Dell will celebrate its 40th anniversary in 2024. It’s a monumental accomplishment, one that I have witnessed up close over the years as a former Dell employee and a technology analyst. In 1991, I joined the company in a consumer inside sales role fresh out of the University of Texas at Austin, the same school that founder, chairman and chief executive Michael Dell was attending when he started his company in a dorm room. It’s been quite a journey for Dell, from its roots in providing personal computers to today, when Dell Technologies and its sister companies offer client computing, services and infrastructure spanning servers, storage, networking, security and cloud networking globally.

I recently spent time with Michael Dell and his executive management team in Austin, discussing the company’s generative AI strategy for both its internal operational use and burgeoning customer deployments. Many of those discussions occurred under non-disclosure, so I can’t discuss those aspects here. Still, my time with the Dell leadership provided a peek into the impact that AI could have on the company’s broader portfolio and especially its telecom business unit. In mid-August, I also had the opportunity to spend time with Dennis Hoffman, who leads the company’s efforts with mobile network operators and communication service providers. In this article, I want to share my insights from that discussion and the recent analyst technology summit to speculate about the possible applications of AI that could help Dell differentiate its telecom services.

Dell Finally Goes Vertical With Telecom

At its founding in 1984, Dell’s go-to-market model involved direct sales over the telephone. As a Dell employee, I vividly recall the company’s vision statement, which echoed the need to pioneer and innovate in a direct-relationship sales and marketing effort. That mission served the company well, as evidenced by its hypergrowth in the 90s, but as it grew, Dell recognized the need to embrace the IT distribution channel and the internet to fuel a new phase of growth. The company also quickly realized the benefit of adopting selling strategies tailored to enterprise, healthcare and educational institution sales, but stopped short of pursuing vertical sales until the founding of Dell’s telecom systems business a few years ago.

The telecommunications industry is ripe for disruption, and Dell is well-positioned to capitalize on that. The company’s DNA, rooted in leveraging industry standards, plays perfectly into the recent momentum behind open radio access network solutions leveraging software-defined tools and server platforms. During my conversation with Hoffman, Open RAN emerged as a key topic of conversation. Open RAN has had a long ramp time, but there have been challenges, such as standardization, third-party integration and blueprints, that have slowed adoption. Dell aims to address these issues and deliver a lower RAN capital expense model for mobile network operators. In the process, the company is playing a role in leading Open RAN ecosystem developments—aligning independent software vendors and acceleration solutions that include Marvell 5G silicon while identifying new operator monetization opportunities to address perceived adoption gaps. Similar Open RAN efforts by Rakuten Symphony and, most recently, NTT DoCoMo’s OREX platform are promising, but operators are highly competitive and likely want other alternatives for consideration.

It is also worth highlighting that one of Dell’s competitors, Hewlett Packard Enterprise, is providing compelling telecom solutions through its Athonet acquisition for 5G core, Open RAN and performance acceleration with Qualcomm and orchestration through an internally developed software stack. From my perspective, the competition between both companies is a good thing for mobile network operators and should go far to raise the innovation bar.

Possible AI Telecom Applications

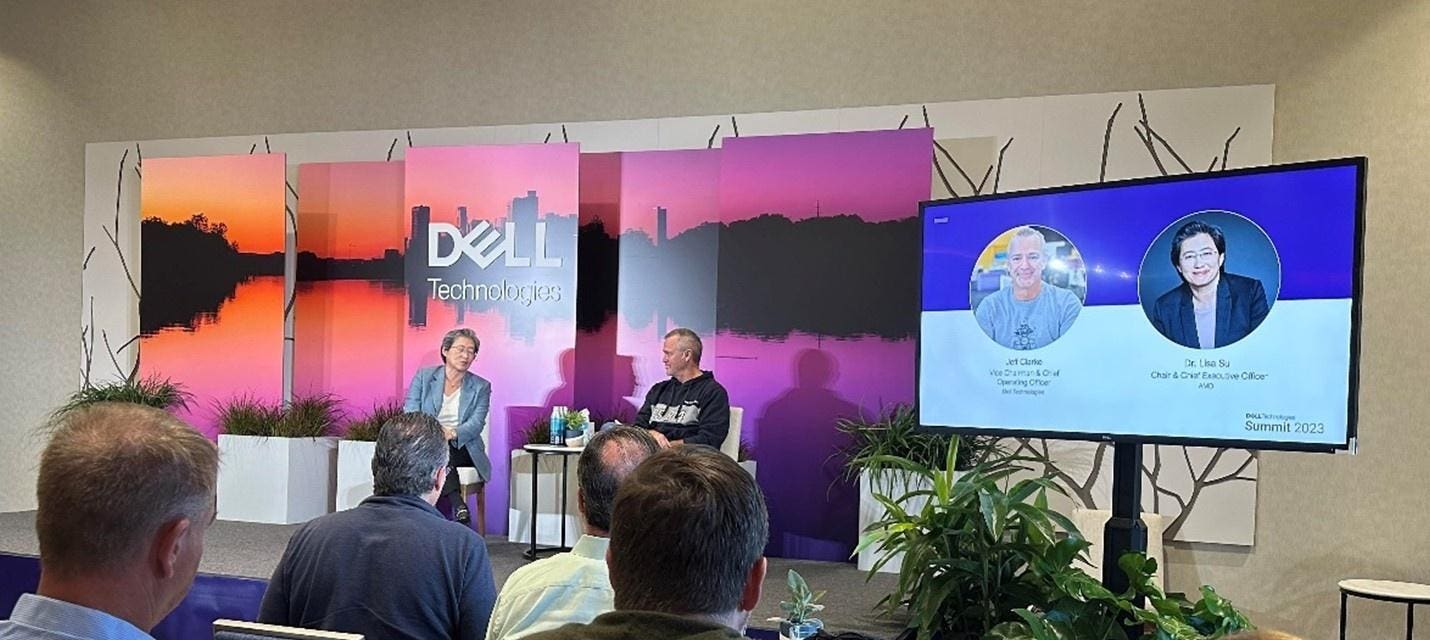

I returned impressed after spending two days with Dell at its recent technology analyst summit. I can’t share much of that content, but Dell is leaning heavily into AI from an ecosystem perspective—identifying and curating AI tech stacks, services and infrastructure recommendations. The company is also packaging solutions and creating blueprints and infrastructure sizing tools to remove the guesswork for determining which computing, storage and networking gear an organization needs.

Its AI lifecycle effort has the potential to speed AI adoption. This effort leverages the Dell Knowledge Portal and AI Technology Foundation, with the latter encompassing devices, infrastructure and orchestration across on-premises, cloud and edge domains. Dell’s AI software and model ecosystem is also helping to democratize access to open-source AI models through recent strategic partnerships with Meta and Hugging Face.

Dell’s parallel efforts to disaggregate the RAN and develop the company’s AI capabilities raises the question: what are the possible telecom applications of AI for Dell? It’s early days, but from my perspective, AI can have a demonstrable impact by improving mobile network resilience, creating richer subscriber experiences and enabling new enterprise applications. In the long term, innovation will come from the developer community. From my perspective, Dell is laying a solid foundation, given its investments described above.

Wrapping Up

Dell has transformed itself over the last four decades. In the process, it has established a dominant market position in both IT client and infrastructure solutions, giving it end-to-end solution delivery capability coupled with a world-class supply chain. This positions the company for future upside, especially given the intense interest in AI and its potential to revolutionize productivity and business operations. AI could be highly disruptive in future mobile network service delivery, complementing 5G Standalone deployments that will continue to roll out into next year.

Given its investments in AI, I expect Dell will play a significant role in not only the evolution of the telecommunications industry but also in broader markets that want to leverage the potential of generative AI.

Moor Insights & Strategy provides or has provided paid (wish services to technology companies, like all tech industry research and analyst firms. These services include research, analysis, advising, consulting, benchmarking, acquisition matchmaking, and video and speaking sponsorships. The company has had or currently has paid business relationships with 8×8, Accenture, A10 Networks, Adobe, Advanced Micro Devices, Amazon, Amazon Web Services, Ambient Scientific, Ampere Computing, Analog Devices, Anuta Networks, Applied Brain Research, Applied Micro, Apstra, Arm, Aruba Networks (now HPE), Atom Computing, AT&T, Aura, Avaya Holdings, Automation Anywhere, AWS, A-10 Strategies, Bitfusion, Blaize, Box, Broadcom, C3.AI, Calix, Cadence Systems, Campfire, Cisco Systems, Clear Software, Cloudera, Clumio, Cohesity, Cognitive Systems, CompuCom, Cradlepoint, CyberArk, Dell, Dell EMC, Dell Technologies, Diablo Technologies, Dialogue Group, Digital Optics, Dreamium Labs, D-Wave, Echelon, Elastic, Ericsson, Extreme Networks, Five9, Flex, Fortinet, Foundries.io, Foxconn, Frame (now VMware), Frore Systems, Fujitsu, Gen Z Consortium, Glue Networks, GlobalFoundries, Revolve (now Google), Google Cloud, Graphcore, Groq, Hiregenics, Hotwire Global, HP Inc., Hewlett Packard Enterprise, Honeywell, Huawei Technologies, HYCU, IBM, Infinidat, Infoblox, Infosys, Inseego, IonQ, IonVR, Inseego, Infosys, Infiot, Intel, Interdigital, Intuit, Iron Mountain, Jabil Circuit, Juniper Networks, Keysight, Konica Minolta, Lattice Semiconductor, Lenovo, Linux Foundation, Lightbits Labs, LogicMonitor, LoRa Alliance, Luminar, MapBox, Marvell Technology, Mavenir, Marseille Inc, Mayfair Equity, MemryX, Meraki (Cisco), Merck KGaA, Mesophere, Micron Technology, Microsoft, MiTEL, Mojo Networks, MongoDB, Movandi, Multefire Alliance, National Instruments, Neat, NetApp, Netskope, Nightwatch, NOKIA, Nortek, Novumind, NTT, NVIDIA, Nutanix, Nuvia (now Qualcomm), NXP, onsemi, ONUG, OpenStack Foundation, Oracle, Palo Alto Networks, Panasas, Peraso, Pexip, Pixelworks, Plume Design, PlusAI, Poly (formerly Plantronics), Portworx, Pure Storage, Qualcomm, Quantinuum, Rackspace, Rambus, Rayvolt E-Bikes, Red Hat, Renesas, Residio, Rigetti Computing, Ring Central, Salseforce.com, Samsung Electronics, Samsung Semi, SAP, SAS, Scale Computing, Schneider Electric, SiFive, Silver Peak (now Aruba-HPE), SkyWorks, SONY Optical Storage, Splunk, Springpath (now Cisco), Spirent, Splunk, Sprint (now T-Mobile), Stratus Technologies, Symantec, Synaptics, Syniverse, Synopsys, Tanium, Telesign,TE Connectivity, TensTorrent, Tobii Technology, Teradata,T-Mobile, Treasure Data, Twitter, Unity Technologies, UiPath, Verizon Communications, VAST Data, Veeam, Ventana Micro Systems, Vidyo, Volumez, VMware, Wave Computing, Wells Fargo, Wellsmith, Xilinx, Zayo, Zebra, Zededa, Zendesk, Zoho, Zoom, and Zscaler.

Read the full article here