Overview

I have a local Best Buy (NYSE:BBY) around the corner from me and I always wondered what draws people back. I can usually get the same products for cheaper online at sites like Amazon (AMZN). I just don’t see the benefit of visiting a BBY location and then paying a premium for a product you can find elsewhere. Perhaps it’s the location convenience or helpful customer service? I feel that if seeing a human cashier is the only merit of going to a store like Best Buy, then the future looks troubled. At the moment though, the 5.5% dividend yield is tempting and entry before holidays sales are captured adds to the attractiveness. However, the yield is not worth taking on the risk of investing in a company that may be in decline.

Best Buy is a major retailer in the U.S. and Canada, specializing in a wide range of tech products, services, appliances, and entertainment products. Despite my own perspective, I aim to provide a non-biased look into the company and whether BBY makes a smart investment or not.

Dividend

According to the latest declared dividend of $0.92/share, the dividend yield sits around 5.5%. BBY has managed to increase dividend distributions for 23 consecutive years while also having a five year compounded annual growth rate of 16.6% The payout ratio is surprisingly healthy as well, sitting at only 56% which leaves plenty of room for future dividend growth.

I do think that the 5% yield is enough of an argument to hold an existing position in BBY. A high yield like 5% may be enough to still provide investors with a solid total return over a given period of time. It may also be a strong contender for income focused investors looking for some tax-advantaged income for their portfolio so I would totally understand why one would chose to hold onto their shares. This is especially true with the relatively conservative payout ratio. However, the dividend yield is not a good enough point to start a new position as I ultimately believe the share price will likely not experience much growth into the future because of their declining financials.

Financials

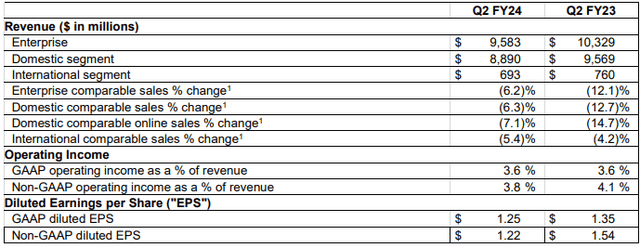

As recently as August, Best Buy reported their Q2 earnings. Best Buy reported healthiness with a Non-GAAP EPS of $1.22, surpassing expectations by $0.15. The company also reported revenue amounting to $9.58 billion, exceeding estimates by $60 million. Despite beating estimates, these numbers still represent a 6.2% decline in comparable sales. In addition, the reported revenue of $9.58 billion still comes in 7.3% less than the prior year.

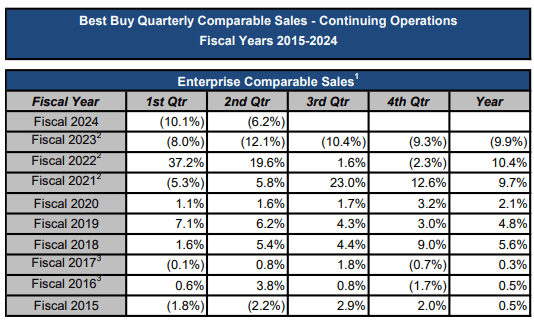

BBY plans to have their Q3 earnings call on November 21st and I suspect that the report will also follow suit with lower negative revenue growth. We can see that the enterprise comparable sales have never quite been strong with the exception of 2021 when the world was thriving in the recovery of Covid. Fiscal year 2023 ended at a decline of 9.9% and it seems that fiscal year 2024 is following suit.

BBY Comparable Sales

Best Buy Q2 Release

Looking ahead to the fiscal year 2024, Best Buy demonstrates transparency with the ability to adjust expectations by revising its revenue outlook to a more realistic range of $43.8 billion to $44.5 billion. This revision is down from a prior range of $43.8B to $45.2B and should eliminate any unrealistic optimism. Quite frankly, this revision of lowered revenue is a negative but it does help mitigate any future disappointment if revenue reporting falls short. This also shows that Best Buy is aware, realistic, and transparent with their forecast.

Despite anticipating a comparable sales decline of 4.5% to 6.0%, the company projects a positive trajectory for its enterprise non-GAAP operating income rate, expected to be between 3.9% and 4.1%. For me though, this sort of growth is very lackluster and doesn’t justify a buy. I cannot confidently recommend buying into a company with shrinking declining revenue.

Competitors

It was recently announced that Best Buy plans to phase out the sales of DVD & Blu-Rays from their physical locations as well as online. In my opinion, this was such a slow adaptation from BBY and competitors seem to be much quicker to make the needed adjustments in products. While competitors are still selling DVD & Blu-Rays online, I believe this decision to be a bit different for BBY.

For the sake of comparison, the competitors I will use against BBY are:

- Amazon (AMZN)

- Walmart (WMT)

- Target (TGT)

- Circuit City, that closed doors in 2009

BBY appears to be conducting a thorough product assessment out of necessity. They are evaluating the consumer market dynamics and making a change like this to save face. While I cannot link any specific proof that this is BBY’s strategy, I am pulling this perspective from historical references such as Circuit City. Before Circuit City closed their doors in 2009, they tried a lot of the same strategies that Best Buy is currently going through.

One notable initiative was the introduction of Firedog services, offering technical support and installation services to diversify revenue streams. Comparing this to Best Buy, there are parallels here. Best Buy introduced the Geek Squad, providing technical support and repair services. Additionally, both Circuit City and Best Buy expanded their product offerings to include appliances, trying to capitalize on diverse consumer needs. Lastly, as Circuit City closed stores, they tried to shift focus within the more successful stores to be more engaging for customers. Best Buy has been closing locations for a decade and shifting to a similar strategy of focusing only on their winning locations and making them more engaging for customers.

Regarding DVDs & Blu-Rays, this choice seems to stem from recognition of the declining relevance of physical media and a reactive stance to mitigate revenue losses from these old product offerings. The slow adjustment pace reflects a hesitancy to fully embrace the digital era and a strategic move borne more out of survival instincts rather than a forward-thinking strategy, similar to Circuit City. In my view, both companies share the sentiment of being reactive more than proactive.

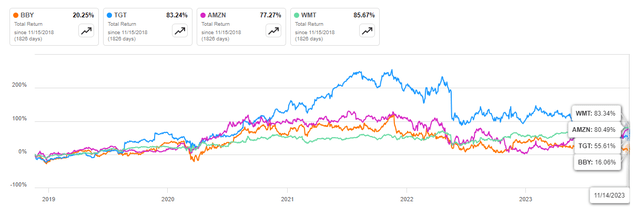

Seeking Alpha

As you can see, BBY performs the worst in total return over a 5 year period compared to these competitors. The same is true for a 3 year comparison as well as a 10 year comparison. I strongly believe this is due to Best Buy’s lack of “stand out” shopper experiences. When you walk into best Best Buy, it feels like every other brick and mortar store that closed over the last few decades, most notably Circuit City. In short, I believe that all of the competitors offer much better all-around experiences.

Amazon offers much better price flexibility, variety, and customer support. Target works with new personal care brands, the same tech offerings, and a wider range of products outside of the tech niche. Target has also increased their dividend for over 55 consecutive years. Side note, I recently published an Article on Target’s 35% Price Upside.

Lastly, Walmart generally offers a similar shopping experience while also having an abundance of locations and better online portals without the same premium prices that Best Buy has. Walmart has also raises their dividend for 49 years in a row and has almost crossed dividend king status.

You can argue that Geek Squad is the standout offering from Best Buy but the company isn’t exactly transparent with how much this segment of the business brings in. Although, it is estimated that Geek Squad services bring in $1.5 billion in revenue for BBY. Geek Squad is a subsidiary of Best Buy, and it provides various technology-related services, including technical support, installation, and repair services for consumer electronics.

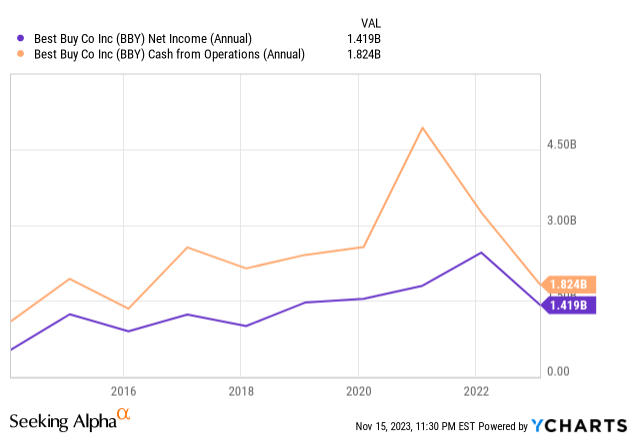

Valuation

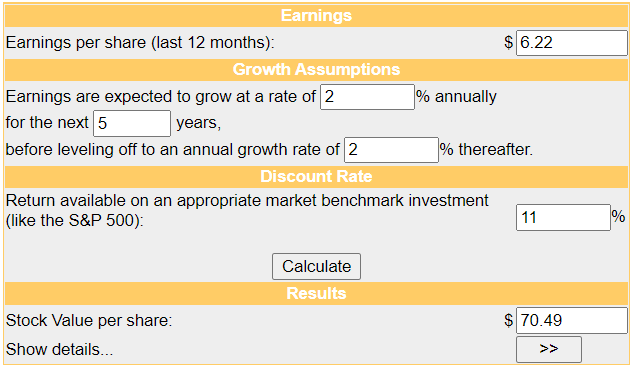

Using a discounted cash flow model, we can determine a rough estimate for the fair price value of BBY. We can use the estimated EPS (earnings per share) and expected growth going forward. For reference, the Wall St. price target average sits at $80.55/share which represents a 17% price upside from the current level. We will use an EPS of $6.22 and an expected growth of 2%, despite management’s estimate being 3%.

After much consideration, I think 2% is a more realistic figure here. This is because the 5 year average revenue growth comes in at roughly 2.14%. The last 5 year period has been rough with record high inflation, a pandemic that prevented all in-store buying, job loss, and a more defensive consumer spending habit. With this in mind, we can determine that the stock is trading near fair value of $70.49/share which means there is very limited upside here.

Money Chimp

The environment hasn’t exactly been very supportive of higher consumer spending for companies like BBY with record high inflation, higher interest rates, and a higher cost of living shifting funds to more important purchases. However, even when the environment shifts and gets in a more supportive position for consumer spending, I do not think BBY will thrive.

At the moment, I believe the risks outweigh the benefits. We do have the holiday seasons coming up so some short-term upward price movement wouldn’t be surprising. This is especially true when we consider that the forecasts for holiday spending is estimated to increase 3% to 4% from the year prior. Like I previously stated though, holding existing shares to collect the dividend is understandable but I would not start a position here as I believe the negatives and risks are more prominent than future gains.

Risks

Best Buy reported that customers are having trouble paying off their credit card. I don’t see how holiday spending can possibly match the forecasts as it seems people are already struggling to maintain their household finances. We have inflation at 3.7%, mortgage rates above 8%, and record high credit card debt. I believe people will opt for cheaper online alternatives from one of the previously mentioned competitors this holiday season.

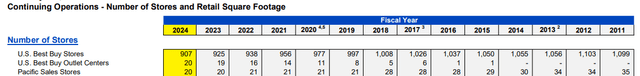

Ultimately, the risk here is underperformance to competitors and investing in a business that’s essentially in a dying space. Analyst Harrison Schwartz, wrote a fantastic article on this exact thing: The Dying Electronic Store. Best Buy has been steadily closing stores over the last decade while trying to focus on the more profitable locations.

Best Buy Store Count

Takeaway

The local convenience of Best Buy (BBY) is not enough to maintain growth. The juicy 5.5% dividend yield clashes with the backdrop of declining financials and a shaky in-store model. While Q2 showcases wins in EPS and revenue, the shadow of declining comparable sales looms in the background.

In the competitive arena, rivals like Amazon, Walmart, and Target outshine Best Buy, evidenced by lackluster total returns. The slow exit from DVD & Blu-Ray sales highlights a lagging adaptation strategy, while Geek Squad’s estimated $1.5 billion revenue offers a potential silver lining.

Valuation signals fair pricing, but economic shifts and changing consumer habits cast doubt for me. Risks, including customer credit struggles and ongoing store closures, overshadow the allure. While the holiday spending surge may provide a short-term lift, the uncertain trajectory of Best Buy in a transforming retail landscape urges caution. Holding existing shares for dividends is reasonable, but starting a new positions seems unwise given the uncertainties in the future.

Read the full article here