The Eaton Vance Limited Duration Income Fund (NYSE:EVV) is a closed-end fund, or CEF, that specializes in providing a high level of current income to its investors. The fund’s very name implies this, and its current 10.75% yield reinforces this conclusion. As everyone reading this is no doubt well aware though, many income-focused investment options have seen considerable price weakness over the past few months. This is mostly driven by a repricing of yield. After all, the ten-year U.S. Treasury (US10Y) has fallen in price and seen its yield increase significantly since mid-July. As we can see here, on July 31, 2023, the ten-year U.S. Treasury had a 3.9570% yield but today its yield has risen to 4.812%:

CNBC

The ten-year U.S. Treasury bond is generally considered to represent the risk-free rate of return, so the fact that this value increased over the period means that the yield of everything else had to adjust upward in order to provide an appropriate premium to the risk-free rate. When yields increase, asset prices decrease. This is the biggest reason why just about every income-producing asset has fallen in price over the past three months. However, as we will see in this article, the Eaton Vance Limited Duration Income Fund should be somewhat more resistant to this than many other assets.

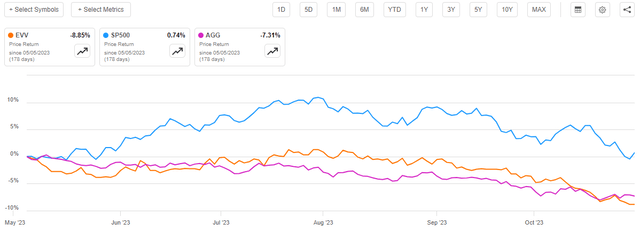

As regular readers may recall, we last discussed the Eaton Vance Limited Duration Income Fund back in May. The fund’s performance since that time has, unfortunately, been rather disappointing as its price has declined by 8.85%. This is worse than either the S&P 500 Index (SP500) or the Bloomberg U.S. Aggregate Bond Index (AGG):

Seeking Alpha

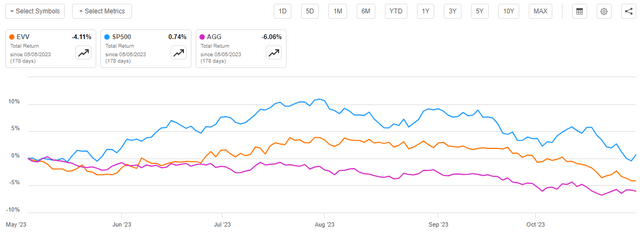

However, the Eaton Vance Limited Duration Income Fund has a significantly higher yield than either of these two indices, which is something that we need to take into account when determining the actual performance of the asset. After all, if an asset’s price declines by 1% per year but it pays a 3% yield, the investor is still making money at the end of the day. When we take this into account, investors who purchased shares of this fund on the day that my previous article was published have only lost 4.11% of their investment. This is a better performance than investors in the aggregate bond index received but it is still not as good as the total return provided by the S&P 500 Index since that date:

Seeking Alpha

While this may suggest that the S&P 500 Index is a better investment, it is important to keep in mind that the S&P 500 Index is a common stock index, so it is not directly comparable to either the aggregate bond index or this fund. The fact that the Eaton Vance Limited Duration Income Fund manages to beat the Bloomberg U.S. Aggregate Bond Index is quite admirable and should prove to be very attractive to investors. The fund is likely to be able to continue this outperformance going forward, at least for as long as rates continue to rise.

About The Fund

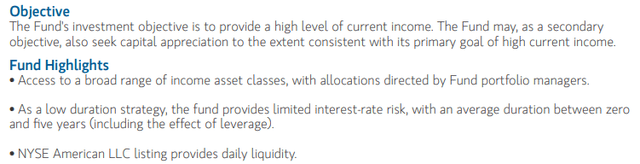

According to the fund’s website, the Eaton Vance Limited Duration Income Fund has the primary objective of providing its investors with a high level of current income. This makes a great deal of sense as the fund’s name specifically states that it will be providing its investors with income. As is usually the case with Eaton Vance funds though, the website itself does not explicitly describe the strategy that the fund uses to accomplish its objectives, nor does it provide any insight into what makes it unique. Fortunately, the fact sheet provides somewhat better information:

Fund Fact Sheet

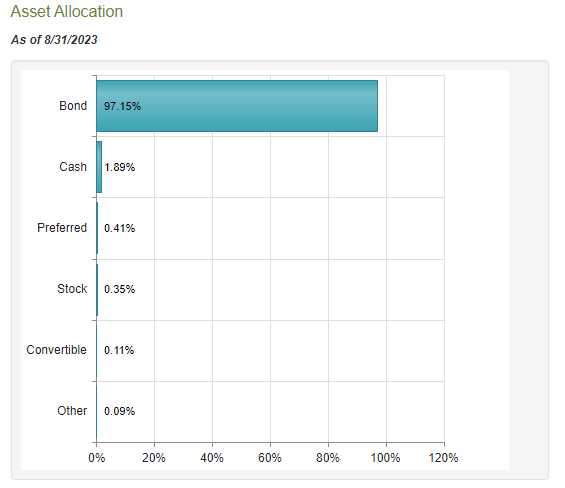

The fund’s fact sheet specifically states that the fund invests in a broad range of income asset classes. This statement could be somewhat confusing as there are a lot of things that can be used by income-focused investors including dividend-paying common stocks, fixed-rate bonds, preferred stocks, and various types of floating-rate or hybrid securities. This bond specifically invests in debt securities, despite the implications of that statement. As we can see here, 97.15% of the fund’s assets are invested in bonds or other debt securities, with the remainder almost entirely in cash:

CEF Connect

We can see very limited exposure to common stock as well as various hybrid securities in the portfolio, but the allocation to those assets is negligible and does not really make a difference in evaluating the overall performance of the fund. For the most part, this fund should be thought of as a bond fund and since bonds deliver all of their net investment returns in the form of direct payments to investors (income), the fund’s income objective makes sense.

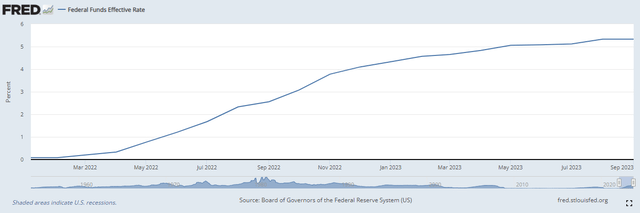

As everyone reading this is no doubt well aware, the past year or two has been very challenging for bond funds in general. This is because of rising interest rates throughout the United States and abroad. In an effort to combat the incredibly high inflation plaguing the American economy, the Federal Reserve has embarked on one of its most aggressive monetary tightening cycles in history. As we can see here, the effective federal funds rate has risen from 0.08% in February 2022 to 5.33% today:

Federal Reserve Bank of St. Louis

As bond prices move inversely to interest rates, this naturally causes bond prices to decline. That caused the net asset value of just about every bond fund to decline, thus causing share prices to go down. In addition, any investor or fund that has sold bonds over most of the past two years has suffered some realized losses. The rising interest rates are not really a problem for anyone who is holding their bonds to maturity though, since bond investors who purchase bonds at face value receive the face value back at maturity regardless of the market price.

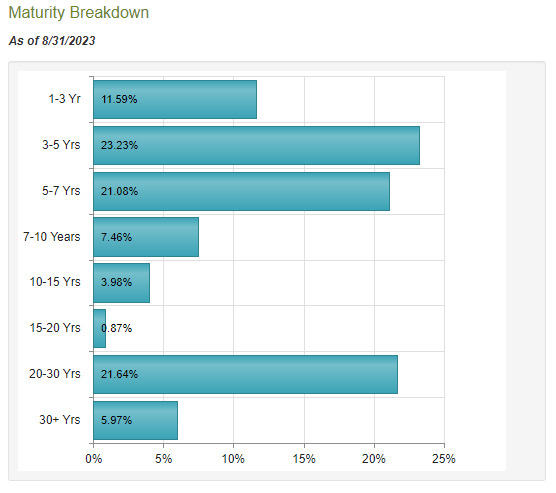

The fact that bonds held to maturity do not result in losses for the investor unless the issuer defaults is an important concept for the Eaton Vance Limited Duration Income Fund. This is because the fund only invests in very low-duration bonds. As the fact sheet states, the fund invests its assets in bonds with a duration of less than five years. Curiously though, neither the fund’s website nor the fact sheet provides a breakdown of the duration of the bonds in the fund’s portfolio. We do see that this fund has a number of bonds that have a maturity date more than five years into the future:

CEF Connect

In particular, we see that 61% of the fund’s assets are invested in bonds that have a maturity date that is more than five years in the future. This could disprove the fund’s stated focus on investing only in low-duration bonds. However, duration and maturity are not necessarily the same thing. A bond’s duration is the amount of time that it will take until the investor receives their initial investment back from the bond. Thus, bonds with a high coupon rate have a lower duration than bonds with a low coupon rate. This is because the high coupon rate results in a more rapid return of capital to the investor. As of the time of writing, the average coupon yield of one of the bonds in the fund’s portfolio is 6.64%, which is certainly not as high as most brand-new junk bonds today.

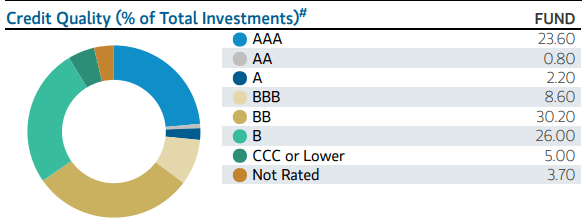

Indeed, this fund does not appear to be investing primarily in junk bonds. We can see this quite clearly by looking at the credit quality of the bonds that constitute the fund’s largest positions:

Fund Fact Sheet

A junk bond is anything rated BB or lower, which only describes 64.90% of the portfolio. The remainder of the fund’s assets are invested in investment-grade bonds. In fact, we can see that an outsized proportion of the fund’s assets are invested in AAA-rated paper. This is mostly Ginnie Mae mortgage-backed securities that are explicitly guaranteed by the U.S. government. The fund’s portfolio looks very different from most income-focused fixed-income funds. As we have discussed in various previous articles, most of these funds are very heavily invested in junk-rated debt because of the very high yields possessed by these securities.

In fact, during the period that stretched from the 2008 financial crisis to last year, the only way to obtain some semblance of an acceptable yield from bonds was to purchase junk-rated debt. As closed-end funds typically pride themselves on delivering a very high yield to shareholders, it makes a lot of sense that they would have focused on junk bonds during that period and simply opted to continue it today due to already having expertise in evaluating and investing in those securities.

The fact that a significant percentage of the portfolio of the Eaton Vance Limited Duration Income Fund consists of reasonably highly rated debt securities, at least when compared to other bond funds, will probably provide some source of comfort to those investors who are highly concerned about the preservation of principal. This is a category that would include many retirees, since they have a more difficult time obtaining new principal than individuals who are still working for an income.

With that said though, we still see that 56.20% of the fund’s assets are invested in BB or B-rated securities, which are the highest two junk bond ratings. Thus, the majority of the fund is still invested in junk bonds, which do have a higher risk of losses due to an issuer default than investment-grade bonds. In fact, Fitch believes that approximately 4.5% to 5% of U.S. junk bond issuers will default in 2023, which is a significant increase over previous years. That is certainly a high enough rate to scare more conservative investors. However, junk bond yields are over 9% right now so the higher default risk is priced in, and properly diversified junk bond portfolios should still make money.

In addition, as I have pointed out in various past articles, a rating of BB or B implies that the issuer does have the financial ability to carry their current debt obligations even in the event of a short-term economic shock. Such an economic shock in the near future is highly possible as a majority of American corporate leaders are expecting a recession by the middle of 2024 and are positioning their companies accordingly. Recessions can sometimes be a self-fulfilling prophecy, as a massive number of companies cutting back on investment and capital spending in preparation for the recession can sometimes cause it to occur. Regardless though, we can still see that most of the issuers whose securities are represented in this fund should be able to weather such a recession and the fact that the fund’s portfolio includes securities from 1,845 issuers should ensure that any default will not have a noticeable impact on the fund’s investors.

The fact that the fund claims to invest in limited-duration securities should work to its advantage in the current rising-rate environment. This is because low-duration assets are less affected by interest rates than high-duration assets. This is, in fact, the very definition of duration. According to PIMCO:

Duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon, and call features. These many factors are calculated into one number that measures how sensitive a bond’s value may be to interest rate changes.

Thus, investors who are concerned about rising rates would be best served by investing in bonds that have a low duration, since they should hold their value better in such an environment. For example, let us compare the JPMorgan Ultra-Short Income ETF (JPST) against the Bloomberg U.S. Aggregate Bond Index over the past three years:

Seeking Alpha

As we can clearly see, the JPMorgan Ultra-Short Income ETF has held its value much better than the Bloomberg U.S. Aggregate Bond Index. The JPMorgan ETF invests in very low-duration corporate bonds compared to the index, which includes a combination of low-duration and high-duration bonds from both the Federal Government and various corporations. While the Eaton Vance Limited Duration Income Fund invests in assets with a higher duration than the JPMorgan ETF, it is lower than the aggregate bond index. As such, it should be able to deliver a performance that is somewhere between these two indices.

That is exactly what we see by looking at the fund’s performance history over the period. Over the past three years, shares of the Eaton Vance Limited Duration Income Fund have delivered a 0.60% loss when we consider the effects of the distribution on the overall return. This is not nearly as good as the JP Morgan ETF but it is much better than the Bloomberg U.S. Aggregate Bond Index:

Seeking Alpha

It is important to note that we need to consider the fund’s distribution in order to get the above chart. If we look solely at the share price, the Eaton Vance Limited Duration Income Fund has been far worse than either of the indices over the period. This probably stems from the fund’s use of leverage and the fact that its income and capital gains were not sufficient to cover the distribution over the entire period. Thus, the fund overdistributed in some years, which is destructive to its net asset value. I pointed this out in my previous article on this fund. It does do pretty well if your intent is to reinvest the distributions, however. It also should perform reasonably well if your goal is to get and spend a high level of income and you do not care if the market value of your assets declines over time.

Leverage

As is the case with nearly all closed-end funds, the Eaton Vance Limited Duration Income Fund employs leverage as a method of boosting its effective yield beyond that of any of the underlying assets in the portfolio. I explained how this works in my previous article on this fund:

Basically, the fund borrows money and then uses those borrowed funds to purchase bonds and other income-producing securities. As long as the purchased assets have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, that will usually be the case.

However, the use of debt is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not using too much leverage since that would expose us to excessive amounts of risk. I do not typically like to see a fund’s leverage exceed a third as a percentage of its assets for that reason.

As of the time of writing, the Eaton Vance Limited Duration Income Fund has levered assets comprising 31.42% of the portfolio. This is quite a bit better than the 34.94% ratio that the fund had the last time that we discussed it. That is good to see right now, as the costs of carrying leverage are rising and have forced some funds to cut their payout. I discussed this in an article that went out to Energy Profits in Dividends subscribers back in July.

The fund’s reduction in leverage since May has actually been sufficient to bring it down under the one-third ratio that we typically like to see. As such, the balance between the risk and the reward here is quite acceptable and it does not appear that investors need to worry too much about the fund’s leverage.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the Eaton Vance Limited Duration Income Fund is to provide its investors with a very high level of current income. In order to achieve this objective, the fund invests in a combination of investment-grade and speculative-grade bonds with low duration. As of right now, these bonds have fairly high yields as the risk-free rate is higher than we have experienced in the United States in more than twenty years. This fund invests in a variety of these bonds, but it takes things a step further and applies a layer of leverage to boost the effective yield of the portfolio. The fund collects all of the coupon payments that it receives from the bonds in the portfolio and pays them out to its investors, net of the fund’s expenses. We might expect that this process would give the fund a very high yield in the current environment.

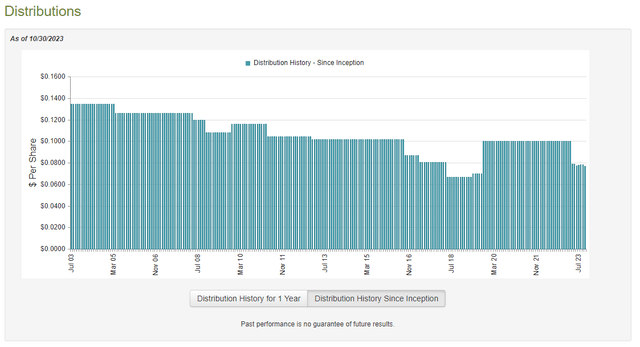

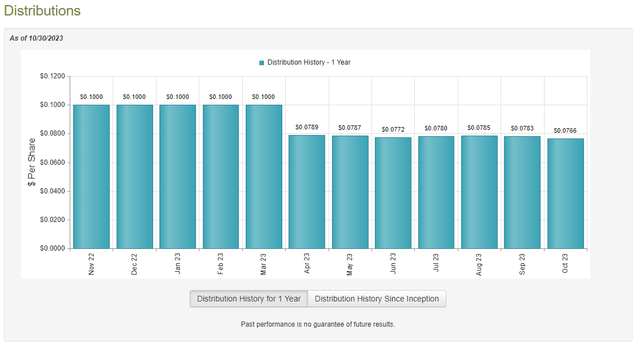

That is certainly the case as the Eaton Vance Limited Duration Income Fund currently pays a monthly distribution of $0.0766 per share ($0.9192 per share annually), which gives the fund a 10.75% yield at the current price. This certainly compares respectably to many other fixed-income funds in the market, although there are some closed-end funds that manage to outperform it in terms of yield. Unfortunately, though, the fund has not been especially consistent with respect to its distribution, and it has changed it many times over the years:

CEF Connect

This seems likely to be something of a turn-off for those investors who are interested in receiving a safe and consistent income from the assets in their portfolio. The fact that the fund’s distribution has been varying from month to month over the past year is likely to be even more irritating to these investors:

CEF Connect

However, it is not unusual for fixed-income funds to vary their distributions with time. After all, the investment profits that these funds are able to generate are highly dependent on interest rates in the broader economy. The fact that this fund invests in low-duration bonds helps reduce its interest rate exposure somewhat, but it is certainly not immune from the impact that interest rates have on bond prices. A fund will normally want to change its distribution based on the performance of the assets in its portfolio in order to avoid overdistributing and destroying its net asset value.

As is always the case though, it is critical that we ensure that the fund can actually afford the distribution that it pays out. After all, we want to ensure that it can actually carry its current distribution without causing the destruction of its net asset value. We also want the fund to hopefully be able to do a reasonable job of sustaining its distribution over time.

Unfortunately, we do not have an especially recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the full-year period that ended on March 31, 2023. As such, this report will not include any information about the fund’s performance over the past seven months. That is quite disappointing because the market has changed significantly over that period as the market’s optimism that was driving up bond prices and holding yields down during the first half of the year has since faded. As such, bond prices have fallen and this has probably resulted in this fund taking some realized or unrealized losses that will not be reflected in this financial report.

During the full-year period, the Eaton Vance Limited Duration Income Fund received $3,598,262 in dividends along with $112,709,633 in interest from the assets in its portfolio. This gives the fund a total investment income of $116,307,895 during the period. The fund paid its expenses out of this amount, which left it with $81,866,574 available for shareholders. That was, unfortunately, not nearly enough to cover the $139,444,152 that the fund paid out to its investors during the period. At first glance, this is quite concerning as we normally like debt funds to pay their distributions solely out of net investment income.

However, there are other methods through which the fund can obtain the money that it needs to cover the distribution. For example, it might be able to earn some money by selling appreciated bonds into a friendly market and earning capital gains. As might be expected, considering that most of the period reflected in this report is the incredibly challenging market of 2022, the fund failed at this task. It reported net realized losses of $48,404,601 and had another $91,991,826 net unrealized losses during the period. Overall, the fund’s assets fell by $207,971,738 during the full-year period after accounting for all inflows and outflows. That is, clearly, not nearly enough to cover any distribution yet the fund still paid one out.

This certainly explains why the fund’s management felt that it was necessary to cut the distribution back in April 2023. After all, the fund’s previous distribution was highly destructive to the net asset value, and such a situation is unsustainable over any extended period of time. It remains to be seen how sustainable the fund’s new distribution policy is, as the cut was implemented after the time period that is covered in this report. We have to wait for the fund’s semi-annual report to have confidence in the current distribution and it may be two months before that report becomes available.

Valuation

As of October 30, 2023 (the most recent date for which data is currently available), the Eaton Vance Limited Duration Income Fund has a net asset value of $9.96 per share but the shares currently trade for $8.59 each. This gives the fund’s shares a 13.76% discount on net asset value at the current price. That is better than the 11.46% discount that the shares have had on average over the past month, so the current price certainly looks like an acceptable entry point.

Conclusion

In conclusion, the Eaton Vance Limited Duration Income Fund is an interesting way for an investor to obtain a high level of income from the assets in their portfolio. The fund focuses its investment activities on bonds that have a very low duration, which should position it to handle rising interest rates much better than an ordinary bond fund. We do in fact see that as the fund has outperformed the Bloomberg U.S. Aggregate Bond Index over the past three years. Unfortunately, its most recent financial report leaves a lot to be desired, as the fund overdistributed in the most recent year and was forced to cut its payout.

It remains to be seen if the new distribution will be sustainable or not, but it may be a good idea to be prepared for another cut just in case. Fortunately, Eaton Vance Limited Duration Income Fund’s valuation is very attractive, and a distribution cut does appear to be priced into the shares. An investor could certainly do worse than this fund, but I would rather hold a floating-rate fund if you are worried about further rate hikes.

Read the full article here