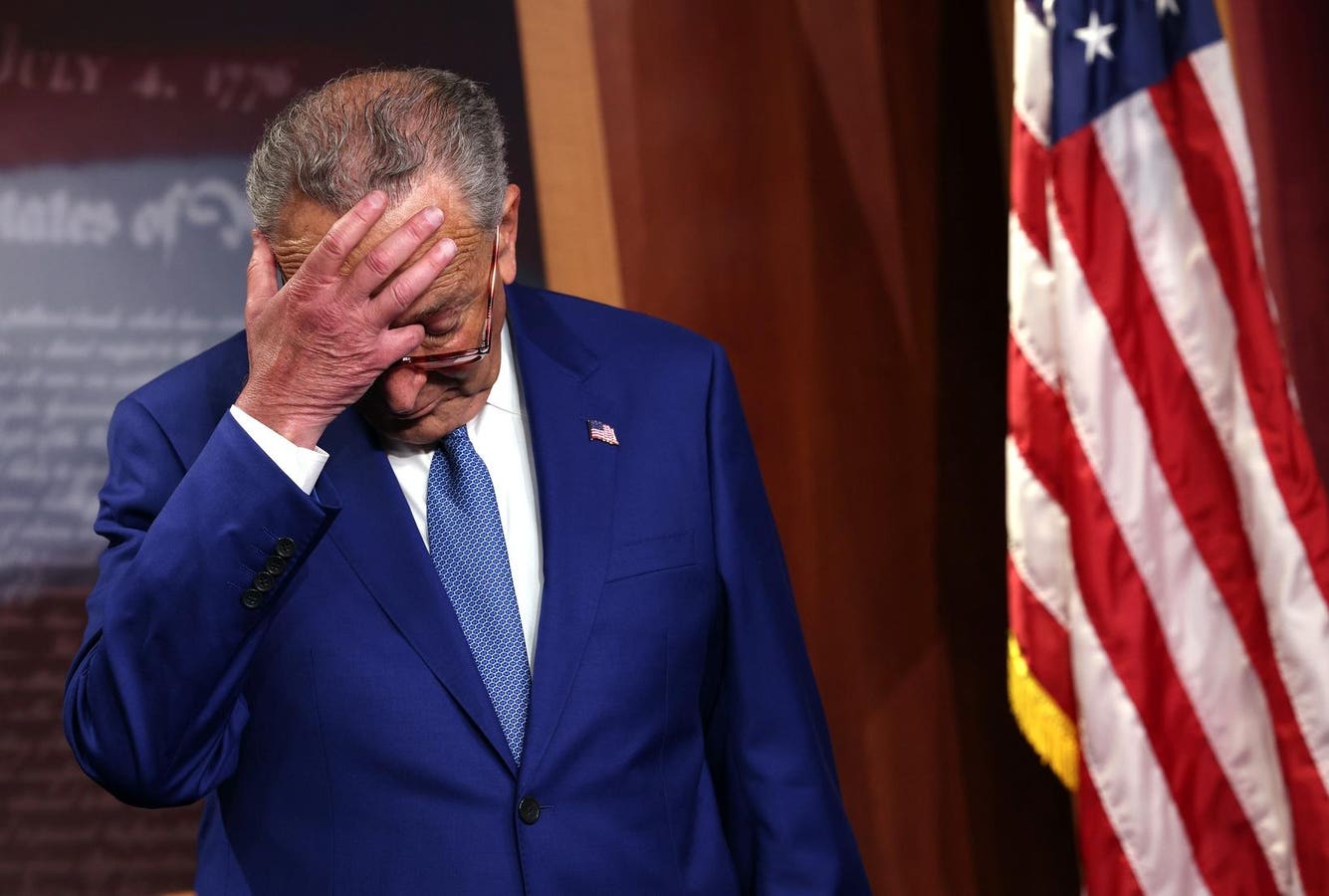

As the adage goes, to a hammer, everything looks like a nail. When it comes to Senate Majority Leader Chuck Schumer and other anti-energy forces in Washington, it seems any moves by energy producers, even perfectly sensible ones, are yet another sign of misbehavior crying out for government action.

In Schumer’s latest reckoning, significant mergers in the oil industry were the reason for penning a letter to the Federal Trade Commission, along with 22 Senate colleagues, asking regulators to launch antitrust probes. Pointing to October announcements that ExxonMobil

XOM

CVX

For starters, these mergers, while financially substantial, aren’t unusual. Exxon’s deal to acquire Pioneer will cost $60 billion, and Chevron’s acquisition of Hess has a price tag of $53 billion, figures certain to grab headlines. Still, this kind of merger and acquisition activity is exactly what we should expect, given the state of oil markets. Volatility in oil prices and the market forces that continue to drive them have caused consolidation in the past. In addition, rising interest rates have increased the cost of capital, making it more expensive for oil producers, who face massive capital outlays for exploration and development, to do business. These factors are only compounded by the antagonistic regulatory environment the Biden Administration has promoted since Day One, making it more difficult for anyone – not just larger companies – to explore and develop new resources.

Second, while Schumer and his cohorts bemoan these mergers as harbingers of market consolidation, hearkening back to monopoly days of old, these latest developments don’t come close to raising a red flag. Consider, for example, that Exxon’s merger with Pioneer will increase the company’s share of U.S. production to just 5 percent. Compare this to OPEC’s position, with its member countries controlling approximately 80 percent of the world’s proven oil reserves. Today, there are roughly 9,000 independent producers representing 83 percent of U.S. oil production, with Texas alone claiming more than 5,700 oil and gas producers in 2022.

Third, Schumer is dead wrong about how these mergers will impact consumers. By allowing these major producers to increase their presence in major U.S. shale plays, these deals create opportunities to bring significant new supplies to market. As The Wall Street Journal recently pointed out, President Biden demanded that oil and gas companies spend their record profits on increasing production. That’s what they’re doing.

He also misses the mark in claiming oil and gas exports would hurt consumers since U.S. crude oil exports work to lower oil prices and ease OPEC’s stranglehold on global markets. With the acquisition of Pioneer, Exxon’s Permian Basin production would more than double to 1.3 million barrels of oil, helping to lower prices and strengthen America’s energy security. The FTC knows this, which is why it characterized a 2004 GAO report claiming petroleum industry mergers raised gas prices, the very report cited by Schumer, as “fundamentally flawed,” and why the Commission has resisted taking up Biden’s call to investigate the oil industry for price gouging.

If Schumer is interested in the real problem, he should turn his attention to the state-owned energy companies in the Middle East, China, Russia, and South America that constitute real market monopolies. That’s because 16 of the top 19 oil companies in 2020 were state-owned, controlling over three-quarters of global crude oil reserves.

We should applaud developments, including the latest mergers, that bolster U.S. oil production, as they represent one more step away from dependence on OPEC and other foreign energy sources. Contrary to what Chuck Schumer says, these mergers are a win for consumers and a victory for American energy security.

Read the full article here