Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the fourth week of October.

Market Action

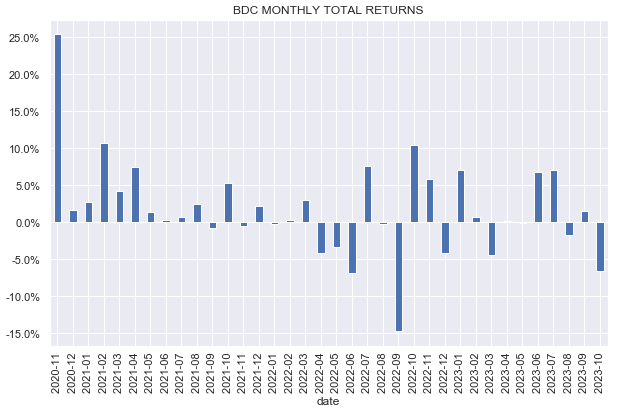

BDCs fell around 2.5% on the week – another in a series of down weeks as risk sentiment across markets remains poor. The sector is down around 6% so far in October.

Systematic Income

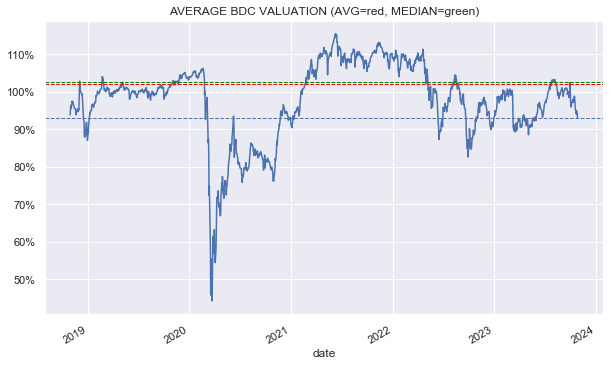

Sector valuation has now moved to around 93% from a recent peak of 103%. This is a much more attractive BDC investing environment that we have had for the previous few months.

Systematic Income

Market Themes

As many income investors know, BDCs typically have a bit over 1 turn of leverage on average. This means that they are financed roughly evenly in two ways – with equity and with debt. The debt portion is, in turn, on average roughly evenly divided between a floating-rate secured credit facility and fixed-rate unsecured bonds. Most BDCs leave their bonds alone while a handful choose to swap them out to floating-rates.

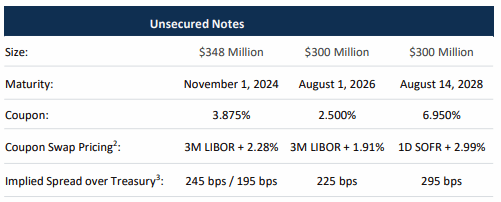

For example, TSLX swaps all of its bonds to floating rates as we can see in the following table.

TSLX

The argument for swapping out fixed-rate debt to a floating rate is to minimize the impact of interest rate moves on net income. It’s not possible to fully immunize net income from rate changes, of course, as the portion that is financed by equity is not offset by another floating-rate.

Apart from the question of partial net income immunization, a good question to ask is how have the swaps worked out in absolute terms i.e. in terms of overall impact on net income. The answer to this question is – not great.

For instance, because TSLX swaps its 2.5% 2026 bond to 3m Libor + 1.91%, it is paying around 7.4% on the bond instead of 2.5%. If you ask TSLX shareholders, they would probably prefer to pay 2.5% in interest on the bond rather than 7.4% even if the 7.4% “immunizes net income”. In this case the “immunize” bit keeps net income lower and more stable than it would have been otherwise.

Naturally, this is the unlucky outcome of a rising rate cycle – if interest rates moved lower instead TSLX would have seen a reduction on its interest expense while also keeping net income partly immunized.

What’s on a lot of BDC investor minds is the upcoming refinancing wave that we will see over the next couple of years for BDC bonds that were issued in the low yield 2020-2021 period. For example, a 3.5% 2023 bond issued by ARCC matured recently and it faced the question of whether to use cash to repay the bond or to refinance it at a significantly higher coupon. As it happens, ARCC repaid the bond with cash and has since upsized the credit facility by about half the size of the repaid bond.

Now that rates are even higher through October, BDCs face a potentially higher jump in interest expense. For instance a 5Y bond would be issued around 7-8% or well above nearly all periods this century. With a weighted-average portfolio yield of around 13% that doesn’t leave a lot of net income on leveraged assets after taking out management and incentive fees.

One view is that a company like TSLX that swaps out its bonds is less impacted by refinancing risk. This view is not correct since the swaps run to the maturity of the bond. Once the bonds mature, the company can make a decision whether to swap it out to a floating-rate or not. However, this decision can be made by any other company when their bonds come due. Every bond maturity is a do-over for every company whether it swapped the bond out or not.

A related view is that a company like TSLX is immunized on the way down as well – if short-term rates fall, its net income will not fall as quickly as for a BDC with fixed-rate liabilities, all else equal. This is correct, however on a refinancing, the new swap is done at market rates which price in a certain interest rate outcome. If the market believes interest rates will fall, that will be reflected in the pricing for the swap – that is, with a fixed-rate (received by the company) below the floating-rate it is paying. This translates into an immediate increase in interest expense.

In other words, the company that swaps out the new bond on the refinancing only gains overall if short-term rates fall more than what was implied by the swap pricing at the time it was executed. In short, for a company that swaps out its debt, it’s easily possible to have a scenario where short-term rates fall but the cost of the swapped bond ends up higher than had the company done nothing. It’s not sufficient for short-term rates to fall for the company to benefit from the swap – they need to fall more than the swap pricing implies.

Net net there is no free lunch for the swappers – they may end up better or worse in the end from a net income perspective. That is likely a more important criteria for most investors than whether net income is somewhat more or less stable.

Market Commentary

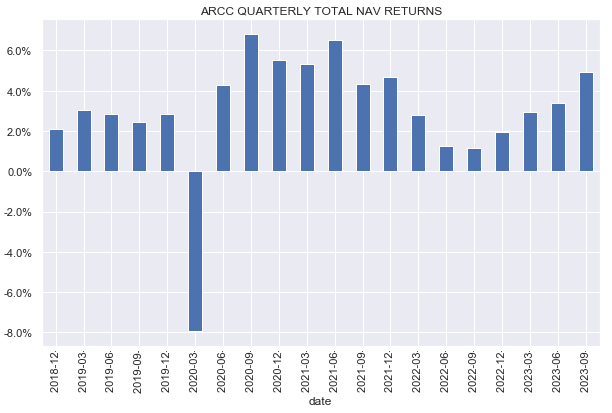

The BDC reporting season is kicking off with ARCC. The NAV rose by 2.2% – due to the combination of retained income and unrealized appreciation in excess of realized losses. The 4.9% total NAV return over the quarter is stellar and the best since mid 2021.

Systematic Income

High-yield corporate bond spreads have widened 0.5% so far over the quarter so if this extends or even remains stable we could see a reversal of the unrealized appreciation the company enjoyed this quarter.

In terms of portfolio quality, non-accruals fell, likely due to some realized losses. Valuation of 6% over the median BDC in the coverage is OK however there should be a better opportunity to add the stock once it does its regular secondary offering which often pushes the price down 3-5%. However, given the stock is trading below the NAV we’ll need to wait for it to move higher for the secondary offering to happen.

Stance And Takeaways

The BDC market is now much more attractive than it has been in the last few months. Earlier we downsized our allocation to BDCs as we viewed valuations overly rich. Now that valuations have deflated somewhat we are looking to add to the sector.

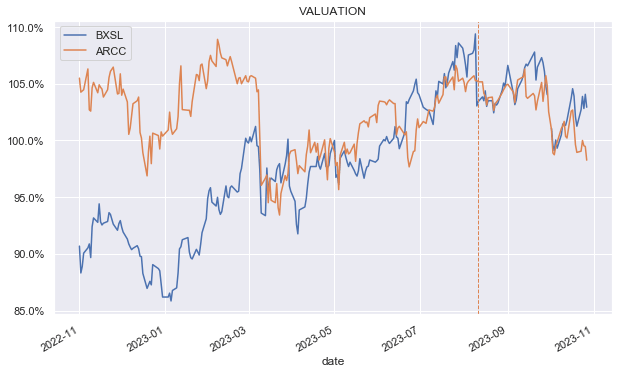

As always, we are also looking at a number of relative value opportunities. Specifically we are looking to reverse the ARCC to BXSL rotation we made when the BXSL valuation fell below that of ARCC.

Systematic Income

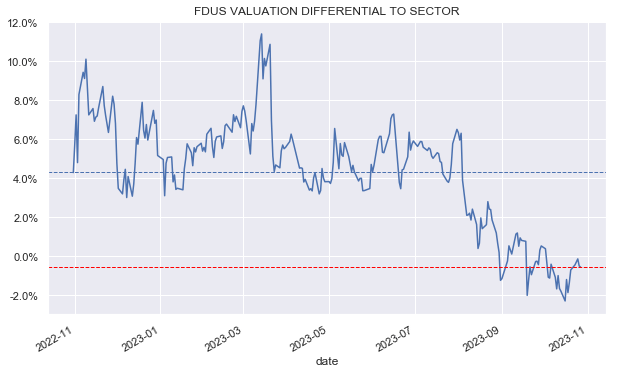

We are also looking to add to our FDUS position after its valuation deflated significantly and now trades below the sector average – unusual given the pattern over the last year.

Systematic Income

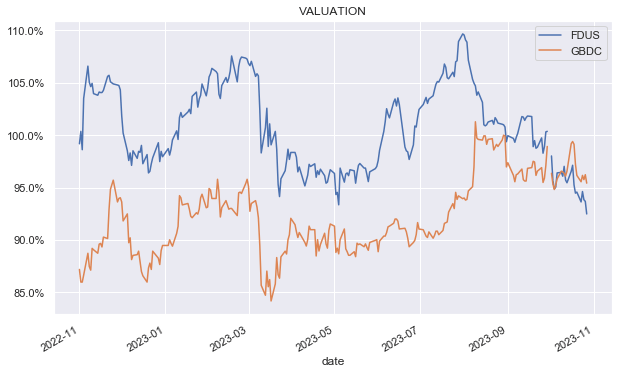

GBDC is a strong candidate as the source of capital as it has recently jumped out to a higher valuation, on the back of its management fee reduction.

Systematic Income

Read the full article here