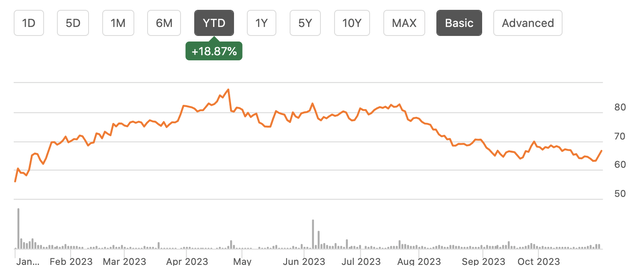

Shares of GE HealthCare Technologies (NASDAQ:GEHC) have had a solid year since being spun out of GE (GE), rallying 18%, though they had lost some of their momentum since the summer. That changed on Tuesday with the stock jumping 5% on a strong quarterly earnings report. I see scope for this rally to continue as the company is operating well as an independent entity and has favorable secular trends.

Seeking Alpha

In the company’s third quarter, GEHC earned $0.99, besting consensus by $0.09 as revenue rose by 5% to $4.8 billion. Organic growth was about 6%. Alongside this report, it raised the low-end of guidance to expect $3.75-$3.85 in earnings, up 14% from last year on 6-8% organic revenue growth and a 50-100bp expansion in EBIT margins to 15-15.5%. Overall, it generated $744 million in EBIT with a 15.4% margin, up 120bp from last year on a stand-alone basis.

Looking into component results, imaging revenue rose 5% to $2.6 billion with EBIT up 19% as supply chain improvements allowed it to fulfill more orders for its CAT scan and MRI machines. As it has worked through its backlog, GEHC is now moving to lower-cost inventory as input prices have fallen, which is helping to widen margins.

Its smaller patient care and pharmaceutical diagnostics segments generated strong 9% and 12% growth respectively as GE has been able to raise prices and work through supply chain challenges. Ultrasounds were the one weak spot with revenue declining 1% to $815 million against a double-digit comp last year, so growth is still running up 5% on a compounded two-year basis.

Products revenue rose 6% and accounted for 66% of the total revenue with services up 5%. That ongoing product growth should help power further services growth in the future as its installed base rises. I was also impressed to see inventories down 1.4% this year even with sales higher, leading to greater working capital productivity. With supply chains normalizing, GEHC is left with fewer partially complete machines waiting for their last parts, allowing it to improve efficiency and delivery times. Tighter inventory conditions also support higher prices, and thanks to these factors, there was 90bp of gross margin expansion.

Importantly, GEHC should be able to continue growing at a mid-single digit pace. First, its rising product count provides more service revenue opportunities down the road to maintain and enhance these machines. Moreover, GEHC continues to grow its backlog. Organic order growth was 1% with a book-to-bill ratio of 1.03x. With orders continuing to outpace deliveries, demand is strong, and GEHC has visibility into the future of its demand.

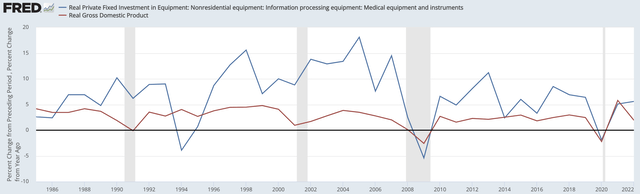

Moreover, I think it is important to note that GEHC serves an end-market with strong demand. Dating back forty years, medical equipment growth has almost always exceeded GDP growth. With an aging population here in the US and around the world, economies will continue to grow more healthcare-intensive, meaning ongoing demand for equipment like cat scans.

St. Louis Federal Reserve

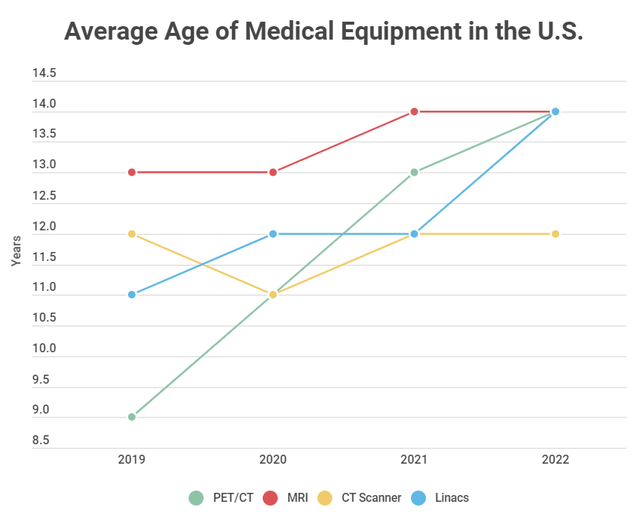

Even with this strong historic growth, the age of medical equipment continues to rise. It is not as though hospitals and doctors have recently completed a major refreshment cycle that will lead to lower future demand. If anything, it is the opposite. Older equipment should support continued order growth while also leading to meaningful ongoing services opportunity. GEHC benefits from the secular trend of an aging population while also having near-term opportunities to replace and modernize aging equipment. This is a favorable place to be.

Radio Oncology Systems

This growth is leading to solid free cash flow generation with $570 million in free cash flow in the quarter and $759 million this year. Given the nature of its billing, interest, and payments cycle, free cash flow is weighted to the second half with Q3 likely to be the strongest. There have also been $550 million in pension payments this year from $9 million last year, which have weighed on 2023 free cash flow but should not recur to the same magnitude.

One downside risk I would note is that GE is guiding to 85% free cash flow conversion, but this assumes that R&D spending can be expensed rather than capitalized. The 2017 tax cuts allowed for expensing R&D temporarily, but this measure has phased out. By capitalizing R&D, only about 1/5 of the spending can be deducted from a company’s tax bill in that year. Now in five years, when there will be five years of spending, each with a 20% allocation, the impact will be modest, but with past years expensed, this shift significantly raises tax bills.

For GEHC, it could reduce free cash conversion down to 75% or by about $160 million. While R&D expensing is popular on a bipartisan basis, the situation in Congress is uncertain to say the least. I would view the action on this item as something to “hope” happens rather than to “expect” to happen.

With its free cash flow, GEHC is first focused on deleveraging its balance sheet. It has $2.4 billion in cash on its balance sheet, up $1 billion this year. It also carries $10.3 billion of debt, about 3.1x adjusted EBITDA, which should be about $3.3 billion this year. Given it seeks to be a strong investment-grade company, it will likely seek to reduce leverage below 2.5x over time, requiring about $1.8-2 billion in debt reduction. At a 75% conversion rate, it should generate about $1.3-$1.4 billion in free cash flow over the next year, assuming 5-7% earnings growth given my view revenue should continue to rise mid-single digits.

If GEHC seeks to de-lever over two years, it will have about $800 million in excess cash flow for both bolt-on M&A and dividend payments. Currently, it pays just a $0.03 dividend. I would expect it to increase this payout meaningfully over-time as it delivers. At $300 million/year, GE can pay about a $0.15 quarterly dividend, which is where I expect the payout to rise to by 2025 while having $100 million/yr for small acquisitions. As we get past 2025 and its deleveraging is complete, there will likely be a substantial increase in dividend capacity and the possibility of share repurchases.

I am often cautious about businesses recently separated from their parent as it is different managing a stand-alone entity than a unit inside of a bigger company. GEHC has acquitted itself well, substantially growing margins, fixing supply chain bottlenecks, and growing the top-line. It is well positioned to continue generating mid-single-digit growth thanks to favorable trends for medical equipment. While it is prioritizing debt paydown, with its substantial free cash flow, shareholder returns will meaningfully rise over the next three years. I expect to see over $4 in EPS next year. 16x forward earnings given this secular backdrop is attractive when the S&P is at 18.4x. I believe GEHC merits at least a market multiple and see an upside to $75. Patience will be rewarded as GEHC pivots from paying down debt to paying back shareholders.

Read the full article here