Over my time as an investor, I have been heavily influenced by individuals like Warren Buffett, Philip Fisher, Benjamin Graham, Peter Lynch, and others. And one of the things that I have learned from them is that, sometimes, the best investment prospects are the most ‘boring’ opportunities that exist. And while the definition of ‘boring’ might be subjective, few would argue that a company that engages in the construction and sale of fiberglass materials, insulation, and other products, would be considered ‘boring’ by many. That business in question is Owens Corning (NYSE:OC). And since I rated the company a ‘strong buy’ back in July of 2022, shares have generated upside of 59.9% at a time when the S&P 500 has returned a more modest 13.9%.

The market tends to look past how cheap ‘boring’ companies can be. And it is in that cheapness that we get the chance to pick up some true bargains. But after seeing its share price rise so significantly since the publication of that article, a fair question would be whether the stock still has further upside from here or not. I would argue that, based on recent financial performance that has shown some weakening across the board, and because the enterprise is no longer quite the bargain that it was previously, it likely does deserve a downgrade. But even so, that positions the company as a solid ‘buy’ candidate at this time.

Time for a downgrade

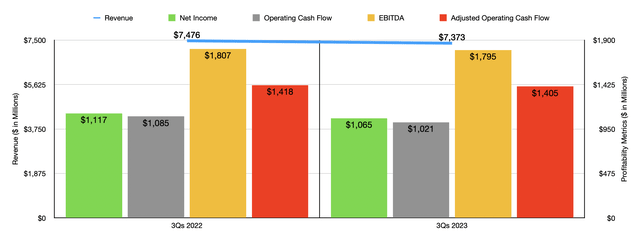

At the time that I rated Owens Corning a ‘strong buy’, the company was doing well to grow both its top and bottom lines. This, combined with how cheap the stock was, led me to the most bullish rating that I can assign to a company. Fast forward to today, and we are starting to see some weaknesses emerge. Consider, for instance, how the business performed during the first nine months of its 2023 fiscal year. Revenue for that time came in at $7.37 billion. That represents a 13.8% drop compared to the $7.48 billion the company generated one year earlier.

Author – SEC EDGAR Data

Management attributed this decline to lower sales volumes in both the Insulation and Composites cyclists the firm. However, these were offset to some extent by higher pricing that the company charged its customers during this inflationary cycle. Interestingly, when you dig a bit deeper, you see that not all of the company’s operations were the same. The Insulation segment, for instance, reported a roughly 1% year-over-year decline in revenue. The big drop, then, came from the Composites segment. Sales plummeted 14.4% from $2.07 billion to $1.77 billion. For the first nine months of the 2023 fiscal year, the segment suffered from a 13% hit associated with lower volumes. You would think that the decline in volume would have been larger given that the company stated very clearly that pricing helped to offset the declines to an extent. However, the company did suffer from foreign currency fluctuations, the impact of certain asset sales and asset purchases, and other factors.

Author – SEC EDGAR Data

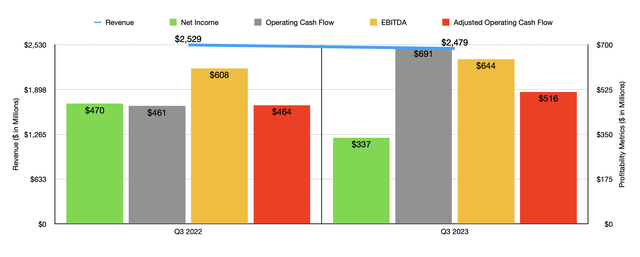

With the drop in revenue came a decline in profits. Net income fell from $1.12 billion to $1.07 billion. Operating cash flow also took a beating, dropping from $1.09 billion to $1.02 billion. If we adjust for changes in working capital, we also get a drop, this time from $1.42 billion to $1.41 billion. Even EBITDA pulled back, declining from $1.81 billion to just under $1.80 billion. When it comes to the most recent quarter, we have started to see some improvement. Although revenue is down year over year as can be seen in the chart above, and net profits have followed suit, the company’s other profitability metrics have shown improvement year over year.

Clearly what we have here is a company experiencing a bit of weakness. But it is encouraging to see some improvement on the bottom line in the most recent quarter. When we dig even deeper though, we find out that the picture is even more bullish for the most recent quarter. And that is because, in the third quarter of last year, the company booked a $130 million gain on its equity method investments. That is why there is a disparity between earnings and cash flows. In addition to that, however, the company was able to keep other costs in line. Marketing and administrative costs increased modestly relative to revenue. However, the business reported an increase in its gross profit margin from 27.4% to 29.3%.

While this may not seem large, that disparity, when applied to the revenue generated in the third quarter alone, translated to an additional $47.1 million in pretax profits for the business. And according to management, this improvement was attributable to the benefit of higher sales prices, as well as lower costs such as lower delivery expenses and lower input costs. What this shows is that, even as inflationary pressures have eased up on the company from a supply side, it has been able to capture more profit by not lowering its prices in tandem with the decrease in costs it experienced.

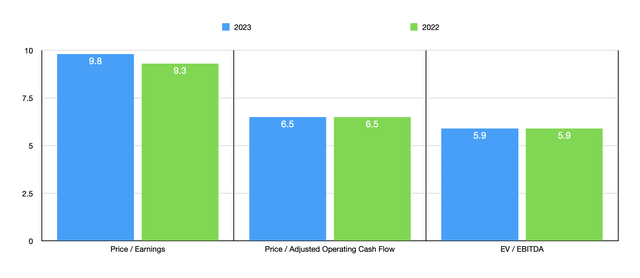

Author – SEC EDGAR Data

Unfortunately, we don’t know what to expect when it comes to the rest of the fiscal year. But if we simply annualize financial figures, we would anticipate net profits of $1.18 billion, adjusted operating cash flow of $1.76 billion, and EBITDA of $2.23 billion. This would imply only a marginal worsening compared to what the company saw in 2022. As you can see in the chart above, using two of the three metrics for valuing the company, the rounded pricing of the business from a multiple perspective is the same from 2022 to 2023. And even the one that’s not, the price-to-earnings multiple, is not materially different.

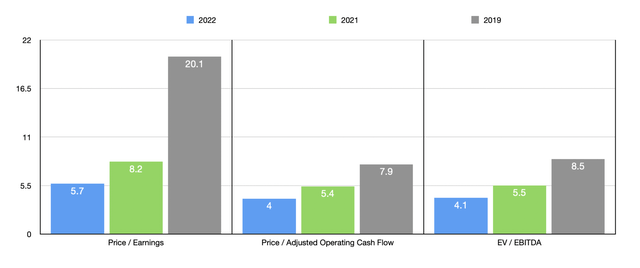

Author – SEC EDGAR Data

In the next chart above, I decided to show how shares were priced when I last wrote about the enterprise. At that time, the forward figures would have been for the 2022 fiscal year. As you can see, while shares of Owens Corning remain incredibly cheap on an absolute basis, they are quite a bit more expensive than when I wrote about the company last July. Now, in the table below, I decided to compare the company to five similar firms. And what I found here is that, using each valuation approach, it ended up being the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Owens Corning | 9.8 | 6.5 | 5.9 |

| Lennox International (LII) | 26.6 | 25.6 | 19.1 |

| Advanced Drainage Systems (WMS) | 20.1 | 13.2 | 11.9 |

| Fortune Brands Innovations (FBIN) | 19.5 | 7.6 | 12.5 |

| Allegion (ALLE) | 16.9 | 16.4 | 13.3 |

| A. O. Smith (AOS) | 37.8 | 18.5 | 27.3 |

Takeaway

At this time, I still remain a major fan of Owens Corning. The company looks incredibly cheap on an absolute basis and it is definitely attractive compared to similar enterprises. It’s nowhere near as cheap as it was previously. But even with that change, it was tempting for me to keep the company rated a ‘strong buy’. The only reason why I have decided to downgrade it to a solid ‘buy’ is because, while the stock is cheap, it has experienced some weakness this year on the bottom line. Ideally, I would want to see growth on this front instead. It wouldn’t take much for me to upgrade the stock again. If the fourth quarter, for instance, comes in much like the third quarter did, and if shares are still priced around where they are today, I likely will upgrade the stock once more. But for now, a ‘buy’ seems to make the most sense to me.

Read the full article here