Gran Tierra Energy Inc. (NYSE:GTE) is delivering double digit production growth and 1P NAV10 of close to $22.45 per share. GTE trades at $6-7 per share. I believe that further investments in jurisdictions offering low cost of labor and low-cost structures as well as more ESG initiatives will most likely bring demand for the stock. I do see risks associated with the total amount of debt, country risks in Colombia or Ecuador, or lower production than expected. However, even considering these risks, GTE stock looks undervalued.

Gran Tierra Energy

Having almost all of its activities in Colombian territory and currently developing projects within Ecuador, Gran Tierra Energy is a company dedicated to oil and gas exploration with international distribution. The operations are covered in a single business segment that currently reports the activities only in Colombia, which represent 100% of the company’s income.

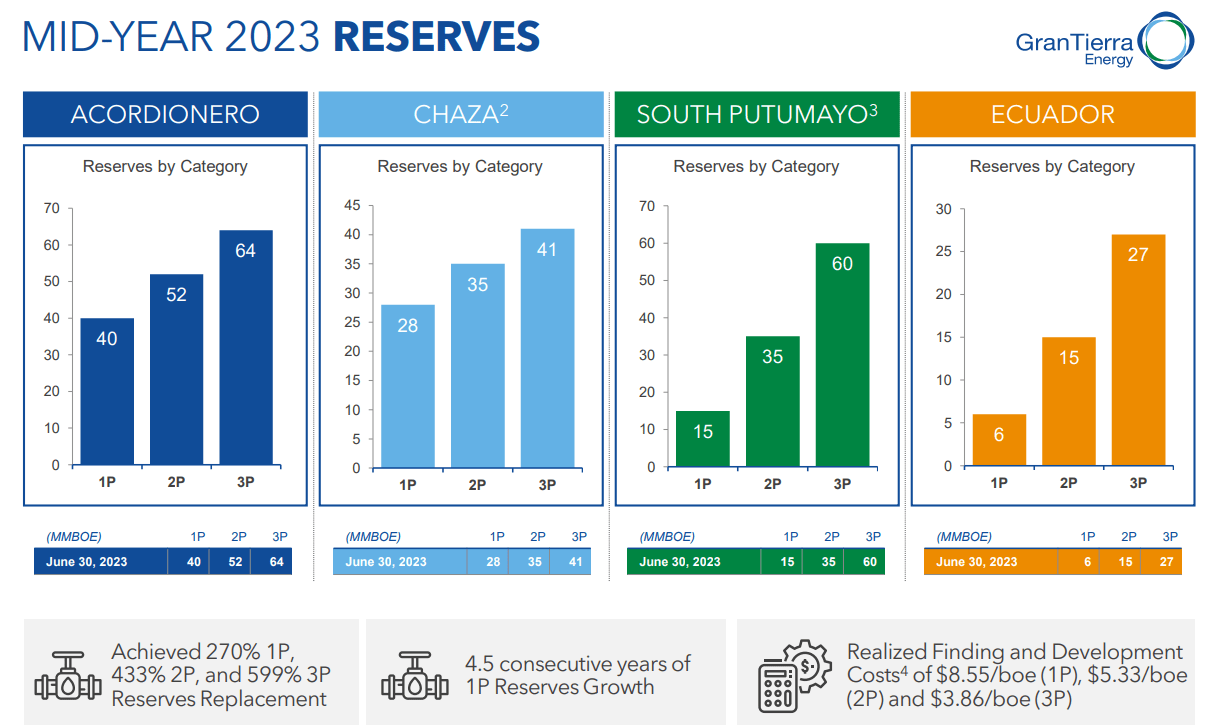

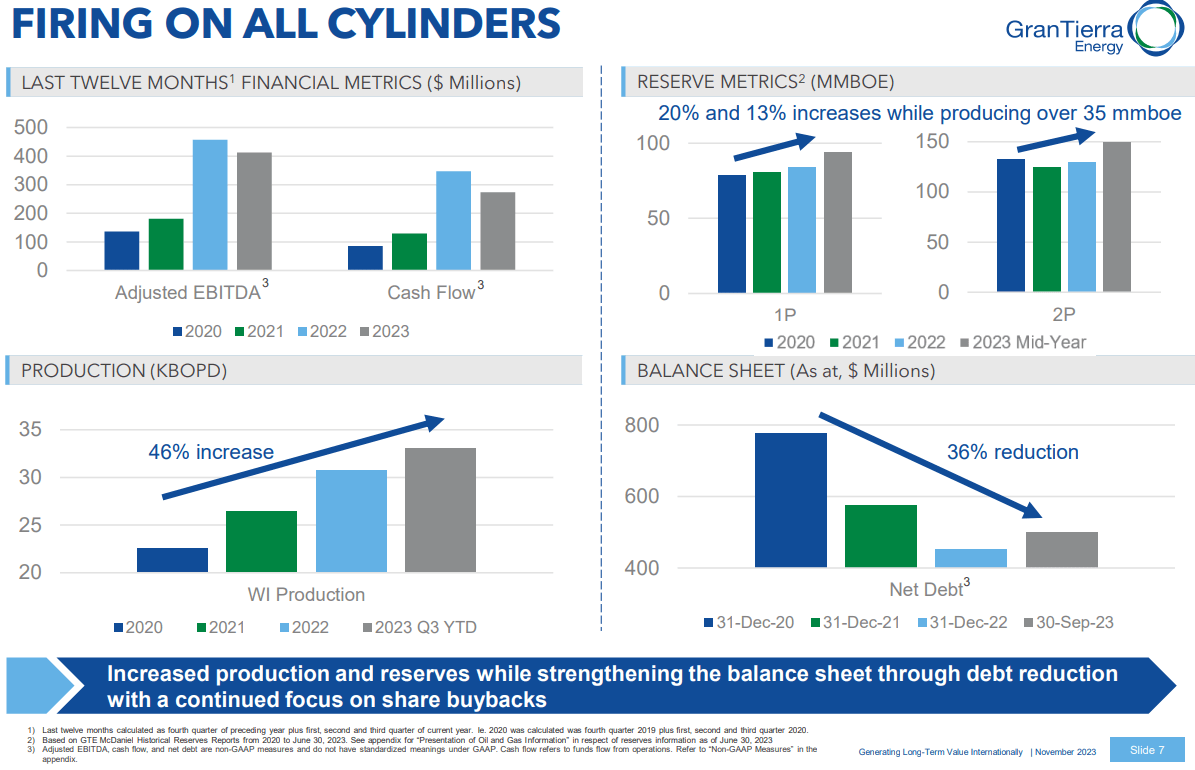

Among the most remarkable about the company, it is worth noting that Gran Tierra experienced 4.5 consecutive years of 1P reserve growth, significant 1P, 2P, and 3P reserve replacement. It appears quite clear that management is pushing its boundaries to bring significant reserve growth. Given the current valuation, I am not sure whether investors did study carefully what the company achieved recently.

Source: Corporate Presentation

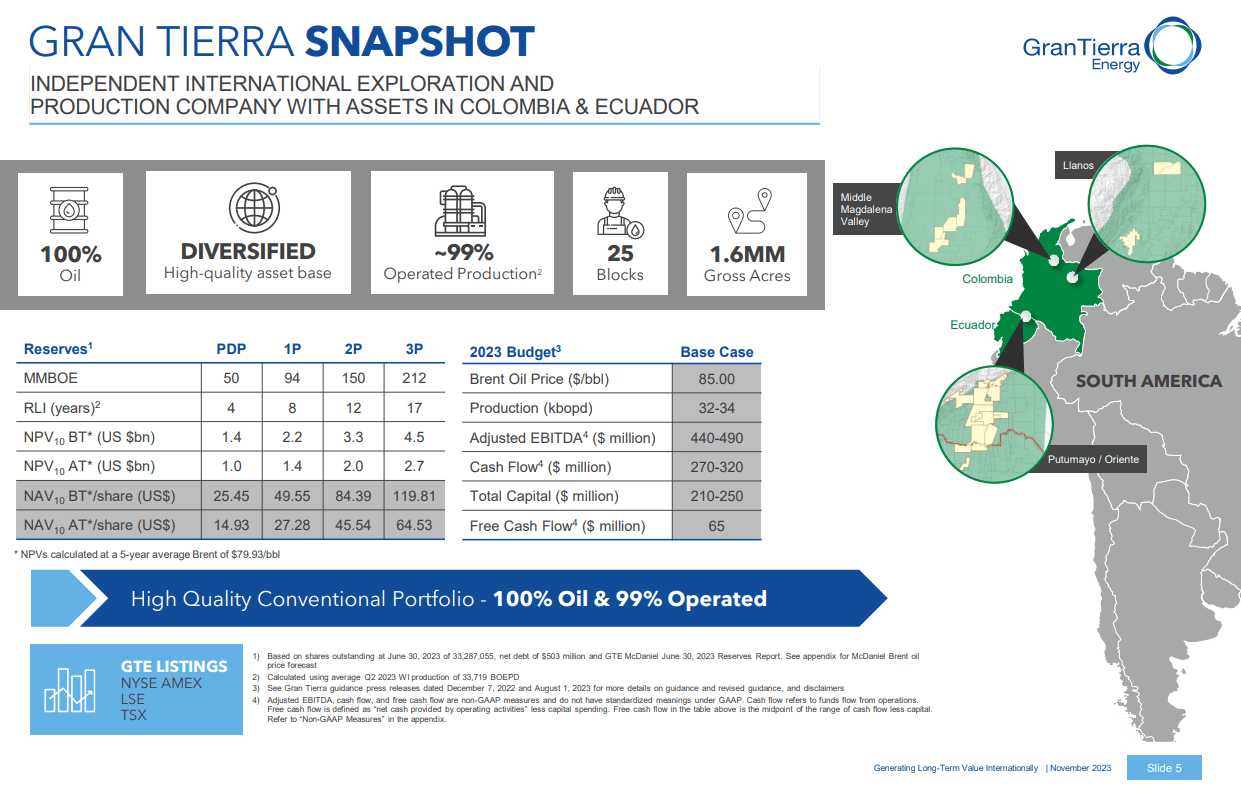

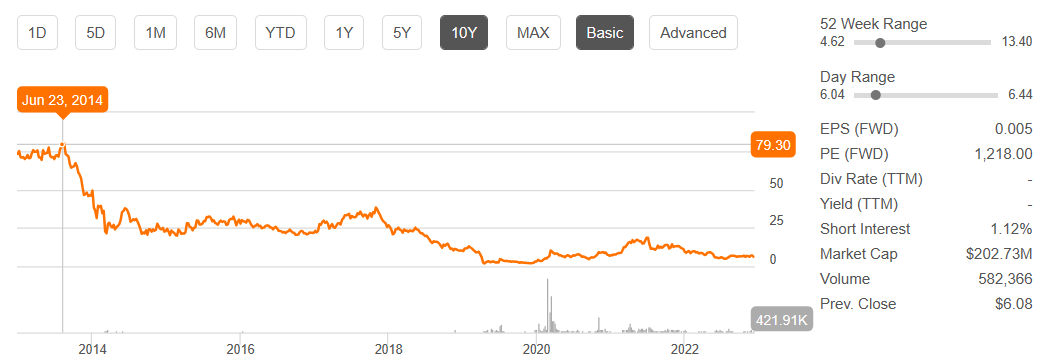

I believe that the undervaluation appears clear if we have a look at the 1P NAV10, which stands at close to $22.45 per share. In 2014, the company traded at more than $70 per share, and now trades at about $6 per share. Perhaps $70 per share was too much in 2014, but right now, I do not see whether $6 per share makes sense with a 1P NAV10 of $22.

Source: Corporate Presentation

Source: SA

The Balance Sheet Appears Healthy.

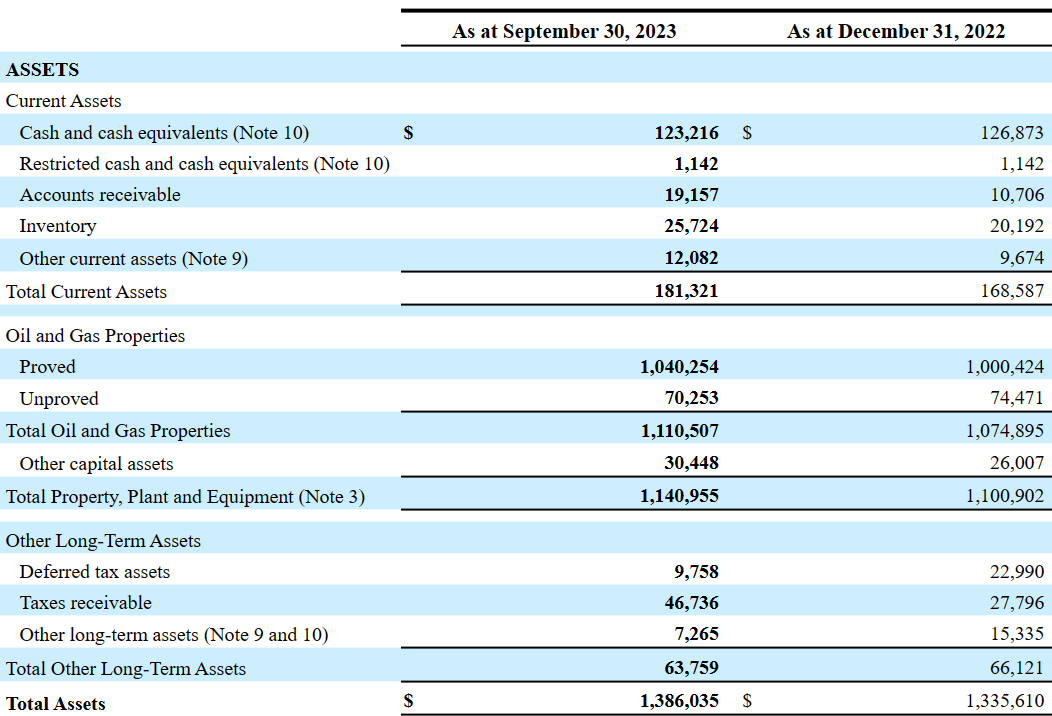

As of September 30, 2023, the company noted cash and cash equivalents of about $123 million, accounts receivable of about $19 million, and inventory worth $25 million. Total current assets stand at about $181 million, and the current ratio is lower than 1x, which most investors may not appreciate. Gran Tierra Energy reports some liquidity risks. Having said that, with total oil and gas properties of $1.110 billion, I believe that management may have some room to negotiate with banks for further credit agreements. Total property, plant, and equipment stands at close to $1.140 billion, and total other long-term assets are equal to $63 million. In sum, total assets stand at close to $1.38 billion.

Source: 10-Q

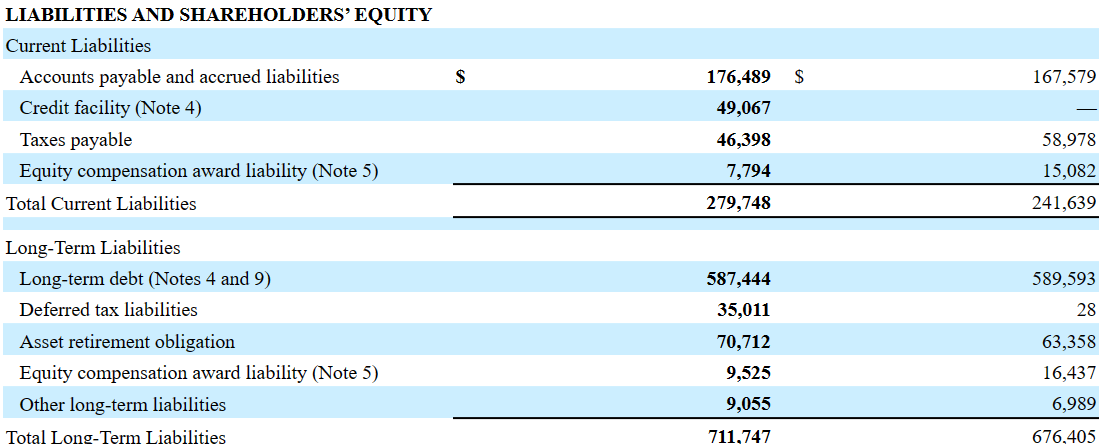

The list of liabilities includes accounts payable and accrued liabilities worth $176 million, a credit facility worth $49 million, and total current liabilities of close to $279 million. The total amount of long-term debt is equal to $587 million, which is not small.

Asset retirement obligations are equal to $70 million, with total long-term liabilities of about $711 million. The asset/liability ratio appears to be larger than 1x, so I would say that the balance sheet appears healthy.

Source: 10-Q

Debt Assessment

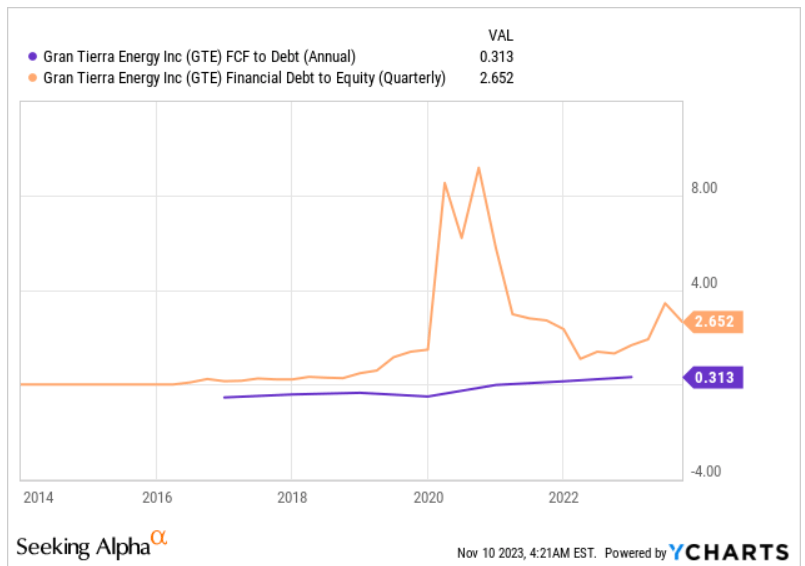

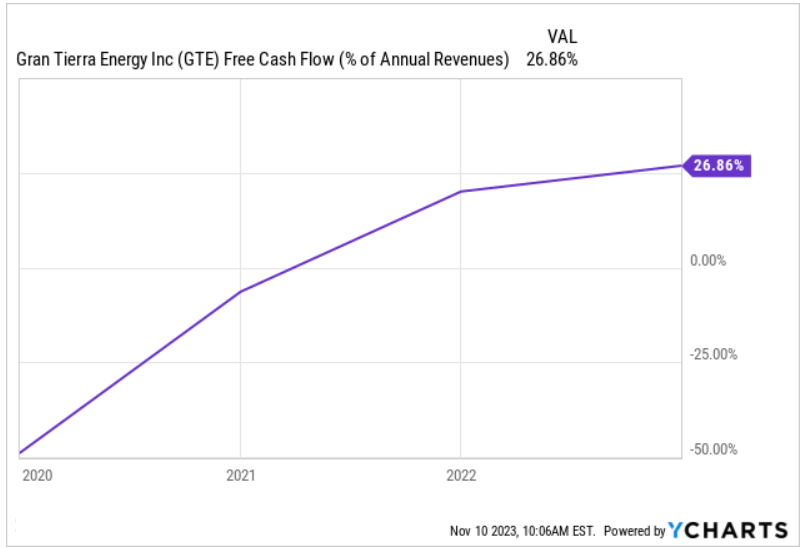

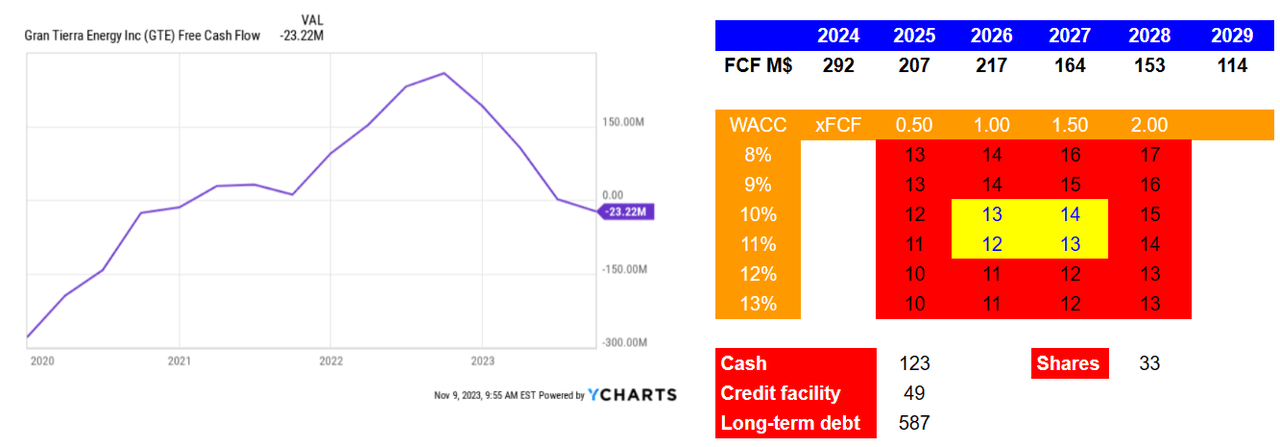

Gran Tierra Energy is a company for those investors who do not worry about holding investments with a significant amount of debt. The company reported financial debt/equity close to 2.6x and FCF/financial debt close to 0.3x. With that, I believe that the financial debt to equity decreased significantly as compared to that reported in 2020. In my opinion, further decrease in leverage will most likely bring demand for the stock.

Source: Ycharts

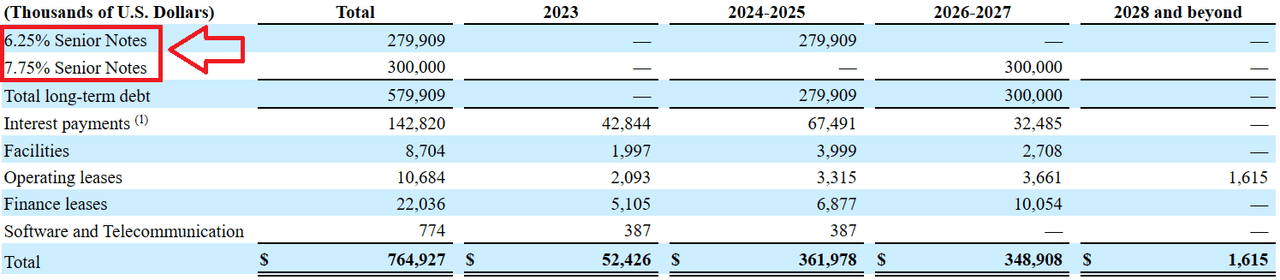

Among the contractual obligations reported by Gran Tierra, the company noted 6.25% senior notes and 7.75% senior notes. It means that the cost of capital would most likely be larger than 7%-8.1%. I used this assumption in my DCF model.

Source: 10-Q

Further Geographic Expansion, Development Of Existing Reserves, And Production Growth Will Most Likely Bring FCF Growth

In my view, further development of projects in basins not yet explored or underdeveloped with a view of generating a network of international activity in the future will most likely bring production and net sales growth.

The statistics in recent years have been positive, generating net income growth and being able to reinvest liquidity flows in the payment of debts. With this in mind and previous figures delivered about double digit production growth and cash flow growth, I believe that there is room for optimism.

Source: Corporate Presentation

Working In Jurisdictions With Lower Cost Of Labor And Low-cost Structure Will Most Likely Bring FCF Margin Growth

The company maintains a low-cost structure base, which is partly supported by the territories, where it maintains its activities, and the cost of labor along with the benefits of the exchange rate from the US dollar. I believe that further expansion in those jurisdictions will most likely bring FCF margin growth at a larger pace than companies working only in the United States.

Source: Ycharts

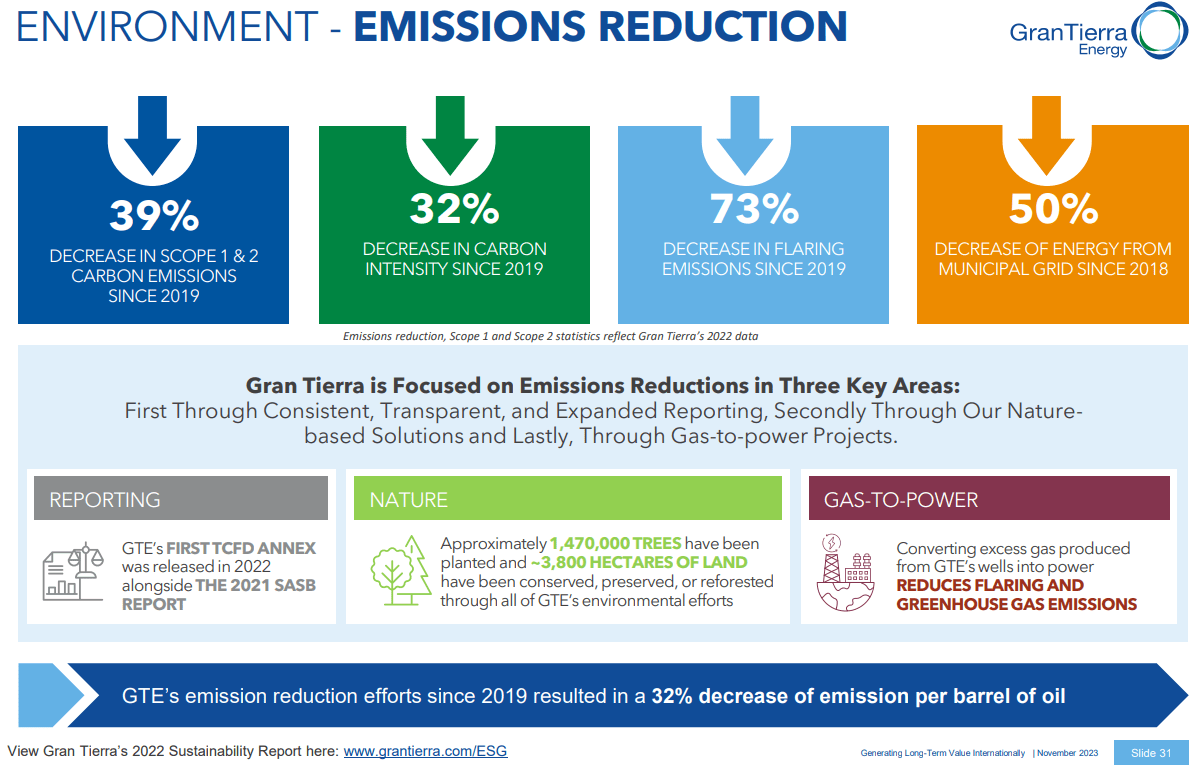

ESG Initiatives May Bring Further Interest From Investors Interested In Emissions Reduction

I think that the recent decrease in carbon emissions, carbon intensity, flaring emissions, and energy from municipal grid reported in a recent report may bring demand from investors.

Source: Corporate Presentation

Given the recent increase and expectations around ESG-focused institutional investment, I believe that the company is working in the right direction, and may receive stock demand.

ESG-focused institutional investment seen soaring 84% to US$33.9 trillion in 2026, making up 21.5% of assets under management: PwC report

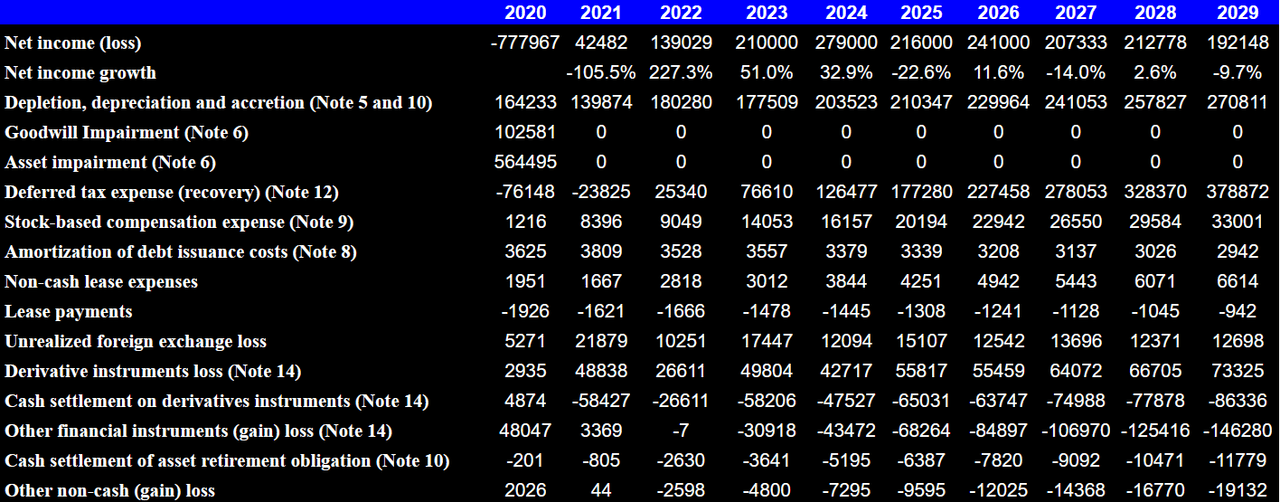

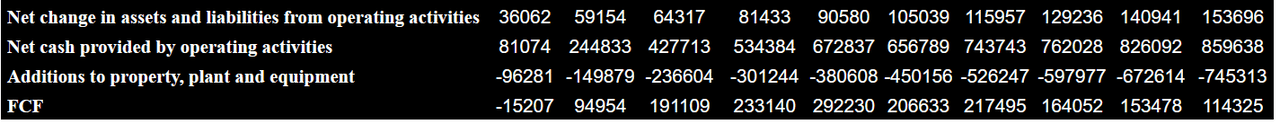

My Financial Model Is Based on Previous Assumptions

In my cash flow statement projections, I included 2029 net income of $192 million, with depletion, depreciation, and accretion of about $270 million, but no goodwill impairment or asset impairments.

Additionally, with 2029 stock-based compensation expense close to $33 million, amortization of debt issuance costs of about $2 million, and non-cash lease expenses of $6 million, I also included cash settlement on derivatives instruments of close to -$87 million.

Finally, taking into consideration other financial instruments of about -$147 million and cash settlement of asset retirement obligation of about -$12 million, net cash provided by operating activities would be about $859 million. With additions to property, plant, and equipment close to -$746 million, 2029 FCF would be about $114 million.

Source: My DCF Model

Source: My DCF Model

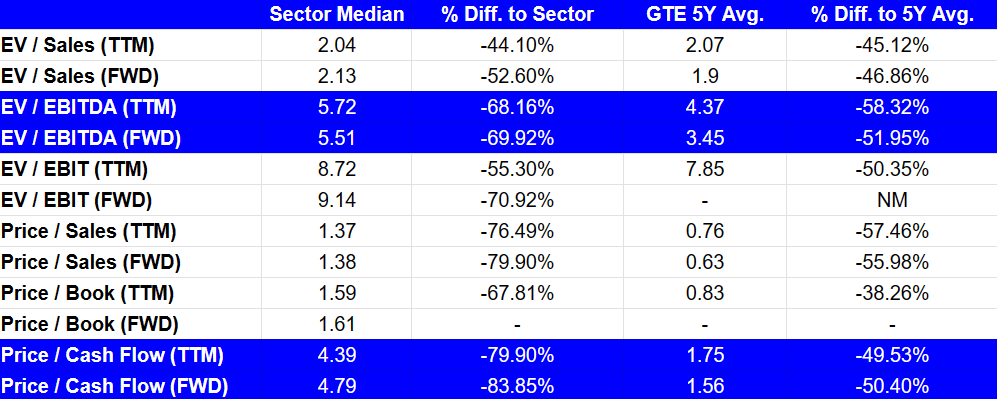

I had a look at the valuation multiples in the sector to assess the exit multiple. According to Seeking Alpha, the median EV/EBITDA TTM stands at close to 5.72x, the EV/EBITDA FWD is about 5.51x, and the price/cash flow TTM is 4.39x. Given the total amount of debt of Gran Tierra, I believe that assuming an EV/FCF of 0.5x-2x appears reasonable.

Source: SA

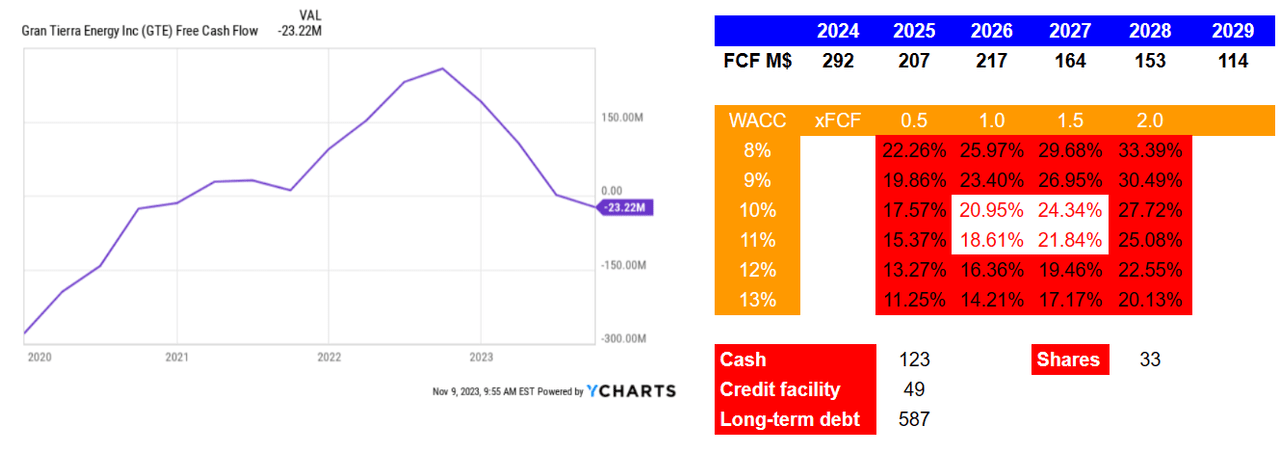

Taking the previous figures together, future FCF would range between $292 million and $114 million, and with a WACC of about 8% and 13%, the implied forecast price would be close to $10 and $17 per share, with a median forecast price of $12-$14 per share. Note that I assumed an exit multiple between 0.5x and 2x, which is quite conservative.

Source: My Financial Model

Now, assuming a DCF model of only five years, from 2024 to 2029, the internal rate of return would range from 11% to 33%, with a median close to 19%. With these numbers in mind, I do see some undervaluation.

Source: My Financial Model

Competitors

Competition in this industry is high, and is given by both national and multinational companies for access to reserves as well as hiring of equipment and professionally trained personnel to carry out extraction tasks. Specifically, in the case of Ecuador and Colombia, the competition is given by the national companies that have the greatest resources and capacity to access the reserve areas and of course the ease of establishing contact with the corresponding government entities regarding bidding and various procedures.

Risks

A risk is evident from the position of national companies in relation to the competition that exists in a series of risks associated with access to new projects, the acquisition of land, and above all the ability to adapt to sudden changes in legislation or the regulations imposed by states towards oil activity in general.

Along with this, the risks inherent to the oil industry are part of this analysis, especially taking into account that the prediction about the availability of reserves in the basins where Gran Tierra is developing its projects may not be accurate, and this logically would mean serious consequences for the short-term structural decision. In the same sense, there are risks due to the geographical concentration of activities in the event of any disruption or natural catastrophe that may occur in the area.

Clients are currently few, and are located in the regions near the basins as well as internationally. It is worth mentioning that from the activity of the Putumayo basin, the sale of production has been directed towards only two clients and from the Magdalena Valley Basin to a single client, always referring to the international scope. The contracts with these clients will expire in 2025, and are subject to renegotiations every 12 months. The company considers that the loss of one or more of its clients would not generate serious consequences, because the demand for oil is high, and they are easily replaceable.

Finally, it must be mentioned that any sanctions that the United States could impose on Colombia or Ecuador or any radical change in diplomatic statements represents potential risks that can directly affect the operations of this company.

Conclusion

Gran Tierra experienced 4.5 consecutive years of 1P reserve growth and double-digit production in the last three years, and offers a business model that invests in jurisdictions offering low cost of labor and low-cost structures. The company is also making significant efforts to lower carbon emissions, and may bring the attention of ESG-focused investors. Even taking into account risks from inaccurate reserve assessment, lower production than expected, country risks in Colombia or Ecuador, or debt-related risks, the company appears quite undervalued.

Read the full article here