Distribution warehouse employees hold a meeting with each other.

The point of dividend growth investing is to build a portfolio that can provide you with a steady and meaningfully growing income stream. This can most easily be attained when an investor takes a qualitative approach toward investing.

What I mean by this is that the quality of your portfolio must come first. In my earlier years of investing, I purchased companies on several occasions that simply “added” to my income stream. There was no second thought given to how, if at all these businesses would fit within my strategy, or whether the income they provided would be sustainable.

In recent years, I have come to learn the importance of being more selective with my purchases. This can save you the heartache of wasting years on stocks that have no business being in your portfolio.

One stock that isn’t in my dividend growth portfolio, but I would seriously consider buying is Prologis (NYSE:PLD). For the first time in a couple of months, let’s revisit the fundamentals and valuation of the world’s largest REIT to understand what makes it a buy.

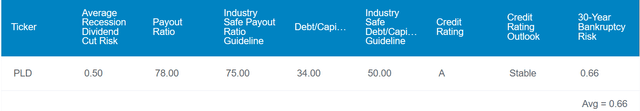

DK Zen Research Terminal

Prologis’ 3.2% dividend yield may not be the most impressive starting yield for a REIT. However, it’s important to remember that it is still double the S&P 500 index’s (SP500) 1.5% yield. Because it shines as a dividend growth stock, it doesn’t have to shine as an immediate income stock, either.

Prologis should have plenty of catalysts to keep growing its dividend for many more years to come. For one, the company’s 78% core FFO payout ratio is about in line with the 75% that rating agencies view as safe for industrial REITs.

Even more importantly, Prologis’ financial health is remarkable. The company’s debt-to-capital ratio of 34% is far below the 50% that rating agencies think is sustainable for the industrial REIT space per Dividend Kings.

Thus, it shouldn’t come as a surprise to learn that Prologis boasts an A credit rating from S&P on a stable outlook. According to Dividend Kings, this implies the probability of Prologis not being around by 2053 is just 0.66%.

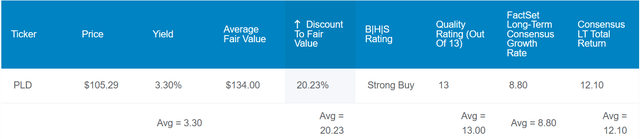

DK Zen Research Terminal

Besides strong fundamentals, Prologis is also priced at an interesting valuation. Using metrics like historical dividend yield and P/FFO, Dividend Kings thinks the stock is worth $134 a share. When I factor the $3.48 annualized dividend per share, a 10% discount rate, and a 7.25% annual dividend growth rate into the dividend discount model, I get a similar $127 fair value.

Averaging these two fair values out, shares of Prologis are worth $130 each. That suggests from the current $110 share price (as of November 18, 2023), the stock is trading at a 16% discount to fair value.

If the REIT grows as anticipated and returns to fair value, here are the total returns that could lie ahead in the next 10 years:

- 3.2% dividend yield + 8.8% FactSet Research annual growth consensus + a 1.7% annual valuation multiple upside = 13.7% annual total return potential or a cumulative 261% total return compared to the 9% annual total return potential of the S&P 500 or a cumulative 137% total return

Strong Third-Quarter Results

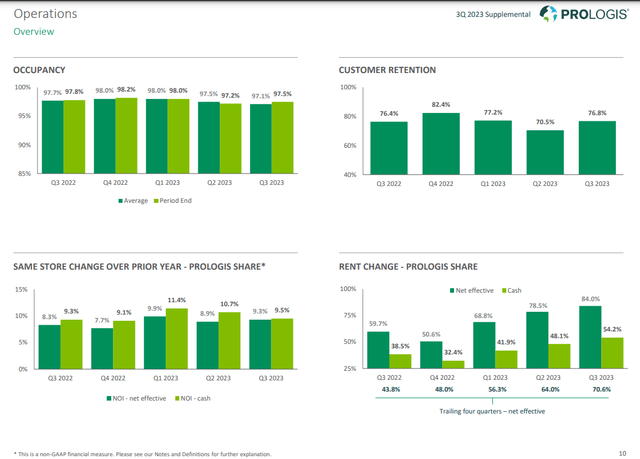

Prologis Third Quarter 2023 Earnings Presentation

As you’d come to expect from a business of utmost importance to the operations of its tenants, Prologis reported excellent results for the third quarter ended September 30.

The company’s period-ending occupancy stood at 97.5%. While this is below the year-ago period of 97.8%, it’s especially encouraging. That is because the company’s approach toward adding quality properties and tenants to its portfolio allows it to hold up better than its industry peers.

As if this above-average occupancy wasn’t enough, Prologis also benefited from a 76.8% customer retention rate in the third quarter. This mark was slightly better than the 76.4% rate during the year-ago period.

But that’s not all. Prologis’ net effective rent change was a record 84% for the third quarter. The company’s strategic locations in booming port cities continued to pay off. Areas that heavily contributed to this amazing rent growth on lease renewals included Northern New Jersey (200% per CFO Tim Arndt’s opening remarks during the Q3 2023 earnings call), Toronto (187%), and Southern California (165%). These factors are what propelled Prologis’ core FFO per share excluding net promote income higher by 14.7% year-over-year to $1.33 in the third quarter.

As has been the case for quite some time, the company also leveraged its A credit rating to its advantage. During the third quarter, Prologis secured $1.4 billion in capital at a weighted average interest rate of just 3.2% and a weighted average term of 5.9 years. At a time when the 10-year U.S. treasury is yielding well over 4%, this is a testament to the confidence that debt investors have in the company’s creditworthiness. The REIT also had a record $6.9 billion in liquidity according to Arndt with no major maturities coming due until 2026 (details sourced from Prologis Q3 2023 earnings press release).

As I noted in my previous coverage of Prologis, these types of debt issuances are a stark contrast to the deals with 4%-plus cap rates that the company is closing. That’s why along with continued rent growth, the FactSet Research annual core FFO per share growth consensus is 8.8% long-term.

An Excellent Dividend Grower That Isn’t Done Yet

Prologis’ quarterly dividend per share has soared 81% in the past five years to the current rate of $0.87. There is good reason to believe that the company has plenty of room for more dividend raises like its most recent 10.1% hike announced in February.

Prologis projects that it will generate $5.09 in midpoint core FFO per share excluding net promote income ($5.08 to $5.10) in 2023. Compared to the $3.48 in dividends per share that are set to be paid for the year, this equates to a 68.4% payout ratio.

Risks To Consider

Prologis’ fundamentals make it a 13/13 ultra SWAN per Dividend Kings’ quality rating. But even so, the company still has risks that are worth considering.

As I alluded to in my last article, a major risk is the thriving industrial real estate outlook itself. When an industry is in secular growth as is the case with industrial real estate, demand isn’t the issue. The problems can manifest when supply outstrips demand, which can weigh on rent growth. If this were to happen, Prologis’ growth potential could be harmed.

I would also reiterate the risk of the role that interest rates play in Prologis’ stock performance and not so much its business performance (investment spreads are still decent after all). If we do stay in a higher for longer interest rate environment as suggested by many economists, it may be a while before the stock blows your socks off. But as long as the underlying company’s fundamentals remain promising as they are, the only question is a matter of when Prologis bounces back in my opinion.

Summary: The King Of REITdom Is On Sale

In the world of REIT investing, they don’t get any bigger or better than Prologis. As some REITs have a tendency to sacrifice portfolio quality for scale, that’s a very rare combination to behold.

Depending on what happens with the economy and interest rates, additional downside could occur. I can’t reasonably predict what Prologis’ stock price will look like next week, next month, or even next year. But my general advice to investors is to not lose the forest for the trees. Before making an investment, I like to ask myself the following: Do I believe this stock will be much higher in five- to 10 years?

The answer for Prologis in my mind is a resounding yes. That’s why it is a business that I am considering eventually buying once I likely resume deploying meaningful capital in January to dividend growth investing.

Read the full article here