As the new year dawns, investors gaze intently at the horizon, seeking advanced signs of market trends that will shape opportunities in 2024.

Here, we drill into the forces that will direct capital flows, risks that need addressing, and technologies poised to disrupt industries – arming investors with insights to capture outsized returns.

1: The Great Rates Debate

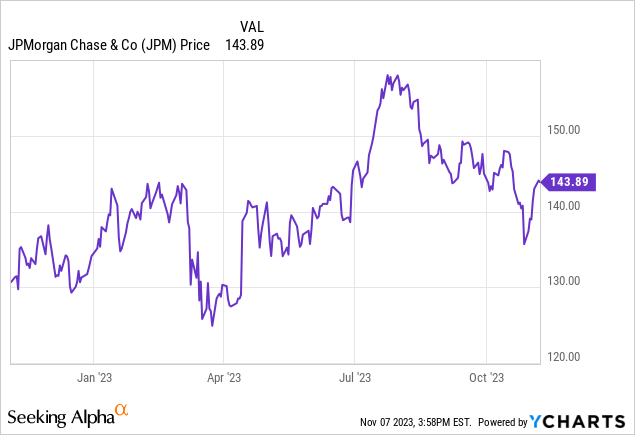

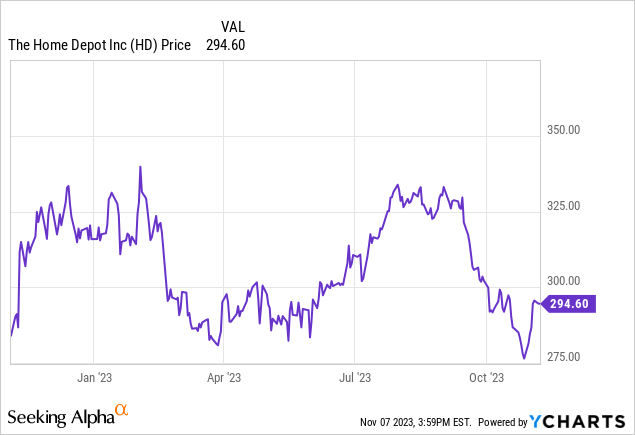

The Fed’s rate hike path remains the wild card, with ongoing tension between taming inflation and avoiding recession. Strategists expect 2-3 more hikes, then cuts in 2024 as policy effects ripple through the economy. This volatility necessitates caution and flexibility.

Stocks to Watch:

- JPMorgan Chase (JPM), which may benefit from higher interest rates boosting its interest income.

- Home Depot (HD), which could be negatively leveraged to interest rate swings affecting the housing market.

2: The Fintech Frontier

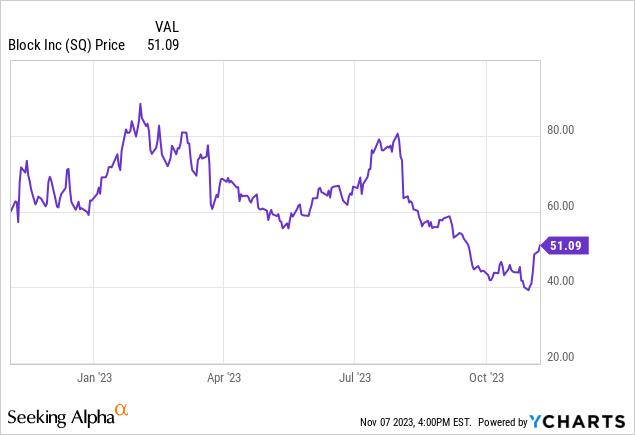

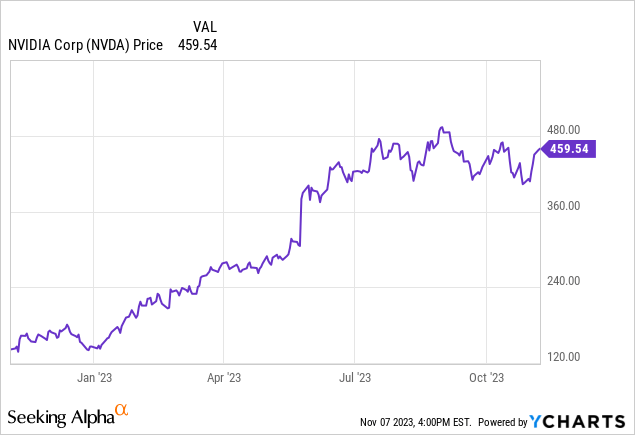

Cryptocurrencies, DeFi, BNPL, embedded finance – financial services face a technology shakeup. As regulators balance innovation and stability, agile startups and proactive incumbents will thrive. The democratization and decentralization of finance are marching on.

Stocks to Watch:

- Block (SQ), which is at the forefront of payment processing and financial services innovation.

- Nvidia (NVDA), due to their hardware’s pivotal role in supporting cryptocurrency mining and AI development.

3: Values-Based Consumption

Consumers increasingly align spending with ethical values – sustainability, organic, local, inclusive. Brands embracing transparency and purpose gain wallet share. Direct-to-consumer models also gain traction by connecting producers and buyers.

Stocks to Watch:

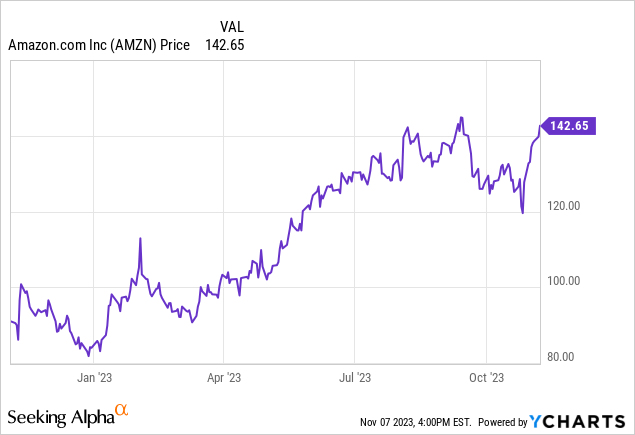

- Amazon (AMZN) is a leader in e-commerce and cloud services.

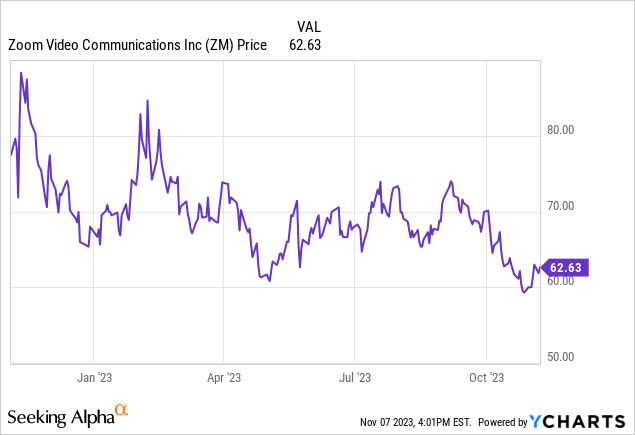

- Zoom (ZM) could sustain demand with a shift to remote work and communication.

4: The ESG Investing Tsunami

Trillions continue pouring into ESG funds as investors seek returns with principles. Stricter reporting standards are raising the accountability bar. Frameworks like the IFRS Sustainability Standards promise greater comparability and rigor.

Stocks to Watch:

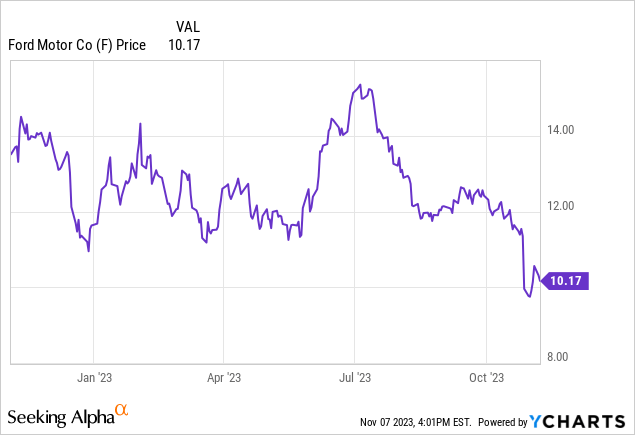

- Ford (F) is a benefactor of the electric vehicle surge.

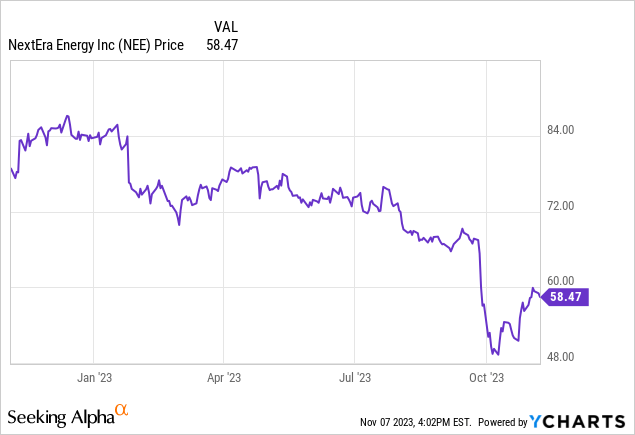

- NextEra Energy (NEE) is a leading company in renewable energy generation.

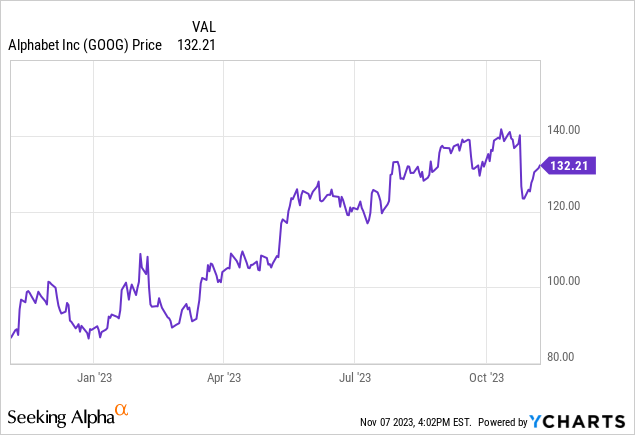

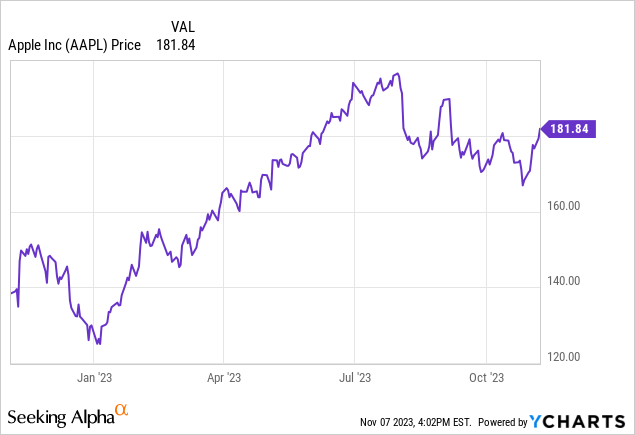

5: The Big Tech Policy Pivot

Critics accuse big tech of stifling competition and infringing privacy. New legislation seeks to regulate acquisitions, data collection, algorithmic amplification. Tech giants are on the defensive but pragmatism on all sides can balance oversight and innovation.

Stocks to Watch:

- Alphabet (GOOG), which faces regulatory scrutiny but has significant resources to adapt.

- Apple (AAPL), which could benefit from its privacy-centric stance.

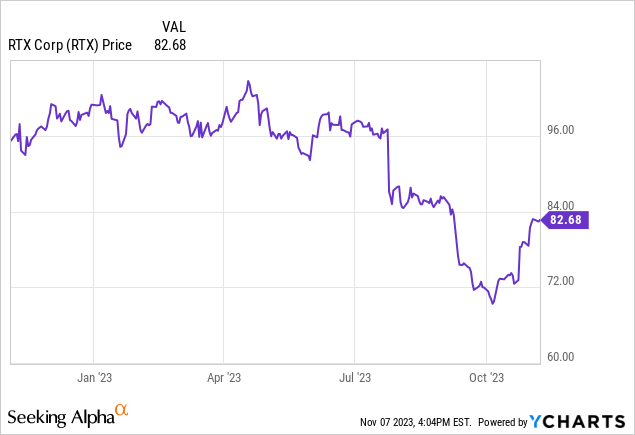

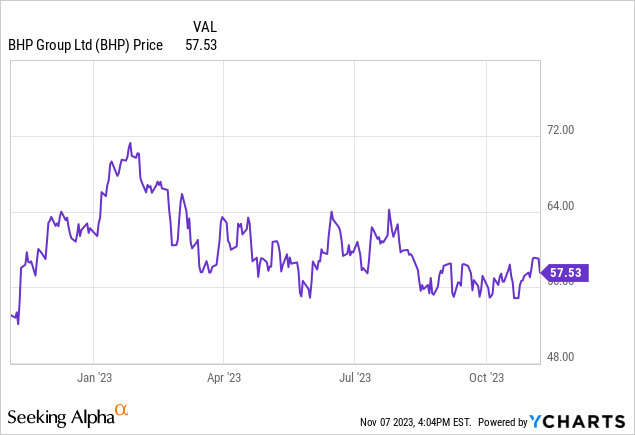

6: The Geopolitical Volatility Vortex

From trade wars to territorial disputes, geopolitical rifts create market uncertainty. Supply chains and commodity prices remain exposed. However, selective reshoring, friendshoring, and multilateral cooperation provide optimism. Investors should monitor risks while seeking assets with geographic flexibility.

Stocks to Watch:

- RTX (RTX), which could see demand in defense.

- BHP (BHP), a major resources company sensitive to trade flows and commodity pricing.

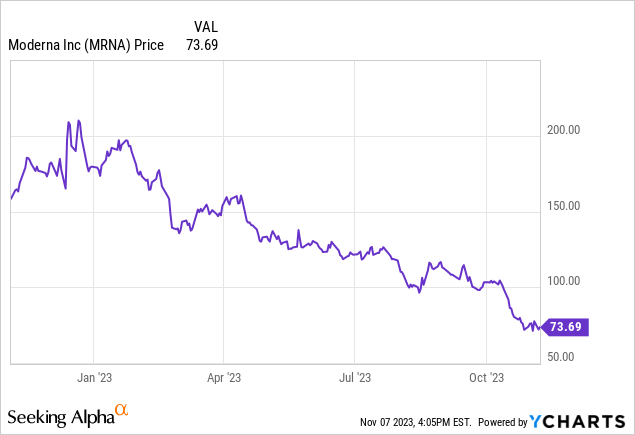

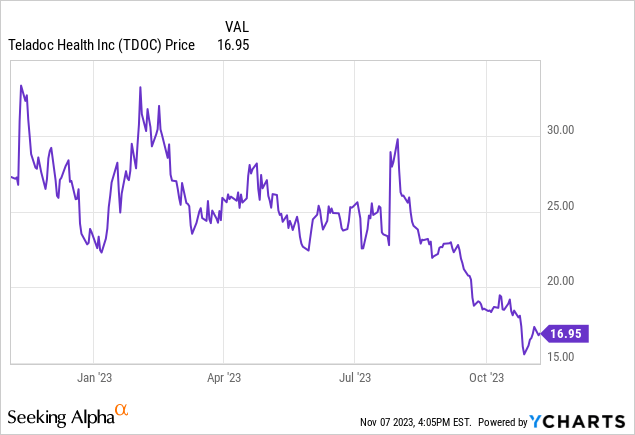

7: Healthcare’s Post-Pandemic Progress

Telehealth’s rise, genomics breakthroughs, and preventative care prioritization will advance healthcare delivery. Digital health funding hit new highs in 2022. While policy and affordability challenges remain, technology and innovation can continue improving access and outcomes.

Stocks to Watch:

- Moderna (MRNA), a leader in mRNA technology.

- Teladoc (TDOC), which may capitalize on the expansion of telehealth services.

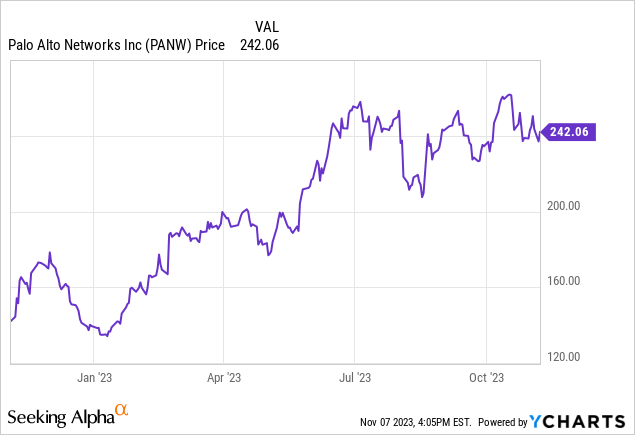

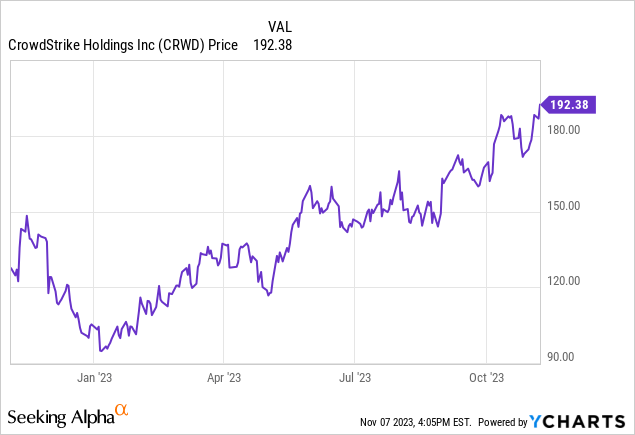

8: The Cybersecurity Investment Imperative

Cybercrime costs could hit $10 trillion by 2025. Ransomware and critical infrastructure threats loom large. As digital penetration deepens, so must commitment to resilient systems and data protection. Expect strong demand growth for security providers.

Stocks to Watch:

- Palo Alto Networks (PANW), a cybersecurity leader.

- CrowdStrike (CRWD), known for its cloud-native endpoint protection.

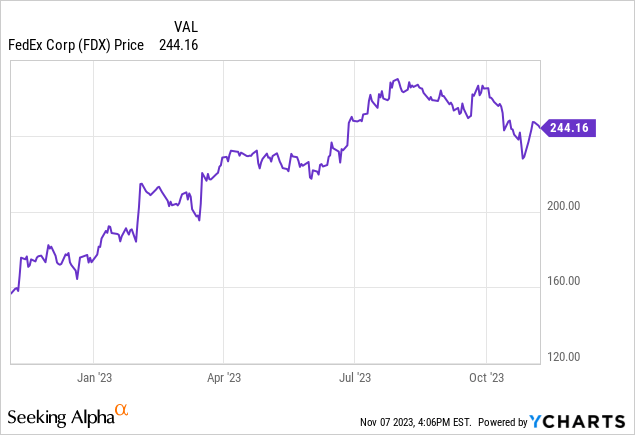

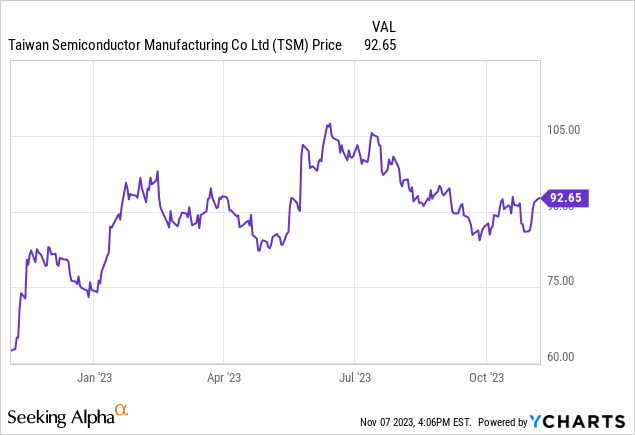

9: Building Supply Chain Resilience

Firms realize reliance on few suppliers and just-in-time inventory carry risks. Diversification, regionalization, buffers, and digitization are crucial now. Companies balancing cost efficiencies with redundancy and risk management will stay competitive.

Stocks to Watch:

- FedEx (FDX), as it adapts to e-commerce logistics challenges.

- Taiwan Semiconductor (TSM), critical for semiconductor supply resilience.

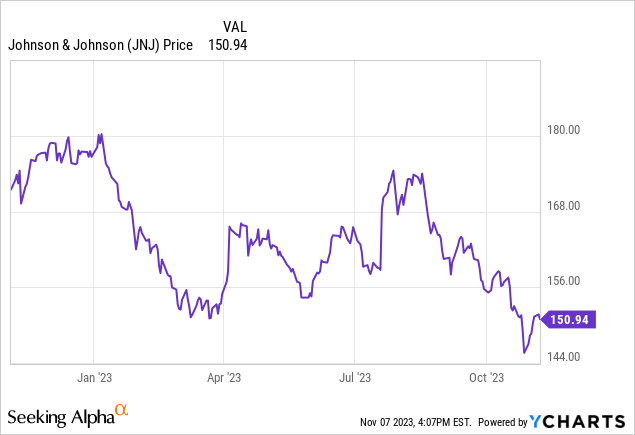

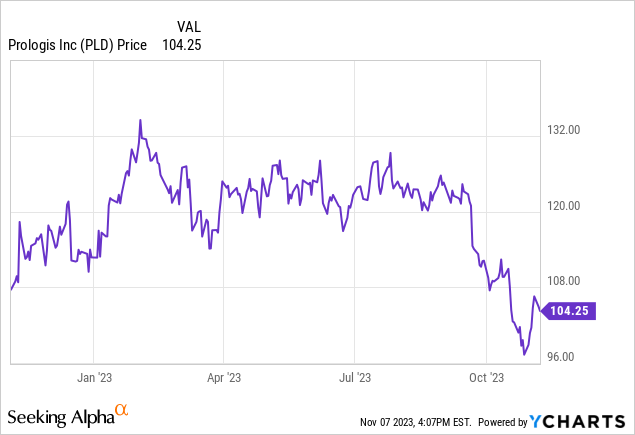

10: Adapting to Demographic Shifts

Declining birth rates and greater longevity raise economic uncertainties but also provide investment angles. Healthcare, real estate, leisure sectors must cater to aging populations’ needs through both innovation and reform.

Stocks to Watch:

- Johnson & Johnson (JNJ), with its wide range of healthcare products.

- Prologis (PLD), a leader in logistics real estate that could benefit from healthcare distribution needs.

The winds of change are gathering speed. Those who identify and harness these powerful trends will sail forth successfully into the new year. In 2024, we’ll navigate alongside you, spotting charted routes and hidden eddies so your portfolio stays the course through all these market currents!

Read the full article here