NovoCure Limited (NASDAQ:NVCR) is an oncology company that has pioneered a novel therapy for solid tumors known as Tumor Treating Fields (TTFields). Central to their business model is not just the provision of this innovative treatment, but also the comprehensive patient support services they offer. These services include training and technical support for Optune users, which begins from the moment a prescription is received. The company is also intensely focused on commercial growth, with a mission to extend the reach of the TTFields therapy to as many patients who can benefit from it as possible.

NovoCure has had a challenging year, down 84% on the back of growing losses and an unsuccessful clinical trial for ovarian cancer. Bears point out the downward revenue, profit, and cash flow trend as they sell positions and short the stock. To be fair, all of those trends exist.

NVCR Revenue and Profit Trend (Seeking Alpha)

However, I believe this is a much more compelling story. NovoCure’s declining revenue is a blip, and declining profitability and cash flow are from investment in the business. Excluding growth initiatives, NovoCure’s core business is a high-margin, high-cash-flow business that in my opinion is worth upwards of $24 a share based on DCF. I also feel that delivering any one of their growth initiatives would represent an upside beyond that price. Given the strong balance sheet and very healthy core business, I rate NovoCure a buy.

Core Business Is Very Healthy

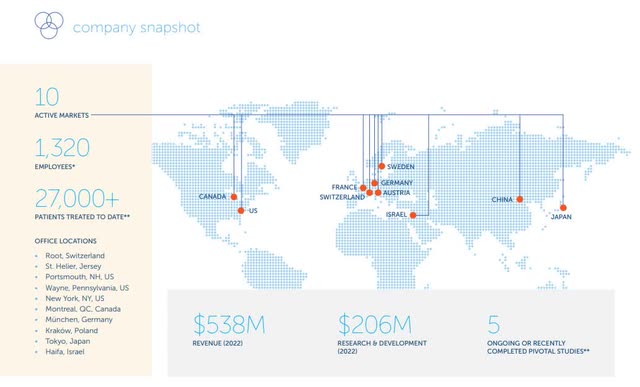

NovoCure has a healthy core business with proven therapeutic oncology products that have treated over 27,000 patients across the globe.

NovoCure Overview (NVCR Investor Relations)

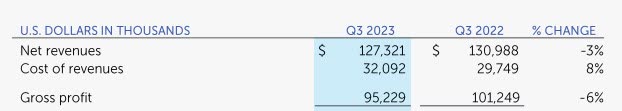

According to the Q3 earnings call, NovoCure had nearly 3,700 patients in active treatment at the end of Q3 2023. At the end of the same period, the therapeutic business was operating at a 75% gross margin.

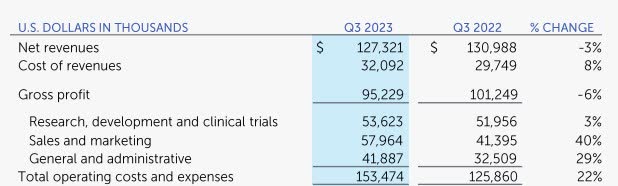

Q3 Gross Margin (NVCR Investor Relations)

Revenue did decline year-over-year, which has caused concern among investors. Management devoted significant time to this in the earnings call. The revenue decline is based on insurance claims recognition activity in the United States and largely reflects accounting noise. This activity is expected to stabilize by the end of the year and will not represent a comparable issue in 2024.

From an industry standpoint, there is room to grow. NovoCure’s technology is under patent for several more years, and packaging with the service business is a competitive advantage. According to a study from IQVIA, Oncology therapeutics is expected to be the fastest-growing therapy space at a 12% CAGR, compared to a 4% CAGR for overall therapies.

Pursuing Growth On Multiple Fronts

Beyond the core business, NovoCure is pursuing growth on two fronts: expanding markets served and expanding cancers treated.

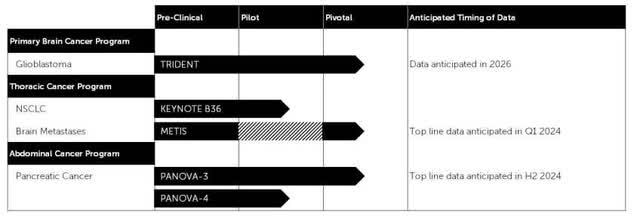

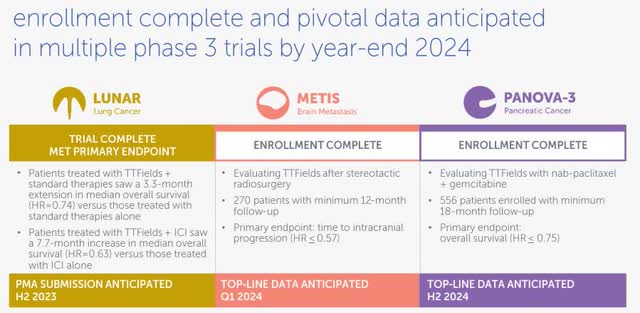

NovoCure has clinical trials in progress for brain cancer, thoracic cancer, and abdominal cancer. New data will begin coming in as soon as Q1 2024.

Clinical Trial Timeline (NVCR Investor Relations)

Results on the trials up to this point have been promising despite a recent flop in the ovarian cancer trials.

Clinical Trial Results (NVCR Investor Relations)

NovoCure is also pursuing growth into new markets, especially emerging markets in Asia. In 2023 NovoCure has been ramping up investments in marketing and S,G,&A to support new markets as well as additional therapies in existing markets.

Operating Expense Growth (NVCR Investor Relations)

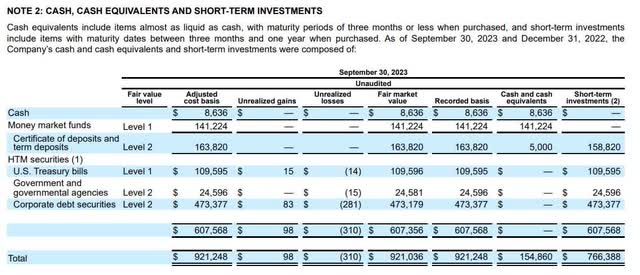

NovoCure is also in the fortunate position of having a strong balance sheet. They could run for 5 to 6 years at current cash burn and current R&D investment levels.

Cash Balance (NVCR Investor Relations)

Significant Upside From Core Business

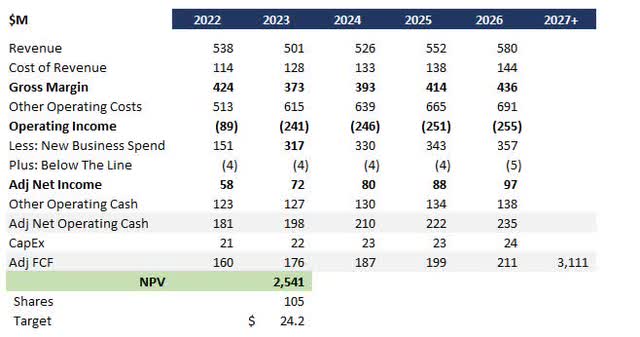

Thinking about the strength of the core business, I ran a DCF excluding investments in R&D and growth initiatives in Marketing and S,G,&A. If every clinical trial failed, this would represent the baseline business.

Revenue growth rate from 2023 to 2026 is 4% based on the forecasted CAGR for the overall therapeutic space. I dropped the terminal value growth rate to 3% as a conservative assumption. Expense growth rates follow revenue at 4% and 3% respectively, slightly ahead of historical CPI. I assume a 10% hurdle rate based on my estimate of a 7% WACC and a 3% risk premium due to volatility in biotech.

NVCR Adjusted DCF (Data: NVCR; Analysis: Mike Dion)

This analysis provides nearly a 100% upside from today’s price, at a price target of $24.

Wall Street analysts are similarly bullish on the stock with a price target of $28.83 or 126% upside from today’s price.

Wall Street Price Target (Seeking Alpha)

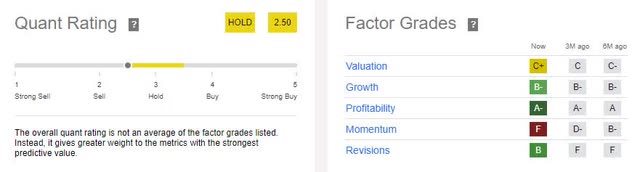

The quant rating is more mixed, largely driven by the downward momentum of the share price. Valuation is challenging as the company is unprofitable and spending down the cash balance. The few valuation ratios that calculate show undervaluation, notably EV/Sales of 2.06 is 40% below the sector.

NVCR Quant Rating (Seeking Alpha)

Downside Risk

Given the strength of the core business, there is limited risk from failed clinical trials. The risk from a failed clinical trial would be investor sentiment driving down the price temporarily, not changing the fundamental value.

In my opinion, the largest risk would be a competitor therapy coming onto the market that is A) cheaper or B) more effective. This would reduce pricing power and shrink margins. However, the company’s diverse pipeline and differentiated technology should provide some protection against this scenario.

Verdict

With healthy margins and stable revenue, I believe there is a strong upside for investors from the core business, even when excluding ambitious growth initiatives in R&D, Marketing, and S, G, &A. A conservative DCF projects an approximately 100% upside from today’s share price, with a target price of $24. Wall Street analysts further corroborate this, providing an even higher target price of $28.83.

While the company is currently unprofitable and drawing down its cash balance, the investments are going into near-term growth initiatives, and the strong balance sheet provides a runway. The company’s diversified pipeline and unique technology protect against potential challenges, such as introducing cheaper or more effective competitor therapies. Considering what I believe to substantial upside potential and mitigated risks, I rate this stock a buy

This article represents my personal opinion and does not constitute financial, legal, or tax advice. Please consult a licensed advisor prior to making investment decisions.

Read the full article here