We previously covered Realty Income (NYSE:O) in August 2023, discussing the massive pessimism embedded in its stock valuations and prices, worsened by the sustained share dilution to fund the aggressive acquisition plans.

The elevated interest rate environment and highly leveraged REIT business model had triggered its eye-watering interest expenses, resulting in impacted profitability.

While we have rated the stock as a speculative Buy then, it appears that the market pessimism surrounding REITs have yet to lift, with the O stock’s declining trend only lifted by the exemplary FQ3’23 earnings call.

We shall further discuss why we maintain our Buy rating.

The O Investment Thesis Remains Decent

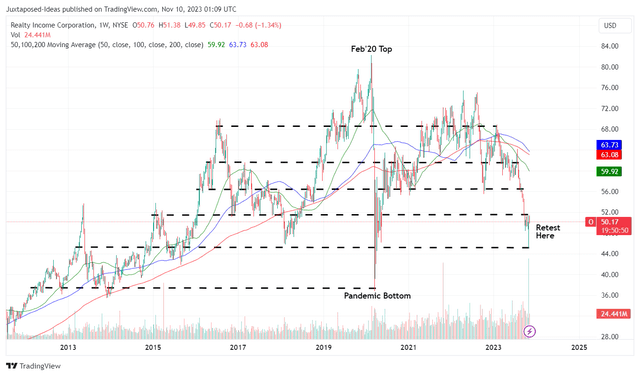

O 10Y Stock Price

Trading View

Investors may want to note that the O stock has further declined by -10.41% since our previous buy rating in August 2023 and -18.48% since our first buy rating in October 2022, with it currently trading sideways at $50s after bouncing off the $46s.

Even so, we believe that our previous buy rating still holds, given the REIT’s double beat FQ3’23 earnings call, with revenues of $1.04B (+1.9% QoQ/ +24.2% YoY) and FFO of $1.04 (+1.9% QoQ/ +6.1% YoY).

This is on top of the consistently raised FY2023 normalized FFO per share guidance range of $4.08-$4.15, compared to the original guidance range of $4.01-$4.13 in the FQ4’22 earnings call.

While some investors may have been concerned about O’s aggressive acquisitions thus far, with the latest being Spirit Realty Capital (SRC) at $9.3B, we are not overly concerned. This is because the deal is all-stock, with zero reliance on debt.

In addition, SRC is expected to be accretive by +2.5% to O’s annualized AFFO per share upon closing by Q1’24, while boosting the latter’s annualized contractual rental revenues by +18.4% from $3.8B to $4.5B.

While O will also take on SRC’s debts of $4.1B, we believe that the terms are still manageable, given the weighted average cost of 3.48%.

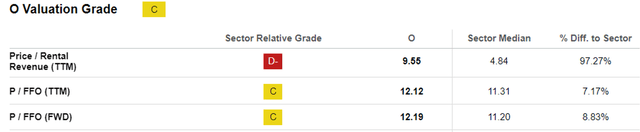

O Valuations

Seeking Alpha

As a result of these developments, we believe that the pessimism reflected in the O stock’s FWD valuations have been overly done, particularly in its FWD Price/ FFO valuation of 12.19x, compared to its 1Y mean of 14.58x and 3Y pre-pandemic mean of 19.23x, though still improved against the sector median of 11.20x.

Thanks to the raised guidance to $4.115 at the midpoint, we are still looking at a decent +1.3% YoY growth in its FY2023 FFO per share, compared to the previous guidance’s inline YoY performance from FY2022 levels of $4.06.

Combined with its discounted FWD Price/ FFO of 12.19x compared to the previous 14.00X, it appears that the O stock is also trading at its fair value of $50.16, only slightly moderated from our previous target of $55s.

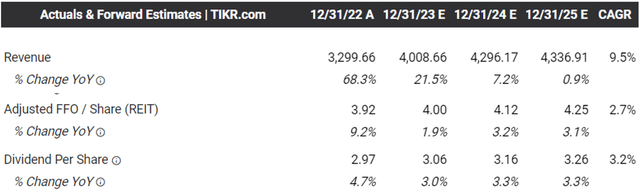

The Consensus Forward Estimates

Tikr Terminal

Perhaps, part of the pessimism is attributed to the underwhelming consensus forward estimates, with O expected to generate a decelerating top and bottom line CAGR of +9.5% and +2.7% through FY2025, compared to its historical CAGR of +20.9% and +5.3% between FY2016 and FY2022, respectively.

This is on top of the ongoing sell off observed in the REIT sector over the past few months, as Mr. Market increasingly worry about the elevated interest rate environment and the impact of rising interest expenses on their profitability and dividend payouts.

However, we believe that O’s dividend investment thesis remains decent, with an TTM Interest Coverage ratio of 2.43x and a 5Y Dividend Growth Rate of +3.69%, compared to the sector median of 1.77x and +0.33%, respectively.

Therefore, while its long-term debts of $19.22B (-1.8% QoQ/ +22.5% YoY) has burgeoned tremendously, compared to FY2019 levels of $7.67B (+17.6% YoY), we believe that the REIT is still able to consistently pay out its dividends moving forward.

Most importantly, even if there is any further rate hike ahead, we believe that there will be immaterial impact on the REIT’s annualized interest expenses of $736.48M (inline QoQ/ +56.8% YoY).

This is because most of its long-term debts are at fixed rate, with a weighted average interest rate of 3.7% by the latest quarter (+0.1 points QoQ/ +0.4 YoY).

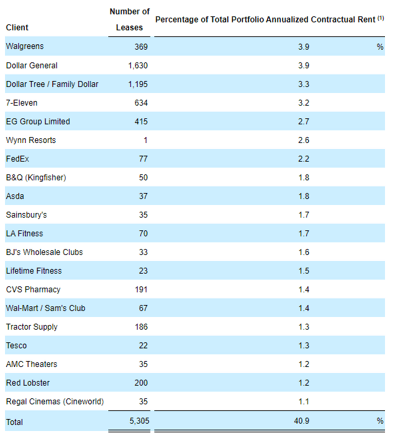

Realty Income’s 20 Largest Clients

Seeking Alpha

And most importantly, we believe that O’s rental collection remains safe, attributed to its well-diversified tenants, with the two largest clients, Walgreens (WBA) and Dollar General (DG), comprising only 7.8% of its portfolio by the latest quarter.

If anything, the REIT’s newer/ renewed leases continue to achieve 106.9% of rent recapture rates by the latest quarter and up to 104.3% YTD, higher than its historical average of 102.3%, implying that the market concerns surrounding decreased commercial property values may be untrue.

And it is for these reasons that we believe the O stock has been unjustifiably sold off, with the pessimism only attributed to the uncertain macroeconomic outlook, with the management still focused on strategic growth.

So, Is O Stock A Buy, Sell, Or Hold?

While there may be other traders tempted by the handsome returns from the US Treasury, currently yielding between 4.62% and 5.39%, we believe that the O stock’s forward dividend yields of 6% is still excellent. This is compared to its 4Y average yield of 4.49% and sector median of 5.30%.

While there has been some noise surrounding the stock’s consistent decline negating its dividend payouts, we believe that a reversal is bound to happen once market sentiments improve.

Will we maintain our Buy rating?

We will indeed, since the O stock is still suitable for income-oriented investors looking to buy and drip indefinitely, with the capital losses only realized if the stock is traded or sold.

Naturally, it goes without saying that the O stock is only suitable for investors with higher risk tolerance, whom are comfortable with volatility, since it remains to be seen when we may see bullish support materialize.

However, with the Fed already freezing its rate hikes, it is only a matter of time when a pivot may occur. For now, investors only need to hang on tight.

Read the full article here