Overview

As someone that enjoys a high level of cash flow hitting my accounts, Prospect Capital (NASDAQ:PSEC) seemed like an attractive candidate for my portfolio. PSEC is a BDC (business development company) that specializes in providing various financial services to mid-sized companies, including mezzanine finance, acquisitions, and real estate investments, mainly in the United States and Canada. They make their cash from the business of lending. They offer secured debt, term loans, and equity investments in a range of sectors, with a strong focus on energy and industry. PSEC invests in small to medium sized businesses, with a typical investment range of $10 million to $500 million.

PSEC has a monthly dividend distribution which is currently yielding over 13% with the recent price drop. The dividend has remained relatively stable since 2016 but lacks any sort of growth. The price movement has been pretty poor as well with the stock being down 25% YTD. The price is currently trading at a discount to NAV but we will analyze whether this presents an opportunity or if you are better off passing altogether.

Financials

According to their latest earnings call, PSEC reported a rise in its net investment income for the fourth quarter, which exceeded the figures from both the previous quarter and the same period in the prior year. The Q4 net investment income came in at $112.8 million, or $0.23 per basic share. This slightly missed the consensus estimate of $0.24. Even though it missed the estimate, it marked an increase from the prior quarter when it was $102.2 million, or $0.21 per share. Also, the NII of $0.23 per share shows growth from the same period in the prior year, which saw net income at $90.0 million, or $0.21 per share. I think this shows a pretty mixed bag so let’s continue on.

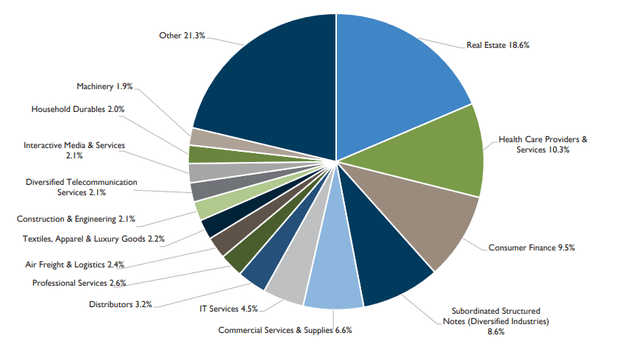

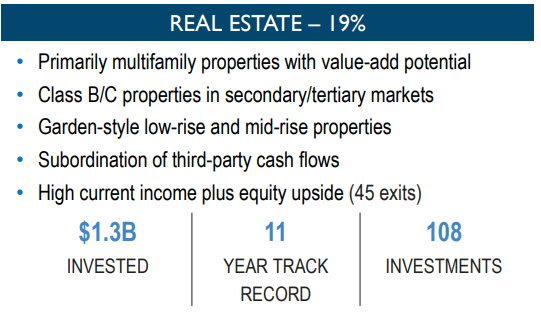

Originations are of most importance for business development companies like Prospect Capital. They serve as the primary means of generating revenue, as BDCs provide capital to middle-market and smaller companies through these new investments. This is what yields interest, fees, and dividends. Originations enable diversification of the BDC’s investment portfolio, spreading risk across various sectors and industries, thus enhancing stability. As we can see, PSEC’s portfolio stretches across many different sectors with real estate leading at over 18%. This is closely followed by health care providers and services at 10% and consumer finance at over 9%. I do believe that the price drop in REITs are also being reflected here in the price of PSEC. PSEC has shifted its primary focus towards multifamily workforce properties and building their investments into the senior living sector.

PSEC 2023 Overview

Lastly, originations grant BDCs access to tailored investment opportunities, leveraging their industry expertise for potentially higher returns. I bring this up because originations are the lifeblood of BDCs, supporting their financial health, growth, and portfolio diversification. PSEC significantly increased its total originations, which climbed to $372.2 million in the fourth quarter, up from $91.7 million in the previous quarter. For fiscal Q1 2024 to date, the total originations amount to $53.2 million. Total repayments in the fourth quarter were $121.7 million, compared to $114.0 million in the third quarter, with Q4-to-date repayments totaling $58.7 million.

Operating expenses for Q4 decreased to $108.7 million from $112.9 million in the previous quarter but rose slightly from the year-ago period when they were at $90.0 million. I think that if management can significantly decrease the operating expenses, we will see the share price recover a bit. The net of cash asset coverage of the debt ratio was reported at 304%, slightly down from 311% at the end of March 2023, but still a comforting number to help support the continued dividend distributions.

Dividends

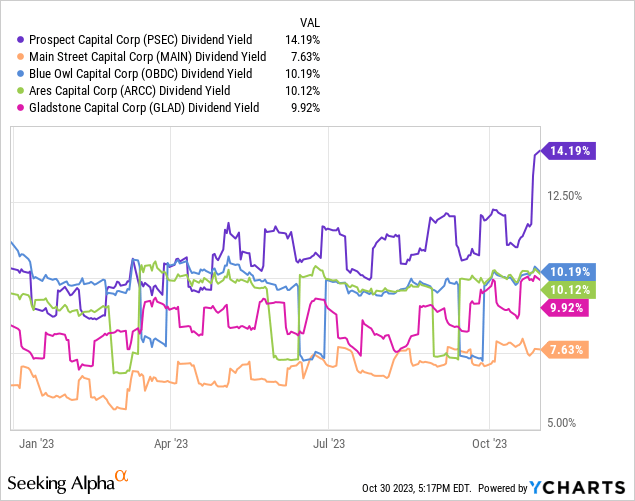

As of the latest declared dividend of $0.06 per share, the current upfront yield sits a little above 14% because of the price drop. After the pandemic, the yield sat between 8% – 10% and this is the highest it’s been since 2020. The dividend yield looks a lot higher than most of their peers.

Although the dividend growth has been poor in the last decade, with essentially nothing but cuts since 2013, the 14% dividend yield looks sustainable going forward because of their growing net investment income. In fact, despite the horribly falling share price over the last decade, your total return would still be approximately 43% because of the high distributions. As long as the NII continues growing, I do not think there is reason for worry. In addition, over 70% of their portfolio are comprised of 1st lien and other secured debt with adds to the stability of income.

Valuation

CEF Data

Historically, PSEC has always traded at a discount to NAV (net asset value). The average discount to NAV over the last 3 year period is approximately 25%. Currently, the discount to NAV sits at 45% which presents an interesting opportunity because this is the largest discount to NAV we have seen over the last 3 year period. This is in exception to the drop in 2020 where the discount to NAV was over 50%. This represents a 20% upside to get back to the average discount to NAV.

Seeing the increasing NII (net investment income) combined with this huge discount to NAV, entices me to start a position here at these levels as I think it’s very likely that we will see continued dividend distributions alongside the eventual upside recovery. to at least $6 per share which would result in double digit returns.

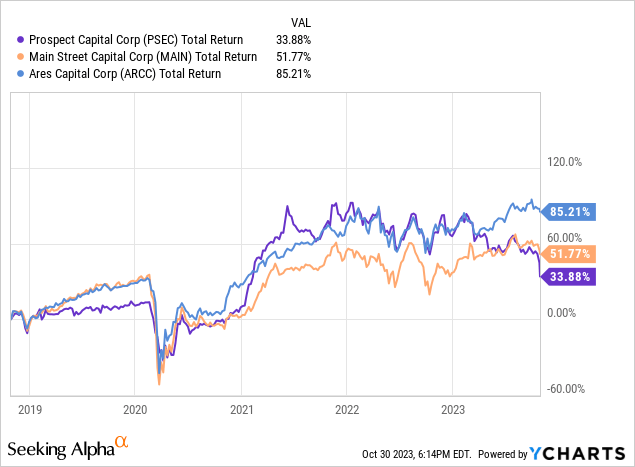

In the past, I avoided PSEC because the peers such as MAIN or ARCC have performed so much better in terms of total return but now the price has fallen so much that entry here could make sense moving forward. ARCC outperforms in total return but this is because the strategy and portfolio makeup of these BDCs all differ. PSEC has a much larger exposure to real estate and has been quite vulnerable this year because of it. I think this presents a unique opportunity as the REIT market will eventually stabilize and recover as will PSEC. This gives us an opportunity to collect a fat 14% yield in the meantime.

Risks

The risk here is future underperformance that may be linked to PSEC’s real estate exposure. REITs have been hit hard this year and I believe that PSEC’s price continues to impacted by the sector. They have invested over $1B to building out the real estate part of their portfolio. I think we should continue to see the price suffer if interest rates remain elevated for a long period of time. This is not fault of PSEC as there’s nothing wrong with the properties they are investing in. It’s just the timing of the market but unfortunately it’s a risk to consider going forward.

PSEC Q4 Presentation

Takeaway

In conclusion, Prospect Capital has drawn attention for its potential to provide substantial cash flow after the recent price fall. While the company’s monthly dividend distribution currently offers an attractive yield, it has remained stable without significant growth. The stock price has experienced a 25% year-to-date decline and trades at a discount to net asset value. PSEC’s investment strategy encompasses diverse sectors, notably in real estate and healthcare, which has both been in the red this year.

PSEC’s strong emphasis on originations plays a pivotal role in revenue generation and portfolio diversification. Despite some financial fluctuations, the company’s commitment to originations underscores its role as the lifeblood of a BDC, supporting financial health, growth, and diversification. Furthermore, the dividend yield, currently above 14%, appears sustainable due to PSEC’s growing net investment income and the stability provided by its secured debt portfolio.

The unique opportunity here lies in PSEC’s substantial discount to NAV, currently at 45%, presenting a promising entry point for potential investors. With the growing net investment income and the potential for an upside recovery, it may offer the prospect of double-digit returns. However, it is essential to acknowledge the risks associated with PSEC’s real estate exposure, especially in a challenging market influenced by interest rates.

Read the full article here