Chip Oversupply to Crash AMAT?

The chip sector is at risk of oversupply due to the high levels of inventories and chip regionalization trends. Chip regionalization refers to the trend of chip manufacturers producing chips in their own regions, rather than relying on global suppliers.

Some analysts have warned that these events could negatively affect the demand for semi equipment companies like AMAT, which provides tools for chip manufacturers. China’s largest foundry SMIC has also expressed concerns about the excess capacity caused by the supply regionalization trend that is going on in the industry. Lately we saw hedge fund manager Michael Burry betting against semis which is also a bearish sign.

We do not share these fears, and argue that the oversupply risk is mostly related to legacy chips. We think that Applied Materials (NASDAQ:AMAT) has low exposure to legacy chips and is focused instead on the advanced chip market which enables technologies such as AI, cloud computing, 5G, and automotive. Chips for these technologies are projected to grow at a faster rate than the traditional market.

Therefore, we see the current chip oversupply situation as a low-risk scenario for AMAT, and think that the company is well-prepared to cope with it. This article makes the case to support this view as we rate AMAT stock as a Buy.

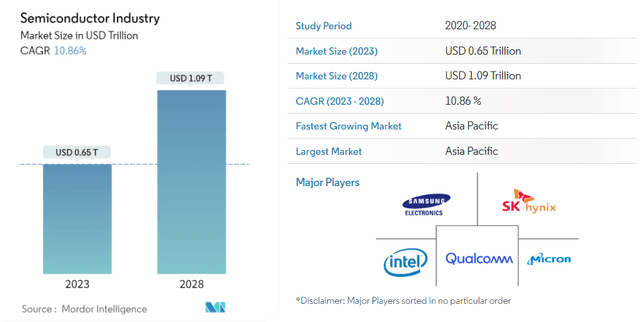

Semiconductor Industry will reach $1 Trillion

According to Mordor Intelligence, the global semiconductor market size is expected to grow from $650 billion in 2022 to $1.09 trillion by 2028, at a CAGR of 11%. This growth will be driven by the increasing demand for faster and more sophisticated semiconductors influenced by advanced technologies, such as AI, IoT, 5G, Robotics and autonomous vehicles.

Semiconductor Market Size (Mordor Intelligence)

Applied Materials is well-positioned to capitalize on this growth opportunity and has a broad portfolio of products and services to accelerate the supply of these next generation silicon fabrication technologies.

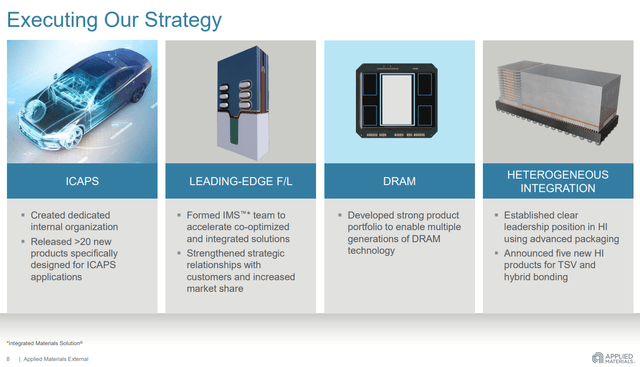

AMAT ICAPS: Focus on High-End Markets

AMAT is betting on the AI and IoT trends, to position itself in the high-end chip markets, which it calls the ICAPS (IoT, Communications, Auto, Power and Sensors). These market solutions require advanced silicon technologies and this is where AMAT is positioned. The company has established a dedicated organization and introduced more than 20 new products for the ICAPS market in the last few years. These markets have been delivering strong sales for AMAT and account for the biggest share of WFE sales in 2023 so far.

The company has also created a team that works on integrated products to accelerate solutions for front-end logic and memory. This has helped the company to design solutions that match the particular needs of its customers and led to strong strategic partnerships and highly unique products.

These initiatives are showing us that AMAT has a clear vision for the industry and is executing its future growth strategy.

AMAT Growth Strategy (AMAT Q3 Earnings Presentation)

AMAT Outperforming the Memory Market

AMAT, is also positioned to deliver strong results in the memory market, especially in high-performance DRAM. The DRAM market is undergoing a transformation in order to meet the increasing demands for AI and IoT solutions in terms of performance, power, and cost. One of the key drivers of this transformation is the smaller feature sizes and higher density on DRAM chips. To overcome these challenges, memory manufacturers need reliable and efficient equipment that can support both EUV-based and multi-patterning processes.

AMAT’s solutions enable multiple generations of high-bandwidth memory (HBM), which is a type of high-performance DRAM that offers higher bandwidth than conventional DDR5. These solutions have enabled AMAT to capture a large portion of the DRAM market share, both for EUV-based and multi-patterning processes. High-performance DRAM is a small fraction of the total DRAM capacity today, but it is expected to grow at a 26% CAGR over the coming years.

In summary, AMAT is outperforming the memory market with high-performance DRAM solutions. As demand for high-performance memory continues to grow, we believe that AMAT will continue to deliver strong results in its Semi Systems segment.

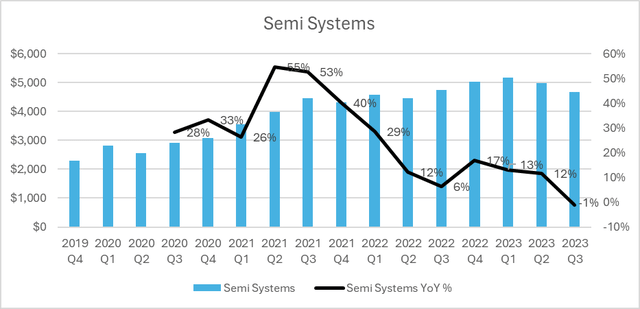

AMAT Segments Financial Performance

Semi Systems: This segment provides equipment, services and software for the fabrication of integrated circuits (ICs). It reported revenue of $4.67 billion (-1% YoY) and Non-GAAP operating margin of 34.8% (-1% YoY) in Q3 quarter. The Semi-Systems revenue growth has been decelerating the last few quarters (see below) We attribute this deceleration to the global semi market slowdown which is forecasted to last until the first half of 2024. However, AMAT is still outperforming the market by growing on a full year basis and company’s Q4 guidance for this segment is 2% YoY growth due to strong DRAM momentum. We think that AMAT is showing resiliency in this segment compared to its industry peers and gaining market share.

AMAT Semi Systems Revenue (Author)

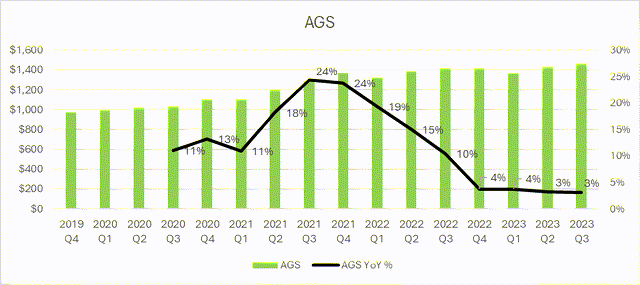

Applied Global Services: This segment provides services such as inspection, yield management, process control and software development. It reported Q3 revenue of $1.46 billion (+ 3% YoY), driven by demand for its services offerings which have 90% renewal rate. The segment’s revenue trajectory is showing a growth deceleration (see below) however 2024 outlook for this segment is positive. As technology becomes more complex, the demand for services offerings will rise we think.

We find it remarkable that AMAT has established such a big subscription based services business, which demonstrates AMAT’s leadership in the semiconductor industry.

AMAT AGS Revenue (Author)

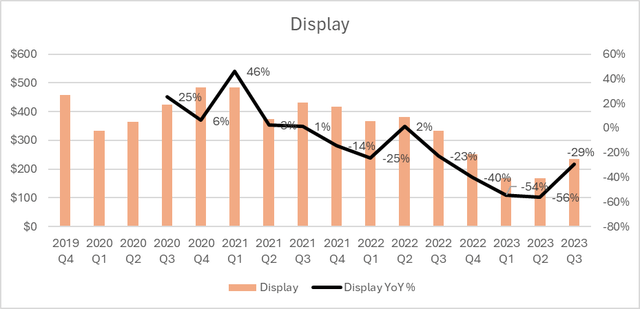

Display: This segment provides equipment, services and software for the fabrication of LCDs and OLEDs. It reported Q3 revenue of $235 million (-29% YoY) and, non-GAAP operating margin of 16% (-5% YoY). This segment is on a downward trajectory (see below) but the segment’s outlook for Q4 2023 is positive, as it expects to grow 23% YoY.

AMAT Display Revenue (Author)

Healthy Balance Sheet

AMAT has a strong and healthy balance sheet that supports its growth strategy and long-term vision. As of September 30, 2023, the company had $6 billion in cash and cash equivalents, $6.1 billion in total debt, and $30.4 billion in total assets. The company’s debt-to-equity ratio is 0.4, and current ratio is 2.32, which indicates very low financial risk. We think that the company’s balance sheet provides it with enough liquidity and financial strength to seek growth opportunities in the market.

Valuation

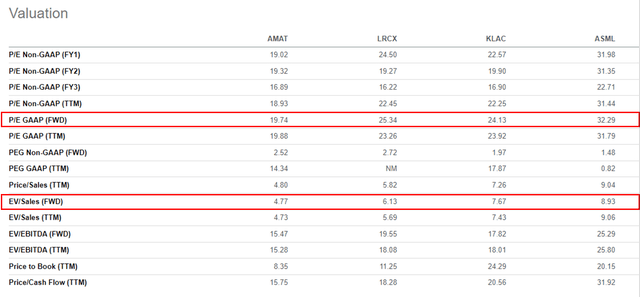

In terms of P/E and EV/Sales multiples, AMAT is valued below its peer group. Its P/E (FWD) and EV/Sales (FWD) ratios are quite low compared to ASML, LAM Research and KLA multiples, suggesting a high upside potential. We believe that AMAT should have a minimum P/E (FWD) multiple of 25x, based on its industry leadership and the growth opportunities that we see in its business. This valuation implies a substantial upside potential for Applied Materials, with a target price of $192.

Peer Valuation (Seeking Alpha)

Risks

- Semi Oversupply: The biggest threat that AMAT is facing is the ongoing global semiconductor slowdown due to weak demand and surplus of chips. The DRAM market, which is a key segment for AMAT, is particularly affected by the oversupply situation. AMAT’s stock price may underperform in the short term.

- China Trade Risks: 27% of AMAT’s revenue originates from China. Any new export restrictions or trade bans imposed on China could negatively affect AMAT business.

Upcoming Earnings

AMAT is scheduled to announce Q4 earnings on Thursday, November 16th, after market close. Analysts expect the firm to earn $1.99 on revenue of $6.5B (-3.7% Y/Y).

We expect the company to maintain its strong performance and beat earnings expectations, which reflects its successful growth strategy.

Conclusion

AMAT has strong leadership positions in the semi material and equipment industry. The company’s strategic vision and next generation products will help overcome the current industry challenges and outperform the market. Our business analysis and peer valuation suggest a significant upside potential for AMAT, making it an attractive investment option.

We recommend a Buy rating for AMAT with a price target of $192.

Read the full article here