This article is part of a series that provides an ongoing analysis of the changes made to George Soros’s 13F stock portfolio on a quarterly basis. It is based on George Soros’s regulatory 13F Form filed on 11/14/2023. Please visit our Tracking Soros Fund Management Holdings article for an idea on his investment philosophy and our previous update for the fund’s moves during Q2 2023.

Soros Fund Management invests globally and the long positions in the US market reported in the 13F filings represent ~25% of the overall portfolio. The 13F portfolio value increased ~10% from $6.41B to $7.05B. The number of positions increased from 172 to 209. Very small stock positions and large debt holdings together account for ~50% of the 13F holdings. The investments are diversified with a large number of very small equity positions, a small number of large equity positions, and a few large debt holdings. The focus of this article is on the larger equity positions. The top three individual stocks held as of Q3 2023 were Horizon Therapeutics, Activision Blizzard, and Alphabet. To learn about Soros’ distinct trading style and philosophy, check out his “The Alchemy of Finance” and other works.

New stakes:

Activision Blizzard, Abcam plc (ABCM), Novo Nordisk (NVO), SPDR Utils ETF (XLU) & Calls, American Equity Inv. Life (AEL): Activision Blizzard was a merger-arbitrage stake established at prices between $82 and $94. Microsoft acquired Activision Blizzard in a $95 per share cash-deal that closed last month. The ~2% NVO position was established at prices between ~$75.40 and ~$100 and the stock currently trades just above that range at ~$101. XLU is a ~1% long position established at prices between ~$59 and ~$68 and the stock is now at ~$62. The ~1% AEL stake was established at prices between ~$52 and ~$54 and it is now just above that range at $54.70.

Apple (AAPL) Puts, PDD Holdings (PDD) Puts, Denbury (DEN), and SPDR Energy ETF (XLE): AAPL and PDD are short positions through Puts established this quarter. AAPL traded at prices between ~$170 and ~$196. It is currently at ~$190. PDD traded at prices between ~$68 and ~$103 and it is now at ~$115. The very small 0.70% DEN stake was established at prices between ~$83 and ~$100. The stock is now at ~$89. XLE is a very small 0.51% long position established at prices between ~$79 and ~$93. XLE currently trades at ~$85.

Stake Disposals:

SPDR S&P 500 ETF (SPY) Puts: The 3.66% of the portfolio short position through SPY Puts was established over the two quarters through Q1 2022 as the underlying traded between ~$416 and ~$478. The position was sold down by ~70% over the next two quarters as the underlying traded between ~$357 and ~$457. Q4 2022 saw the stake rebuilt as the underlying traded between ~$357 and ~$408 while Q1 2023 saw a ~45% reduction as SPY traded between ~$379 and ~$417. There was a ~165% stake increase last quarter as SPY traded at prices between ~$404 and ~$443. The disposal this quarter was when SPY traded at prices between ~$426 and ~$456. SPY is now at ~$451.

Rivian Automotive (RIVN) & Calls: RIVN had an IPO in November 2021. Shares started trading at ~$100 and currently go for $16.70. Soros established the stake at prices between ~$85 and ~$130. Q1 2022 saw a ~30% stake increase while the next quarter saw a similar reduction. The last four quarters saw a ~80% reduction at prices between ~$12 and ~$40. The disposal of the ~1% remainder stake this quarter was at prices between ~$20 and ~$28. They realized losses.

PDC Energy (PDCE) and IVERIC bio (ISEE): These two were merger-arbitrage stakes – Chevron (CVX) acquired PDC Energy in a ~$72 per share all-stock deal that closed in August and IVERIC bio got acquired by Astellas Pharma (OTCPK:ALPMF) in a $40 per share cash deal that closed in July.

Stake Increases:

Invesco QQQ ETF (QQQ) Puts and iShares Russell 2K (IWM) Puts: The large ~7% short stake through Puts was established during Q4 2022 as QQQ traded between ~$260 and ~$294. The next quarter saw a one-third reduction as the underlying traded between ~$262 and ~$321. Last quarter saw a ~160% stake increase as QQQ traded at prices between ~$310 and ~$370. That was followed by another two-thirds increase as QQQ traded at prices between ~$354 and ~$385. QQQ currently trades at ~$386. The 2.51% short position in IWM through Puts was established as the underlying traded at prices between ~$174 and ~$198. It is now at ~$178.

Splunk (SPLK) & Calls: The ~1% leveraged long stake in SPLK through Calls was increased by ~115% during Q1 2023 as the underlying traded between ~$83 and ~$110. The stock is now at ~$151. This quarter saw another ~80% increase at prices between ~$97 and ~$147.

AerCap Holdings (AER), CRH plc (CRH), Alibaba Group Holding (BABA) & Calls, Alteryx, Inc. (AYX) Calls, and KraneShares CSI China Internet ETF (KWEB) & Calls: These five stakes saw large increases this quarter. The 1.65% AER stake was increased by ~120% this quarter at prices between ~$60 and ~$67 and the stock currently trades at $68.59. BABA is a 1.28% stake that saw the position doubled at prices between ~$84 and ~$102. The stock is now at $77.60. The ~1% AYX stake was doubled at prices between ~$28.16 and ~$45 and it is now at $38.61. KWEB is a 0.88% stake that saw a ~95% increase this quarter at prices between ~$26.50 and ~$32. KWEB currently goes for $27.66.

Indie Semiconductor (INDI): The 0.58% INDI stake was built over the three quarters through Q2 2022 at prices between ~$5.35 and ~$16. Q1 2023 saw a ~63% reduction at prices between ~$5.80 and ~$11 while this quarter there was a ~120% stake increase at prices between ~$6 and ~$10. The stock is now at $7.19.

Aramark (ARMK), Booking Holdings (BKNG), CBOE Global Markets (CBOE), and Uber Technologies (UBER): These small (less than ~0.75% of the portfolio each) stakes were increased this quarter.

Stake Decreases:

Horizon Therapeutics: The large merger-arbitrage stake in Horizon Therapeutics was established during Q4 2022. Amgen (AMGN) is acquiring Horizon Therapeutics in a $116.50 cash deal announced last December. FTC sued to block this deal in May. The position increased by ~60% during Q1 2023 while the last quarter saw a ~28% reduction. It was the largest individual stock position at 5.40% of the portfolio as of Q3 2023. The deal closed last month.

Alphabet Inc. (GOOG): GOOG is a 2.61% of the portfolio position purchased in Q2 2019 at prices between ~$52 and ~$64 and reduced by ~50% in Q1 2020 at prices between ~$53 and ~$76. Q4 2020 saw another similar selling at prices between ~$71 and ~$86. There was a ~250% stake increase in the next quarter at prices between ~$86 and ~$107. H2 2021 had seen a ~50% reduction at prices between ~$133 and ~$151. Next quarter saw a one-third increase at prices between ~$127 and ~$148. That was followed with a ~80% stake increase during Q4 2022 at prices between ~$83.50 and ~$105. The next quarter saw a ~19% selling and that was followed with a ~3% trimming last quarter. The stock is now at ~$137. This quarter saw marginal trimming.

Note: Alphabet is a frequently traded stock in Soros’ portfolio.

Amazon.com (AMZN) & Calls: AMZN is a 1.38% of the portfolio position primarily built in H1 2021 at prices between ~$148 and ~$176. H2 2021 had seen a roughly one-third selling at prices between ~$159 and ~$187. There was a ~40% stake increase in Q2 2022 at prices between ~$102 and ~$168. The two quarters through Q1 2023 saw a two-thirds reduction at prices between ~$82 and ~$121. The stock currently trades at ~$145. There was a ~9% stake increase last quarter and marginal trimming this quarter.

iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD): The LQD stake was increased by ~140% to a ~4% of the portfolio stake during Q1 2023 at prices between ~$105 and ~$112. The last quarter saw a ~30% further increase at prices between ~$106 and ~$110 while this quarter there was a ~75% selling at prices between ~$101 and ~$107. LQD currently trades at ~$104 and the stake is at 1.25% of the portfolio.

Five9 (FIVN) Puts, and Five9 (FIVN) Calls: The leveraged short position in FIVN through Puts was established as the underlying traded between ~$52 and ~$83. There is an offsetting position through Calls in the portfolio. Both stakes were reduced this quarter. FIVN is now at $72.91.

iShares iBoxx $ High Yield Corporate Bond ETF (HYG) Puts: The 0.24% short position through Puts in HYG was increased by ~25% during Q1 2023 as the underlying traded between ~$73 and ~$77. The position was reduced by ~70% last quarter as HYG traded between ~$73.50 and ~$75.50. That was followed with a similar selling this quarter at prices between ~$72 and ~$74. HYG is now at $74.77.

Aptiv PLC (APTV), ARK Innovation ETF (ARKK) Calls, Intuit (INTU), Okta, Inc. (OKTA), PDD Holdings (PDD), and RenaissanceRe Holdings (RNR): These small (less than ~0.60% of the portfolio each) stakes were reduced this quarter.

Kept Steady:

Liberty Broadband (LBRDK): LBRDK is now at 1.80% of the portfolio. The stake was established in Q2 2016 at prices between $55 and $60.50. Q4 2019 saw a ~20% selling at prices between $103 and $125. Q1 2021 saw a similar reduction at prices between ~$142 and ~$157. The four quarters through Q3 2022 saw another roughly two-thirds reduction at prices between ~$74 and ~$191. The stock currently trades at ~$83.

SPDR EURO STOXX 50 ETF (FEZ): FEZ is a small 0.82% of the portfolio stake established during Q4 2022 at prices between ~$30.50 and ~$41 and the stock currently trades well above that range at $45.34.

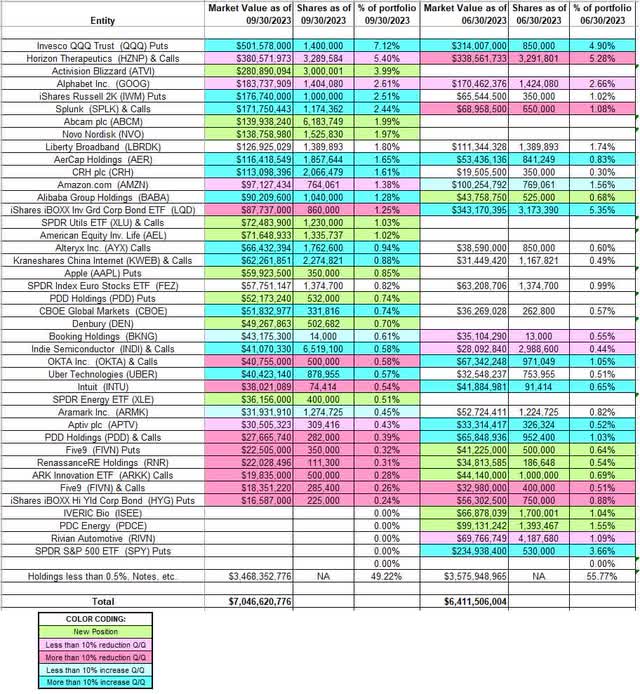

The spreadsheet below highlights Soros’s significantly large 13F positions as of Q3 2023:

George Soros’ Q3 2023 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Soros Fund Management’s 13F filings for Q2 2023 and Q3 2023.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here