A Quick Take On QMIS TBS Capital Group

QMIS TBS Capital Group Corp. (QMIX) has filed to raise $17.25 million in gross proceeds from the sale of its common stock in an IPO, according to an SEC F-1 registration statement.

The company provides a range of financial advisory, brokerage, research and investment services in Hong Kong and Malaysia.

QMIS TBS Capital Group Corp. has produced little revenue and is thinly capitalized in a highly competitive industry.

I’ll provide an update when we learn more IPO details from management.

QMIS TBS Capital Overview

Kuala Lumpur, Malaysia-based QMIS TBS Capital is a diversified services company engaged in offering various financial services, including:

-

Independent advisory and brokerage services

-

Venture capital

-

Investment research

-

Investment banking

-

Clean energy and biomedical devices.

The firm operates primarily through its wholly-owned specialized service subsidiaries.

QMIS is headed by Chief Executive Officer Dr. Yung Kong Chin, who previously served as the financial controller of the Kwok Group Company in China.

Dr. Chin will own a significant percentage of the company’s outstanding common stock upon completion of the offering.

Customer Acquisition

Payroll & Benefits expenses as a percentage of total revenue have risen as revenues have increased, as the figures below indicate:

|

Payroll & Benefits |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended June 30, 2023 |

2.4% |

|

2022 |

2.4% |

|

2021 |

1.4% |

(Source – SEC.)

The Payroll & Benefits efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Payroll & Benefits expense, rose to 15.3x in the most recent reporting period, as shown in the table below:

|

Payroll & Benefits |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended June 30, 2023 |

15.3 |

|

2022 |

-104.3 |

(Source – SEC.)

QMIS TBS Capital’s Market And Competition

QMIS operates in the broader investment banking and advisory industry, providing a range of services, including independent advisory and brokerage services, venture capital, investment research, and investment banking.

According to a 2019 market research report by Wise Guy Reports, investment banks across the globe are moving toward businesses requiring less regulatory capital due to regulatory changes that have made some investment banking activities more expensive than others.

As a result, large players have announced their plans to move from only traditional underwriting business to other activities, including mergers and acquisitions advisory as well as fundraising.

However, despite the regulatory change restricting the range of some banks and forcing them to specialize, others, such as Citibank and JPMorgan, have continued to offer a complete range of investment banking services.

Major competitors that provide or are developing investment banking globally include:

-

Barclays

-

JP Morgan

-

Goldman Sachs

-

Bank Of America

-

Morgan Stanley

-

Deutsche Bank.

QMIS’ Financial Performance

The company’s revenue for the six months ended June 30, 2023, was $1,145,339, compared to $726,037 for the same period in 2022.

QMIS reported a net loss of ($123,989) for the six months ended June 30, 2023, compared to a net loss of ($1,701,359) for the same period in 2022.

The firm’s recent financial results are shown below:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2023 |

$ 1,145,339 |

57.8% |

|

2022 |

$ 1,261,771 |

-71.2% |

|

2021 |

$ 4,387,915 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2023 |

$ 701,748 |

-266.1% |

|

2022 |

$ (342,242) |

-120.9% |

|

2021 |

$ 1,638,879 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2023 |

61.27% |

119.5% |

|

2022 |

-27.12% |

-172.6% |

|

2021 |

37.35% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended June 30, 2023 |

$ 807,343 |

70.5% |

|

2022 |

$ (1,995,710) |

-158.2% |

|

2021 |

$ 116,357 |

2.7% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

Net Margin |

|

Six Mos. Ended June 30, 2023 |

$ (91,660) |

-8.0% |

|

2022 |

$ (2,180,025) |

-172.8% |

|

2021 |

$ (40,080) |

-0.9% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended June 30, 2023 |

$ (165,675) |

|

|

2022 |

$ (1,707,595) |

|

|

2021 |

$ (76,794) |

|

|

(Glossary Of Terms.) |

(Source – SEC.)

The company had cash and cash equivalents of $120,605 as of June 30, 2023. Its total liabilities were approximately $2.0 million.

Net free cash flow for the twelve months ended June 30, 2023, was negative ($523,559).

QMIS’ IPO Details

QMIS intends to raise $17.25 million from the sale of its common stock, not including the sale of customary underwriter options, in a U.S. IPO.

No existing or potentially new shareholders have indicated an interest in purchasing shares at the IPO price.

The company will be considered a “foreign private issuer” and an “emerging growth company,” which will enable it to provide substantially less information to public shareholders.

Such companies have generally performed poorly post-IPO.

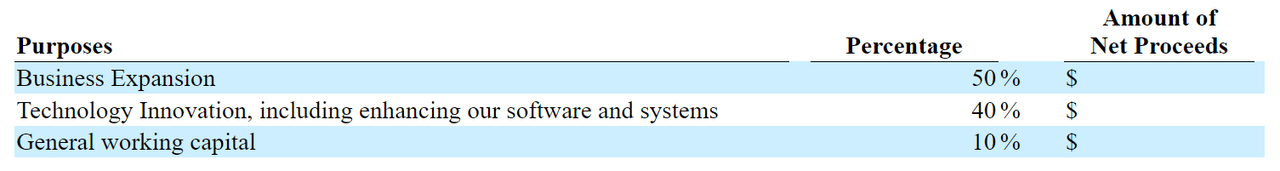

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

SEC

Management’s presentation of the company roadshow is not available.

As of the date of the prospectus referenced at the top of this report, management said there were no pending legal proceedings involving a director or officer of the company, nor was management aware of any threatened litigation.

The sole listed underwriter of the IPO is Pacific Century Securities.

Commentary About QMIS TBS

QMIX is seeking U.S. public capital market investment to fund its general growth and expansion plans.

The company’s financials have shown uneven revenue growth, reduced net loss, and lower cash used in operations.

Free cash flow for the twelve months ended June 30, 2023, was negative ($523,559).

Payroll & Benefits expenses as a percentage of total revenue have risen as revenue has fluctuated, and its Payroll & Benefits efficiency multiple rose to 15.2x in the most recent reporting period.

QMIS has never declared or paid any cash dividends on its capital stock and does not intend to pay any cash dividends in the foreseeable future.

The firm’s recent capital spending history indicates it has continued to spend on capital expenditures despite negative operating cash flow.

The market opportunity for providing a wide range of financial and advisory services in the Asia Pacific region is large and expected to grow in the coming years, although it features intense competition.

The company faces several risks, including a going concern question by its accounting firm, the potential for inappropriate business behavior of entrepreneurs raising funds via the company’s platforms, and the risks of operating in a heavily regulated industry, which can include unpredictable regulatory changes.

The firm’s revenue base is still tiny, and it is thinly capitalized.

I’ll provide an update when we learn more details about the IPO.

Expected IPO Pricing Date: To be announced

Read the full article here