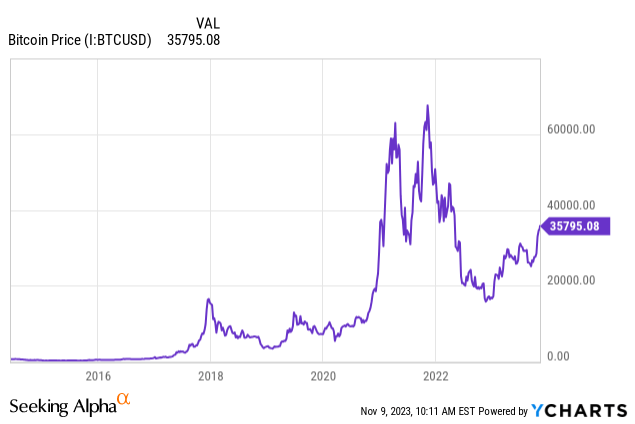

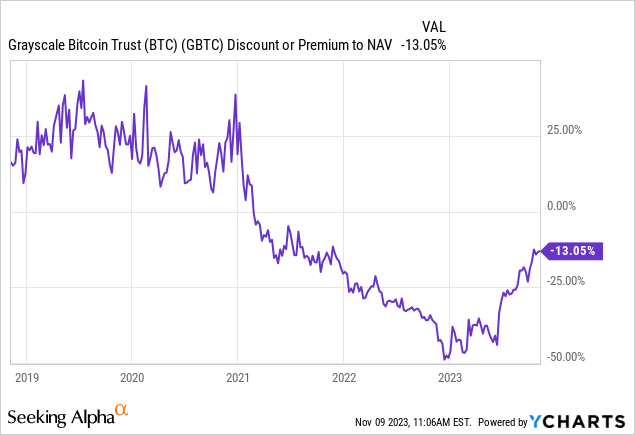

After a monster run over the past month, Bitcoin (BTC-USD) has quietly become one of the year’s top-performing assets. Key drivers for the crypto rally include continued uncertainty around global inflation, Bitcoin’s 2024 halving, and Grayscale Investments’ victory in appellate court over the SEC’s denial of a spot Bitcoin ETF. After tumbling in 2022, the buzz around Bitcoin is back. After 2024’s Bitcoin halving, annual inflation in BTC will drop from roughly 1.8% annually to under 0.9%, a mere fraction of the inflation currently being experienced in major fiat currencies. Additionally, traders looking to join Bitcoin’s run still have an interesting arbitrage opportunity in Grayscale’s Bitcoin Trust (OTC:GBTC). GBTC currently trades for a roughly 13% discount to Bitcoin. This discount is likely to be erased in the coming weeks or months when GBTC converts to an ETF–the SEC has indicated that they won’t try to appeal to overturn Grayscale’s legal victory, and the two entities are reportedly now working together on details to finish the ETF conversion.

What Will The 2024 Bitcoin Halving Mean For BTC?

Bitcoin is expected to undergo its long-awaiting “halving” in 2024. Halving is to Bitcoin what central bank monetary policy is to the dollar, except it’s pre-programmed. Sometime in 2024, the supply of new Bitcoin being added to the market will be cut in half. Past halving events have correlated with massive bull runs in BTC, as this piece by Morgan Stanley analysts notes.

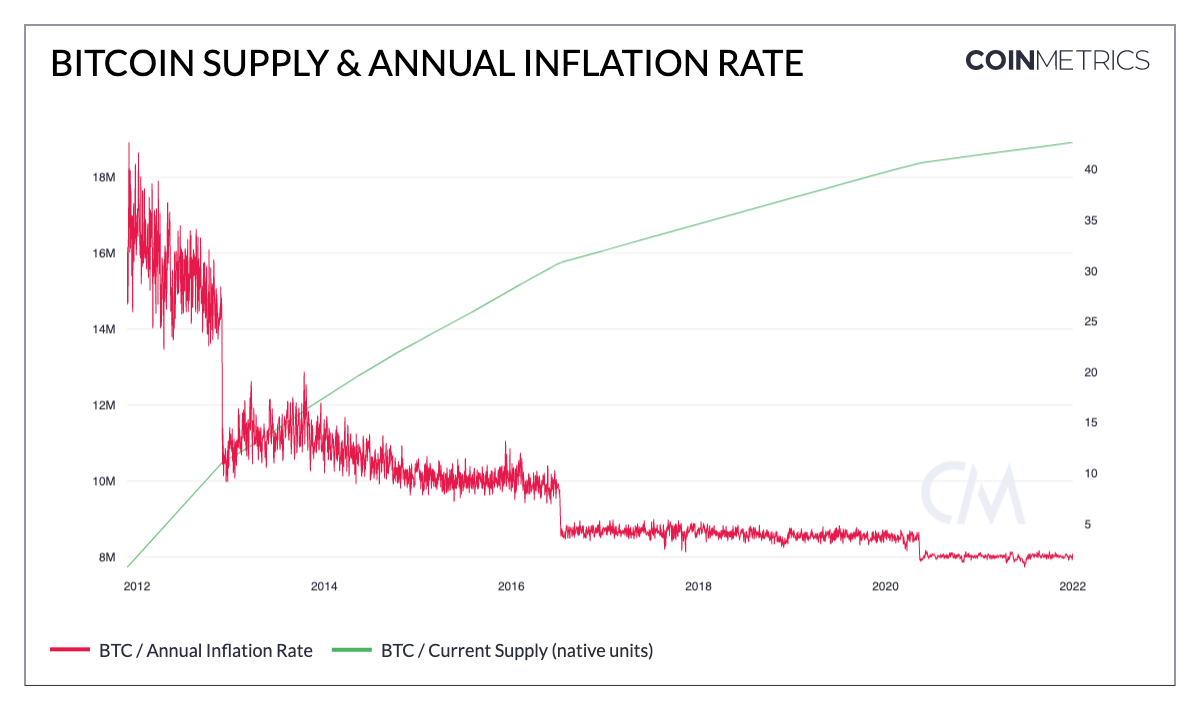

Below you can see how past halvings have taken effect and their impact on the supply of BTC. You should be able to spot the past halvings in 2012, 2016, and 2020. You can also see the decline in BTC’s inflation from 10% annually in early 2016 to its current rate of about 1.8%. In 2024, this will get cut in half again.

Bitcoin Halvings And Inflation (Finbold)

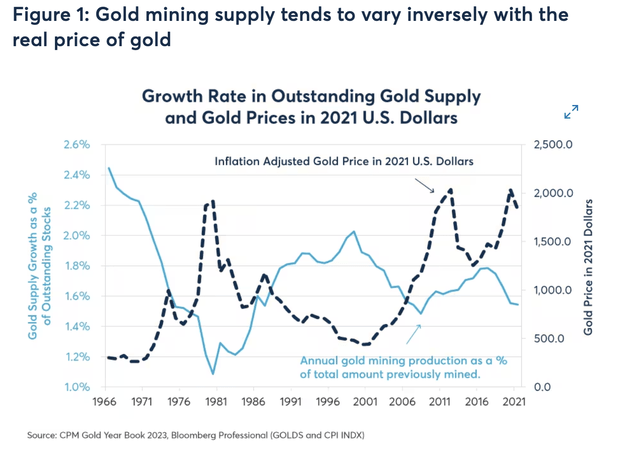

We know that there’s a correlation between big bull runs in BTC, but is it reasonable to expect 2024 to play out similarly? Historical evidence from the gold market says that this is a reasonable assumption. For thousands of years before paper currencies, gold was the world’s main store of value. But like paper money (and BTC), the supply of gold is not fixed. In fact, the supply of gold historically increases by around 1.5% to 2% annually due to mining. Because mining is difficult, this allowed a higher level of trust in the value of gold than would otherwise be possible. To this point, lower levels of gold production are correlated with higher prices for gold.

Gold Supply vs. Price (CME)

I’m fascinated by this graph. It shows a clear correlation between rises in the price of gold and lower mining, and vice versa. We see the same thing in BTC. In both markets, there is secondary supply, i.e. people can sell or recycle their gold or trade their BTC for dollars. However, the primary supply tends to have an outsized impact on the price.

Does this mean BTC will explode higher in 2024? No one knows for sure what the price of Bitcoin will do going forward. But if Bitcoin does push back towards $100,000, the halving will certainly be among the prime reasons cited as to why the move happened. And importantly, gold’s history during the 1970s shows that moves like these are not necessarily predicated on the economy or overall stock market performing well.

Arbitrage In BTC: GBTC Still Trades For A ~13% Discount to NAV

Bitcoin halving is likely to be the main event for cryptocurrency next year, but this year’s story is largely about the push for a spot Bitcoin ETF in the US. Grayscale Investments has the world’s oldest and largest Bitcoin fund, but it’s a closed-end fund, meaning new shares can’t be created and redeemed to force the value to correspond to the net asset value. This creation/redemption mechanism is very technical, but it’s the reason that ETFs trade very close to the value of their assets, while closed-end funds often do not. Initially, GBTC traded at a large premium, but over time, this structure caused Grayscale to trade for a discount to its net asset value.

I’ve been in this trade for a while, and it’s been an odyssey. The discount reached insane levels early this year as arbitrageurs panicked and dumped their positions. Grayscale’s first conversion attempts were denied by the SEC, leaving billions of dollars in crypto locked away in the ice. Grayscale appealed the decision and in August of this year, investors finally got the good news they’ve been waiting for. The conversion is still yet to happen which is why the discount still exists, but I believe it is now very, very likely to happen, for the following reasons.

- The SEC didn’t appeal.

- The two entities are now working together on the technical details of a spot ETF.

- Other big firms like BlackRock (BLK) and Fidelity have filed applications for Bitcoin ETFs as well. These firms aren’t doing this on a whim–they’re doing it to be the first ones in line for the Bitcoin ETF market.

13% is a pretty big discount for a conversion deal that looks like a formality at this point. In the end, it’s for the best, as spot ETFs will give ordinary investors an easy way to buy and sell crypto without having to worry about storage, security, fraud, or high fees. I thankfully avoided getting caught up in the BlockFi collapse by withdrawing my money before things got dicey, but friends of mine have lost tens of thousands of dollars in various crypto heists and scams. Would much of this have happened if people could have bought a BlackRock or Fidelity Bitcoin ETF? Probably not, and that’s likely a big part of the reason why the court felt that having a spot Bitcoin ETF would be a net positive for society.

In other news, remember the famous story of the guy who lost his password to hundreds of millions of dollars in Bitcoin? Some clever hackers in Seattle developed a way to crack the code. Apparently, he won’t let them recover his Bitcoin. Is this a case of existential angst, a contract dispute, or was he making it up all along? We may also find out about this one in the coming weeks.

Bottom Line

The crypto trade here is simple– you can buy GBTC for about 87 cents on the dollar and sell it for 100 when the conversion goes through. All signs are now saying that it will. Then, if another ETF comes along that has a cheaper annual fee, you can swap it out for that one. 2024 is shaping up to be a big year for Bitcoin with halving happening at some point in the year, so getting BTC now at a 13% discount looks appealing.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here