Thesis

IMAX Corporation (NYSE:IMAX) is making a strong comeback in the wake of disruptions in the global movie industry caused by the pandemic. IMAX’s expansion into local-language content in Greater China has contributed to the growth of the company. I believe that both consumers and studios are emphasizing the cinematic experience, particularly for high-profile franchise IPs, which bodes well for IMAX’s role as a percentage of box office revenue. With a promising film slate ahead and strong international exposure, I have a positive outlook on IMAX’s installation growth.

Q3 Review and Outlook

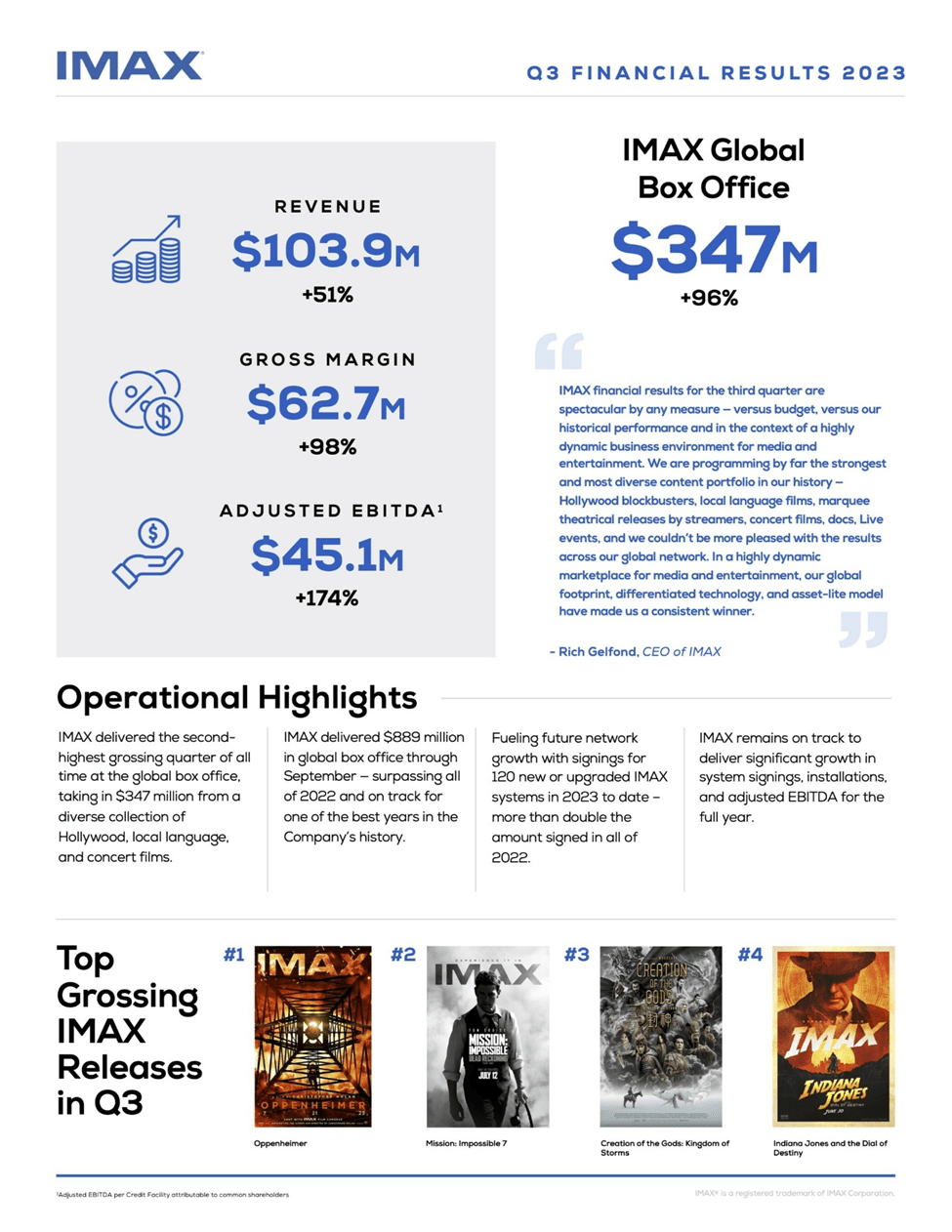

IMAX’s reported revenue for the third quarter came in slightly higher than the consensus estimate, reaching $103.9 million. Additionally, the adjusted EBITDA of $45.1 million exceeded consensus estimates as well. This strong performance was driven by robust box office results, which led to improved operating leverage in the Content Solutions business. I believe despite potential risks to the box office in 2024, IMAX is relatively insulated due to several factors. First, it typically features only one blockbuster at a time, allowing it to adapt to changing release schedules. Second, the growth of local-language films as a percentage of the total global box office (currently at 22% compared to 12% pre-pandemic) contributes to its resilience. Third, alternative content like concert films can help fill gaps in content offerings. The company reiterated its expectation of reaching $1.1 billion in global box office sales in 2023 but expressed caution regarding the 2024 movie pipeline due to ongoing Hollywood strikes.

Company Presentation

International Markets Present a Growth Opportunity

International box office ticket sales experienced strong growth over the past decade before the pandemic disrupted the global film industry. In 2022, worldwide cinema box office earnings reached $26 billion, marking a solid 27% increase compared to 2021. However, it’s important to note that trends in this regard vary by region, and much of the growth has been driven by the Asia-Pacific region, particularly China.

From IMAX’s perspective, international box office sales represent a substantial opportunity due to its global presence and significant exposure to China. IMAX derives 66% of its revenue from customers outside the United States and Canada. Moreover, IMAX’s current commercial screen network, 75% of it is located in international markets, with the remaining 25% in the US and Canada. IMAX’s management believes that it can expand its commercial multiplex network to 3,318 screens globally, compared to the 1,569 screens currently in operation. The majority of this anticipated growth is expected to come from international markets.

Looking ahead, I consider IMAX’s international exposure to be a positive factor for its long-term growth prospects. This is particularly due to its significant presence in China and other Asian markets, which I believe offer strong and sustainable growth opportunities. The Asia-Pacific region, primarily driven by China, remains one of the most attractive areas globally for box office growth.

I anticipate that IMAX will benefit from its substantial exposure to this region, leveraging its strong brand presence and other favorable factors. These factors include the growth of local language films, the increasing popularity of premium formats worldwide, and the trend of blockbuster content consumption in China. These dynamics are expected to lead to higher market share and growth for IMAX China.

However, for sustained long-term growth, I believe the company needs to diversify beyond its core movie-related business. IMAX generates a portion of its sales through joint-revenue-sharing agreements, where box office earnings are shared with cinema operators. The technology side of the business, especially sales related to system installations, may slow down in the following year due to a reduced number of releases resulting from ongoing Hollywood strikes.

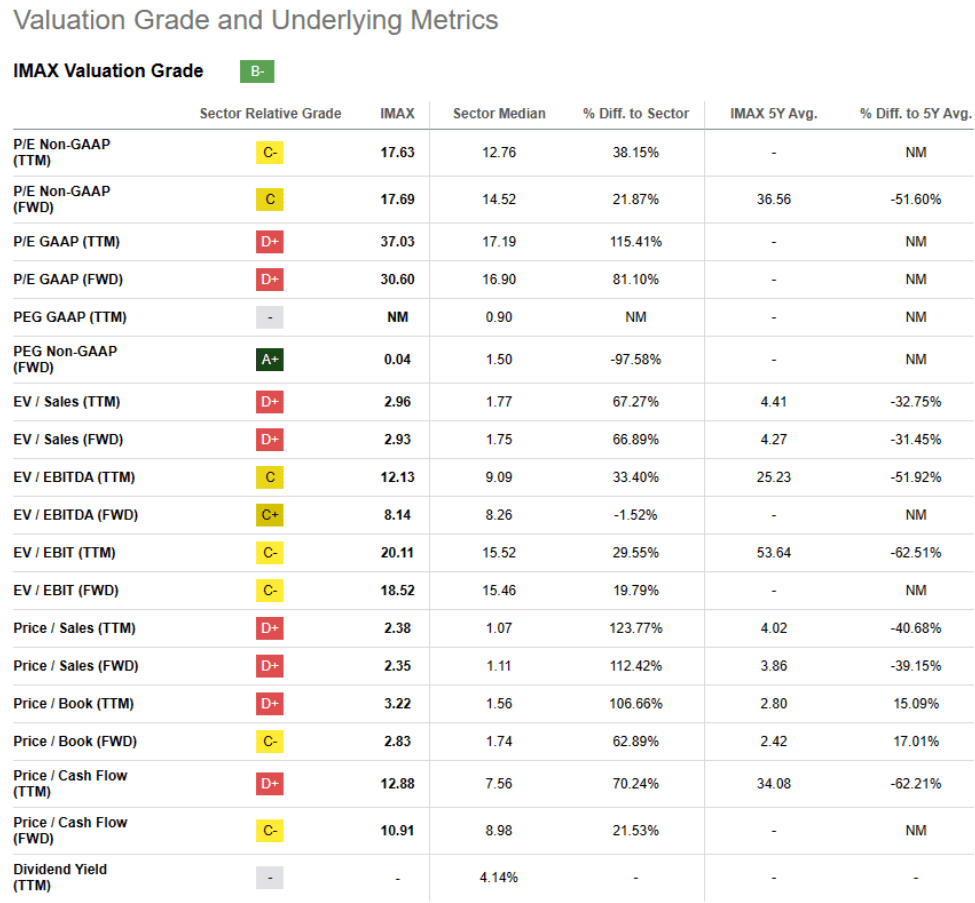

Valuation

Consumers and film studios are increasingly emphasizing the idea of turning a trip to the movie theater into a special and immersive experience. This trend will primarily concentrate on major blockbuster films tied to popular franchises. As a result, IMAX is expected to capture a larger share of box office revenues. When you factor in a promising lineup of upcoming films and a strong international presence, I am optimistic about the prospects for IMAX installations. As per Capital IQ, IMAX has traded at an average forward EV/EBITDA of 22x compared to the current multiple of 12x. The macroeconomic headwinds have had an impact on valuations across the board and I believe the current valuation level remains attractive for long-term investors in the stock. I think the combination of growth in China, expansion of installs, and premiumization of theatrical experiences can act to push the multiple higher.

Seeking Alpha

Investment Risks

The most significant concern for IMAX appears to be the film studios themselves. They have complete flexibility when it comes to deciding how and when they release their movies, and many of them are prioritizing their streaming strategies. While I believe that major studios, including Disney, still value the theatrical experience as a strong way to connect with consumers through their intellectual property, the overall trend is shifting more content towards streaming platforms, which poses a risk for IMAX. Moreover, IMAX has not traditionally generated significant free cash flow because it consistently reinvests in its technology and expands its installed base. While this is common among growth and technology companies, it does make IMAX more susceptible to fluctuations in revenue.

Conclusion

I believe that IMAX is the leading candidate to capitalize on the growing preference for high-end cinema experiences and the studios’ renewed emphasis on major theatrical releases. This trend towards enhancing the movie-going experience is a key factor driving my positive outlook on IMAX’s box office earnings, its expansion in terms of installations, and its resurgence in the Chinese market. I believe the current valuation is reasonable and, hence, assign a buy rating to the stock.

Read the full article here