Leggett & Platt, Incorporated (NYSE:LEG) designs, manufactures, and markets engineered components and products worldwide. It operates through three segments: Bedding Products; Specialized Products; and Furniture, Flooring & Textile Products.

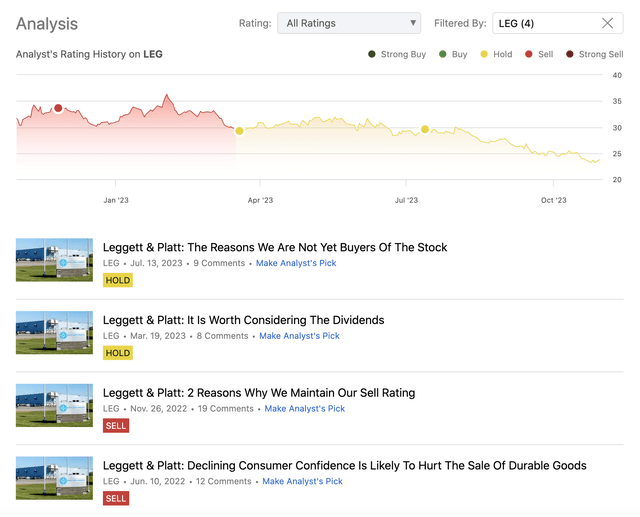

We have started covering the company in June 2022, with an initial bearish rating, which we have maintained until the end of 2022, due to the challenging macroeconomic environment, including elevated inflation levels and poor consumer sentiment. Later, as the valuation of the firm has improved, we have turned slightly more bullish, upgrading to a neutral rating.

Analysis history (Author)

As the firm has recently published its quarterly results, and its stock price has declined further, we have decided to revisit our previous thesis and give an update both on the financial results and on our latest view of fair value.

Q3 results

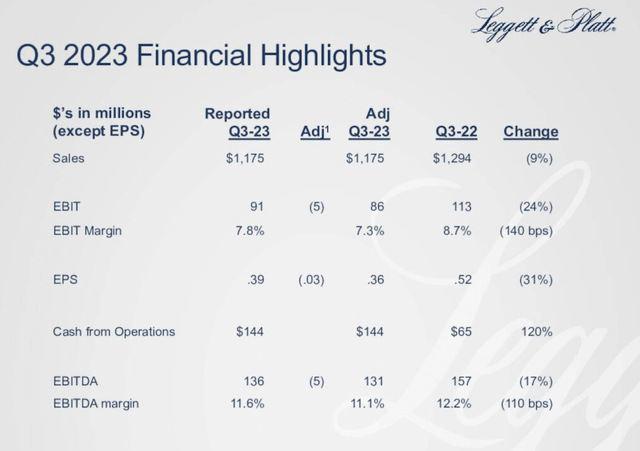

In the previous quarter, the firm has performed relatively poorly with both top- and bottom-line figures declining substantial compared to the prior year. Revenue has come in at $1.18 billion, representing a 9% decrease compared to the third quarter in 2022. At the same time, EPS has declined as much as $0.13 year-over-year, coming in at $0.39.

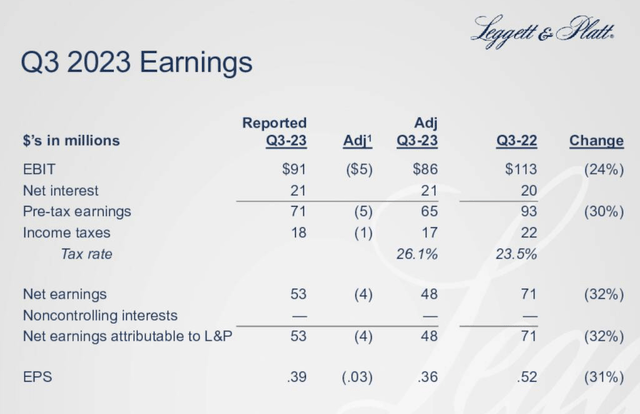

Q3 financial highlights (LEG) Q3 earnings (LEG)

Management has once again cited the weak demand for the firm’s products, especially in the Bedding Products and Furniture, Flooring, & Textile Products segments as the primary driver of the relatively poor results.

Ongoing weak demand impacted our Bedding Products and Furniture, Flooring, & Textile Products segments but was partially offset by continued demand strength in our Specialized Products segment.

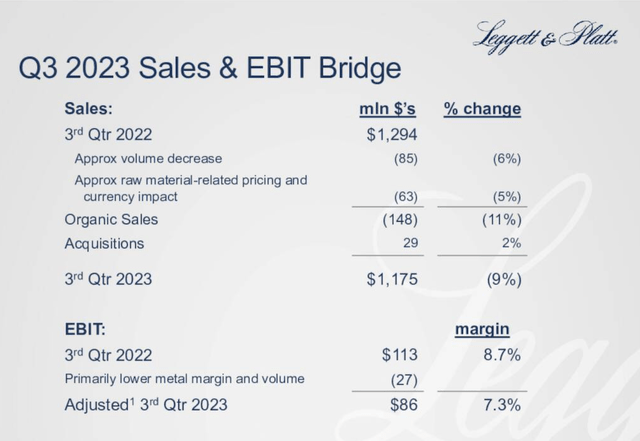

Both a decline in volume and a decline in raw material-related selling price have been contributing to the lower revenue.

Q3 sales and EBIT bridge (LEG)

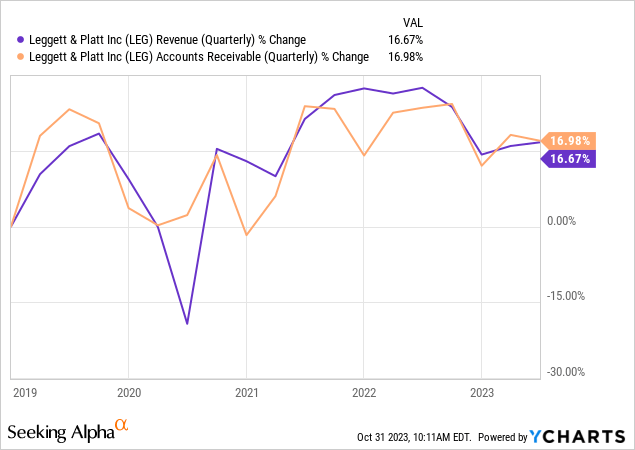

The following chart shows how the firm’s revenue has been developing over the past 5 years, along with the development of the accounts receivable.

Normally, we like to compare these two metrics, as divergence between the two line items can potentially point to artificial inflation of the sales figures. Fortunately, this does not appear to be the case for LEG.

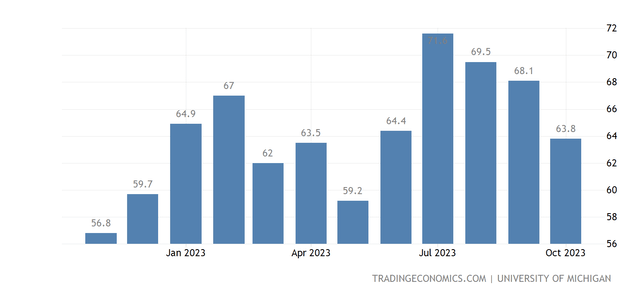

Looking forward, we believe that this headwind is likely to continue for LEG in the near future. While in the United States there have been shorter periods of improvement in the consumer confidence this year, the indicator has been relatively volatile, potentially signaling that the demand for discretionary, non-essential products is likely to remain soft.

U.S. Consumer confidence (tradingeconomics.com)

This negative outlook is also reflected in the firm’s latest lowered guidance:

2023 guidance lowered: sales of $4.7–$4.75 billion; EPS of $1.45–$1.55, adjusted1 EPS of $1.35–$1.45.

Valuation update

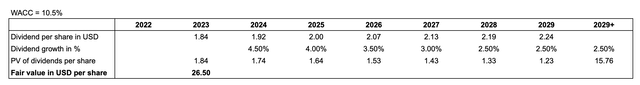

Previously, we have determined the fair value of LEG’s stock using a dividend discount model. When we last valued the stock in July, 2023, we have estimated the fair value to be roughly $26, assuming a required rate of return of 10.75% and a declining dividend growth rate from 4.5% to 2.5% over the course of the next five years.

Now, we will take a look at the two input parameters and modify them, if necessary, to reflect the most recent micro- and macro developments.

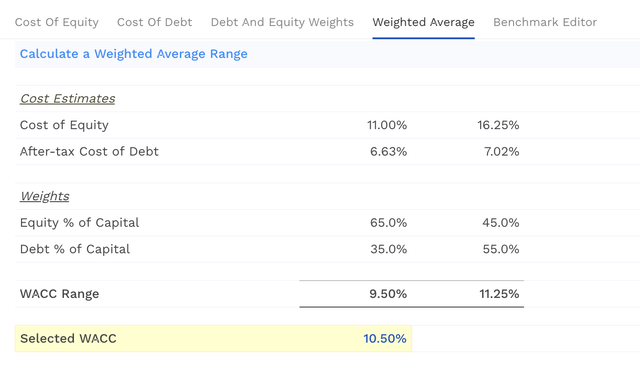

Required rate of return

Just like before, we will be using the firm’s weighted average cost of capital as our required rate of return. According to the latest estimates, the company’s WACC comes in at 10.5%, slightly below the previous estimate.

WACC (finbox.com)

Dividend growth rate

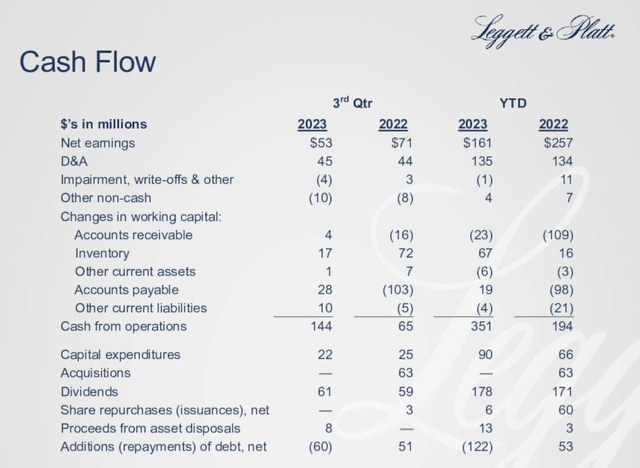

Despite the deteriorating results, the firm is still generating sufficient cash flow from operations that it can cover and even increase its dividend payments in the near term. For this reason, we believe that our previous dividend growth rate assumption is still valid.

Cash flow from operations (LEG)

In accordance with these changes, the estimated fair value has slight increased to about $26.5 per share.

Results (Author)

As the shares are currently trading at around $23, this indicates a potential upside of more than 10%.

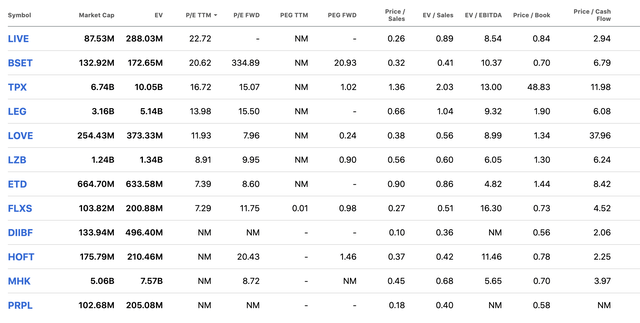

On the other hand, when we assess LEG’s fair price from a relative valuation perspective, we can see that the company appears to be trading more or less in line with its peer group’s median.

Comparison (Seeking Alpha)

All in all, we believe that LEG became slightly more attractive from a valuation point of view since our last writing, but we are still not convinced, that it could be an attractive investment in the current macroeconomic environment. While the almost 8% dividend yield is definitely attractive for dividend and dividend growth investors, we would like to see an improvement in the macroeconomic environment, which could fuel the demand for LEG’s products, before we could rate the company’s stock as a “buy” at the current price levels.

For these reasons, we are maintaining our “hold” rating.

Read the full article here