Investment Thesis

Voya Financial, Inc. (NYSE:VOYA) is set to outperform major competitors and warrants a buy rating due to three unique, competitive advantages within its industry. First, Voya’s diversification model postures the company for stable, long-term growth. Second, its strategic acquisitions have propelled the company and given it earnings momentum. Third, while Voya just increased its dividend, it maintains a low payout ratio, reserving cash for further acquisitions and additional long-term growth. Voya is undervalued considering these advantages and represents a buying opportunity.

Voya’s Diversification Edge

Voya is a U.S. diversified financial services company focusing on health, wealth, and investment services and products for its 14.7 million customers. With a market capitalization of $7.2 billion, the primary competitors for Voya considered for comparison are Equitable Holdings, Inc. (EQH), Jackson Financial Inc. (JXN), Corebridge Financial Inc. (CRBG), and NewtekOne, Inc. (NEWT). Voya Financial’s primary value proposition is customer-focused wealth management with the goal of being “America’s Retirement Company“.

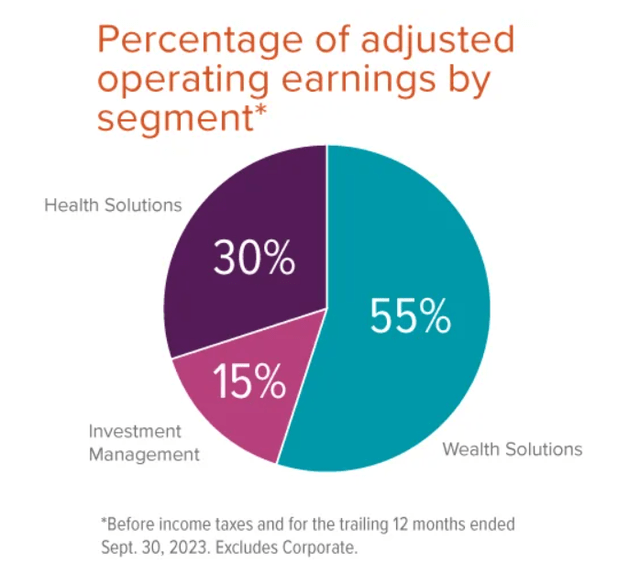

While Voya’s competitors are also in the diversified financial services industry and provide products in life insurance and investing, Voya also augments this business with a substantial focus on healthcare solutions. In simple terms, Voya’s healthcare solutions segment works to provide health savings accounts and flexible spending accounts for employees to manage healthcare costs. Voya’s earnings therefore come from three different market segments including wealth solutions (55%), investment management (15%), and health solutions (30%).

Voya’s Earnings by Market Segment (Voya)

As a result of these three segments, Voya has seen strong revenue which has played out in increasing share price over recent years. Compared to its four primary competitors, Voya has demonstrated solid YTD, 3Y, and 5Y price returns. Voya, according to its own website, is focused on generating high free cash flow, high return, and being light on capital. The qualities represent distinct strengths that will result in Voya continuing a trend of outperformance.

Voya Financial and Leading Competitor Price Return Comparison

|

Company |

YTD Return (%) |

3-Year Return (%) |

5-Year Return (%) |

|

Voya Financial, Inc. |

10.71 |

27.68 |

47.53 |

|

Equitable Holdings |

-6.82 |

10.22 |

21.69 |

|

Jackson |

14.76 |

26.36 |

26.36 |

|

Corebridge |

4.90 |

1.92 |

1.92 |

|

NewTekOne |

-11.63 |

-15.30 |

-24.50 |

|

Competitor Average |

0.30 |

5.80 |

6.37 |

Source: Seeking Alpha, 7 Nov 23

Beyond solid revenue, Voya’s diverse revenue streams from its three segments have also provided additional stability. This can be seen with its comparatively low beta value. Its inclusion of healthcare as approximately 30% of its business has bolstered its performance while offering reduced risk. Over the past five years, Voya has been able to achieve a higher return at lower volatility than major peer competitors. Given Voya’s focus on further expanding all three of its market segments, one can reasonably assume that this trend will continue. Therefore, Voya’s diversification model represents its first distinct advantage.

Volatility Comparison (24-month and 60-month Beta Values)

|

Company |

24M Beta |

60M Beta |

|

Voya Financial, Inc. |

0.93 |

1.13 |

|

Equitable Holdings |

1.19 |

1.41 |

|

Jackson Financial |

1.49 |

1.41 |

|

Corebridge Financial |

1.09 |

– |

|

NewtekOne |

1.06 |

1.43 |

|

Competitor Average |

1.21 |

1.42 |

Source: Seeking Alpha, 7 Nov 23

Voya’s Strategic Acquisitions are Paying Off

The second key advantage Voya maintains over its competition is its successful strategic acquisitions. In January ’23, Voya Financials acquired Benefitfocus, Inc., a benefits administration technology company, further bolstering its health solutions segment. The success of this acquisition has been seen throughout 2023 and highlighted in Voya’s Q3 results. In Voya’s Q3 earnings announcement, health solutions net revenues grew 35.8% YoY. Excluding Benefitfocus, net revenues grew only 17.7%.

In November ’21, Voya also acquired Czech Asset Management, a loan sourcing and investment management company with $5B of capital. Additionally, in August ’22, Voya acquired Tygh Capital Management, a specialist in small-cap growth funds. These acquisitions have positioned Voya for growth ahead of its industry competitors. Compared to its three largest competitors, Voya has demonstrated the highest YoY revenue growth and higher net profit margin compared to its peer average.

Key 2023 Financial Metrics for Voya Financial

|

Voya Financial Metrics |

Q1 ’23 |

Q2 ’23 |

Q3 ’23 |

|

Revenue |

$1.76B |

$1.87B |

$1.82B |

|

YoY Revenue Growth |

22% |

23% |

36% |

|

Net Income |

$83M |

$235M |

$246M |

|

Net profit margin |

4.7% |

12.5% |

13.5% |

Source: SEC.gov

While Voya is focused on long-term growth and making strides to ensure a quality customer experience, not all of its competitors have made successful acquisitions. For example, Equitable Holdings acquired CarVal, an alternative investment firm, for $750M in 2022. The acquisition was expected to boost EQH’s profits in the long run with 11.7% YoY revenue growth. Such growth failed to materialize for EQH with a YoY decline in all quarters reported this year. In contrast, Voya’s strategic acquisitions are an indicator of strong business leadership and a clear vision for the company.

Revenue, EBITDA, and EPS Growth Comparison

|

Voya Financial |

Equitable Holdings |

Jackson Financial |

Corebridge Financial |

NewtekOne |

|

|

YoY Revenue Growth |

22.51% |

-17.97% |

-56.64% |

-14.08% |

50.69% |

|

EBITDA Growth YoY |

78.79% |

-36.30% |

– |

-56.12% |

-48.28% |

|

EPS Growth (FWD) |

2.29% |

-1.94% |

-14.98% |

– |

-13.92% |

Source: Seeking Alpha, 7 Nov 23

Voya’s Focus on Growth vs. Dividend Yield

The final key advantage Voya holds over its competitors is its capacity for additional growth. While Voya’s dividend yield is a positive point for income seekers, Voya maintains a low yield compared to peers. This aligns with the company’s priority on continuing growth versus dividend payments.

Voya recently announced an increase of its dividend to $0.40 per share, up from $0.20 per share for the fourth quarter of 2023, bringing its current dividend yield to 2.28%. Voya has also shown 4 years of consistent dividend growth. Looking at the payout ratio, an indicator of dividend sustainability, Voya’s payout ratio is at or below its peer competitors. Therefore, Voya is postured to not only sustain a dividend yield but also maintain its focus on long-term growth.

Dividend and Debt-to-Equity Comparison

|

Voya Financial |

Equitable Holdings |

Jackson Financial |

Corebridge Financial |

NewtekOne |

|

|

Dividend Yield (FWD) |

2.32% |

3.31% |

6.28% |

4.49% |

4.74% |

|

Payout Ratio |

12.76% |

4.56% |

14.28% |

23.35% |

156.88% |

|

Consecutive Years of Growth |

4 |

4 |

1 |

0 |

0 |

|

Total Debt to Equity |

73.40% |

139.75% |

69.49% |

129.29% |

319.82% |

Source: Seeking Alpha, 7 Nov 23

In addition to a relatively low dividend yield, Voya’s total debt-to-equity indicates to me that the company is capable of additional acquisitions. The company’s strong YoY revenue growth in addition to an increasing net profit margin point to greater growth and increasing market share compared to its competitors. When looking at the trifecta of Voya’s diversified business segments, its successful acquisitions, and low but increasing dividend yield, Voya has a positive outlook for buyers.

Weighing Risk versus Reward

Despite stable growth, Voya Financials is not without risks. Throughout its history, the company has had several instances of regulatory violations. In 2020, Voya was fined $22.9 million by the Securities and Exchange Commission (SEC) for failing to disclose conflicts of interest and providing misleading information to clients between 2013 and 2018. Unfortunately, this was not the only instance of regulatory issues. In 2017, Voya agreed to an SEC settlement for $3.1 million in connection to its sales of mutual funds.

Regulatory issues aside, the potential upside for Voya is strong. The company’s strong YoY revenue and EPS growth combined with low dividend yield, indicate potential for additional acquisitions and investment. Voya’s augmentation of health solutions with traditional investment management has yielded lower volatility for the company compared to its peers. The acquisitions of Benefitfocus, Tygh Capital, and Czech Asset Management are already paying off. These strategic acquisitions are indicative of solid leadership with a focus on growth.

Valuation

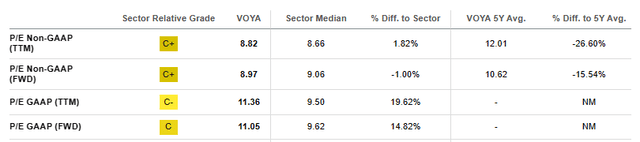

Voya holds a P/E GAAP (FWD) ratio of 11.05, compared to a sector median of 9.62. The four major competitors discussed earlier hold an average P/E GAAP (FWD) of 10.88. Voya is currently in the mid-range of its 52-week price and below its high price of $78.11 seen earlier this year. Voya’s current price is also slightly lower than when its Q3 earnings were released on November 2nd. While Voya represents a buy for me, I see the average price target of $82.86 presented by multiple firms as overly optimistic compared to its current price of $68.22. A price target of $82.86 represents a 21.5% upside for VOYA which is uncharacteristically high given its trend data over the past 5 years.

Voya Financials Valuation Metrics (Voya)

Given its Q3 earnings and three distinct advantages discussed, Voya surpassing its all-time high of $78.11 in 2024 is very reasonable, representing a 14.5% upside. While historic performance is never a guarantee of future returns, Voya has demonstrated a strong trend of upward momentum. This has been seen with its YTD, 3Y, and 5Y returns compared to peers.

Concluding Summary

Voya Financial is a buy for me given its potential to outpace competitors in coming years and therefore increase its market share. Voya’s diversification into multiple segments including wealth solutions, investment management, and health solutions has already proven high YoY revenue growth. Additionally, Voya has demonstrated a competitive net profit margin with low volatility compared to its peers. For income seekers, Voya has recently increased its dividend yield which is now higher than the yield of an S&P 500 index fund.

With a relatively low payout ratio and a 4-year history of increasing dividends, Voya demonstrates dividend sustainability and capacity for increased growth. The financial conglomerate is well-postured for long-term results given its focus on investment in its future. Voya is currently trading at 14.5% below its all-time high in early 2023. Voya’s earnings this year have demonstrated that the company has momentum for further growth. Given its solid performance as well as dividend yield, VOYA presents a buying opportunity for both income and capital appreciation.

Read the full article here