Meta Platforms, Inc. (NASDAQ:META) stock has outperformed the S&P 500 (SPX, SPY) since my August 2023 update. I urged investors to capitalize on its still attractive valuation and improved buying sentiments as I anticipated a further surge toward its all-time highs.

Notwithstanding the recent pullback, I believe my call on META was the right one, given its relative outperformance. Meta’s third-quarter or FQ3 earnings release demonstrated that the Mark Zuckerberg-led company is back on the right track.

Accordingly, Meta posted a YoY revenue growth of 23.2%, reaching $34.15B. It also posted an operating margin of 40.3%, as its operating profit reached $13.75B. Relative to FQ2’22, the recovery of Meta’s business corroborates its wide-moat business model. Moreover, Reels monetization has reached a “net neutral” phase, suggesting Meta no longer sees the headwinds that Reels posted last year. Moreover, its business messaging segment has reached “600M daily conversations.”

Also, AI has continued to drive growth, with AI-driven feed recommendations “contributing to a 7% increase in time spent on Facebook and a 6% increase on Instagram this year.” In addition, Meta stressed that its Advantage+ shopping campaigns have recorded a $10B run rate, suggesting robust growth momentum. With “more than half of Meta’s advertisers are utilizing Advantage+ creative tools,” I believe CEO Zuckerberg has proved that Meta is back with a loud hurrah after a disastrous 2022. As such, I have confidence that the remarkable recovery in META would likely be sustained, improving sentiments as dip buyers look to buy on pullbacks.

Notwithstanding my optimism, I must highlight that Meta’s growth rates have likely peaked as it recovers from its malaise last year. It makes sense, right? YoY comps are expected to be more challenging from Q4 as it fully laps last year’s downturn. Meta is expected to post revenue growth of 21% in Q4, in line with management’s guidance. However, it’s expected to slow further through H1’24, reaching 13.6% by FQ2’24. As such, investors must temper their expectations of repeating last quarter’s surge as Meta’s business returns to a more normalized momentum.

Despite that, META isn’t aggressively valued, as it last traded at a forward EBITDA multiple of 9x, way below its historical average of 14.9x. As such, I believe the market has priced in sufficient headwinds against higher capital spending in 2024 as Meta ramps up its CapEx for AI and Reality Labs. Accordingly, Meta anticipates CapEx spending of between $30B and $35B. The updated analysts’ estimates of $33.2B are in line with management’s guidance. It represents a marked 18.2% YoY growth from FY23’s estimates. Therefore, the market likely didn’t favor management’s commentary on “softer” ad spending at the start of Q4, given near-term headwinds attributed to the worsening geopolitical conflict in the Middle East.

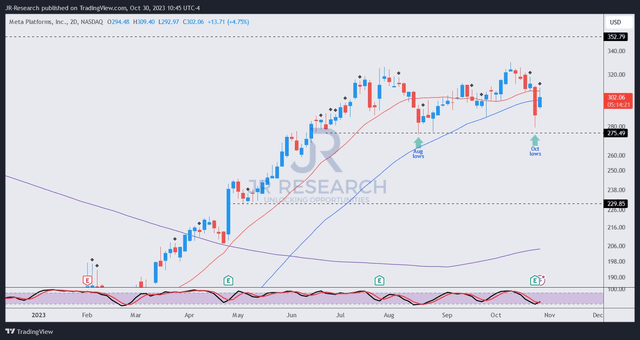

META price chart (2-Day) (TradingView)

META faced significant resistance at the $330 zone, marking its highs in July and October 2023. That zone is expected to impede META’s near-term ability to recover its 2021 all-time highs. I anticipate an extended consolidation phase, underpinned by META’s $275 support level, which saw dip buyers returning in August and after META’s post-earnings selloff last week.

As such, that zone seems to be well-supported by dip buyers looking to capitalize on the near-term downside to pick up more META shares. On META’s longer-term charts, it does seem like its upward momentum has stalled. As such, if META fails to regain decisive control of its $300 support zone, it could see renewed selling pressure potentially breaching its $275 support level.

Taking out the $275 level could spur steeper technical selling, leading to a further selloff toward the $260 level. However, I consider that level as undervalued and would consider adding Meta Platforms, Inc. shares aggressively if it does get there.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here