STMicroelectronics (NYSE:STM) experienced robust growth in automotive semiconductor revenue but faced weak sales in personal electronics during Q3 FY23. The overall quarterly result met expectations, and there are no major revisions to their full-year guidance. I am encouraged by their strong growth prospects in the silicon carbide market and maintain a “Strong Buy” recommendation with a fair value of EUR 69 per share.

Q3 FY23 Review and Outlook

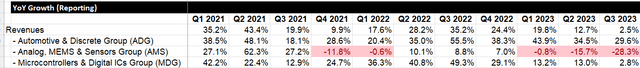

In Q3 FY23, their revenue grew by 2.5%, while operating income decreased by 2.4%. This decline in operating income was expected, given the strong sales in automotive chips, which offset the weak performance in personal electronics. Notably, the revenue of the Automotive & Discrete Group (ADG) increased by 29.6% year over year, building upon the impressive 55.5% growth observed in Q3 FY22. It is worth mentioning that the personal electronics-related chips are currently facing sluggish demand in the end market. Consequently, the revenue of the Analog, MEMs & Sensors Group declined by 28.3% year-over-year.

STM Quarterly Results

For the full-year guidance, the midpoint for revenue is projected at $17.3 billion, indicating a 7.3% year-over-year growth, with a gross margin of 48.1%. As of September 30th, 2023, the company held $5 billion in total cash and equivalents and had $2.6 billion in total debts. Consequently, they maintained a net cash balance of $2.4 billion, showcasing a strong and healthy balance sheet.

I believe their full-year guidance is realistic, reflecting sustained robust growth in the automotive end-market, despite weaknesses in the personal electronics sector. I will address their challenges in the personal electronics market in the risk section.

During the pandemic, major automotive OEM companies recognized the critical importance of automotive chips, particularly in EV manufacturing. These OEMs began entering into long-term supply agreements with major chip manufacturers and stockpiling automotive chips in their warehouses as essential materials. This shift in concept is highly positive for automotive chip manufacturers. It provides them with increased visibility into near-term demands and enables more efficient management of their supply chain, akin to a foundry.

Silicon Carbide Updates

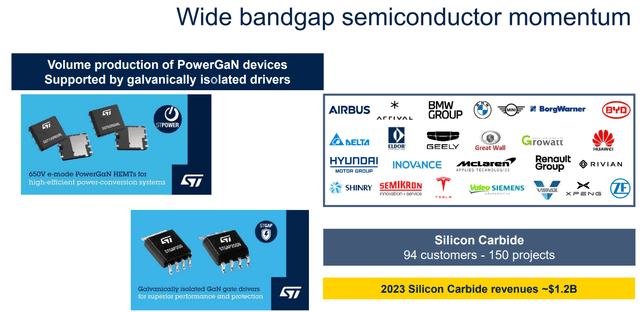

They provided some updates on silicon carbide during the earnings call, stating that they are currently working with 94 customers and 150 projects, up from 90 customers and 140 projects in the previous quarter. Additionally, they confirmed that silicon carbide revenue is anticipated to reach $1.2 billion this year.

STM Q3 FY23 Presentation

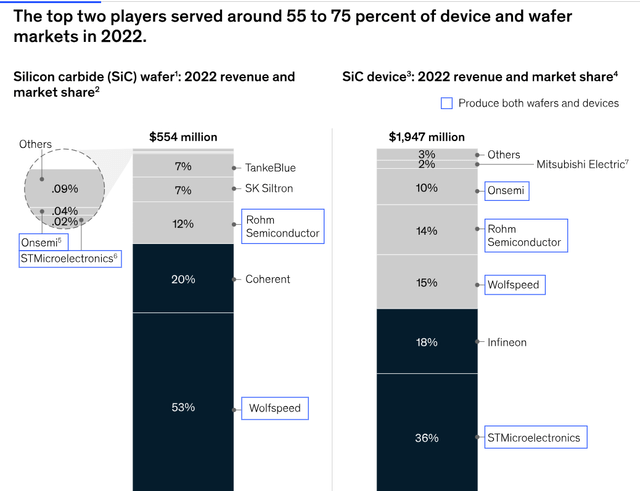

Using their midpoint guidance, silicon carbide revenue would account for only 6.9% of total revenue in FY23, still a relatively small percentage for the entire group. As I mentioned in the introductory article, silicon carbide represents a structural growth end-market and is poised to be widely used in long-range EVs in the future. Presently, ON Semiconductor (ON), Infineon (OTCQX:IFNNY), ROHM, Wolfspeed (WOLF), and STMicroelectronics are leading the game.

In a recent conference, ON Semiconductor’s management pointed out that the silicon carbide market is expected to grow by 30-35% year over year for the next five years. ON is targeting to grow at 2x the market rate and has already secured around $11 billion in long-term supply agreements with key OEMs for silicon carbide. In Q3 FY23, ON Semiconductor is guided to achieve $800 million in revenue for FY23, $200 million less than the previous guidance. ON’s management expects they own more than 25% of the market share in the silicon carbide market by the end of FY23.

Overall, I believe STMicroelectronics’ silicon carbide business is slightly larger than ON’s at this point. However, the entire silicon carbide market is still in its infancy, and I anticipate significant growth for all major players over the next few years.

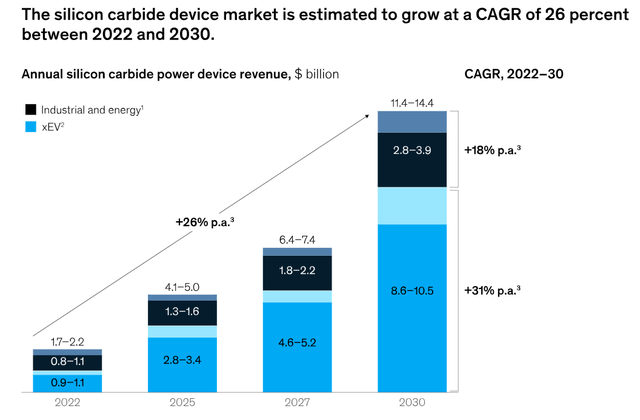

McKinsey Report: “New Silicon Carbide Prospects Emerge as Market Adapts to EV Expansion”

Recently, McKinsey published a compelling report titled “New Silicon Carbide Prospects Emerge as Market Adapts to EV Expansion” on October 17th, 2023. In this report, they emphasized the critical role of silicon carbide technology in driving future EV penetration. McKinsey forecasts that silicon carbide adoption in EVs will grow at an annual rate of 31%, reaching a substantial market value ranging from $8.6 to $10.5 billion by 2030.

McKinsey Report: “New Silicon Carbide Prospects Emerge as Market Adapts to EV Expansion”

I believe the growth of silicon carbide is structural. Silicon carbide offers higher efficiency for EV batteries, leading to an extended driving range. Traditional silicon materials cannot support the same level of energy efficiency as silicon carbide. For long-range EVs, silicon carbide is the best alternative for chips. Additionally, silicon carbide has greater power density compared to silicon-based designs using IGBTs in EV chargers. This higher power density enables EVs to charge their batteries at a faster rate.

Key Risks

The personal electronics end market is currently facing significant challenges, and STMicroelectronics cannot remain immune to these difficulties. During the earnings call, their management indicated that the personal electronics market is expected to hit its lowest point in Q4 FY23 and early next year.

In addition to the challenges posed by end-market demands, STMicroelectronics is in the process of replacing optical modules with silicon. While this transition may temporarily decrease revenue, it is expected to result in higher gross margins. Ultimately, they anticipate generating slightly lower revenue but with similar or even higher gross profits from these products. Nevertheless, the company faces near-term revenue pressure in the personal electronics sector.

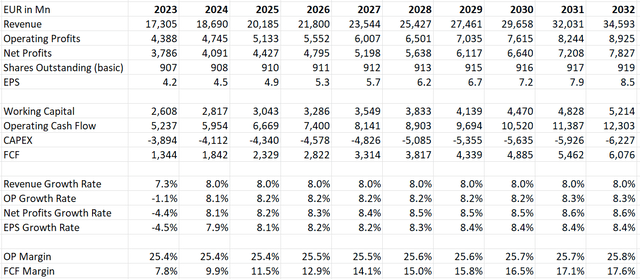

Valuations

I use their full-year guidance midpoint for my DCF model, incorporating a 7.3% revenue growth for FY23, which already accounts for the weak personal electronics revenue in the near term. Due to their substantial investment in silicon carbide manufacturing and R&D, the model forecasts a gradual expansion of their operating margin. I have not made any changes to the margin assumptions in the model.

STM DCF-Author’s Calculation

The new fair value of their stock price is calculated to be EUR 69 per share according to my estimate. I believe their stock price is significantly undervalued at the current level.

Conclusions

I like STMicroelectronics’s position and potential growth in the silicon carbide end-markets. Their Q3 results were as expected, and I maintain a ‘Strong Buy’ rating with a fair value of EUR 69 per share.

Read the full article here