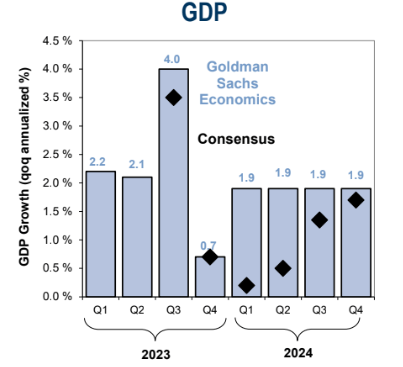

The 2023 US GDP growth rate will likely verify much better than what analysts had been expecting. Strong consumer spending was of course the primary culprit, and not even more than 500 basis points of tightening in the Fed Funds target rate by the FOMC could disrupt quarterly economic expansion.

Now, you would think that would be bullish for hard assets since better public and private demand should result in higher prices among many cyclical commodities like oil and copper. That thesis has not played out for the most part.

I reiterate my hold rating on the Invesco DB Commodity Index Tracking Fund (NYSEARCA:DBC). Price action has been lackluster and there is the expectation that global GDP growth will turn more sluggish in 2024, particularly over the first half of the year.

Weaker US GDP Growth Seen in Q4 2023, 1H24

Goldman Sachs

According to the issuer, DBC seeks to track changes in the DBIQ Optimum Yield Diversified Commodity Index Excess Return plus interest of the fund’s holdings. The rules-based index is composed of futures contracts on 14 of the most heavily traded and important physical commodities in the world. The Fund and the Index are rebalanced and reconstituted annually in November.

DBC is a sizable fund with more than $2 billion in assets under management and it features a high annual expense ratio of 0.85%. Price action momentum has been solid lately, earning the ETF a B+ ETF Grade by Seeking Alpha, while risk tends to be high. The fund does not pay a consistent dividend rate, but liquidity is often healthy with DBC – its 90-day average volume is more than 1.2 million shares while the 30-day median bid/ask spread is just four basis points, per Invesco.

As of November 9, 2023, DBC’s largest futures position is RBOB gasoline at close to 13%. WTI Crude Oil is the runner-up at 12.6% while Brent Crude and NY Harbor ULSD are closely behind. Aside from these key energy-related commodities, gold is nearly 8% of the ETF, and some agricultural soft commodities are also found in the fund’s top holdings. So, there is a decent amount of diversification, but investors should be aware that the energy component is usually a major factor in how DBC performs.

DBC Portfolio: High Weight In Energy Commodities

Invesco

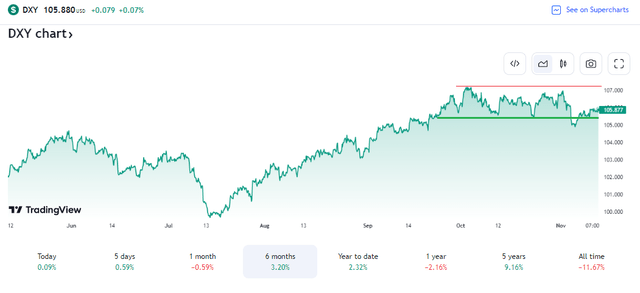

Also important for commodities is how the dollar performs. Normally, a stronger dollar results in lower prices for USD-denominated hard assets. That has not been the trend in the last two years, however.

We can go back to when Russia invaded Ukraine – the first half of 2022 featured the greenback and DBC price action moving generally in tandem. Moreover, commodities have also held up decently in the face of a rising dollar. Lately, following a steep Q3 advance in the US Dollar Index, commodities have basically traded sideways, with a slightly bearish bias amid volatile oil prices.

Dollar Wavering

TradingView

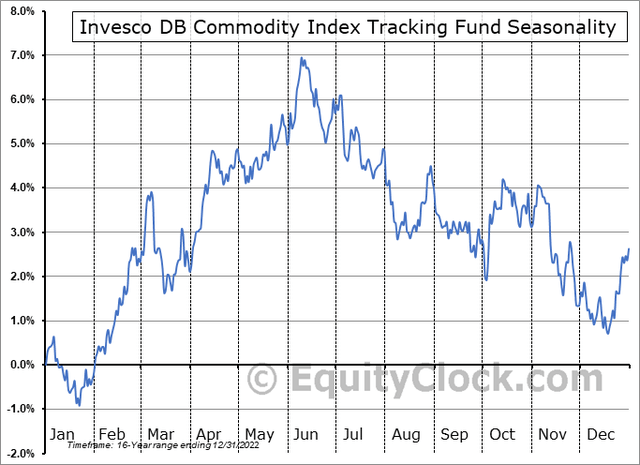

Seasonally, DBC tends to struggle leading into the holidays, with price bottoming, on average, in mid-December. That marks a favorable 6-week period to get long the fund, though, since rallies have historically transpired from late January through early June in DBC’s 16-year price history, according to data from Equity Clock.

Seasonal View: December-January Is the Time to Buy

Equity Clock

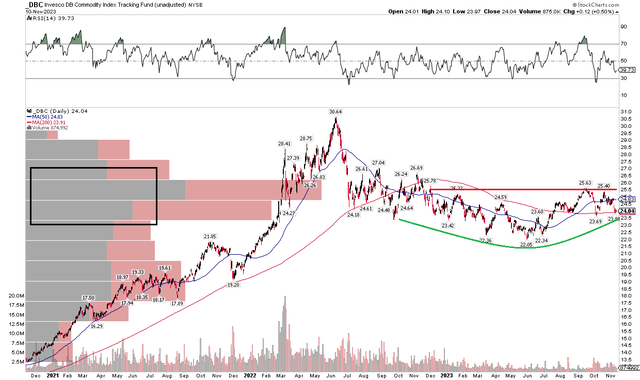

The Technical Take

DBC features some interesting indicators right now. Notice in the chart below that its long-term 200-day moving average, maybe the ultimate arbiter of trend, is flat in its slope today. The ETF has straddled that line over the last year-plus. Take a look at how the fund’s price dropped below the 200dma late last year and then found selling pressure at that mark on several occasions until August this year. More than three months ago, DBC rallied care of an uptick in energy commodity prices, and the fund held that trend indicator line three times in the last 90 days. For now, the burden is on the bears to take DBC under the 200dma.

Elsewhere, I see resistance at the September and October highs in the $25.40 to $25.63 range while $23.69 to $23.88 is near-term support. Bigger picture, a bullish rounded bottom pattern might be in play, as illustrated below. Finally, with a high amount of volume by price in the $24 to $27 zone, the current price area is a high-congestion range which could result in more choppy price action.

DBC: Bullish To Bearish Reversal Possible, Mid-$26s Resistance

Stockcharts.com

The Bottom Line

With a flat-lining dollar, ebbing GDP growth trends, and neutral technical action, I reiterate my hold rating on DBC.

Read the full article here