More than a decade of near-zero interest rates spawned a generation of bonkers financial decisions. Now, we are in the reveal and clean-up phase.

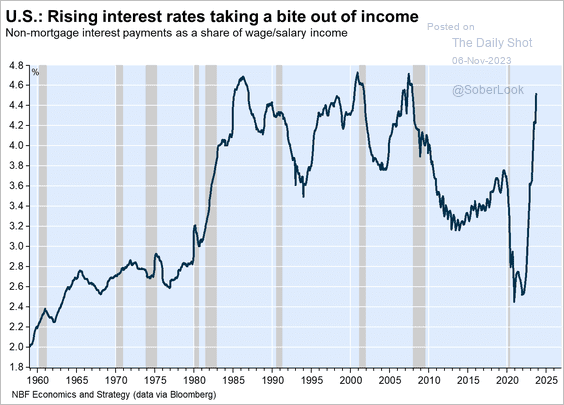

Unlike fixed-term mortgages, other forms of credit quickly change with overnight policy rates set by central banks.

As shown below, since 1960, courtesy of the Daily Shot, non-mortgage interest payments now suddenly consume 4.5% of employment income – the highest share in 15 years.

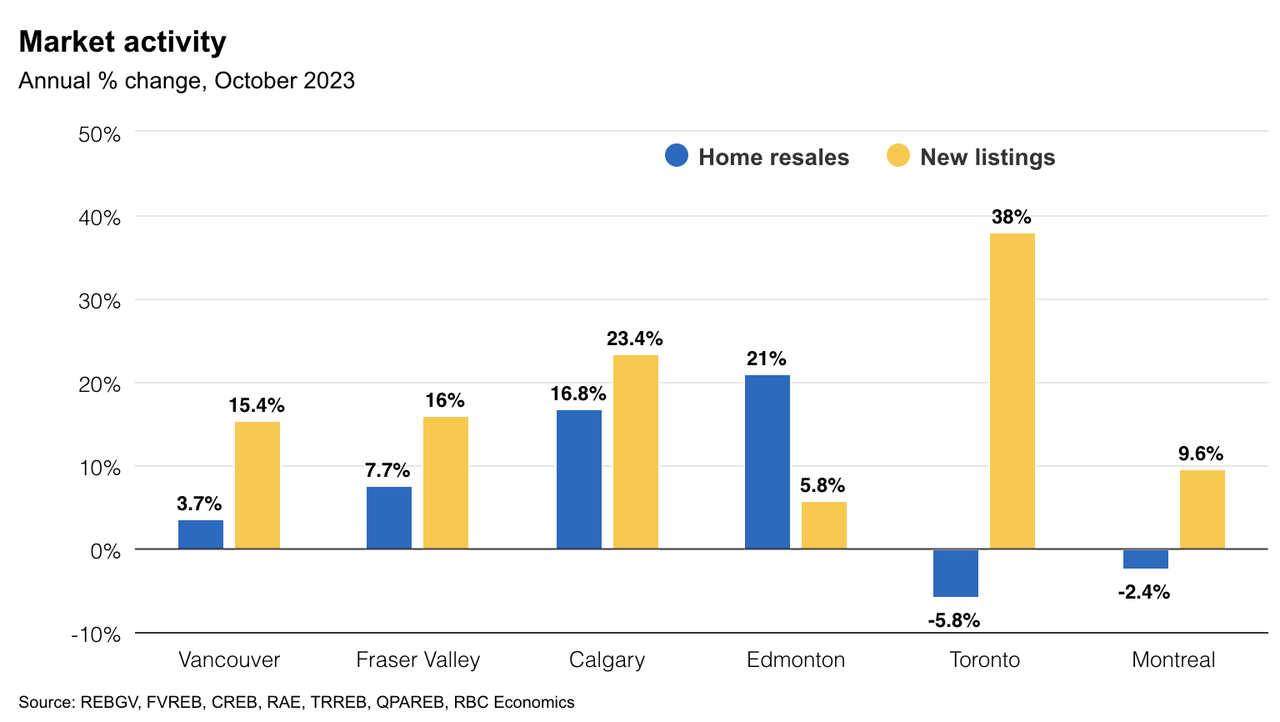

Inventory for sale is spiking across most assets as available credit and able buyers contract.

Home sales (in blue below) in the Greater Toronto and Montreal areas outright contracted year-over-year in October, while new listings (in yellow) have leapt in all major cities. See more in Fall housing market stuck in a low gear across Canada.

Prices are naturally moving lower as initial denial by owners and lenders shifts to terror and liquidation mode.

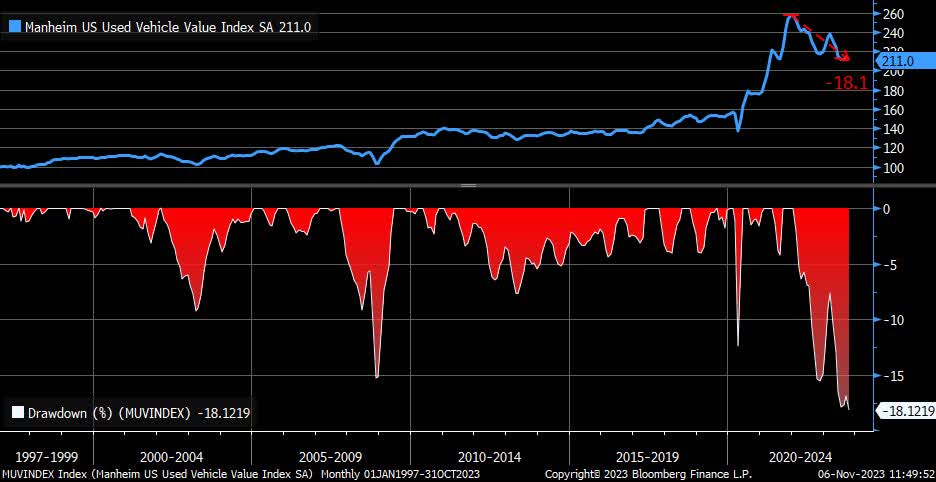

Used vehicle prices in October were 18% below their 2021 peak (Manheim US Used Vehicle Value Index in red below since 1997). This is the largest drawdown on record, but prices are still 33% higher than in 2020. Mean reversion has only started here.

Delinquencies and bad debts are mounting. It is hard to imagine the madness that has been.

Disclosure: No positions

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here