By James Knightley, Chief International Economist

Payrolls momentum continues to soften

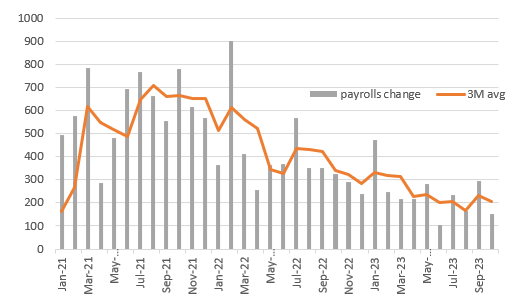

Today’s US jobs report is softer than predicted everywhere you look. Payrolls rose 150k in October versus the 180k consensus while there were 101k of downward revisions to the past two months. The unemployment rate ticked up to 3.9% from 3.8% (consensus 3.8%) while wages came in at 0.2% month-on-month/4.1% year-on-year, whereas the consensus was 0.3%/4.0% with revisions impacting the flow a little there. It is down from 0.3%/4.3% last month, and when you strip out the pandemic distortions, it is the weakest annual pace of wage gains since before the pandemic struck. Below is a chart of the monthly change and the 3M average, showing the decelerating trend in employment growth.

Monthly change in non-farm payrolls & 3M moving average (000s)

Macrobond, ING

Jobs growth concentrated in just three areas

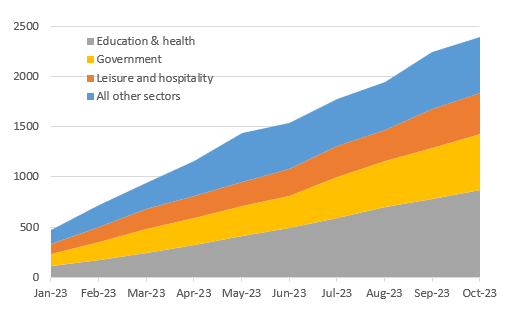

The details show manufacturing employment fell 35k, which was impacted by the auto strike action and associated knock-on effects with suppliers. All the strength was again concentrated in government (+51k) and education and health (+89k). Year-to-date employment in education/health is up 3.5%, leisure and hospitality is up 2.5%, and government is up 2.5%. The rest of the economy has seen employment rise just 0.6%.

Where the jobs have come from in 2023 (Cumulative increase in employment in 2023 000s)

Macrobond, ING

The rise in the unemployment rate and underemployment rate (to 7.2% from 7%), despite the participation rate dropping back to 62.7% from 62.8% points to a loosening labour market, a message reinforced by the weaker wage growth. This should give the Fed a bit more confidence that inflation can continue its softening trend, especially in the wake of the big falls seen in gasoline prices.

The Fed just needs to sit and wait

Low response rates from businesses and households to create this data have reduced the credibility of the report and are intensifying inconsistencies (household employment fell 348k, for example, despite payrolls rising 150k). But the US is not alone. This is something that is being experienced across developed markets and means we are seeing (and will continue to see) significant revisions. Nonetheless, payrolls is the number that markets focus on, and with unemployment rates and wages softening, it all reinforces the view that the Fed is finished hiking interest rates.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here