Introduction

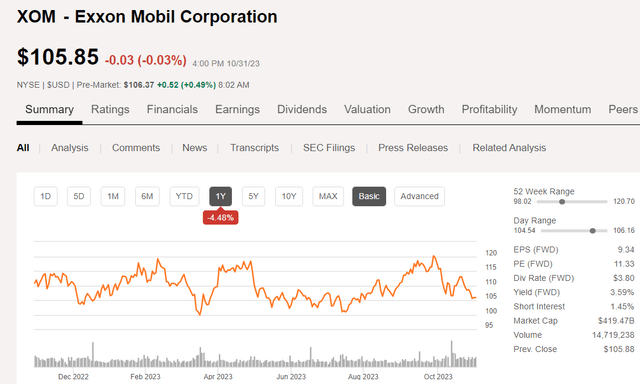

The current selloff in everything oil could be handing us an entry point to Exxon Mobil Corporation (NYSE:XOM) we thought had slipped by. The company has returned to the low $100’s in the recent oil market froth brought on by the retrenchment of WTI prices (CL1:COM) into the low $80’s from the mid $90’s at the end of September. Barely four weeks into the rear view, and XOM has corrected nearly 20%.

XOM price chart (Seeking Alpha)

The market also has some divergent views on the impact of the proposed, all stock merger of XOM and Pioneer Natural Resources Company (PXD). The merger when is completed will result in substantial dilution of current XOM shareholders, and the selloff in the company is also reflective of that reality. We don’t think investors with a long view of holding the company should be overly perturbed and think the dilution is priced into the stock at this point.

In this article we will look at another technical aspect of the deal that no one (but me) seems to be focusing on-Horizontal lengths and their impact on production. The upshot is that XOM needs PXD to ever have a hope of hitting or exceeding it’s 1.5 mm BOEPD target for the Permian, and if the merger is shot down, shale output could begin to drop sharply as XOM reallocates capital.

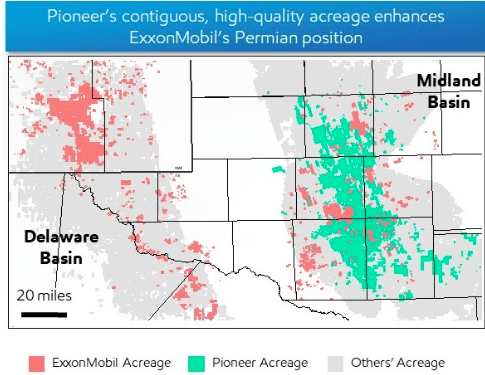

The combined footprint in the Midland Basin

I have discussed this in past articles, but the newly released pictorial from the Press Release on the deal brings it into sharper focus. You can clearly see that XOM’s acreage footprint in the oil-rich Midland basin is patchy and widely dispersed. PXD’s massive acreage footprint fills in the gaps in most areas and will make possible the drilling technology that both companies deploy to deliver more oil and gas in the coming years.

XOM/PXD footprint (XOM)

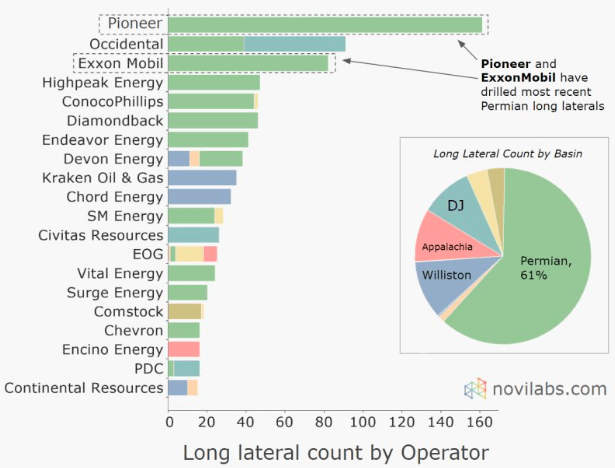

The impact of lateral length

One of the things we have discussed in recent times is the increases in efficiency that have resulted from technology advances in drilling and completions. One advance is lateral length.

If you go back to the late teens (2016-18) lateral lengths were in the 7-8,000 foot range. Now companies are routinely drilling above 10,000′ laterally, and a significant number are reaching 15,000 feet. That puts additional reservoir in contact with the well bore, and explains (in large part) the relentless rise in Permian production even as the rig count has declined. When you combine the longer lateral sections with the increased intensity of reservoir stimulation-pounds of sand per foot of interval, and increased number of frac stages, you see increased frac efficiency-squeezing as much oil out of each foot of interval as you can, you have a pretty good explanation as to why production has continued to increase.

Who is doing it?

A graphic put together by Ted Cross, VP of Novi Labs brings a unique perspective gained from their consulting work with operating companies in the Permian. What pops out at you is that PXD is at the forefront of this ultra-extended reach drilling, followed by Occidental Petroleum (OXY), and then XOM in third place.

Long Laterals Graphic (Novi Labs)

It is not a coincidence that two of the primary long lateral drillers are contemplating a merger. Technology is key, but you have to have the resource base to enable it. That’s what PXD brings to the party.

How many more 14-15,000 foot lateral wells can XOM drill with PXD’s footprint combined with their legacy footprint. Thousands. We looking at over a million acres of contiguous footprint that will enable the production growth that XOM envisions, perhaps reaching 2 mm BOEPD in just a few years. Without the merger, the odds of XOM being able to achieve this type of growth are speculative at best.

Risks

Just yesterday an additional hurdle was raised politically to the merger. Senate leadership penned a letter to the Federal Trade Commission, suggesting they look into the anti-competitive issues involved in the XOM and Chevron, “Mega Mergers.” There can be no argument that the two companies together represent a serious consolidation of shale output in the Permian. If you take October’s EIA-DPR showing Permian output to be ~6 mm BOEPD, XOM/PXD would represent ~26% of that figure. That could put a big, fat target on that deal. It’s early days yet so we will move on.

XOM paid an admittedly lofty price for Pioneer. Were oil prices to fall back into the $70’s or below for any substantial period of time, this pricing would have to be adjusted. That might put the kibosh on the entire thing.

Your takeaway

I won’t handicap the chances of a merger. That contains too many intangibles with which to deal. Focusing on our entry target for XOM, this could be as good as it gets.

The risk we can quantify-dilution, can easily be recovered in share buybacks and higher dividends over the next few years. Shareholder returns will be enhanced by reduced opex costs declining as the law of large numbers drives efficiencies. Ok let’s deal with the dilution.

XOM is planning to issue ~540 mm new shares to pay for PXD, diluting current shareholders by about 13.5%. Ouch. But, let’s remember that the company has been buying back about ~150 mm shares a year recently. With the increased cash flow from PXD- ~$10 bn a year minimum, this rate could easily be bumped to 250 mm shares a year. Two or three years of that and PXD has been paid out and the rain of cash driven by the merger will continue decades into the future. It’s a bet I am willing to take in this price range.

XOM is in a buy zone at current pricing, and I will be looking for an entry point at current levels over the next day or so. I don’t see this opportunity lasting long as the market has a cockeyed view of oil prices right now. There is jolt out there that will result in an upward correction and take XOM along with it.

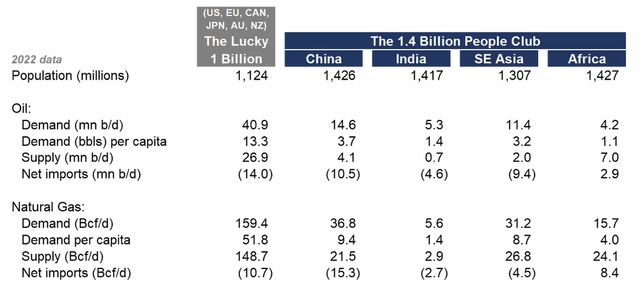

Oil and gas have bright futures as far as the eye can see. I have made this point in many articles. This time I’ll let someone else make it. Arjun Murti is a deep thinker on energy issues. Some of you may know of him from his Goldman Sachs career as an energy analyst. Semi-retired now he publishes regularly in Substack, and I lap up everything he puts out. This graphic taken from his September 9th posting, “The 1.4 Billion People Club Will Dominate The Outlook For Energy,” tells a story that does not require much embellishment.

1.4 Billion graphic (Super-Spiked by Arjun Murti)

Looking at the left-most column you see the Lucky Billion Club. We consume most of the world’s energy. The members of the 1.4 bn club include China, India, SE Asia, and Africa that consume only fractions of what we do, and have aspirations to consume more. Arjun summarizes the situation neatly in his post and I’ll let him speak for himself from here on-

We do not believe the oil and gas industry is anywhere near its sunset phase, not so long as there is such a massive gap between the energy needs of the other 7 billion people on Earth and the lucky 1 billion of us. The capital spending cycle will drive the timing and magnitude of the supply response to rising oil and gas demand; hence, price and profitability cycles are more driven by the timing of CAPEX vis-a-vis demand, rather than solely demand. Geopolitical volatility can have a meaningful and potentially multi-year impact on prices and profitability. Currently, we believe the CAPEX cycle is still closer to trough than even mid-cycle let alone peak, which bodes well for structural profitability in the context of this decade. We believe many industry observers are way too bearish on long-term oil demand, leading to a subdued CAPEX impulse.

Tell it Arjun!

Wrapping up here. I am giving XOM a strong buy at current levels, and think analyst price targets of up to $150 are realistic, with our oil price assumptions bearing out, and it would require only a modest increase in their EV/EBITDA to 7ish from the current 5ish to obtain that figure. This doesn’t seem farfetched to me.

Read the full article here