While many football fans know that the best offense is a good defense, the notion originated with the father of the United States and its first President, George Washington. In 1799, he wrote, “Make them believe, that offensive operations, often times, is the surest, if not the only (in some cases) means of defense.” Meanwhile, in his work, The Art of War, Sun Tzu, the sixth-century BC Chinese general and military strategist, wrote, “Attack is the secret of defense, defense is the planning of an attack.”

A strong defense depends on military tools, which have become highly sophisticated in this technological age. Countries worldwide spend massive sums on defense, and keeping ahead of potential enemies requires constant expenditures to keep pace with technological advances. Defense contractors are the companies that supply the defense tools of war that deter enemies. When conflicts break out, those tools become critical for successful outcomes.

Markets reflect the economic and geopolitical landscapes, which have become increasingly uncertain over the past years. In January 2023, the Bulletin of the Atomic Scientists moved its Doomsday Clock to ninety seconds to midnight, the closest to a global catastrophe in history.

The iShares U.S. Aerospace & Defense ETF (ITA) owns shares of the leading U.S. defense contractors. The Direxion Daily Aerospace & Defense Bull 3X Shares Direxion Daily Aerospace ETF (NYSEARCA:DFEN) turbocharges ITA’s price action. As risk is always a function of potential rewards, leveraged exchange-traded fund (“ETF”) products like DFEN carry far higher risks than unleveraged products as they employ options and swaps that suffer from time decay. Therefore, price direction and timing are critical when using any leveraged ETF product.

The world has become more dangerous – Two wars and a bifurcation of the world’s nuclear powers

The handshake between Chinese President Xi and Russian President Putin in February 2022 on a “no-limits” alliance bifurcated the world’s nuclear powers. Less than one month after the leaders pressed the flesh, Russia invaded Ukraine. The world continues to hold its breath for when China will force reunification on Taiwan.

Russia likely believed its move into Ukraine would quickly cause surrender, putting the Eastern European country Russia considers Western Russia under its political umbrella. Russia was wrong. Ukrainian resistance, with support from the United States and NATO allies, has caused an ongoing war that is approaching its second anniversary.

On October 7, Hamas, the organization that governs Gaza, invaded Israel in an unprecedented terrorist attack. Israel declared war on Hamas, igniting war in the Middle East. Hamas and other terrorist groups in the region have financial and military support from Iran. Iran is part of the Chinese-Russia alliance that includes North Korea, a burgeoning Asian nuclear power.

The world has become very dangerous over the past years, and the danger level dramatically increased with the October 7 attack.

Defense spending in increase – The leading contractors will profit

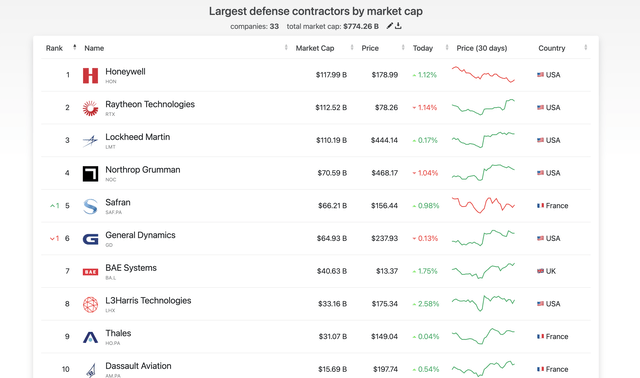

While the threat of a third world war is now a clear and present danger, even if the world avoids that conflict, defense spending will soar. The wars in Ukraine and the Middle East and the bifurcated nuclear powers will only increase military budgets over the coming years. The leading defense contractors by market cap are:

The Top Defense Contractors by Market Cap (companiesmarketcap.com)

The chart shows six of the ten top defense contracts are U.S. companies. As military spending increases, Honeywell (HON), Raytheon (RTX), Lockheed Martin (LMT), Northrop Grumman (NOC), General Dynamics (GD), and L3Harris (LHX) profits will likely soar.

When the U.S. allocates funds supporting war efforts in Ukraine and Israel, it translates to arms purchases from many of these U.S. defense contractors. While monetary support for allies is a critical consideration, the U.S. military buildup will only earmark for expenditures benefiting these contractors.

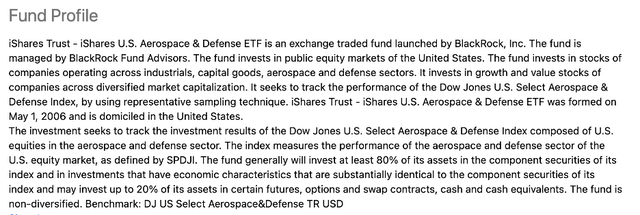

The ITA ETF tracks the Dow Jones U.S. Select Aerospace & Defense Index

The fund summary for the iShares U.S. Aerospace & Defense ETF states:

Fund Profile for the ITA ETF Product (Seeking Alpha)

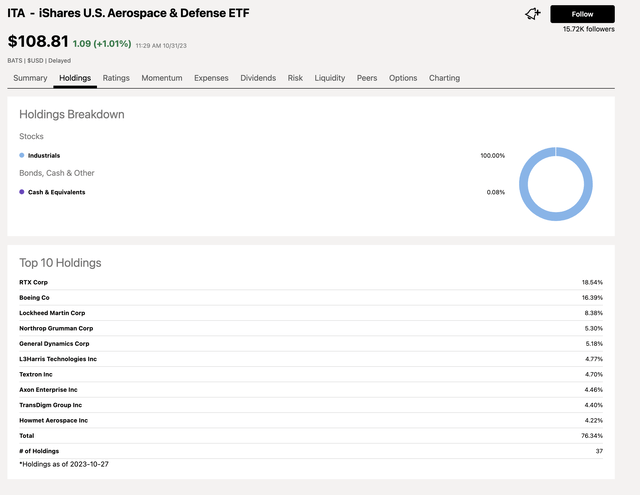

ITA’s top holdings, which comprise the Dow Jones U.S. Select Aerospace & Defense Index, include:

Top Holdings of the ITA ETF Product (Seeking Alpha)

ITA owns shares in most of the leading U.S. defense contractors.

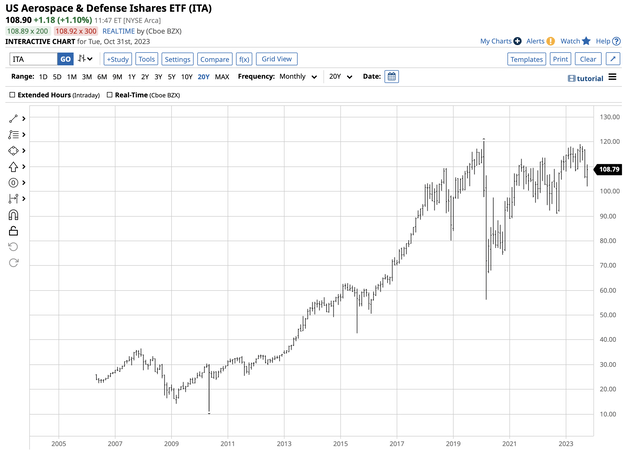

A bullish trend in ITA – The prospects are for more gains

At just under $109 per share on October 31, ITA had nearly $5.1 billion in assets under management. ITA trades an average of over 739,000 shares daily and charges a 0.39% management fee. The blended $0.98 dividend translates to a 0.90% yield, which pays for the management fee in under six months.

Chart of the ITA ETF Product (Barchart)

As the chart illustrates, ITA has made higher lows and higher highs over the past years and remains in a bullish trend in early November 2023.

The geopolitical landscape is a compelling fundamental factor, supporting a continuation of the bullish trend in defense contractors’ shares and the ITA ETF product.

DFEN turbocharges ITA – DFEN jumps in early October – A short-term product that requires a risk-reward plan

The Direxion Daily Aerospace & Defense Bull 3X Shares ETF is a highly leveraged product that turbocharges ITA’s price action. The fund summary states:

Fund Profile for the DFEN Leveraged ETF Product (Seeking Alpha)

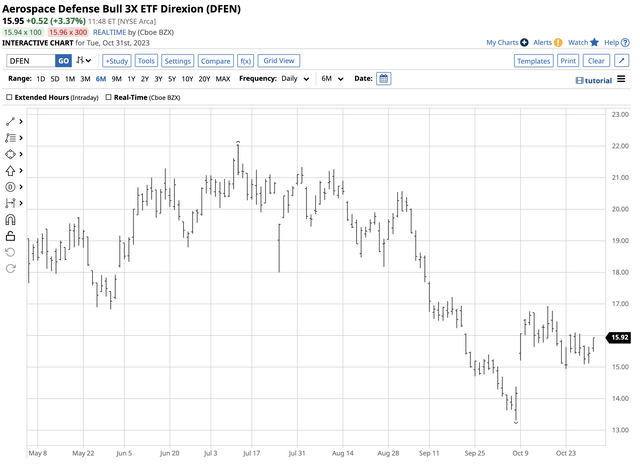

At $15.95 on October 31, DFEN had around $146.5 million in assets under management. DFEN trades an average of nearly 779,000 shares daily and charges a 0.96% management fee.

DFEN is a leveraged product, only appropriate for short-term risk positions. The ITA ETF closed at $102.02 on Friday, October 6, the night before the terrorist attack in Israel. ITA rose 8.7% to $110.91 on October 17.

Chart of the DFEN Leveraged ETF Product (Barchart)

The chart highlights DFEN’s 22.5% rise from $13.31 to $16.93 per share over the same period as DFEN turbocharged ITA’s price performance.

Defense spending is going to rise, favoring the leading U.S. contractors. Defense is a growth sector in a highly uncertain stock market in late 2023. Defense stocks could be the offensive investment approach.

DFEN’s leverage makes it a highly volatile instrument. Risk positions should have both time and price stops, as DFEN is only appropriate for short-term trading purposes. Those looking to move capital to defense stocks on dips could use DFEN for short-term risk positions, as bull markets rarely move in straight lines, and pullbacks in ITA could cause opportunities for leveraged positions using the turbocharged product.

As long as war risk remains high, defense spending will increase, supporting the leading defense contractors. DFEN leverages those war risks as the geopolitical landscape remains highly uncertain in late 2023.

Read the full article here