On November 7th, Uber Technologies, Inc. (NYSE:UBER) announced earnings for the FY Q3. The company’s leadership highlighted the sustained growth and profitability of Uber’s core business, expressing a focus on enhancing the user experience for both consumers and drivers. The management also stressed disciplined investments to support long-term value creation.

We continue to make disciplined investments in growth opportunities to support long-term value creation for all stakeholders.

Reported Numbers

The company’s financials indicate a positive trajectory in both gross bookings and revenue, supported by an increasing user base and a resilient business model, despite some challenges affecting revenue margins in the Mobility and Delivery segments. However, Uber missed analysts’ expectations in terms of revenue and net income.

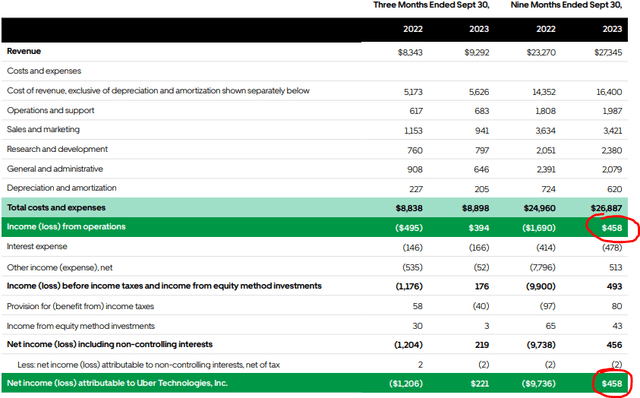

Condensed Consolidated Statements of Operations (Uber)

The operating income for the nine months ended equals the net income for the same period. Yet, the margins remain extremely low and they are at the break-even level.

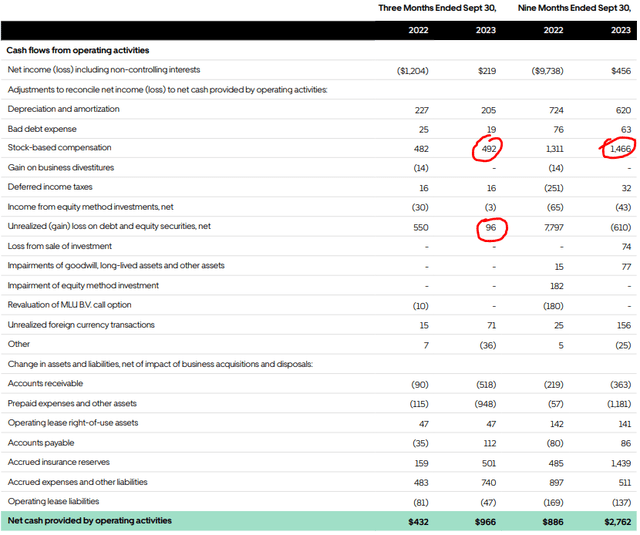

What also deserves investors’ attention is the statement of cash flows and the stock-based compensation that grows with every quarter.

Condensed Consolidated Statements of Cash Flows (Uber)

If the share-based compensation and a one-time event such as a gain on debt and equity securities were excluded, the company’s free cash flow (“FCF”) would be $317 million instead of $905 million. That also gives a Free Cash Flow Yield of 3.4% for the Q3 instead of 9.7%.

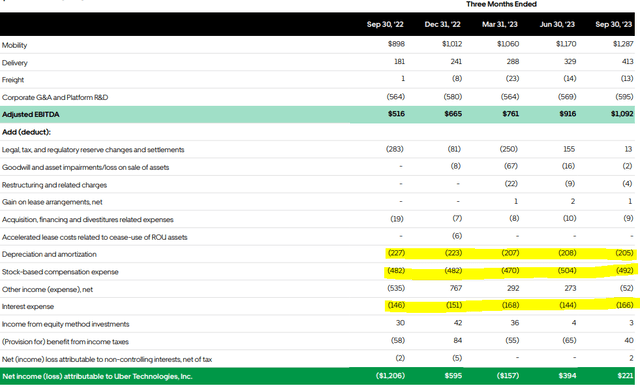

Another metric, the company shows in its earnings’ supplemental data is EBITDA (Earnings Before Interest Taxes Depreciation, and Amortization), which according to one of the most famous value investors, Charlie Munger, are shenanigans.

He believes that EBITDA can be misleading as it excludes various crucial expenses and financial elements, thereby presenting an incomplete picture of a company’s actual profitability.

Adjusted EBITDA Reconciliation (Uber)

EBITDA excludes important costs like interest, taxes, and other expenses, offering an overly simplified view of a company’s financial health. The metric can be misleading and can paint a more positive or flattering picture of a company’s earnings than it is. In the case of Uber, depreciation, amortization, stock-based compensation, or interest expense are real costs that shouldn’t be treated as if they didn’t exist. What is more, those expenses will remain and likely grow with time.

Highlights and Outlook

The management focuses on the positives and prognoses further growth:

- Gross Bookings of $36.5 billion to $37.5 billion.

- Adjusted EBITDA of $1.18 billion to $1.24 billion.

Undeniably, there are developments in each segment, that investors may be excited about. Some of them include:

Platform:

- Monthly Active Platform Consumers (MAPCs) increased to 142 million, with a 15% YoY growth.

- Trips on the platform reached 2.4 billion, showing a 25% YoY increase.

- Launched “Uber One,” a cross-platform membership program, now available in 18 countries with a global member base of 15 million.

Mobility:

- Introduced new features such as Group Rides, coalesced taxi products, and expanded services like Uber Moto in Latin American cities.

- Enhanced safety measures with the opt-in audio recording feature for trips.

- Announced partnerships with JetBlue and others to improve services for customers.

Delivery:

- Launched an AI-powered conversational shopping experience to aid consumers in ordering and exploring new options.

- Introduced affordability and access initiatives, including acceptance of SNAP benefits for grocery access and expansion of grocery selections in partnerships with multiple retail chains.

- Furthered partnerships and expansions in delivery services, collaborating with Oracle, Deliverect, and entering exclusive partnerships with various retailers and stadiums.

Freight:

-

Insights AI: Launched Insights AI, utilizing large language models to generate insights from Uber Freight’s vast transportation data, aiming to enhance decision-making for logistics customers.

-

Product Roadmap Progress: Introduced upgrades to the Uber Freight Transportation Management System (TMS) for improved usability and visibility, and rolled out the Uber Freight Exchange to accelerate freight procurement and execution.

-

Autonomous Vehicle (AV) Initiatives: Forged a strategic partnership with Waabi to deploy driver-as-a-service solutions using generative AI and simulation for autonomous technology. They plan to cover billions of miles over the next ten years, with the first commercial route initiated in Texas. Achieved over 100,000 autonomous miles driven on the Uber Freight network.

These highlights signify Uber’s efforts to expand services, improve safety measures, and diversify its revenue streams through various partnerships and innovative features across both the Mobility and Delivery segments. The company’s focus on enhancing user experiences and extending accessibility through partnerships indicates a strategic approach to sustained growth and customer engagement.

Risks

All the positives and highlights don’t change the big picture of the economics of the ride-hailing business and the industry. Companies like Lyft (LYFT) and Uber face various regulatory risks that can affect their operations and lead to potential bans in certain countries. Some of the key regulatory risks include:

- Regulatory Compliance: Ride-sharing companies must comply with local, regional, and national regulations, which can vary significantly from one place to another. These regulations cover areas such as licensing, insurance, background checks for drivers, vehicle standards, pricing, and taxes.

- Legal Battles and Lawsuits: Ride-sharing companies have faced legal challenges in several regions. These may involve lawsuits related to the classification of drivers (as independent contractors or employees), passenger safety concerns, or disputes with local taxi industries.

- Public Safety Concerns: Safety and security issues, such as accidents involving ride-sharing vehicles, incidents with passengers, or concerns about driver background checks, have led to regulatory scrutiny and potential restrictions.

- Competition with Local Services: The emergence of ride-sharing services often conflicts with traditional taxi services, leading to regulatory battles driven by existing transportation providers.

- Economic and Labor Concerns: The impact of these services on traditional employment structures and the gig economy model has raised concerns about workers’ rights, minimum wages, and benefits.

Bans or restrictions on ride-sharing services vary in ease and likelihood depending on the region’s political climate, existing transportation infrastructure, public opinion, and the adaptability of these services to local regulations. Some countries or cities have welcomed ride-sharing, while others have imposed strict regulations or outright bans.

Overall, the ease of banning such services in other countries varies, and it’s typically a complex process influenced by a combination of political, economic, safety, and legal factors.

Valuation

Not only is risk outweighing reward, when investing in Uber, but the valuation is not compelling at all. The company is trading at the forward P/E ratio of 126.41. This translates to a 0.8% earnings yield. Until now, Uber hasn’t reported net profit for a fiscal year. Thus, it’s very difficult to make any assumptions about the future.

Besides that, forward EV/EBIT is as high as 123.74, while the sector median is 14.82.

The share price has experienced a tremendous run this year and it may well continue. However, the company seems to be overvalued and the price would have to drop significantly to be compelling for value investors.

Conclusion

Despite positive significant developments at Uber and foreseeable growth, the company continues to face inherent risks due to various regulatory challenges. While financial success and expansion efforts may suggest growth and potential stability, Uber’s operations remain precarious due to ongoing legal battles, safety concerns, and regulatory uncertainties. Despite its financial performance, the company’s sustainability is threatened by the potential for bans, legal complexities, and the continuous need to adapt to various regional regulatory landscapes, which could significantly impact its long-term viability and global reach.

Read the full article here