The Gabelli Dividend & Income Trust (NYSE:GDV) is a closed-end fund or CEF that can be used by those investors who are seeking to earn a very high level of income off their portfolios. As the name implies, the fund seeks to achieve this objective by investing in a portfolio of dividend-paying stocks. That is a very reasonable strategy, which is used by many investors whose biggest priority is getting some income while still retaining the upside potential of the common stocks in the portfolio. After all, most dividend-paying stocks do not have especially high yields and most stocks with very high yields have limited potential for capital gains. This fund does manage to have a higher yield than most common stocks though, as it boasts a 7.26% yield at the current share price.

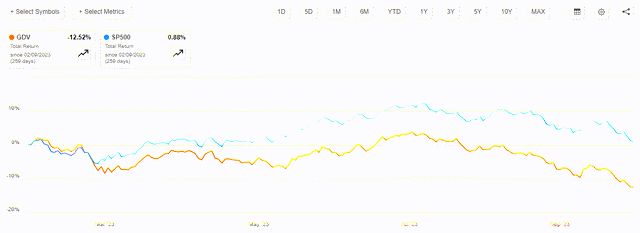

As regular readers may recall, we last discussed the Gabelli Dividend & Income Trust back in February of this year. The fund’s performance since that time has unfortunately been rather disappointing. As we can clearly see here, the Gabelli Dividend & Income Trust’s share price is down 16.61% since the time that the previous article was published. This is substantially worse than the performance of the S&P 500 Index (SP500) over the same period:

Seeking Alpha

That is undoubtedly going to be very disappointing to potential investors. However, we do see that the fund’s general direction matches that of the S&P 500 Index. The Gabelli Dividend & Income Trust simply suffered a much steeper decline than the index back in March and has not fully recovered. We might blame this on the fact that the fund tends to be somewhat heavily weighted towards the financial sector, which makes sense as that is one of the highest-yielding sectors in the market. The financial sector naturally suffered in the market right around the time of the collapse of Silicon Valley Bank and it has yet to recover. However, that cannot explain all of the performance differences, especially since the fund’s financial sector allocation is not noticeably different from the S&P 500 Index.

As I have pointed out in numerous previous articles, closed-end funds such as the Gabelli Dividend & Income Trust frequently aim to deliver nearly all of their investment return via the direct payments that they make to shareholders. As such, it is usually better to look at the fund’s total return than price return when evaluating its performance. After all, the total return more accurately reflects what an investor in the fund actually received. In this case, including the distributions in the fund’s performance helps but it still significantly underperformed the S&P 500 Index since the date that the prior article was published:

Seeking Alpha

This is still very disappointing and will probably prove to be a turn-off to many investors. However, it is still important to have a look at the fund and determine whether or not buying it may make sense. After all, sometimes beaten-down assets can present a fantastic buying opportunity.

About The Fund

According to the fund’s website, the primary objective of the Gabelli Dividend & Income Trust is to provide its shareholders with a high level of total return. As is usually the case, the fund’s website includes a more in-depth description:

The Gabelli Dividend & Income Trust, or the Fund, is a diversified, closed-end management investment company whose objective is to provide a high level of total return.

Under normal market conditions, the Fund invests at least 80% of its assets in dividend paying or other income producing securities. In addition, under normal market conditions, at least 50% of the Fund’s assets will consist of dividend paying equity securities. In making stock selections, the Fund’s investment adviser looks for securities that have a superior yield and capital gains potential.

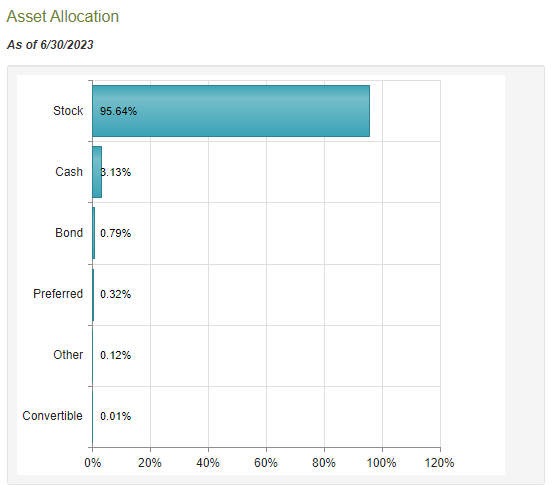

In other words, this is an equity fund that focuses its efforts on investing in dividend-paying equity securities. As such, we might expect that the fund’s portfolio will consist primarily of common stock. That is indeed the case as currently 95.64% of its assets are invested in such securities:

CEF Connect

The fund’s focus on total return makes a great deal of sense in this light. After all, common stocks are by their very nature a total return vehicle as investors purchase common stock both to receive a certain level of income via the dividend payments that they make as well as benefit from capital gains as the issuing company grows and prospers with the passage of time. In the case of most common stocks though, the majority of the returns will be in the form of capital gains. After all, the SPDR® S&P 500 ETF Trust (SPY) only yields 1.58% at its current level, which is nowhere close to enough to provide a suitable level of income for any investor. After all, a $1 million investment at that yield will only produce $15,800 in annual income. That is nowhere near enough income to meet the lifestyle needs of any individual who is capable of coming up with the money to make a $1 million investment.

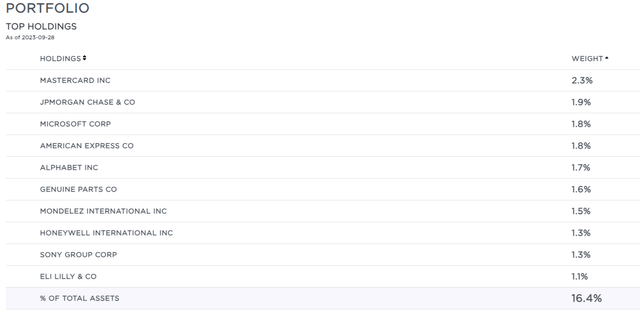

The fund’s description explicitly states that the Gabelli Dividend & Income Trust invests in dividend-paying common stocks. These tend to do a bit better than the index in terms of yield, due to the fact that the index’s average is dragged down by a few large technology companies that do not pay a dividend. We can see that dividend-paying stocks tend to be a bit better in terms of yield than the market by looking at the largest positions in the fund. Here they are:

GAMCO Gabelli Funds

Here are the yields of each of these companies:

|

Company |

Current Dividend Yield |

|

Mastercard Incorporated (MA) |

0.63% |

|

JPMorgan Chase & Co. (JPM) |

3.10% |

|

Microsoft Corporation (MSFT) |

0.91% |

|

American Express Company (AXP) |

1.70% |

|

Alphabet Inc. (GOOG) (GOOGL) |

N/A |

|

Genuine Parts Company (GPC) |

2.99% |

|

Mondelez International, Inc. (MDLZ) |

2.61% |

|

Honeywell International Inc. (HON) |

2.44% |

|

Sony Group Corporation (SONY) |

0.36% |

|

Eli Lilly and Company (LLY) |

0.81% |

Admittedly, many of these companies do not do as well in terms of yield as we would have hoped. After all, only half of them actually beat the broader market index. This is somewhat annoying right now, especially considering that the high-rate environment has been causing share prices to decline across the board. Thus, low-yielding stocks are not nearly as attractive as they were only two years ago. This is especially true when we consider that the one-month Treasury bill is at 5.413% as of the time of writing so there is little reason to purchase any low-yielding stock today when we can wait a month and probably get the stock cheaper than it is today.

The possible exception to this is energy stocks, which have actually seen some gains recently and frequently boast much higher yields than anything that we see in this portfolio. Strangely, the fund does not have any energy companies included in its top ten holdings despite the fact that these stocks are perfect for dividend investors right now.

There have been very few changes since the last time that we discussed this fund. In fact, the only change of note is that Swedish Match was removed from the fund’s largest positions list and replaced with Eli Lilly & Company. That change makes a great deal of sense as Philip Morris International Inc. (PM) executed a takeover bid of Swedish Match around the end of last year. The company has been delisted from the stock market and now operates solely as a subsidiary of Phillip Morris International. The remaining companies are all the same as the last time that we looked at this fund, although the weightings have changed somewhat. This is not necessarily a sign that the fund is engaging in trading activity as it could simply be caused by one stock outperforming another over the past six months.

Indeed, the Gabelli Dividend & Income Trust only has a 10.00% annual turnover, which is incredibly low for an equity closed-end fund. As I explained in various previous articles, this is nice due to the simple fact that it costs money to trade stocks or other assets, and that creates a drag on the fund’s overall performance.

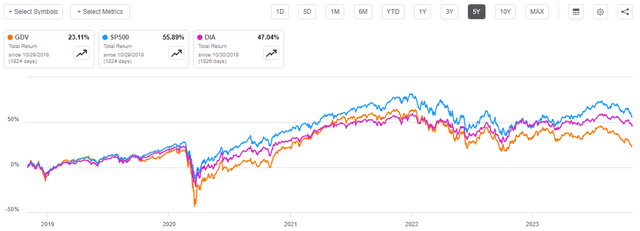

Unfortunately, the fund’s low turnover does not seem to be helping it against the market. Over the past five years, the Gabelli Dividend & Income Trust has underperformed both the S&P 500 Index and the Dow Jones Industrial Average (DIA). This is true even when we take the distributions that were paid by the fund into account:

Seeking Alpha

One thing that is nice though is that this fund managed to deliver a positive total return over the period. There are a good many funds, notably some in the energy or fixed-income spaces, that have failed to accomplish this feat. The underperformance relative to the two American indices is very disappointing though. With that said, the Gabelli Dividend & Income Trust does have a higher yield than either of the indices so an investor who is more concerned about earning a high level of income rather than maximizing their total return may opt to purchase shares of this fund anyway despite the lower total return.

The big question right now is whether or not the high-interest rate environment will cause dividend-paying stocks to come back into fashion. As I pointed out in the past, a significant proportion of the total return of the S&P 500 Index over the past decade has been due to a handful of mega-cap technology stocks that either do not pay dividends or pay such a small dividend that they may as well have no yield. The outperformance of these companies was at least partly due to the “free money” that was being handed out by the Federal Reserve. The fact that interest rates were so low resulted in investors not really caring if it took twenty years or more for a company to grow into its valuation and they were willing to wait years or even decades for their investments to be able to start returning money.

However, today it is quite easy to get a 5% return on investment simply by parking cash in short-term Treasuries or money market funds. This is a very safe return for obvious reasons. As such, market participants may not be as patient with respect to how quickly a company can return all of its money. This may cause money to shift away from the low-yielding growth stocks and towards stocks with higher yields due to the more rapid return of capital. That would benefit the stocks that are contained in this fund at the expense of growth stocks. As growth stocks account for an outsized proportion of the S&P 500 Index, this scenario could improve the fund’s performance relative to the index. Unfortunately, there are no guarantees here as we did see the market favor long-duration stocks during the first half of this year.

Leverage

As is the case with many closed-end funds, the Gabelli Dividend & Income Trust employs leverage as a method of boosting its effective return. I explained how this works in my last article on this fund:

Basically, the fund is borrowing money and using those borrowed funds to purchase dividend-paying common stocks. As long as the purchased assets deliver a higher total return than the interest rate that the fund needs to pay for the borrowed money, the strategy works pretty well to boost the overall yield of the portfolio. Since the fund is able to borrow money at institutional rates, which are substantially lower than retail rates, this will usually be the case.

Unfortunately, the use of leverage is a double-edged sword. This is because debt boosts both gains and losses. As a result, we need to ensure that the fund is not using too much leverage since that would expose us to too much risk. I generally do not like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

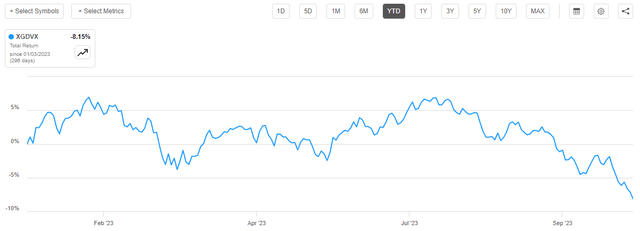

As of the time of writing, the Gabelli Dividend & Income Trust has levered assets comprising 14.85% of its portfolio. This is a significant increase from the 13.32% leverage ratio that the fund had the last time that we discussed it. However, this was probably caused by the fact that the fund’s net asset value is down 8.15% year-to-date:

Seeking Alpha

Thus, the leverage ratio would have increased unless the fund actually paid it off. This is because debt does not decline when the fund’s assets do, which is the whole reason why leverage increases losses. The fund’s leverage still represents a very acceptable balance between risk and reward though, so we should not need to worry too much about it at this point.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the Gabelli Dividend & Income Fund is to provide its investors with a very high level of total return. However, it seeks to accomplish this by investing in a portfolio that consists mostly of dividend-paying common stocks. One of the characteristics of most dividend stocks is that they tend to have somewhat lower capital gain potential than a non-dividend-paying stock, but they make up for it by making direct payments to the investors. This provides a source of income for this fund. In addition to this, the fund aims to generate capital gains from its positions as the issuing companies grow and prosper. The fund combines its income with any realized gains and pays out all of the money to its shareholders, net of any investment expenses. As capital gains can be a pretty high percentage of a stock’s price during a given year, we might expect that this process would allow the Gabelli Dividend & Income Fund to pay a very high yield to its investors.

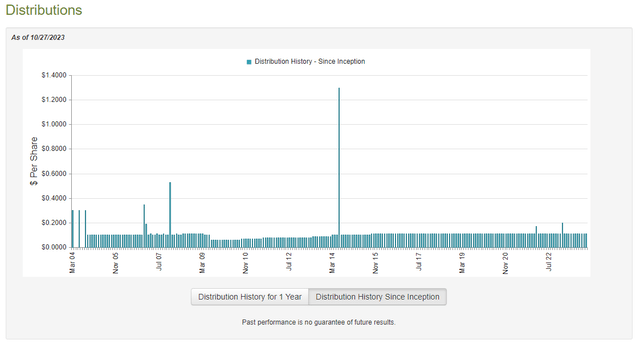

This is certainly the case, as the fund currently pays a monthly distribution of $0.11 per share ($1.32 per share annually), which gives it a 7.26% yield at the current share price. This is nowhere near as attractive as some other closed-end funds possess but at the same time, it is a sign that the market expects that this fund will be able to sustain its distribution going forward. Its past performance is encouraging in this respect as the fund has generally maintained or grown its distribution since 2009:

CEF Connect

This actually makes the Gabelli Dividend & Income Trust one of the only closed-end funds that has not had to cut its distribution in response to the COVID-19 pandemic or the bear market of 2022 that persists to this day. This is likely going to prove somewhat appealing to those investors who are seeking to earn a safe and secure income from the assets that they have accumulated over their lifetimes. However, it is also curious that this fund was able to accomplish such a feat when many of its peers have failed. Thus, we should have a look at its finances to see how sustainable its distribution is likely to be.

Fortunately, we have a fairly recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on June 30, 2023. This is a much newer report than the one that we had available to us the last time that we discussed this fund, which is quite nice. After all, this report should give us a good idea of how well the fund managed to take advantage of the bull market bounce during the first half of this year. It will also give us a better idea of where its finances stand after the carnage that the market of 2022 wreaked upon many portfolios.

During the six-month period, the Gabelli Dividend & Income Trust received $24,934,207 in dividends (net of foreign withholding taxes) and $2,730,346 in interest from the assets in its portfolio. This gives the fund a total investment income of $27,664,553 during the six-month period. It paid its expenses out of this amount, which left it with $12,776,619 available to shareholders. As might be expected, that was nowhere near enough to cover the fund’s distributions during the period, which totaled $59,517,914. At first glance, this is certain to be concerning to any investor as the fund’s net investment income was nowhere close to enough to cover the money that it actually paid out to its shareholders.

However, the fund does have other methods through which it can obtain the money that it needs to cover its distribution. For example, the fund might have been able to realize capital gains from appreciated stocks in the portfolio. This money is not considered to be part of investment income, but it certainly represents money coming into the fund that could be paid out. Fortunately, the fund did enjoy some success in this area during the period. It reported net realized gains of $1,665,465 and had another $140,500,164 net unrealized gains. Overall, the fund’s net assets increased by $90,271,110 over the six-month period. Thus, the fund did manage to fully cover its distribution.

With that said, we can clearly see that the fund was only able to cover the distribution because of net unrealized gains. Its net investment income and net realized gains were nowhere near sufficient. This could be somewhat concerning as unrealized gains can be very easily erased by a market correction. Thus, we cannot necessarily count on them for support in covering the distribution unless the fund sells the assets and realizes the gains. The market turned very quickly after the date covered by this financial report so there is no guarantee that the fund managed to realize these gains before they started to get erased. As such, we do not know exactly how sustainable the fund’s distribution is likely to be right now. The fact that its net asset value is currently lower than what it had at the start of the year is not promising though, as it could indicate that the fund has since lost all of its former gains and is actually struggling to sustain the distribution at the current level.

Valuation

As of October 27, 2023 (the most recent date for which data is currently available), the Gabelli Dividend & Income Trust has a net asset value of $22.08 per share but the shares currently trade for $18.20 each. This gives the fund’s shares a 17.57% discount on net asset value at the current price. That is in line with the 17.10% discount that the shares have had on average over the past month. In addition, as I have pointed out before, a double-digit discount is generally a reasonable price to pay for the shares of any fund. Thus, the current price appears to be quite reasonable for anyone who wishes to acquire shares.

Conclusion

In conclusion, the Gabelli Dividend & Income Trust has a strategy that may pay off right now. In particular, the high-rate environment might give some advantage to dividend-paying stocks over non-dividend-paying growth stocks. However, Gabelli Dividend & Income Trust has been underperforming the S&P 500 Index by quite a lot all year, and this may be due to the fact that its distribution could be too high. The fund managed to cover it in the first half of the year due to significant unrealized gains, but there are signs that these may since have been erased. This is because the fund’s net asset value is currently lower than at the start of the year. The fund is trading at a reasonable valuation though, so investors who like it do have a pretty good opportunity to acquire shares right now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here