Elevator Pitch

My investment rating for Olo’s (NYSE:OLO) stock is a Hold. I have a positive view of OLO’s Q3 2023 financial performance and the company’s decision to raise its full-year guidance. But Wingstop’s (WING) recent insourcing move indicates that there are downside risks to OLO’s future revenue and earnings in the scenario that an increasing number of restaurants, including Olo’s clients, choose to develop their own technology platform. Taking into account both Olo’s good results and risks relating to customer insourcing, I deem OLO’s shares to be worthy of a Hold rating.

Company Description

Olo refers to itself as “a leading open SaaS platform for restaurants” in its press releases. The company was first established in 2005, and the stock was listed on the NYSE starting in March 2021.

Olo’s Solutions For Restaurants

OLO’s FY 2022 10-K Filing

OLO’s Key Metrics In A Snapshot

Olo’s Q3 2023 Results Presentation

In the most recent fiscal year, OLO derived 97.8% and 2.2% of the company’s revenue from software platform fees and professional services, respectively as disclosed in its FY 2022 10-K filing. Olo is solely focused on the US market, as the company doesn’t earn any sales from foreign markets.

Wall Street’s Q3 2023 Financial Projections For OLO

The sell-side analysts had anticipated that Olo would register decent year-on-year top line and bottom line expansion in the third quarter of the current year, before OLO’s actual Q3 financial results announcement on November 6, 2023 after trading hours.

In specific terms, the analysts forecasts that OLO’s revenue would grow by +19% YoY to $56.3 million (source: S&P Capital IQ) for Q3 2023. Olo’s normalized EPS was estimated to double from $0.02 for Q3 2022 to $0.04 in the most recent quarter.

I touch on Olo’s actual financial performance in the subsequent section.

Olo’s In-Line Third Quarter Earnings Were Overshadowed By Wingstop’s Insourcing Move

Top line for Olo grew by +22% YoY to $57.8 million in the third quarter of 2023, and OLO’s most recent quarterly revenue beat the consensus sales estimate by +3% as per S&P Capital IQ data. At its Q3 2023 earnings briefing on November 6, the company credited the revenue beat to “growth across all three of our product suites, most notably Olo Pay, which is tracking ahead of our expectations.” OLO’s actual Q3 2023 normalized EPS of $0.04 also didn’t fall short of the market’s consensus bottom line projection.

To make things even better, Olo revised the company’s full-year FY 2023 top line and operating profit guidance upwards. In specific terms, the mid-points of OLO’s full-year revenue and operating income guidance were increased by +1.6% and +2.3% to $224.05 million and $17.8 million, respectively.

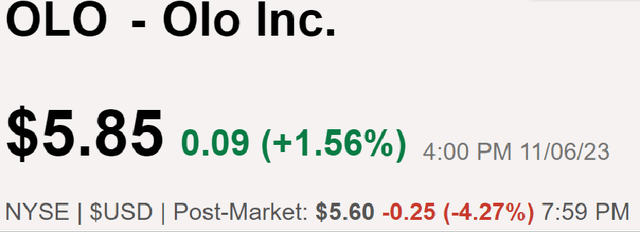

During post-market trading hours on November 6, 2023, Olo’s shares declined by -4% as highlighted below, despite the fact that the company’s third quarter earnings met sell-side expectations and it raised its full-year FY 2023 financial guidance.

OLO’s Share Price Performance During Post-Market Trading Hours On November 6

Seeking Alpha

I am of the opinion that Wingstop’s (one of OLO’s customers) decision to insource its technology platform has hurt investor sentiment for Olo. OLO shared at its third quarter results call that WING “indicated an intent to transition from the (Olo’s) platform when their contract expires at the end of Q1 2024” and develop its own “homegrown software platform.”

In the next section, I touch on why the market has viewed Wingstop’s latest insourcing move in a negative way.

OLO’s Growth Prospects Might Be Affected If Insourcing Trend Gains Momentum

Olo currently trades at a consensus forward next twelve months’ normalized P/E multiple of 36.6 times, and OLO’s valuation premium is justified by the company’s long-term growth potential. In the company’s Q3 2023 results presentation, OLO highlighted that a mere “15% of restaurant orders are digital” as one of the key datapoints providing support for the company’s long growth runway.

But it might be necessary to lower one’s expectations of the growth outlook for Olo in the long run and expect a more modest P/E multiple, if the insourcing trend gains momentum among restaurants.

At the company’s Q3 results briefing, OLO made a good argument for most restaurants outsourcing to SaaS platforms in the future. Specifically, Olo noted that Wingstop had allocated $50 million as “a down payment on a homegrown software platform” in comparison with the “$90 million (OLO spends) annually to maintain our platform and to innovate.” Simply put, it doesn’t seem to be the most economical solution for every restaurant to build its own software platform due to the lack of scale.

On the flip side, it isn’t just about cost efficiency considerations when certain restaurants choose the insourcing route. At its most recent quarterly earnings call, Wingstop emphasized that scaling up its “best-in-class digital platform” will “help protect the (company’s) moat” and drive an “increased level of hyper-personalization” which is expected to translate into higher “conversion retention rates.” In other words, there are strategic reasons for specific restaurants making the tough decision to develop and expand its own in-house technology platform.

Wingstop accounts for under 3% of Olo’s top line, so the loss of WING as a client isn’t likely to have a major impact on OLO’s near term financial performance. Nevertheless, there is a real risk that Olo’s future growth potential could be overstated, assuming that more restaurants follow in Wingstop’s footsteps.

Concluding Thoughts

I award a Hold investment rating to Olo. On one hand, I am encouraged by OLO’s Q3 results and FY 2023 guidance. On the other hand, I am concerned that the insourcing trend might possibly gain momentum among restaurants.

Read the full article here