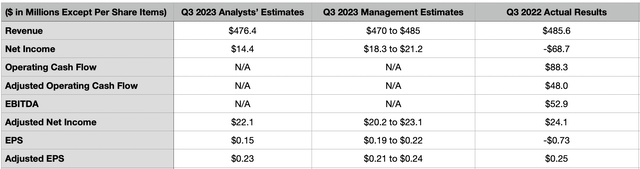

As I mentioned earlier in this article, after the market closes on November 2nd, the management team at ACCO Brands is expected to announce financial results covering the third quarter of the company’s 2023 fiscal year. At this time, analysts are forecasting revenue of $476.4 million. This would be down 1.9% compared to the $485.6 million generated one year earlier. It also seems to be a fairly realistic expectation when you consider that management forecasted revenue for the third quarter to be between $470 million and $485 million. Earnings per share, meanwhile, are expected to come in at $0.15, while adjusted earnings should be somewhere around $0.23. The GAAP earnings would actually represent an improvement over the $0.73 per share loss generated in the third quarter of last year. But the adjusted earnings would be down by $0.02 year over year. In the table above, you can see what this all would mean for actual net profits and adjusted net profits. You can also see other important profitability metrics that investors should pay attention to when earnings do come out.

When the company reports financial results, it will give management the opportunity to touch on guidance for the year as a whole. They currently anticipate revenue for 2023 to be down by between 1% and 3% compared to what the company generated in 2022. Adjusted earnings per share, meanwhile, should be between $1.08 and $1.12. At the midpoint, that would imply adjusted profits of $105.9 million, which would be up slightly from the $101 million reported for 2022. No estimates were given when it came to other profitability metrics. But based on my own estimates, adjusted operating cash flow should be around $163.7 million, while EBITDA should total $240.5 million.

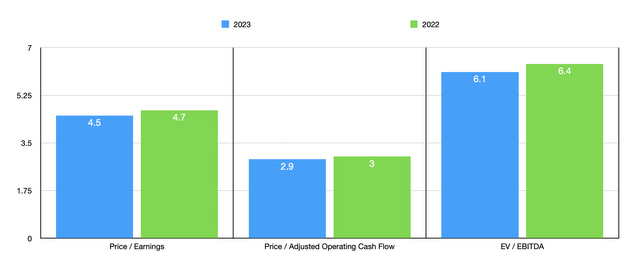

Author – SEC EDGAR Data

Using these estimates, I was able to value the company as shown in the chart above. As you can see, shares are at the low single digits. A lot of this has to do not only with the volatile financial results, but also with the $995.2 million of net debt that the company has. That gives it a net leverage ratio of 4.14 if we use the 2023 forward estimates. But even with that kind of leverage, the stock looks very attractive to me. It’s also cheap relative to similar firms as shown in the table below. Using any of the three valuation metrics, I found that ACCO Brands is the cheapest amongst the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| ACCO Brands | 4.5 | 2.9 | 6.1 |

| NL Industries (NL) | 32.2 | 6.8 | 8.2 |

| MSA Safety (MSA) | 464.6 | 33.1 | 26.4 |

| HNI Corporation (HNI) | 20.5 | 9.7 | 11.1 |

| Interface (TILE) | 112.7 | 5.1 | 9.7 |

| Steelcase (SCS) | 22.3 | 4.1 | 7.6 |

Takeaway

Only time will tell how things will go with ACCO Brands when it reports financial results covering the third quarter of its 2023 fiscal year. Personally, I would love to see some strong signs of a turnaround, but we are probably a couple of quarters, at least, away from that point. Even so, while revenue and profits are down, cash flows are up and shares are very attractively priced. This latter statement is true not only on an absolute basis, but also relative to similar enterprises. When all of this is combined, I do still believe that a soft ‘buy’ rating is appropriate at this time.

Read the full article here