Elevator Pitch

I rate Lucid Group, Inc. (NASDAQ:LCID) stock as a Sell.

Earlier, I compared Lucid against Tesla (TSLA) in my April 11, 2023 write-up, and came to the conclusion that LCID was the relatively less appealing investment candidate of the two. My unfavorable opinion of Lucid appears to have been validated by the company’s most recent Q3 2023 financial results and outlook as detailed in this article.

Lucid was hit by a substantial -29% top line miss in Q3, and the company also revised its production guidance for the current year downwards. This explains my decision to downgrade LCID’s rating to a Sell.

LCID Stock Went Down After Reporting Q3 Results

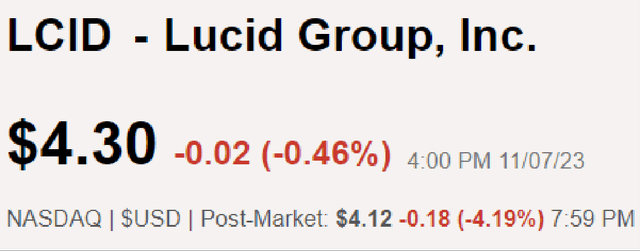

Lucid’s shares closed at $4.30 at the end of the November 7, 2023 trading day. LCID disclosed the company’s third quarter financial performance after 4 p.m. on November 7, and the company’s shares corrected by -4.2% during after-hours trading.

Lucid’s Stock Price Performance During Post-Market Trading On November 7

Seeking Alpha

LCID’s last done stock price of $4.12 is -36% below Wall Street’s consensus price target of $6.49 and +18% above the lowest sell-side target price of $3.50. This shows how depressed Lucid’s share price has become. In the next section, I evaluate LCID’s recent quarterly results and forward-looking guidance to determine if LCID’s stock price weakness post-earnings announcement is justified.

Lucid Missed Q3 Revenue Estimate But EBITDA Loss Was Narrower Than Expected

Revenue for Lucid contracted by -29% YoY from $195.5 million for the third quarter of the previous year to $137.8 million in the most recent quarter. As a comparison, LCID’s actual third quarter sales came in -29% below the sell side’s consensus top line projection of $195.2 million as per S&P Capital IQ data.

LCID revealed at its Q3 2023 earnings briefing that the company “started production of Air Pure rear-wheel drive” which is “our most attainable air with a starting price of just $77,400.” In other words, an unfavorable change in Lucid’s sales mix with an increase in revenue contribution from a vehicle boasting a lower ASP (Average Selling Price) hurt its revenue for the recent quarter.

Separately, LCID’s non-GAAP adjusted EBITDA loss widened from -$552.9 million in Q3 2022 to -$624.1 million for Q3 2023. But it is worth noting that Lucid’s normalized EBITDA loss for the third quarter was better than the analysts’ consensus EBITDA forecast of -$720.7 million (source: S&P Capital IQ).

Considering that Lucid’s top line decreased YoY and turned out to be weaker than expected, it is fair to say that operating leverage wasn’t the reason for LCID’s narrower-than-expected EBITDA loss. Instead, it is more likely that Lucid’s expense control efforts have paid off in the third quarter of this year. At the company’s Q3 results call, Lucid highlighted ongoing expense management plans such as “material cost-out initiatives”, “labor and overhead cost down initiatives”, and the “automation of key processes.”

I will refer to LCID’s recent set of financial results as mixed. On one hand, Lucid suffered from a massive revenue mix in Q3. On the other hand, LCID’s actual EBITDA loss wasn’t as substantial as what the market had feared.

As such, Lucid’s poor after-market trading share price performance is most probably attributable to the company’s dim prospects as detailed in the subsequent section of the article.

The Outlook For Lucid

Lucid lowered its full-year fiscal 2023 production guidance from over 10,000 units previously to 8,000-8,500 units now following the release of its Q3 2023 results. This was a major negative surprise for investors, even though LCID claimed at its third quarter results briefing that it is “taking a prudent approach to inventory management and working capital to better align with deliveries.”

A positive revenue surprise for LCID in Q4 2023 seems less likely based on both its updated FY 2023 production expectations and the company’s outlook relating to sales mix.

LCID had indicated at its Q3 earnings call that its ASP growth is most probably going to be flattish in Q4 2023 according to the assumption that its sales mix won’t change significantly for the final quarter of the year. Recall that Lucid’s Q3 2023 top line had missed the consensus forecast due to a revenue mix comprising of revenue generated from the lower ASP Air Pure rear-wheel drive.

Positive Valuation Re-Rating In The Near Term Appears To Be Unlikely

Lucid’s Enterprise Value-to-Revenue valuation multiple has de-rated from 35.6 times in mid-September 2021 (point where consensus forecasts were first available) to 5.9 times (source: S&P Capital IQ) as of November 7, 2023. In contrast, Tesla’s consensus forward next twelve months’ Enterprise Value-To-Sales metric is just slightly higher at 6.2 times as per S&P Capital IQ data.

LCID noted in its most recent quarterly results call that external factors like “interest rates” and “other macro conditions” and internal factors such as “delivering on our product rollout promises” and “making important progress against our plan” are what potentially affects its share price. Although external factors such as the rising rate environment are headwinds for companies in general, Lucid has disappointed the market on internal factors like its recent quarterly sales and the FY 2023 production guidance.

In the prior section, I had already mentioned that I don’t see Lucid delivering positive surprises with its Q4 2023 financial performance. Furthermore, Lucid’s valuation discount relative to its profitable and larger peer Tesla isn’t very significant. Therefore, my opinion is that LCID isn’t going to witness valuation multiple expansion anytime soon.

Closing Thoughts

Lucid’s shares are rated as a Sell. I am unimpressed with LCID’s Q3 results and its FY 2023 production guidance. More importantly, I don’t expect Lucid’s shares to experience a meaningful valuation re-rating in the short term based on my expectations of the company’s Q4 2023 performance.

Read the full article here