2023 will not be remembered as an easy year for the banking sector, still struggling after the SVB bankruptcy and the Fed’s monetary policy. Even as the yield on loans increases, bank funding is becoming more and more expensive.

Since the beginning of the year, Preferred Bank (NASDAQ:PFBC) has lost 13.61%, which is not too bad when compared to peers. In any case, despite the slump and a balanced financial situation, I don’t think there is a basis for buy. The stock has already recovered much of the lost ground and it is probably too late to buy it today.

Asset analysis

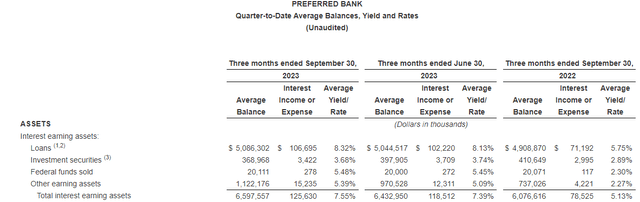

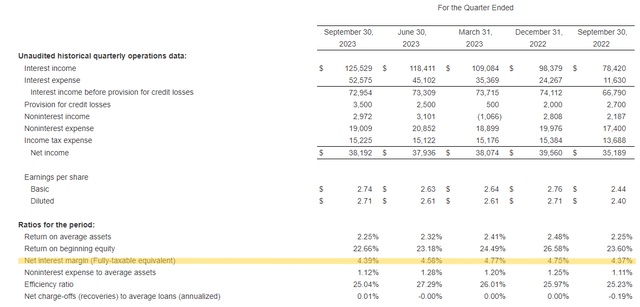

Preferred Bank Q3 2023

As already anticipated, loan yields have improved a lot: 257 basis points higher than last year and 19 basis points higher than the previous quarter. However, the amount of loans appears to be rather struggling in terms of growth, +0.82% over last quarter and +3.61% over last year.

These results were quite predictable since demand for credit has weakened a lot as interest rates have risen. Refinancing debt is no longer possible for all companies; after all, they would have to do so at a rate close to double digits.

Regarding the securities portfolio we are in a similar situation, the only difference is that the growth rate is negative. From quarter to quarter maturing securities have not been replaced and compared to last year the securities portfolio is worth $41.68 million less. This is a wise choice, adopted by many regional banks to reduce the unrealized losses experienced during the continuous increases in the Fed Funds Rate. To date, they total $39.10 million, $5.09 million more than in the previous quarter, and about 5.50% of equity.

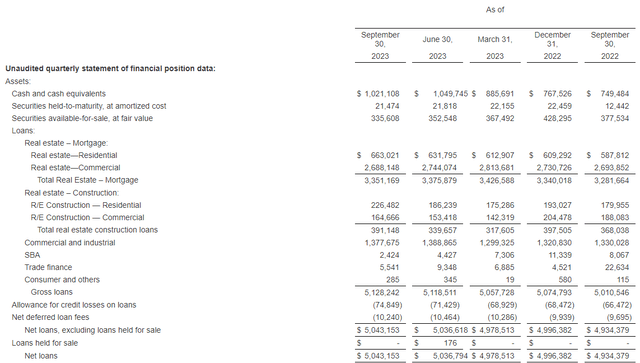

Preferred Bank Q3 2023

Turning back to the loan portfolio, it is visible that the main segment that is driving Preferred Bank’s growth is residential rather than commercial. Compared to last year, residential mortgages grew by 12.79%, while commercial mortgages remained almost flat. The same is true for real estate construction: the residential segment grew 25.85% while commercial declined 12.45%.

However, the bulk of this bank’s turnover depends on the commercial segment, so if the latter does not grow, the residential segment is unlikely to make up for it on its own.

Since interest rates are unlikely to be cut before mid-2024, declining demand combined with the rising cost of deposits will likely lead to lower EPS.

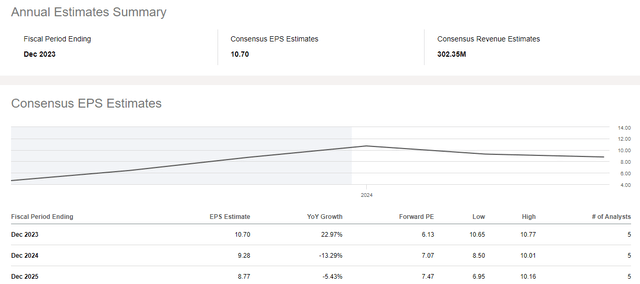

Seeking Alpha

Street Estimates forecast EPS growth in 2023 and will reach $10.70, but it may decrease in both 2024 and 2025: by 13.29% and 5.43%, respectively.

Deposits and net interest margin

According to management’s expectations, if the Fed keeps interest rates stable, it is likely that the cost of deposits will remain almost unchanged in the next quarter.

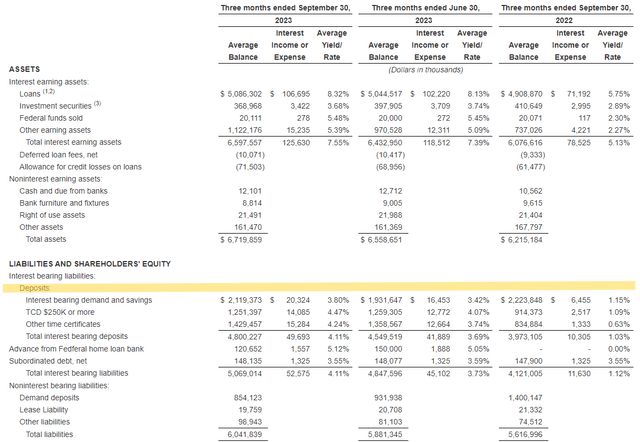

Preferred Bank Q3 2023

Be that as it may, their cost has already increased greatly, in fact over the course of one year total interest-bearing deposits have gone from providing an average yield of 1.03% to the current 4.11%. The total amount of deposits reached $5.65 billion, about 5.21% more than last year. Overall, although increasing in nominal terms, the quality of deposits has deteriorated, in fact, demand deposits today are only 15% of total deposits, last year they were 26%.

All this has obviously had a negative impact on the net interest margin, but it still remains quite high: 4.39% against the average of peers standing still at 3.26%.

Preferred Bank Q3 2023

Compared to last year it represents an improvement of 2 basis points, but compared to previous quarters it is a slight step backward.

Based on Preferred Bank estimates, the net interest margin is expected to decline in the coming quarters:

- In Q4 2023 it should lie between 4.15% and 4.25%.

- In Q1 2024 it should lie between 3.90% and 4%.

Even considering the lower limits, Preferred Bank would still have a higher net interest margin than its peers. Moreover, its profitability remains well above average:

- The net income margin (TTM) is 53.85%, the sector median is only 25.31%.

- ROE (TTM) is 24.39%, sector median is only 11.66%.

Shareholder remuneration

One of the most important aspects related to Preferred Bank is the remuneration of its shareholders, in fact it tends to purchase a lot of its own shares and issue a sustainable and growing dividend.

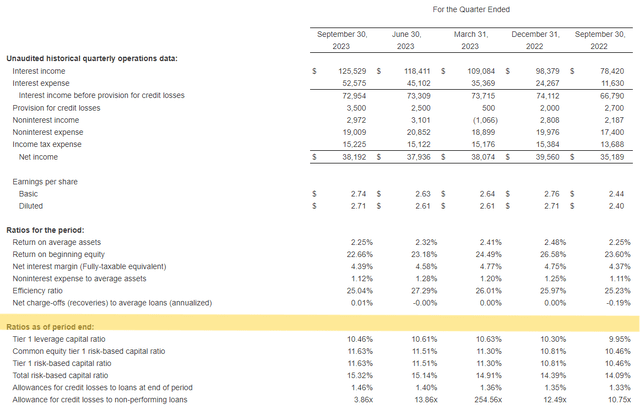

Starting with the buyback, in December 2018 there were 15.10 million shares outstanding, but today there are 13.60 million, about 10% less. This is a significant buyback since we are talking about a bank, but largely sustainable since it is well capitalized as the capital ratios show.

Preferred Bank Q3 2023

However, there is one more aspect I would like to point out, which is the correct timing of the buyback. In fact, management bought back many of its own shares after mid-2023, which is when Preferred Bank’s price per share was declining due to distrust of the banking industry. Since that time 720,000 shares have been purchased at an average price of $58.33, for a total amount of $42 million. According to management’s reference, the buyback did not stop there. After all, there is no shortage of liquidity since it accounts for 15% of total assets, and the CET1 risk-based capital ratio is quite high at 11.63%.

Turning to dividends, the current dividend yield is 3.36%, slightly lower than the sector median of 3.73%. In any case, it is justified by the fact that its sustainability is higher since the payout ratio is only 20.68% while the sector median is 35.95%.

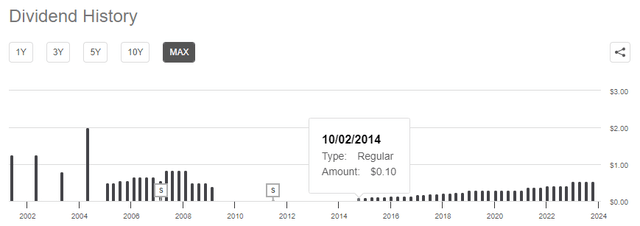

Seeking Alpha

Taking a look at history, it is relatively recent that Preferred Bank has been issuing a steady and increasing dividend; in fact, before 2014 there had been quite a few problems. The 2008 crisis had cut the dividend completely, but even before that there were early difficulties.

Since late 2014, a balance seems to have been found, and the dividend growth rate is quite encouraging.

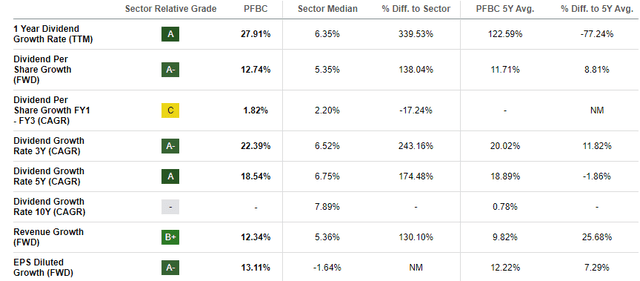

Seeking Alpha

The 5Y dividend growth rate (CAGR) is 18.54%, significantly higher than the industry median of 6.75%. Assuming the same for the next 5 years, buying this bank now, the dividend yield on cost in 2028 would be about 8%. Definitely a good yield, but I doubt that over the next 5 years, the growth can be similar, after all, the macroeconomic environment has changed dramatically.

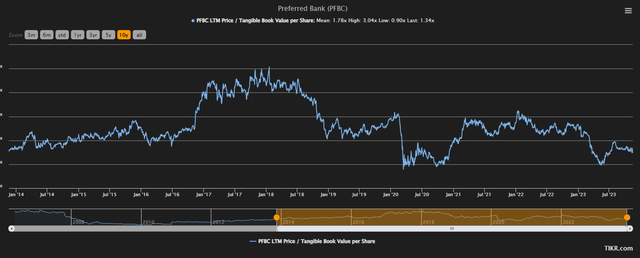

TIKR

The current price/TBV per share is 1.34x, lower than the historical average of 1.78x but not low enough to make this bank a buy in my opinion. When this ratio reaches 1x it is a great buy signal, but this opportunity vanished a few months ago. At the current price, I think a hold is more appropriate.

Conclusion

Preferred Bank is an excellent bank as it shows far above-average profitability. Moreover, its capital ratios are good, and countless buybacks have not weakened its financial structure.

The dividend yield is slightly lower than the industry median, but the growth rate is far greater: by investing today there is the possibility of an excellent dividend yield on cost in a few years. In any case, the recent rally has taken the price per share outside the buy-zone, located around the price/TBV per share of 1x. Personally, I am waiting for a further drop before buying this bank.

Read the full article here