In July, the Federal Reserve (“Fed”) raised the overnight benchmark interest rate to a range between 5.25% and 5.50%, a 22-year high. Despite the higher rate environment, economic indicators have remained robust.

Most recently, consumer spending in September grew 0.7% compared to a 0.4% increase in August and expectations of a 0.3% rise. This is notable since spending is the primary driver of economic growth. Look no further for evidence of this than gross domestic product (“GDP”), which recently came in at a seasonally and inflation-adjusted 4.9% annual rate in the third quarter, its strongest rate of growth in nearly two years, due largely to consumer spending. It’s also worth noting that the data on both spending and GDP follow the release of September’s blowout employment figures.

Given the economic data, it may come as a surprise that interest rate traders are currently factoring in a 99.9% probability, as reported by CME’s FedWatch tool, that the Federal Open Market Committee (“FOMC”) will remain on hold at their next two-day meeting beginning Tuesday. Here are some variables that suggest a rate pause is more certain than one may expect.

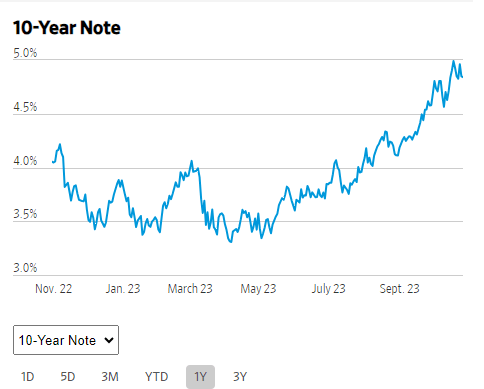

The Rise In Long-Term Treasury Yields

I view the recent rise in long-term yields as a de facto rate increase. This month the yield on the 10-year U.S. Treasury note rose to its highest level in 16 years.

The Wall Street Journal – Graph Of Yield On 10-Year Treasury Notes Over The Last One Year

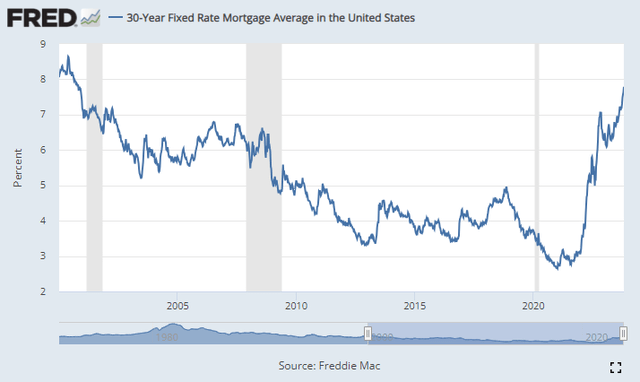

Its rise is noteworthy since the benchmark is a significant underlying of U.S. borrowing costs. Rates on mortgages, auto loans, and business debt all are set in line with the long-term yield. Mortgage rates, for example, are broaching the 8% mark, a level not seen since the early 2000s.

St. Louis Fed – Graph Of 30-Year Mortgage Rates From 2000 To Present

Granted the rise in mortgage rates could, perhaps counterintuitively, keep core inflation higher than desired. According to an analysis performed by real estate firm, CBRE, the average monthly new mortgage payment is over 50% higher than the average apartment rent. Prospective buyers, therefore, would be best served staying in their rental units. Landlords in turn would have a favorable cushion for rental growth, knowing their rental unit’s relative discount to ownership.

While the dynamics surrounding mortgage rates and overall inflation may be more complex, higher long-term rates elsewhere, such as in auto loans and business debt, will more clearly have an impact on future investment given the cost of capital and pricing considerations. For instance, in their Q3 earnings release, CFO Bob Mack of powersports retailer, Polaris (PII), noted softness in the demand environment and higher promotional activity due in part to the higher financing environment.

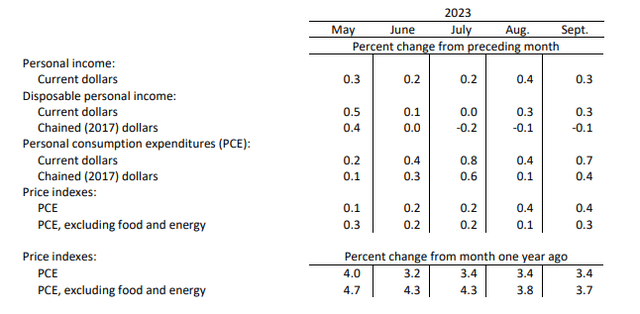

Steady Decline In Fed’s Preferred Inflation Gauge

While overall inflation has remained above the Fed’s 2% target, the acceleration in the downward trend provides confidence that the Fed will remain comfortable holding interest rates steady at their upcoming meeting.

In September, the personal consumption expenditures price index (“PCE”) rose at the same pace as in August, at 0.4%. Though the core increased 0.3%, notably higher than the 0.1% reading in August, its rise follows a continued batch of lower readings previously.

Department of Commerce – Summary Of PCE For September

When converted into an annualized rate, core prices were up 2.8% over the last six months, significantly below the 4.5% annualized rate in the prior six-month period.

With the annualized run in the PCE not far off the Fed’s target, there’s a strong likelihood that core inflation in the more widely watched CPI report could fall below the Fed’s projected 3.7% rate in the fourth quarter. This provides additional confidence in the Fed keeping interest rates stable.

Declining Savings Rate

The most recent surge in GDP was the strongest pace of growth since 2021. While that may fuel concerns about further pricing pressures, the report did provide some hints that the growth is unlikely to continue at its current blistering pace.

The two datasets from the report that lead me to believe the growth won’t continue are the declining savings rate paired with lower real incomes. In the third quarter, Americans’ savings as a share of income declined to 3.8%, a large step down from 5.2% in the second. And the decline in savings was in conjunction with the 1% decline in after-tax, inflation-adjusted income.

If consumers continue to draw down on their savings, they will have less room for purchases. Many also have limited capacity for new debt, especially in the current rate environment. With much of the GDP growth driven by consumer spending, it’s reasonable to foresee the figure pulling back in future periods.

Generally Dovish Commentary

One of the clearest signals that the Fed is likely to remain pat on interest rates is recent commentary from policymakers; and none other than the Chairman himself, Jerome Powell.

At a recent lunchtime address in New York, Powell signaled that the FOMC will extend their interest-rate pause, citing the rise in long-term Treasury yields as one potential factor. However, he also added the caveat that the central bank’s monetary policy only focuses on short-term rates. Nonetheless, he acknowledged that the rise is indeed having a tightening effect, saying, “We have to let this play out and watch it, but for now, it is clearly a tightening in financial conditions.“

Powell’s commentary was also in line with commentary from other policymakers. In prepared remarks at a separate event, Dallas Fed President, Lori Logan said, “If long-term interest rates remain elevated because of higher term premiums, there may be less need to raise the fed funds rate.“

Off the subject of long-term yields, Atlanta Fed President, Raphael Bostic pointed to the decline in overall inflation as one factor supporting his view that there’s no need for further rate increases.

Is The Fed Done Raising Rates In 2023?

While an extension of the interest rate pause at this week’s upcoming meeting appears to be a foregone conclusion based on recent Fed commentary and the current economic variables, what the FOMC does at their meeting in December is less certain.

Currently, interest rate traders are assigning a 20% probability of a 25-basis point increase in December, according to the CME FedWatch Tool; a low likelihood, yes, but certainly a step-up in uncertainty from the less than 1% chance of an increase at this week’s meeting.

In my view, I don’t see the Fed raising rates any further in 2023. The conviction lies in the current yield on long-term Treasurys, a key determinant for business investment and consumer borrowing costs.

The most recent GDP report showed that business investment stalled in Q3, particularly on equipment purchases. Observers should expect the lull to continue as businesses continue to adjust to the higher rate environment.

Similarly, on the consumer side, auto-loan defaults have been on the rise in recent periods. Higher long-term rates, a declining savings buffer, and lower real incomes, all further negatively impact the future consumer financing outlook.

Two uncertainties that could expose the economy to further vulnerabilities are the ongoing wars in Ukraine and the Middle East, as well as the possibility for another contentious negotiation surrounding government funding later in November.

With all these considerations in mind, the Fed is more likely to stay on pause for the remainder of the year than risk compounding the potential economic downsides from the numerous externalities that exist in the current operating environment.

Read the full article here