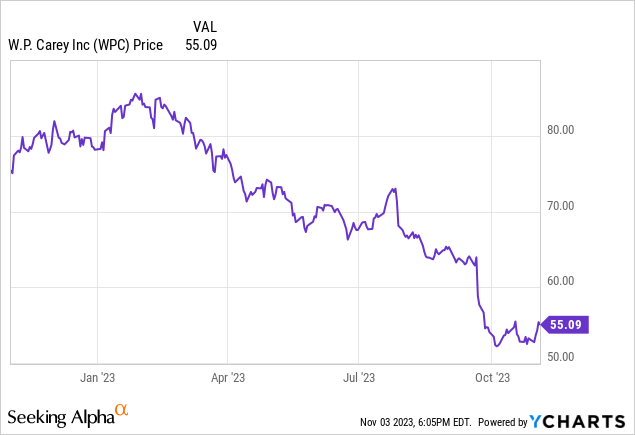

There is one REIT stock that we have been asked about time and again for about 6-7 months straight by those who follow our work or those who belong to our trading group. For a quick reminder to those of you reading who are new to Quad 7 Capital’s work, we were short the REIT space for several quarters and it has been one where buyers kept coming in only to lose. We started turning bullish a few weeks ago on select names, and overall have a rosier picture for the sector as we move into 2024, and we are specifically of the opinion that by this time next year operating conditions will be substantially better. For the many investors who have paper losses in a number of these names, eventually through dividends and a turn in the space, along with those of you who are savvy enough to work with options, getting back to even is likely. It may take longer than you would like. That said, one name we had continued to recommend avoiding due to so many follies was W.P. Carey (NYSE:WPC).

We will not go in depth about the company’s holdings or their portfolio here, there are countless other columns that have these details right on the quote page. We will say however that the REIT is unique, with exposure to several segments. While from an operational and diversification view point, that is somewhat attractive. But we will not waste your time or the white space on your screen with extra words just to make this column longer. What we will say is that investors have been clobbered here, and while the stock looks like it is finally forming a base, what caught our attention today was recent management decisions the came with the just-reported earnings.

It really is something. First, it was a downguide in the outlook. That is just dandy. But the reason for the downguide of course was the plan to offload its commercial assets into Net Lease Office Properties, or (NLOP), so it was largely expected. There are a number of reasons why the commercial space has been troubled, but the bottom line is that occupancy rates have suffered due to work from home, technology, mobile work, and more. This has led to pain for many REITs with office space exposure, including W.P. Carey. So, W.P. Carey’s spin of NLOP was completed November 1, and this was the 4th largest business line. About half of the value went into MLOP, while the other half is being sold off. Further, it has sold four properties so far for gross proceeds of $143 million and has signed contracts for half a billion dollars worth of addition sales which should be completed by Q2 2024.

All that sounds great, right? According to management the benefits are

- Providing a clear path to monetizing its legacy office portfolio

- Enhancing its growth profile through an improved cost of capital

- Increasing the quality and stability of its earnings and cash flows through better end-of-lease outcomes, including higher overall releasing spreads, reduced downtimes and carrying costs, and lower capex requirements

- Improving overall portfolio quality and key portfolio metrics, including an increased weighting to warehouse and industrial assets

- Maintaining a strong, scalable investment grade balance sheet

But the thing is, it really has not been clearly communicated how this will all happen, or what it means for valuation, or for the dividend. Although on the conference call which we will discuss more below, there was reference to a 20% reduction. The spinoff of course did not require shareholder approval. If it did, we doubt it would have passed because there is so much opacity on the deal and the medium-term impacts. But that is the past, and shareholders had no say there (not unusual, but making a point). The stock has reflected this as it is unsure what to do, other than knocking shares down after the deal was announced. While there has been some stabilization in the chart, and a recent rally with the market, there is a long way to go here.

Now, obviously, shares were already on a decline before we learned in September about the spin, and we had been short the sector, though perhaps begrudgingly, we were not short this specific name, despite following the name for our members. Since the spin was announced, shares have been in a narrow range, which suggests stabilization and that is a good thing for income seeking investors, though not if you have been holding through this chaos.

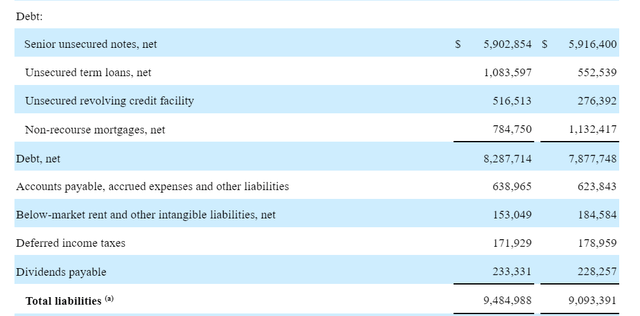

Where we take issue beyond the opacity of how the spinoff and asset sales really drive the 5 pillars of benefits above, other than getting a troubled ‘problem child’ segment of occupancy off the main books, is the still existing mountain of debt on the balance sheet. This is a real problem, and yes, we know that massive debt and leverage is of course an issue for many in this sector, but there is a heavy burden of maturities coming due in the next few years for this company. While we believe rates will be cut in a year from now, and that is a good thing, the company has to refinance about half of the balance sheet in the next few years which suggests an uphill battle for interest expenses. That is a major headwind and one of the reasons we question whether we will see meaningful capital appreciation from present levels.

There was $8.3 billion of debt here before the spin was completed.

WPC debt (WPC Q3 10-Q)

So this is sizable debt. Of course, with the NLOP spin we will see some movement here. What we can tell you is that NLOP’s portfolio of 59 office properties with 62 corporate tenants operating in a variety of industries, generating ABR totaling approximately $145 million. In terms of debt here, NLOP entered into a new $455 million debt facility, which was executed by NLOP and funded upon the closing of the Spin-Off on November 1, 2023. Approximately $350 million of this amount was retained by W.P. Carey in connection with the spin-off.

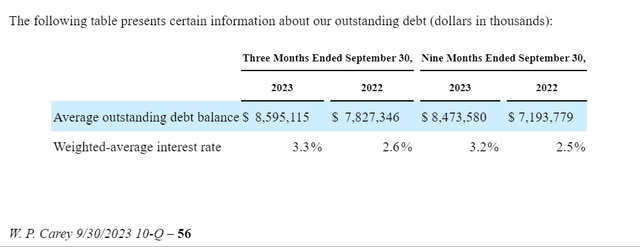

So, the office real estate issue we guess is an NLOP problem moving forward once the other sales are completed in the coming months. Of course, it may be your problem too if you own NLOP. While WPC may now be a leaner company with arguably a better future, not so sure we can say the same for NLOP. But we do believe that if management makes a sound decision with the capital coming in from office sales, rather than roll it into more investments, they should cover some of the maturities they have coming do. That would be prudent. As you can see the weighted interest rate has significantly increased

WPC Q3 10-Q

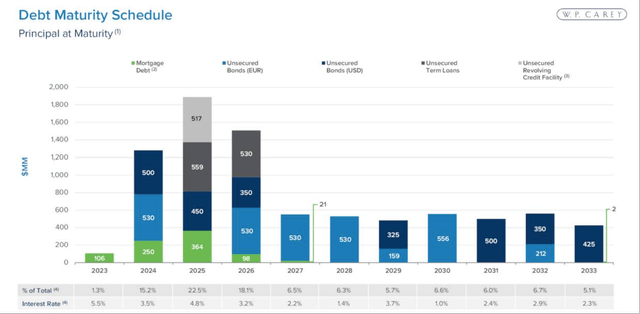

So we are up to 3.3% here, and the weighted average maturity on the profile is just over three and a half years. But so much of that debt is coming due. Here is a nice view of the debt principal coming due over the next few years:

WPC Q3 slides

So, as you can see here, more than half of the debt profile needs to be paid off (refinanced) by the end of 2026. As one can imagine, those refinances will come at higher rates. Right now interest expense has been $220 million in the first 9 months of the year, up about 45% from the comparable 2022 period’s interest expense. As such, we believe the company should look to use its incoming liquidity to pay down some of this debt, rather than refinance and keep a 5.5X plus debt to EBITDA leverage. However, this is unlikely to happen. On the conference call CEO Jason Fox stated:

we don’t expect a need to issue new capital in the near-term. It could potentially go to the end of 2024 without having to access the capital markets if they remain unfavorable, even if we temporarily repaid our 2024 debt maturities with cash… The significant pool of dry powder we have gives us a meaningful competitive advantage on new deals, especially versus net lease peers that may become capital constrained if they’re unable to access the capital markets or their cost of capital remains too high.

This is of course in regards to what they will be doing with the added liquidity. If the company was to take all of the capital influx and pay down debt, significant interest expense could be saved. We estimate if $1 billion of cash was used to wipe out the remaining 2023 an 2024 debt, it would save some $35 million plus in interest payments. However, any refinancing will come with increased interest expense. The company will not use all the cash for debt, it is not realistic, they will look to redeploy, but don’t worry, because do you know where money will be saved? Why of course it is out of your pocket with the dividend resetting. Yes the dividend resetting saves money too, meaning you get paid less. And the cut was larger than many were expecting, some 20%.

Now look, we are not saying investing in new properties and deals is necessarily a bad thing, and investment activity has slowed, but when you already have a massive debt load, shareholders that you have absolutely clobbered with what we view as questionable decisions, and you factor in other occupancy issues in other segments, it would seem to us that focusing on the newly reduced portfolio first would be prudent before deploying more capital to projects that will not need “new capital in the near-term.” When we hear new capital, we hear more debt, more dilution, both of which are red flags.

But the investments continue regardless of our opinion on the matter. For guidance, AFFO will now hit $5.17 to $5.23 per share per management, based on full year investment volume of between $1.3 billion and $1.5 billion, and factoring in expected ongoing interest expenses, and rental revenues. Now in 2024 AFFO will decline given the far less property in the port, with half of the office space being sold and the other half now in NLOP. But AFFO could be increased if they knocked down some of those interest payments. But, you can expect more of the same. High leverage, ballooning interest payments, and more investments. They have made about $1 billion in new investments this year. But what really should give investors pause is the reference at all to possibly needing new capital. It was mentioned again later in the call by the CEO, when talking about what we view as the number one priority in the debt and how it will be addressed:

“our guidance assumes we have sufficient capital and liquidity to fund our anticipated investment activity and repay our 2024 debt maturities [1 billion of bonds and $220 million in mortgages] without needing to access the debt markets until late in the year and that we may not need to raise equity capital at all in 2024″

The door is very open to raising more equity capital next year, despite the massive inflow of liquidity. Can you believe that? Refinancing will come at a heavy interest cost, make no mistake. If rates are somehow substantially lower a year from now it means the economy completely fell off a cliff, in which case WPC and REITs will have much larger issues. Shareholders should question why talking about raising more funds is even a consideration, since in our opinion, they have already clobbered investors.

For the bulls, it probably is positive that the office overhang is all but gone. More liquidity is a good thing. Better lease outcomes are welcomed. Better portfolio occupancy is welcomed. Making new investments to grow generally should be welcomed. But given shareholders took both a capital haircut and a dividend as part of the spin, we think you should take anything management asserts here with a big grain of salt. In regards to the debt there is one positive that merits mentioning. WPC is on course to recast its $1.8 billion credit facility before 2024 which would allow them to extend the maturity on a significant portion of the total debt maturing over the next couple of years. That is positive.

For those buying for the dividend, the reset is a 20% cut. And so, this is where the investments that are being made absolutely must be accretive to AFFO. This is because given the 70% payout goal management will adjust the dividend in line with AFFO growth. If management does execute, the dividend will be raised, and perhaps at a higher rate than the past.

Overall, there are a lot of moving parts for this controversial REIT. We have avoided it all year, and not just because we were short REITs. It is due to the many different issues happening here. While shares appear to be stabilizing with future growth looking likely, shareholders have been clobbered here. The question you need to ask yourself is whether you think you get burned again by questionable decisions, or whether this is the turn around.

From our perspective, given the history and uncertainty of how this transition all plays out, we rate shares a “don’t buy/avoid” neutral.

We welcome your thoughts

Are we too concerned with the balance sheet? Are we wrong about shareholders getting clobbered? Was the NLOP spin a win? Was the 20% cut anticipated? Do you think AFFO and the dividend will grow in 2024? Why talk about raising capital in the equity markets?

Read the full article here