Article Thesis

Alibaba Group Holding Limited (NYSE:BABA)(OTCPK:BABAF) reported its most recent quarterly earnings results on Thursday morning. The company beat profit estimates, and yet, the market’s reaction wasn’t positive, as BABA’s stock slid by 8%. The company also announced a dividend, albeit a small one.

What Happened?

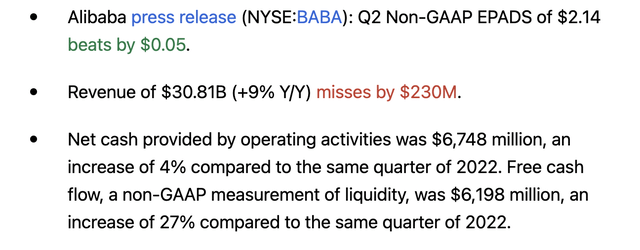

Alibaba Group Holding announced its earnings results for the fiscal second quarter on Thursday, prior to the market’s opening. The headline numbers can be seen in the following screenshot from Seeking Alpha:

Seeking Alpha

We see that the company beat profit estimates by around 2%, while the company missed the revenue consensus estimate by around 0.8%. That being said, the company nevertheless delivered appealing business growth, as revenues came in 9% higher compared to the previous year’s second quarter.

That is, for reference, a little less than Amazon’s (AMZN) revenue growth during the most recent quarter, as AMZN grew its top line by 13% year over year — although it is important to note that Amazon trades at a way higher valuation of more than 50x forward net profits.

Alibaba Group also noted its strong cash flows during the period. While operating cash flows rose by 4%, a reduction in BABA’s capital expenditures resulted in a hefty free cash flow increase of 27% compared to the previous year’s period, which is attractive in absolute terms, and which is even more attractive considering the bargain valuation of 9x forward net earnings BABA is trading at right now.

The market did not like these results as shares headed lower following the release of these results. Due to a positive profit surprise and strong cash flows, this is somewhat surprising, especially when we consider that macro pressures could be easing, as the meeting between President Biden and President Xi has gone well, which could result in the easing of tensions between the US and China.

BABA’s Results: Many Things To Like

Over the last couple of months, we have heard many things about the (presumed) slowdown in the Chinese economy. Troubles in the country’s real estate market had, according to many, a negative impact on consumer confidence and spending, as well as on overall economic growth.

In such a climate of sub-par economic growth, a 9% revenue growth rate is highly appealing, I believe. Alibaba is a very large company already, thus it is not easy for the company to grow at a high rate, and yet the company managed to grow its sales by almost 10% in a harsh macro environment.

Even better, however, was the company’s profit performance. While revenue growth is good, earnings growth — or, more precisely, earnings per share growth — is what ultimately decides about the value of the company’s shares. Alibaba has been focused on improving its profitability, and with its most recent quarterly earnings results, Alibaba has once again proven that it is highly capable of creating shareholder value by focusing on improving margins over time.

A 9% revenue growth rate was turned into an 18% EBITDA growth rate, as cost-cutting measures and a focus on the most profitable core business lines paid off handsomely. Even better, operating profit rose by 34% compared to the previous year’s quarter, which is a very strong growth rate. Even many US-based tech companies, oftentimes trading at gigantic premiums compared to Alibaba, are not growing this fast.

Alibaba Is A Bargain

EBITDA reached a level of $5.9 billion, or around $24 billion annualized, which is a pretty hefty number for a company that is trading with an enterprise value of just $170 billion, using YChart’s numbers and adjusting it for the 8% pre-market share price drop. With an enterprise value to EBITDA ratio of 7x, BABA is a pretty cheap stock — considering the strong business, earnings, and cash flow growth rate, that does not seem justified, I believe.

We can also look at other metrics to see whether those support an undervaluation thesis as well. Over the last four quarters, Alibaba has generated around $30 billion of free cash flow, while trading with a market capitalization of just above $200 billion (note: BABA’s market capitalization is higher than its enterprise value due to a net cash position on its balance sheet). This translates into a free cash flow multiple of around 7x, which, again, is pretty low. In other words, investors can buy BABA with a free cash flow yield of around 14%, with said free cash flow growing at a high pace during the most recent quarter.

Last but not least, BABA’s earnings multiple is pretty low as well, at less than 9x for the current year, and this does not yet account for the fact that BABA has outperformed expectations for the most recent quarter, which may indicate that current profit estimates for this year could be too low.

No matter how you slice it, Alibaba is a pretty inexpensive stock. Of course, bears will argue that there are good reasons for that, so let’s take a look at the arguments.

– Geopolitical worries and tensions between the US and China have been cited as a reason for BABA’s low valuation. It is true that there are tensions, but those seem to be easing — see the article on the Biden – Xi meeting linked above. It is in both countries’ best interest to let tensions ease further, as both countries want to see their economies grow.

– Some bears have argued that all of BABA’s cash flows are not creating any value for shareholders, with some arguing that Chinese companies could never pay out all of their cash to their shareholders. Alibaba has been buying back its own common stock for some time, and they have now declared a dividend for the current year: BABA will pay out $2.5 billion, or $1 per ADS, in a new strategic shift towards higher direct payouts to shareholders. While the dividend yield is not especially high, at around 1.2%, the increase in shareholder payouts suggests that BABA can indeed access its cash and that shareholders do benefit from the company’s strong cash generation. I thus believe that the bearish argument about the cash flows being of no value to investors has been invalidated. If BABA keeps buying back shares while possibly ramping up its dividend payments over time, shareholders would benefit considerably from the massive cash flows the company generates.

– Business interference and regulation in China has been cited as a risk by some bears. It is true that this is a risk, but Western tech companies face similar regulatory risks — this alone does not justify an extremely low valuation for BABA. I do believe that it is not in China’s best interest to hurt its tech champions, and China has not interfered a great deal in BABA’s operations in the recent past. While one can argue that this risk justifies somewhat of a discount for BABA’s shares relative to those of Western tech players, it is hard to argue that BABA at 9x forward net profits is fairly valued compared to AMZN at more than 50x net profits. Even if BABA’s shares were to double, the company would still trade at a massive discount compared to AMZN, after all.

Takeaway

I believe Alibaba Group is an attractive company. BABA offers exposure to both e-commerce and the digital economy and to China’s growing consumer market. The company delivered nice business growth and excellent profit and cash flow growth during the most recent quarter, and the valuation is very low.

With the company entering a new stage of shareholder returns via its first dividend announcement, investors can look forward to meaningful shareholder returns.

While BABA is not a risk-free investment, the risks seem more than accounted for at the current price, I believe — at just 7x free cash flows, BABA is priced for a disaster.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here