This is the published version of Forbes’ CMO newsletter, which offers the latest news for chief marketing officers and other messaging-focused leaders. Click here to get it delivered to your inbox every Wednesday.

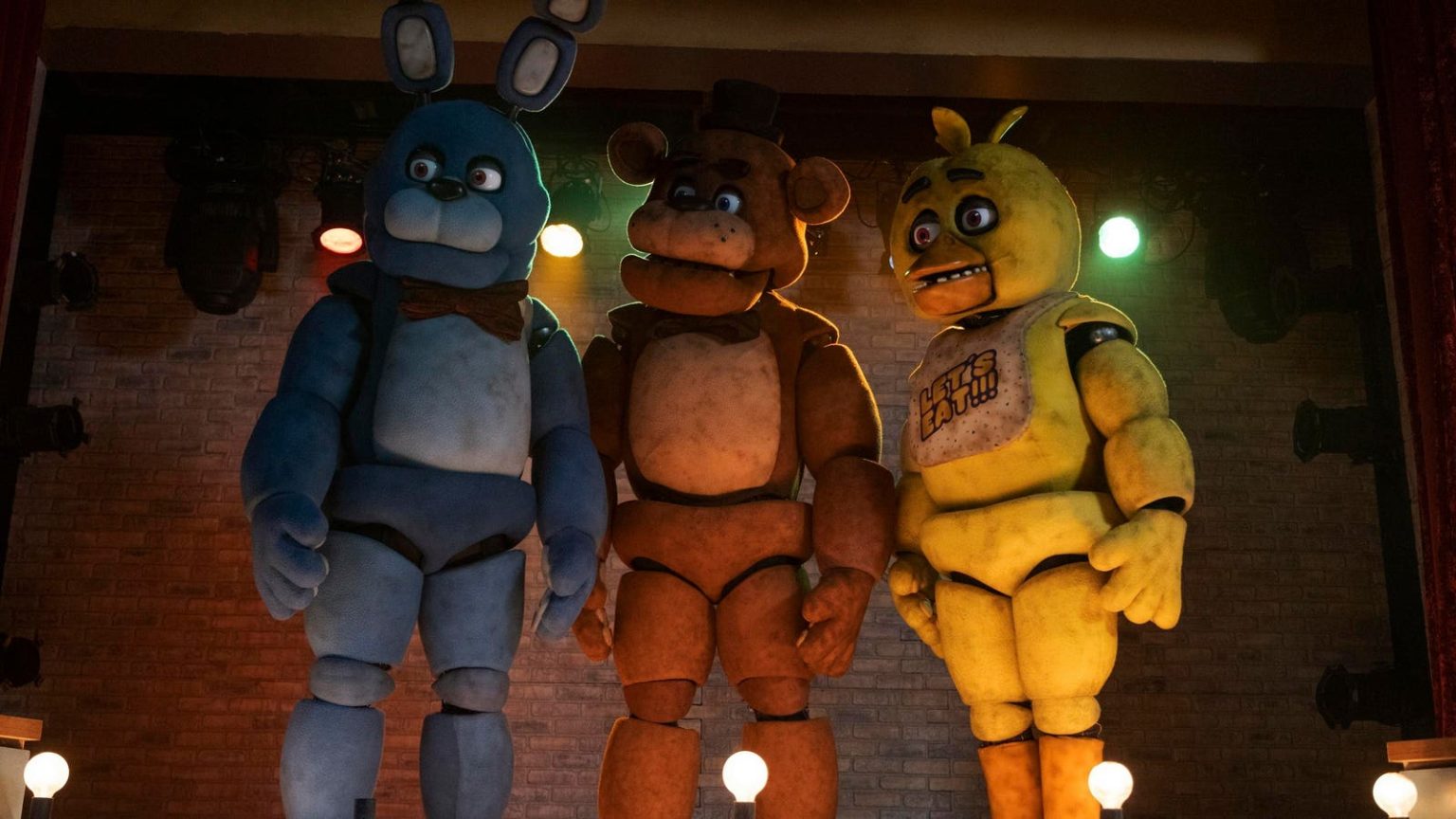

Last weekend, the horror movie Five Nights At Freddy’s raked in $78 million at the box office with the best-ever Halloween weekend opening in cinema history. It also showcased the generation gap between young people in Gen Z and Generation Alpha and just about everyone else.

Critics roundly panned the movie, which has a 27% review at Rotten Tomatoes at the time of this writing. But Gen Zers have been packing the theaters (and gave it an 88% review on Rotten Tomatoes). The huge sentiment gap between critics and fans likely has a lot to do with the target audience, who grew up playing the game that inspired the movie and watching YouTube videos of excited people playing it.

While some older generations could easily write off the movie’s success as a case of not being able to understand kids these days, it’s a valuable lesson for marketers. While advertising during teen-centric TV programs was the way to earn young fans a generation ago, today’s young people have been watching shorter streaming videos, like those on TikTok or YouTube, literally since birth. The best way to grab their attention might be introducing characters or a franchise on social media platforms, where short-form video reigns. Warner Brothers Discovery research shared at the Advertising Research Foundation OTT conference came to this conclusion.

“We like to say Gen Z learned to swipe before they learned to wipe,” said WBD Executive Director of Entertainment Insights and Corporate Strategy Vera Chien said, presenting the study.

People following the industry are already saying Five Nights At Freddy’s is bound to spin into a movie franchise with multiple sequels due to its success. And it’s likely that even more internet-born phenomena will find their way to the big screen soon—even if nobody older than 25 really understands.

ECONOMIC IMPACTS

Luxury brands are continuing to struggle as consumers hold off on making luxury purchases amid inflation and geopolitical upheaval. Gucci owner Kering reported disappointing quarterly earnings last week, with revenues down 9% year over year. Kering also owns Yves Saint Laurent, Bottega Veneta, Balenciaga and Alexander McQueen, and each one of these big brands saw losses of 7% or more. Geographically, sales were down the most in North America—22% off—but the company also saw losses in Western Europe and the Asia Pacific region.

Kering executives said on the earnings call they are hopeful the first collection from Gucci’s new creative director Sabato De Sarno, just released in September, will jumpstart the company’s sales. Kering leaders also said they are working to create more exclusivity, enhance product quality and be more efficient.

However, those things might not matter if consumers don’t want to buy luxury goods right now. And that actually could be the case. Earlier this month, luxury goods leader LVMH—owner of top brands including Louis Vuitton, Moët Hennessy, Tiffany & Co., Christian Dior and Fendi—reported a marked slowdown in its growth. In the first two quarters of the year, sales grew 17%. In Q3, they only advanced 9%. A study from the Affluent Consumer Research Company showed declines in affluent consumers’ financial confidence and luxury spending indices.

SOCIAL MEDIA

Advertisements keep many popular social media platforms free to users, but more and more of them are rolling out paid ad-free memberships. Essentially, the social media platforms get their money, but it’s harder for brands to use them for paid messaging—something that could become the new normal.

Over the weekend, X, formerly known as Twitter, announced two new tiers of premium subscriptions. The upper tier, Premium+, costs a user $16 a month, or $168 a year. It eliminates ads in a user’s “For You” and “Following” feeds—as well as offers preferential placement of post replies and profit sharing. X’s new basic subscription tier doesn’t block ads, but gives users access to features like editing posts. These new plans actually might not change much for the majority of companies, since ad revenue on X has declined at least 55% each month since Elon Musk bought Twitter last October, according to data reported by Reuters.

Facebook and Instagram owner Meta hasn’t issued ad-free subscriptions in the U.S. just yet, but the company is now offering them in much of Europe. A subscription costs between 10 euros and 13 euros, depending on whether it’s for an ad-free mobile or desktop experience. Meta was somewhat pushed into creating these tiers after the EU Court of Justice ruled in July that Meta needs users’ consent before serving them personalized ads—a major revenue source for the company. Europe is responsible for about a quarter of Meta’s ad revenue, according to figures in Reuters.

BRANDS + MESSAGING

Kantar’s annual BrandZ Most Valuable Global Brands report is usually an upbeat ranking of the brands that have the most equity, recognition and cachet with consumers. This year’s report, however, opens with a sobering fact: The top 100 brands lost 20% of their value compared with 2022. This is partially a correction; brand values overall were at record highs in 2021 and 2022, which Kantar partially attributes to consumers placing much more value in trusted brands following the Covid-19 pandemic.

In all categories, big brands lost their luster. Out of the top five—Apple, Google, Microsoft, Amazon and McDonald’s—Amazon’s value fell 34% from last year and Google’s value was down 30%. Every sector in general saw some decline in brand value, with the biggest drops in media and entertainment (-32%), retail (-27%) and business technology and service platforms (-24%). The smallest declines were for luxury (-4%), fast food (-4%) and food and beverage (-3%)

A brand’s value has a lot to do with consumers’ trust and continued interest. Staying true to what people like, plus innovating in ways to better serve the consumer—lower prices, differentiated offerings, dedication to sustainability—seem to pay off. While Kantar notes the bigger brands certainly have the greatest ability to strengthen their position this way, their drops in value show ways that smaller, disruptor brands can also push their way in to be at the top of consumers’ minds.

DEEP DIVE

Taylor Swift’s New Era: The Pop Star Becomes A Billionaire

While many were buzzing about Taylor Swift’s re-release of her 2014 smash album “1989” last week, even those who aren’t music fans are taking notice of her newest era: Billionaire (Taylor’s Version). While it’s nothing new for a celebrity to become a billionaire—she’s the 15th celebrity in Forbes’ rankings to reach that status, and the fourth musician to get there—the way she did it is completely her own. Most of the other musicians who reached billionaire status—including Jay-Z, Rihanna and the late Jimmy Buffett—got there both on the strength of their music and successful side businesses. Swift, on the other hand, got there purely through revenues derived from her songs and performances.

The financial details for the 33-year-old musician are impressive. Forbes estimates she earned more than $500 million from music royalties and touring. Another $500 million is based on the rising value of her music catalog. She made about $190 million after taxes from the first leg of the blockbuster Eras tour, and another $35 million from the first two weeks of screenings of Taylor Swift: The Eras Tour movie. She also has $125 million in real estate, including six homes and a $10 million private plane.

While Swift’s only business is her music, she’s been extremely shrewd about it. After the master recordings of her first six albums were scooped up behind her back in 2019 by Scooter Braun and sold to Shamrock Capital for $300 million, Swift utilized her distribution deal with Universal Music Group, which gives her complete ownership and economic interest in songwriting and recordings, to re-record new (Taylor’s Version) albums of four that were sold. She’s also released four completely new albums under this deal.

Swift’s catalog “is a testament to the exceptional reach and impact an artist can achieve. Her music not only transcends borders but also defies the challenges faced by creatives in the streaming era,” Alex Heiche, the founder and CEO of Sound Royalties, told Forbes.

FACTS + COMMENTS

Mattel beat analysts’ expectations for sales and earnings in its third quarter, largely thanks to the summer blockbuster movie featuring its iconic doll, Barbie.

$125 million: Mattel’s estimated revenue boost from Barbie, which includes sales of dolls and related merchandise, as well as movie earnings

14%: Increase in Barbie sales

‘The movie has broadened Barbie’s fan base’: Mattel Chairman and CEO Ynon Kreiz said on the earnings call.

VIDEO

Berner On How Music Has Amplified His Cannabis Business

QUIZ

A new song from one of the biggest bands in recent history is being released tomorrow, thanks to AI. This song, “Now And Then,” was found on a demo tape recorded before one of the musicians died, and became recording-quality through technology. Which band is the song from?

A. The Doors

B. The Who

C. The Beatles

D. Nirvana

See the right answer here.

Read the full article here