Investment Thesis

Due to their ability to continuously raise dividend payouts on an annual basis, dividend growth companies are a key component of an extensively diversified and risk-adjusted dividend income portfolio.

Before I describe the selection process and present each of the selected companies, I would like to highlight the general benefits of investing in dividend growth companies:

- Continuous and Significant Annual Dividend Enhancements: Dividend growth companies contribute significantly to raising the dividend payments of your portfolio. This means for investors that their annual income stream can be raised continuously and to a significant amount.

- Hedge against Inflation: Due to the growing dividend payments of dividend growth companies, investors can hedge their invested money against inflation.

- Benefit from the Compounding Effect: Investors can reinvest the continuously increasing dividends from the companies they are invested in, thus benefiting from the compounding effect.

- Reduction of the Portfolio’s Volatility and Risk Level: Compared to growth companies that do not pay a dividend, dividend growth companies tend to be less volatile and can contribute to reducing the risk level of your portfolio.

The Importance of Dividend Growth Companies for The Dividend Income Accelerator Portfolio

For the reasons mentioned above, dividend growth companies are also a key component of The Dividend Income Accelerator Portfolio, helping investors to enhance the potential of raising their dividend income each year. The balanced mix of high dividend yield and dividend growth companies makes The Dividend Income Accelerator particularly attractive for investors. The attractiveness of The Dividend Income Accelerator Portfolio is further rooted in its reduced risk level, achieved through its extensive diversification across sectors and industries. The portfolio is strategically constructed to target an attractive Total Return (to which dividend growth companies significantly contribute to), overweighting companies with an attractive risk/reward profile, aiming to steadily increase investors wealth.

For the same reasons mentioned above, I generally suggest giving dividend growth companies a significantly higher proportion of your overall investment portfolio than pure growth companies: I believe that their performance is much more predictable than the performance of pure growth companies.

Comparing dividend growth companies with pure growth companies – The Example of Visa and Tesla

I would like to illustrate these advantages while comparing an investment in a dividend growth company such as Visa (NYSE:V) with an investment in a pure growth company like Tesla (NASDAQ:TSLA).

Visa’s 60M Beta Factor of 0.95 indicates that you can reduce portfolio volatility and its risk level while Tesla’s 60M Beta Factor of 2.28 clearly indicates that you would increase the portfolio’s risk level. Visa’s significantly lower risk level when compared to Tesla’s, strengthens my belief to overweight the dividend growth company (in this case Visa) while underweighting the growth company (in this case Tesla) in a well-balanced portfolio with a reduced risk level.

Visa’s Dividend Growth Rate [CAGR] of 16.27% clearly indicates that the company should be able to significantly raise its dividend within the coming years, ensuring that your extra income in the form of dividends can increase over the years. This is further underscored by Visa’s low Payout Ratio of 21.35%.

The high probability of dividend enhancements in the years to come further strengthens my belief that Visa’s stock price can increase, since its elevated dividend will ensure that investors receive a superior dividend within the following years than they get today. This can lead to an increased demand for the Visa stock, which in turn can lead to a higher price for it.

In my opinion, this example shows that we can predict with a higher probability that the stock prices of dividend growth companies will increase (due to their continuously raising dividends) when compared to pure growth companies such as Tesla (of course, there are a lot of other factors that can have a strong influence on a company’s stock price over the short term, however, I am convinced that a company’s earnings and dividend payments have the strongest influence on its stock prices over the long term). For these reasons, my investment analyses have such a strong focus on the earnings of companies and the sustainability of their dividends.

At the same time, Visa investors can reinvest the dividend they receive to benefit from the compounding effect, illustrating another benefit of investing in dividend growth companies when compared to pure growth companies.

In today’s article, I will introduce you to 10 dividend growth companies that are worth investing in due to a wide variety of reasons.

First, I would like to explain the selection process for my top dividend growth stocks of the month of November. Since I have already explained this selection process in a previous article, you can skip the following description written in italics, if you are already familiar with the selection process.

First step of the Selection Process: Analysis of the Financial Ratios

In a first step, companies must meet the following requirements to be part of a pre-selection among which I will select the top dividend growth stocks of the month:

- Market Capitalization > $10B [changed from $15B]

- Average Dividend Growth Rate over the past 5 Years > 5%

- Dividend Yield [FWD] > 0%

- P/E [FWD] Ratio < 50

- EBIT Margin [TTM] > 5% or Net Income Margin [TTM] > 5%

- Return on Equity > 5% [changed from 8%]

I consider these metrics mentioned above important in order to help you to make well founded investment decisions and to increase the probability of making good investment decisions.

A relatively high Dividend Growth Rate of more than 5% over the past 5 years ensures to increase the probability that the company will be able to raise its Dividend to a significant amount in the following years.

A P/E [FWD] Ratio of less than 50 contributes to the fact that the growth expectations that are priced into the stock price of the company you aim to invest in are not extraordinarily high. This helps you that you run less risk of the share price decreasing significantly in s short-period of time in case that growth expectations for the company are not met. This can contribute to help you to protect you from losing a significant amount of money in a short period of time.

An EBIT Margin or Net Income Margin of more than 5% and a Return of Equity of more than 5% [changed from 8%] help to filter out companies that are profitable.

Second step of the selection process: Analysis of the Competitive Advantages

In a second step, the companies’ competitive advantages (for example: brand image, innovation, technology, economies of scale, etc.) are analyzed in order to make an even narrower selection. I consider it to be particularly important for companies to have strong competitive advantages in order to stand against the competition in the long term. Companies without strong competitive advantages have a higher probability to go bankrupt one day, representing a strong risk for investors to lose their invested money.

Third step of the selection process: The Valuation of the companies

In the third step of the selection process, I will dive deeper into the Valuation of the companies.

In order to conduct the Valuation process of the companies, I use different methods and criteria, for example, the companies’ current Valuation as according to my DCF Model, the expected compound annual rate of return as according to my DCF Model and/or a deeper analysis of the companies’ P/E [FWD] Ratio. These metrics should serve as an additional filter to select only companies that currently have an attractive Valuation, helping you to identify companies that are at least fairly valued.

The Fourth and final step of the selection process: Diversification over Industries and Countries

In a fourth and last step of the selection process, I have established the following rules for my top picks of the months selection: in order to help you to diversify your investment portfolio, a maximum of 2 companies should be from the same industry. In addition to that, there should be at least one pick that is from a company that is based outside of the United States, serving as an additional geographical diversification.

My Top 10 Dividend Growth Companies to invest in for November 2023

- Nike (NYSE:NKE)

- BlackRock (NYSE:BLK)

- Apple (NASDAQ:AAPL)

- Visa

- Bank of America (NYSE:BAC)

- American Express (NYSE:AXP)

- Microsoft (NASDAQ:MSFT)

- Itaú Unibanco (NYSE:ITUB)

- AbbVie (NYSE:ABBV)

- Crown Castle (NYSE:CCI)

Overview of the selected Dividend Growth Stocks to invest in for November 2023

|

AAPL |

MSFT |

NKE |

BAC |

V |

AXP |

BLK |

ITUB |

ABBV |

CCI |

|

|

Company Name |

Apple |

Microsoft |

NIKE |

Bank of America |

Visa |

American Express |

BlackRock |

Itaú Unibanco |

AbbVie |

Crown Castle |

|

Sector |

Information Technology |

Information Technology |

Consumer Discretionary |

Financials |

Financials |

Financials |

Financials |

Financials |

Health Care |

Real Estate |

|

Industry |

Technology Hardware, Storage and Peripherals |

Systems Software |

Footwear |

Diversified Banks |

Transaction & Payment Processing Services |

Consumer Finance |

Asset Management and Custody Banks |

Diversified Banks |

Biotechnology |

Telecom Tower REITs |

|

Market Cap |

2.90T |

2.75T |

161.49B |

219.05B |

496.04B |

112.50B |

98.93B |

54.46B |

244.69B |

41.48B |

|

Dividend Yield [FWD] |

0.52% |

0.81% |

1.28% |

3.47% |

0.85% |

1.55% |

3.01% |

0.69% |

4.47% |

6.55% |

|

Payout Ratio |

15.36% |

26.70% |

41.98% |

25.21% |

21.35% |

21.76% |

53.66% |

– |

49.66% |

84.92% |

|

Dividend Growth 5 Yr [CAGR] |

6.15% |

10.12% |

11.20% |

12.03% |

16.27% |

10.01% |

11.78% |

12.83% |

10.52% |

8.31% |

|

Consecutive Years of Dividend Growth |

10 Years |

18 Years |

10 Years |

9 Years |

15 Years |

2 Years |

13 Years |

2 Years |

10 Years |

8 Years |

|

P/E GAAP [FWD] |

28.52 |

33.17 |

28.42 |

8.18 |

25.16 |

13.72 |

18.4 |

8.59 |

26.43 |

28.2 |

|

EPS Growth Diluted [FWD] |

5.14% |

10.08% |

5.34% |

-2.80% |

14.24% |

7.09% |

-1.47% |

13.97% |

-4.43% |

4.46% |

|

Net Income Margin |

25.31% |

35.31% |

9.82% |

31.52% |

52.90% |

14.74% |

30.66% |

26.66% |

11.81% |

21.96% |

|

Return on Equity |

171.95% |

39.11% |

33.91% |

10.96% |

46.49% |

31.26% |

13.95% |

18.30% |

46.32% |

21.65% |

Source: The Author, data from Seeking Alpha

Itaú Unibanco

Itaú Unibanco, headquartered in Sao Paulo, Brazil, was founded in 1924 and presently has a Market Capitalization of $54.46B.

Due to the Brazilian bank’s significant competitive advantages (such as its continuous focus on innovation, its financial health (Net Income Margin [TTM] of 26.66% and Return on Equity of 18.77%), and broad network within the financial industry), in combination with its current Valuation (its P/E [FWD] Ratio stands at 8.59, being 18.25% below its average from the past 5 years), it is an interesting option for investors at this moment in time.

Moreover, the Brazilian bank has shown a Dividend Growth Rate [CAGR] of 12.83% over the past 5 years, supporting my theory that it is an excellent candidate for those investors seeking dividend growth.

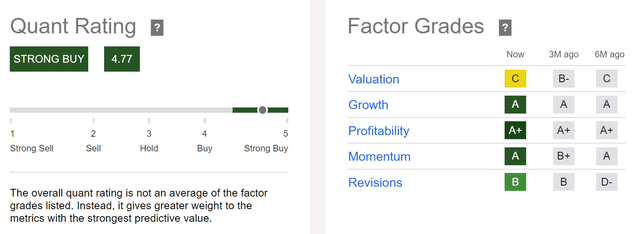

Below you can find the results of the Seeking Alpha Quant Rating and the Seeking Alpha Factor Grades. According to the Seeking Alpha Quant Rating, Itaú Unibanco is presently a strong buy. In regard to the Seeking Alpha Factor Grades, Itaú Unibaco receives an A+ for Profitability, and an A for Growth, and Momentum. For Revisions, it gets a B, and for Valuation, a C.

Source: Seeking Alpha

AbbVie

AbbVie is a company that unifies dividend income and dividend growth, and is therefore a strong candidate for future inclusion into The Dividend Income Accelerator Portfolio.

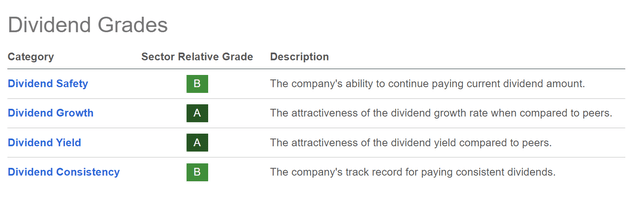

At this moment, AbbVie pays a Dividend Yield [FWD] of 4.47%, and has shown a Dividend Growth Rate [CAGR] of 13.98% over the past 10 years. This numbers underline the company’s strength in regard to its Dividend. This is further underlined when looking at the Seeking Alpha Dividend Grades, according to which AbbVie receives an A rating for Dividend Growth and Dividend Yield, and a B for Dividend Safety and Dividend Consistency.

Source: Seeking Alpha

AbbVie currently has a P/E Non-GAAP [FWD] Ratio of 12.34, which is 31.58% below the Sector Median, indicating the company’s undervaluation.

BlackRock

Like AbbVie, BlackRock can provide your investment portfolio with dividend income as well as dividend growth. Proof of this is the company’s Dividend Yield [FWD] of 3.01%, its 10 Year Dividend Growth Rate [CAGR] of 11.76% as well as its relatively low Payout Ratio of 53.66%.

I plan on adding BlackRock to The Dividend Income Accelerator Portfolio in the future, due to the company’s mix of dividend income and dividend growth, in addition to its excellent risk/reward profile. For the reasons mentioned above, BlackRock is an excellent choice to account for a relatively high proportion of an investment portfolio with a long investment horizon. The company provides investors with an opportunity to obtain a relatively high Total Return while investing with a relatively low risk level. This makes the company an ideal buy-and-hold position for any investment portfolio from my point of view.

I believe that BlackRock is fairly valued right now, which is attributed to its P/E [FWD] Ratio of 18.40, which lies 5.01% below its average from the past 5 years.

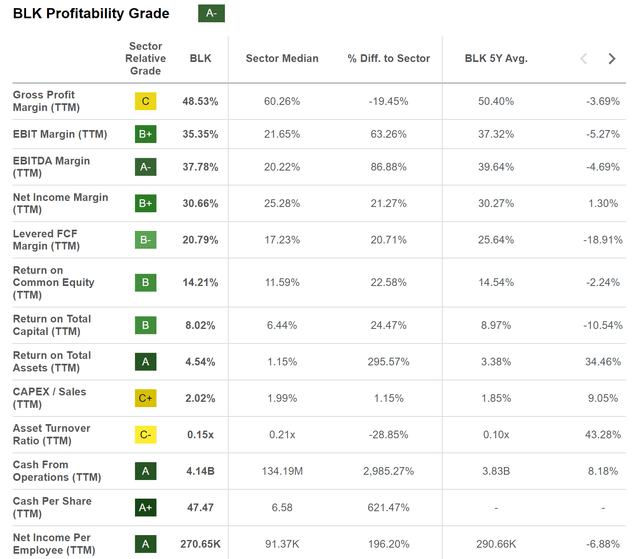

The current results of the Seeking Alpha Profitability Grade for BlackRock, which you can find below, underscore the company’s strong financial health.

Source: Seeking Alpha

Crown Castle

Crown Castle has shown strong results in terms of dividend growth in the past. This is one of the reasons why it has been included in this list of dividend growth companies to consider investing in.

The company has shown a Dividend Growth Rate [CAGR] of 9.26% over the past 3 years, and currently pays investors a Dividend Yield [FWD] of 6.55%. The company blends dividend income and dividend growth, making it an additional candidate for future inclusion into The Dividend Income Accelerator Portfolio as it aligns with the portfolio’s investment approach.

At this moment in time, I consider Crown Castle to be fairly valued, which is based on the company’s P/AFFO [FWD] Ratio of 12.70, being 3.44% below the Sector Median.

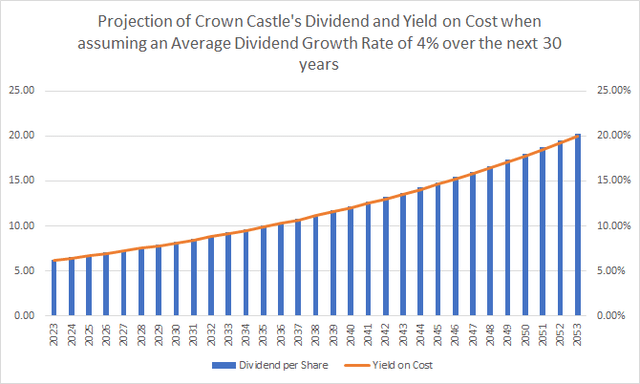

Below you can find the projection of Crown Castle’s Dividend and Yield on Cost when assuming an Average Dividend Growth Rate of 4% for the following 30 years (which is a conservative assumption considering its 3 Year Dividend Growth Rate [CAGR] of 9.26%).

Source: The Author

Nike

Nike is among the positions that account for the largest proportion of my personal investment portfolio (making up 3.28%), and I believe the company is an excellent buy-and-hold company, which you can overweight in a long-term oriented investment portfolio with a focus on dividend growth.

Nike has strong competitive advantages, and I expect the company to maintain its excellent position within its industry due to these competitive advantages as well as its financial health.

I further believe that Nike currently has an attractive Valuation. This is based on the company’s current P/E [FWD] Ratio of 28.42, which stands 21.03% below its average from the past 5 years.

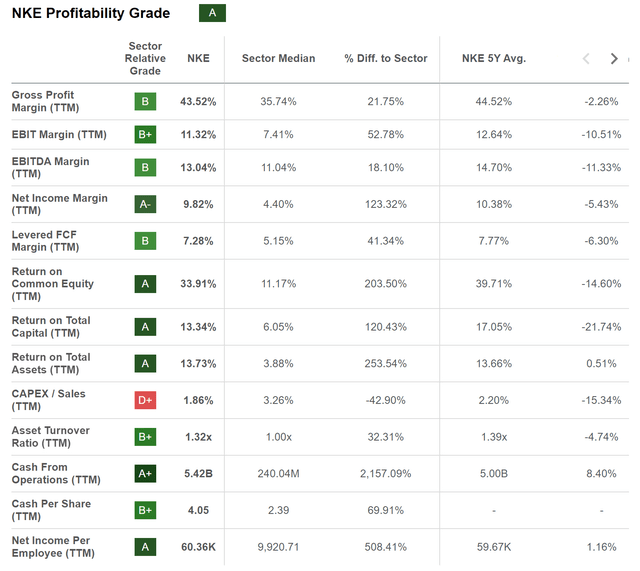

Nike’s excellent position within its industry is reflected in its EBIT Margin [TTM] of 11.32%, which is significantly higher than the Sector Median of 7.41%, and its Return on Equity [TTM] of 33.91%, which is also significantly above the Sector Median of 11.17%.

Source: Seeking Alpha

Bank of America

I have recently included Bank of America in The Dividend Income Accelerator Portfolio. As well as currently being one of the largest positions of The Dividend Income Accelerator Portfolio, it is also part of my personal portfolio.

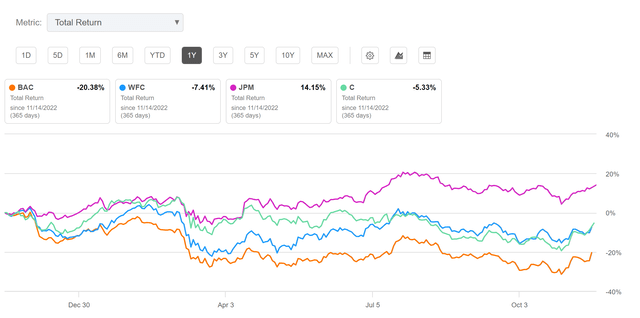

Bank of America has performed significantly weaker than its competitors when considering the past 12-month period. While Bank of America has shown a negative performance of -20.38%, the performance of Wells Fargo (NYSE:WFC) has been -7.41%, Citigroup’s (NYSE:C) has been -5.33%, while JPMorgan’s (NYSE:JPM) has been positive (14.15%).

Source: Seeking Alpha

Bank of America’s 3 Year Dividend Growth Rate [CAGR] of 7.72% is above the one of Citigroup (0.65%), Wells Fargo (2.14%), and JPMorgan (4.00%), suggesting that Bank of America is the top pick among its peers regarding dividend growth.

In addition to the above, it is important to highlight that Bank of America’s current P/E [FWD] Ratio of 8.18 is not only 30.29% below its 5-year average, but also significantly below the Sector Median (9.33). The bank’s extremely attractive Valuation has significantly contributed to its inclusion in this list of dividend growth companies to consider investing in.

Visa

As I commented in a recent article for Seeking Alpha, Visa is among the largest positions of my personal investment portfolio. It currently accounts for 6.34% of the overall portfolio.

Visa’s excellent risk/reward profile (to which its strong competitive advantages and enormous financial health contribute) gives me the belief that the company is an excellent option for an investment portfolio with a focus on dividend growth.

Visa has shown an impressive Dividend Growth Rate [CAGR] of 18.33% over the past 10 years, underlying the company’s strength in terms of dividend growth. This makes Visa an excellent choice for this list of dividend growth companies and also an attractive potential candidate for inclusion into The Dividend Income Accelerator Portfolio in the coming weeks.

I am convinced that Visa’s current Valuation is highly attractive for investors: the company’s P/E [FWD] Ratio of 25.16 stands 21.72% below its average from the past 5 years.

Microsoft

With a current P/E [FWD] Ratio of 33.17, Microsoft is not particularly cheap at this moment in time. However, it should be noted that its current P/E [FWD] Ratio is only 11.01% above its 5 year average, suggesting that the company is currently fairly valued.

In the past, Microsoft has shown excellent results when it comes to dividend growth (3 Year Dividend Growth Rate [CAGR] of 10.11%), and I am convinced it will continue to do so within the following years: Microsoft has significant competitive advantages, is financially healthy, and has a positive growth outlook.

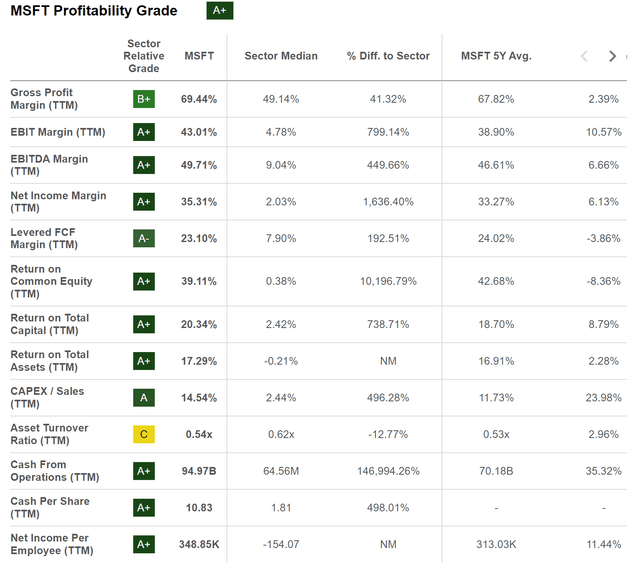

The Seeking Alpha Profitability Grade highlights Microsoft’s enormous financial strength: the company has an impressive EBIT Margin [TTM] of 43.01% (while the Sector Median is 4.78%), and a Return on Equity [TTM] of 39.11% (the Sector Median is 0.38%).

Source: Seeking Alpha

American Express

American Express is among the 10 largest positions of my personal investment portfolio (currently accounting for 2.70% of my personal portfolio). The company is also among my favorite dividend growth companies and I believe it provides investors with an excellent risk/reward profile, which is why it accounts for such a high proportion of my personal portfolio.

What makes American Express such an attractive choice right now is the company’s current Valuation: its P/E [FWD] Ratio of 13.72 is 26.13% below its 5-year average, which indicates that the company is currently undervalued.

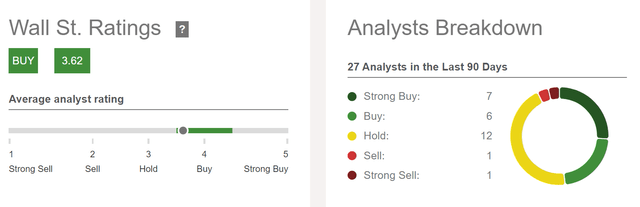

According to the Wall Street, American Express is currently a buy. From 7 analysts, the company receives a strong buy rating, and from 6 analysts, a buy rating. 12 analysts currently rate the company as a hold.

Source: Seeking Alpha

Apple

Apple is currently one of the largest positions of The Dividend Income Accelerator Portfolio, to which it has been added recently, underscoring my positive opinion about Apple’s risk/reward profile.

Apple currently has a P/E [FWD] Ratio of 28.52, which is only 12.57% above the Sector Median, to which it should be rated with a significant premium due to its enormous competitive advantages, strong market position, economic moat, financial health, and relatively low investment risk.

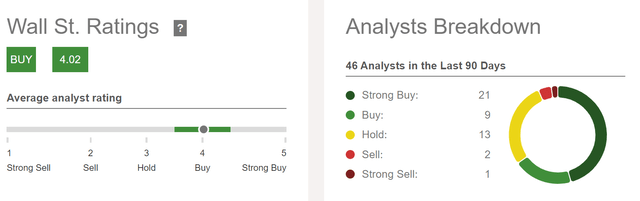

From Wall Street, Apple currently gets a buy rating: while the company receives a strong buy rating from 21 analysts, it gets a buy rating from 9 analysts, while 13 analysts give the company from Cupertino a hold rating.

Source: Seeking Alpha

Conclusion

Investor Benefits of Investing in Dividend Growth Companies

Dividend growth companies are a key component of a well-diversified investment portfolio, and investing in such companies comes attached to many benefits for investors when compared to investing in pure growth companies.

Dividend growth companies can contribute significantly to enhancing investors’ annual income, providing them with an increasing income stream while hedging against inflation. Through the reinvestments of the dividends, investors can benefit from the compounding effect. In addition to that, dividend growth companies tend to be less volatile than pure growth companies, reducing the risk level of your investment portfolio, and raising the likelihood of securing favorable investment outcomes.

The Key Facts about these 10 Dividend Growth Companies to Consider Investing In

Each of these dividend growth companies that I have presented in today’s article can be excellent additions to your portfolio. This is because they have not only shown significant dividend growth in recent years, but they also possess strong competitive advantages, have presently attractive Valuations, growth outlooks, and a relatively low Payout Ratio.

The Importance of a Well-Balanced Portfolio Including Both High Dividend Yield and Dividend Growth Companies

When achieving a balanced mix of high dividend yield and dividend growth companies, you can start to enjoy an attractive supplementary income via dividends from today, with a notable annual increase. This strategy allows you to worry less about stock market fluctuations, ensuring increasing dividend payments each year, regardless of the stock market’s direction.

This investment approach is reflected in The Dividend Income Accelerator Portfolio, which additionally targets an attractive Total Return through overweighting companies with an attractive risk/reward profile.

Investor Benefits of Implementing the Investment Approach of The Dividend Income Accelerator Portfolio

Implementing the investment approach of The Dividend Income Accelerator Portfolio means that dividend payments from companies such as Apple, Visa, or Bank of America can help you cover your expenses while increasing your wealth continuously. How does that sound to you?

Author’s note: I would appreciate hearing your opinion on this selection of dividend growth companies. Do you own any of these picks or plan to acquire them? Are any of the selected picks on your watch list? What are currently your favorite dividend growth stocks to consider for your investment portfolio?

Read the full article here