Investment Thesis: Profitability is Coming. Short Sellers Are Not Ready

SoFi Technologies (NASDAQ:SOFI) delivered yet another strong quarter in Q3 2023, beating expectations and showing continued momentum across its business segments. The fintech company seems well on track to achieve GAAP profitability in Q4 2023, poking holes in the main bearish arguments about the stock. While macroeconomic headwinds persist, SoFi has shown resilience through diversified revenue streams and prudent risk management. The short thesis relying on a recession damaging SoFi’s loan portfolio is on shaky ground.

Overview of Q3 2023 Results: Lots to be Bullish On

In Q3 2023, SoFi generated record adjusted net revenue of $531 million, up 27% year-over-year (Q3 2023 Earnings Release). They surpassed revenue expectations and elevated its forecast for the year. This surge was primarily attributed to a higher volume of student loan originations during the quarter, as noted by SoFi. This marked the 10th consecutive quarter of record revenue for the company. Adjusted EBITDA hit a new high of $98 million, up 121% versus the prior year period. SoFi added over 717,000 new members, bringing the total to 6.9 million, up 47% year-over-year. The company also achieved record product adds of nearly 1 million, increasing total products to over 10.4 million, a 45% increase.

SoFi’s results demonstrate the success of its broad product strategy. 67% of adjusted net revenue growth came from the non-lending businesses – the Technology Platform and Financial Services segments. The Technology Platform generated record revenue of $89.9 million, up 6% year-over-year. The Financial Services segment grew revenue an impressive 142% to $118 million. For the first time, Financial Services achieved a positive contribution profit of $3.3 million, compared to a $52.6 million loss last year. Even the Lending segment saw 15% adjusted net revenue growth to $342.5 million.

On the balance sheet side, SoFi grew deposits by $2.9 billion sequentially to $15.7 billion. Over 90% of SoFi Money deposits come from sticky direct deposit customers (Q3 2023 Earnings Call Transcript). On a trailing 12-month basis, SoFi generated $171 million of tangible book value growth. The company expects full year 2023 adjusted net revenue of $2.045 – $2.065 billion, strong growth. SoFi also anticipates full year adjusted EBITDA of $386 – $396 million, with a 48% incremental margin.

Continued Confidence on Q4 Profitability

SoFi reiterated confidence in achieving positive GAAP net income in Q4 2023, earlier than previous guidance. The company’s incremental GAAP net income margin was 48% in Q3 after excluding one-time items. On this basis, SoFi reduced its net loss to just $19.5 million, down from $74 million a year ago. This steadily improving profitability curve supports management’s guidance.

Multiple factors showcase SoFi’s path to GAAP profits. First, the company benefits from an expanding net interest margin, which reached a record 5.99% in Q3, thanks to higher loan yields and a favorable deposit funding mix. Second, operating leverage is increasing as SoFi scales, with sales and marketing expenses falling as a percentage of net revenue for four straight quarters. Third, the Financial Services segment reached the pivotal point of positive contribution profitability this quarter. With the heavy lifting done, management can prudently invest to further scale this high-margin business.

SoFi also has levers to pull if the macroeconomic environment worsens. It can throttle back discretionary spending on new Financial Services products still in investment mode. Additionally, the company is selling loans at attractive prices to generate gains on sale while also bolstering regulatory capital ratios. SoFi exhibits the hallmarks of an adaptable business built for the long-haul, not a fair weather growth story.

Short Sellers Beware

Despite the impressive results, SoFi short interest remains elevated at around 109 million shares shorted (Nasdaq). Short sellers have steadfastly doubted SoFi’s ability to achieve profitability. The Q3 report should give pause.

Much of the short thesis rests on SoFi’s loan portfolio deteriorating in a recession, leading to spiraling credit losses. However, the company’s lending book has gotten significantly higher quality since the pandemic. SoFi’s borrowers for personal loans and student loans have weighted average FICO scores of 744 and 781, respectively. Delinquency and charge-off rates remain below pre-Covid levels. Underwriting has clearly tightened.

While net interest income may moderate in a recession, SoFi’s non-lending revenues provide a buffer. These capital-light, high-margin businesses now generate incremental revenue. Shorts betting solely on lending issues as SoFi’s Achilles heel could get caught offside. An initial jump after the shares started trading Monday morning could have been the start of a short squeeze. This is definitely still possible. Short interest is 12.98% and short volume makes up a significant portion of the trading volume on any given day. If these short sellers decided to close out their positions, this could be a catalyst.

Partnership with BlackRock Showcases Funding Diversity

SoFi recently announced an agreement to place a $375 million personal loan securitization exclusively with BlackRock (BusinessWire). This demonstrates SoFi’s funding diversity beyond deposits. By tapping different sources of capital, SoFi can continue growing its lending capabilities amidst economic uncertainty. To date, SoFi has sold over $14.5 billion of loans and securitized over $13.7 billion (BusinessWire). The BlackRock partnership provides incremental funding capacity at attractive economics.

Risks to the Thesis

All of this is not to say that SoFi’s path to profits is straightforward. First, the timing of GAAP profitability could take longer than expected if macro conditions significantly deteriorate. Though, management has levers to pull to stay the course as evidenced in their Q3 2023 Earnings Call. Second, while deposits provide a stable source of funding today, liquidity could evaporate in a recession as consumers draw down balances. However, SoFi’s focus on direct deposit customers mitigates this risk. Third, if the Fed has to raise rates higher than expected to tame inflation, loan demand may drop precipitously. Still, any reduction in lending could be offset by Financial Services growth. There are multiple angles to this business. Its business model appears robust.

The Balance of Risks Still Favor the Bulls

On the whole, risks appear contained for SoFi, while the short thesis relies on low odd scenarios given management’s confidence. The Q3 results and profitability guidance reinforce SoFi’s ability to skillfully navigate headwinds. Shorts may have missed their opportunity.

SoFi exhibits an increasingly rare combination in fintech – strong growth and improving profitability amidst economic uncertainty, with student loans powering much of the recent uptick. The company’s diversified business model positions it well to continue gaining share. While macro conditions will ebb and flow, SoFi’s long-term outlook remains bright. Achieving full-year positive GAAP net income in the current environment will be an enormous milestone. More inflections to profitability are likely in 2023. SoFi has the wind at its back – short sellers underestimate that tailwind at their own peril.

Valuation

While given there is likely a feasible path to profitability next quarter, SoFi should probably still not be evaluated on a price to earnings metric given their profit margins have yet to mature. Using price to book (especially because in a lot of ways they are evaluated like a bank) they stack up well. And, given their business model is quite diversified shares appear to be cheap compared to competitors that definitely have less diversified business models:

|

Company |

SOFI |

Credit Acceptance Corporation (CACC) |

Sallie Mae (SLM) |

|

Price to Book (Forward) |

1.27 |

2.72 |

1.67 |

I chose the banking division because this is usually the part of the company that trades at the lowest multiple. The rest of the business (technology platform and financial services) should trade at a higher book. The fact that the blended company trades at a lower price to book ratio than a subprime auto lender and a pure play student loan company is compelling. Their tech makes their business way more competitive in the long run, the market should reward that.

If the company saw its price to book ratio converge on a more reasonable 1.75 times book, we could see shares appreciate 37% which implies a fair value of $9.56 a share.

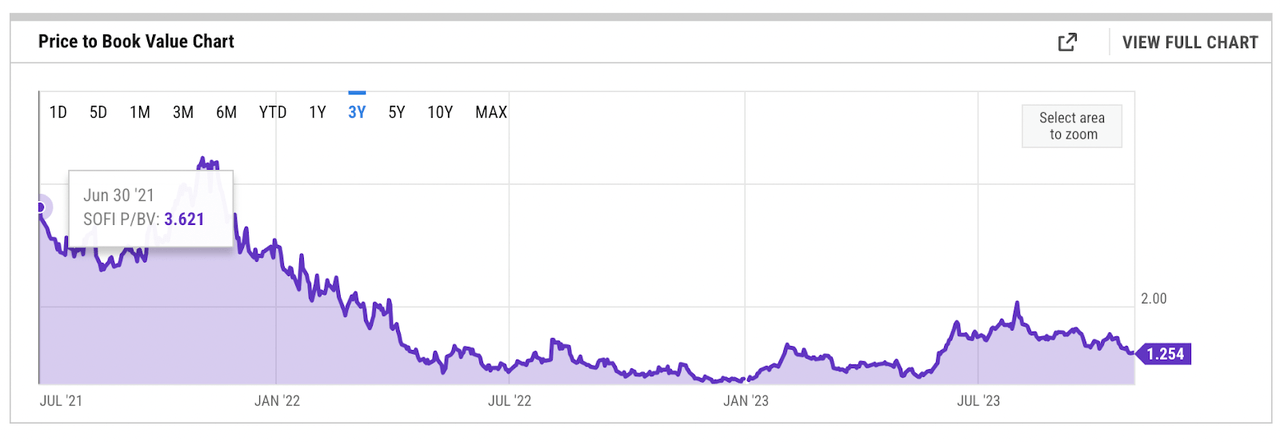

Does 1.75x book-value seem high? For a soon to be profitable financial company I think this is reasonable. This is about ½ the price to book ratio this company traded at during its IPO back in 2021.

SoFi’s Price to Book Ratio History (Y-Charts)

A company that is ~45% cheaper on a fundamental asset valuation basis compared to its IPO and is soon to be profitable (meaning book value should start to increase)?

I like it.

Conclusion: I Believe SoFi’s Future is Bright

SoFi delivered a strong Q3 2023 in the face of persistent macro and industry obstacles. Record revenue, strong member and product additions, prudent risk management, and improving profitability provide grounds for optimism about both near and long-term prospects. With profitability around the corner, short sellers relying on recessionary concerns look increasingly misguided even if a recession does occur. SoFi exhibits traits of a durable compounder, not a fair-weather growth story. Achieving full-year GAAP profitability appears well within reach (Q3 2023 Earnings Call Transcript). While risks exist, SoFi has the business model and management team to power through the current storm. Any major pullback in the stock on broader recession fears is a compelling opportunity. The Q3 results reinforce that SoFi is built for the long haul.

Read the full article here