Almost two years ago, I recommended purchasing American Assets Trust (NYSE:AAT) for its solid business model and its expected recovery from the coronavirus crisis. No-one could have predicted that a war in Ukraine would emerge about a month after that article. Due to the sanctions imposed by the U.S. and European Union on Russia, inflation skyrocketed to a 40-year high and thus the Fed began raising interest rates at an unprecedented pace. Interest rates have now surged to a 16-year high, thus exerting pressure on the stock of American Assets Trust via three ways (more on this below).

As American Assets Trust has underperformed the broad market by a wide margin this year (-27% vs. +18% of the S&P 500), it is only natural that many unitholders are about to throw in the towel and take their losses. However, these investors are running the risk of selling the stock near its bottom. The latest CPI report showed that inflation froze in October on a month-to-month basis for the first time in the last two years, thus spreading hope that it may revert to the target range of the Fed at some point next year. Of course, more data is needed to make sure that the latest report represents a trend and not just a single point. Nevertheless, it is important to realize that American Assets Trust will enjoy strong tailwinds whenever inflation reverts to normal levels and interest rates begin to deflate.

The reasons behind the underperformance of the stock

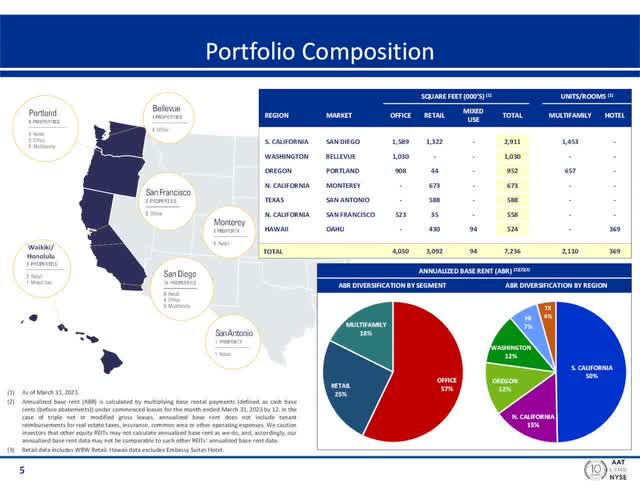

American Assets Trust is a REIT that owns, acquires, develops and improves office, retail and residential properties, primarily in Southern California, Northern California, Washington, Oregon, Texas and Hawaii. As shown in the chart below, the REIT generates half of its annual base revenue in Southern California.

Overview of American Assets Trust (Investor Presentation)

Source: Investor Presentation

Moreover, it generates 25% of its revenue from its retail properties and 18% of its revenue from its multifamily residential properties. These properties have fully recovered from the pandemic. To be sure, the retail properties of the REIT posted a utilization rate of nearly 95% and their highest-ever monthly base rent in the third quarter. The multifamily properties of the trust posted a record monthly base rent as well.

Unfortunately for American Assets Trust, its office portfolio, which generates 57% of the annual revenue of the trust, has not recovered from the pandemic yet, as the work-from-home trend has remained in place for much longer than initially anticipated. In the latest conference call, management reiterated that patience will be required for this segment to recover from the work-from-home trend.

However, according to a recent study by Resume Builder, 90% of companies intend to force their employees back to their offices within the next 12-14 months in order to enhance collaboration, engagement and productivity. If all these companies implement their plans, they will certainly provide a tailwind to the business of American Assets Trust.

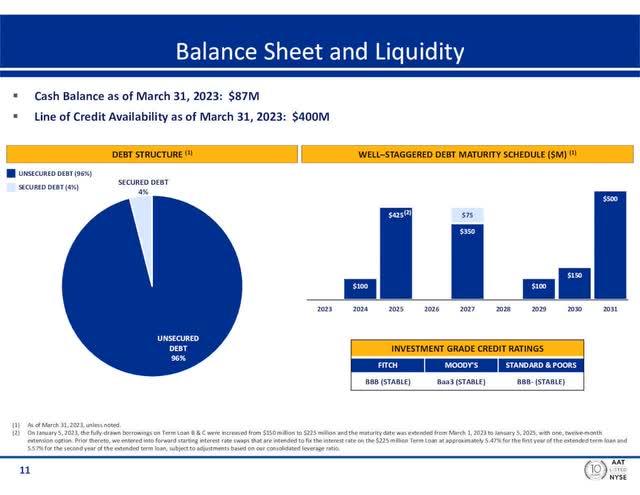

It is also important to note that the stock of the REIT has been severely hurt due to the triple impact of 16-year high interest rates. High interest rates have significantly increased the interest expense of all REITs. Nevertheless, American Assets Trust is one of the most resilient REITs to high interest rates. Its net interest expense has increased only 16%, from $53 million in 2020 to $61.4 million in the last 12 months. To provide a perspective, Realty Income (O), Douglas Emmett (DEI) and Cousins Properties (CUZ) have seen their interest expense jump 111%, 35% and 64%, respectively, over the same period.

The interest expense of American Assets Trust consumes only 51% of its operating income. Therefore, the REIT can easily cover its interest expense. It also has investment grade credit ratings from all the major credit rating firms.

Debt Profile of American Assets Trust (Investor Presentation)

Source: Investor Presentation

Moreover, it has well laddered debt maturities, with just $100 million of debt maturing in 2024. The next major debt maturity is in 2025 ($425 million). Management recently stated that it intends to refinance this amount of debt with the issuance of new bonds. Given its solid interest coverage ratio and its healthy credit ratings, American Assets Trust is not likely to have any problems refinancing its debt.

Another effect of high interest rates is their cooling effect on the total investment in the economy. The surge of interest rates renders many investment projects uneconomical and hence it reduces the amounts invested by companies in offices. American Assets Trust does not provide figures for the utilization of its offices but it has certainly been hurt by the surge of interest rates. Whenever interest rates moderate, the REIT will probably enjoy improved demand for its office properties.

Finally, high interest rates exert pressure on the stock of American Assets Trust due to their impact on the present value of future cash flows. Indeed, the REIT is currently trading at a depressed price-to-FFO ratio of 8.2. This FFO multiple is less than half of the 10-year average of 19.4 of the stock.

The REIT has traded at such a premium valuation level throughout the last decade thanks to its consistent and reliable growth trajectory, which has resulted from the solid business model of the trust and the healthy economic growth of its markets. American Assets Trust grew its FFO per unit every single year between 2012 and 2019. The growth streak was interrupted by the pandemic in 2020 but the trust recovered swiftly, with record FFO per unit of $2.34 in 2022. Moreover, it has provided guidance for all-time high FFO per unit of $2.36-$2.40 this year.

Whenever interest rates begin to revert towards normal levels, the valuation of American Assets Trust will probably begin to recover off its depressed current level. Given also the positive effects of lower interest rates on interest expense and the total investment in the economy, the REIT is likely to enjoy a triple tailwind whenever interest rates moderate.

No-one can predict when the Fed will begin reducing interest rates. It will almost certainly happen when inflation reverts to the target range of 2.0%-2.5% of the central bank. Inflation has cooled from a 40-year high of 9.2% in the summer of last year to 3.2% now. Thanks to the aggressive stance of the Fed, it is reasonable to expect inflation to keep cooling in the upcoming months and reach the target zone of the Fed in 2024 or 2025. When that happens, the central bank will probably begin lowering interest rates.

Dividend

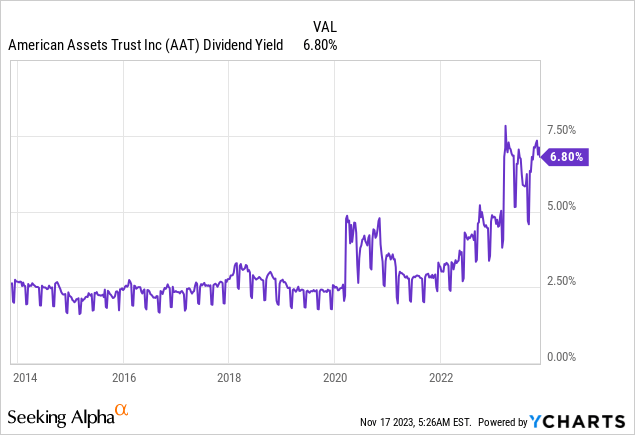

Due to its depressed valuation, American Assets Trust is currently offering a nearly 10-year high dividend yield of 6.6%.

The stock has a FFO payout ratio of 55% and a solid interest coverage ratio of 1.9, with investment grade ratings from all the major rating firms. Therefore, the dividend seems to have a material margin of safety in the absence of a prolonged downturn.

Risks

American Assets Trust has two major risk factors. First of all, if the work-from-home trend persists for years, it will continue weighing on the office portfolio of the REIT. On the bright side, the REIT has proved capable of growing its FFO per unit in the last two years, despite this headwind. Therefore, while a persistent work-from-home trend will be negative for American Assets Trust, it may not derail the REIT from its long-term growth trajectory.

The other risk is the adverse scenario of excessive interest rates for years. If the Fed does not manage to tame inflation, it will not begin unwinding its aggressive interest rate hikes. In such a case, American Assets Trust will be hurt by high interest expense and possibly by lackluster investments of companies in office properties. Those who purchase American Assets Trust should be aware of this risk factor, which will weigh on the stock should it materialize. On the bright side, this scenario is unlikely, given the steep downtrend of inflation in the last 15 months and the determination of the Fed to restore inflation to normal levels.

Final thoughts

Just like many REITs, American Assets Trust has underperformed the S&P 500 by a wide margin in the last 12 months. Notably, the stock has plunged 50% off its peak two years ago. Given the prolonged downtrend of the stock, it is only natural that many unitholders have probably been exhausted. However, this is the right time to be patient. Whenever interest rates begin to deflate, American Assets Trust is likely to highly reward investors thanks to its depressed valuation level, the aforementioned tailwinds from lower interest rates and its nearly 10-year high dividend yield of 6.6%.

Read the full article here